Financial Markets and Economy

Wall Street Is Desperate for a Better Credit Hedge (Bloomberg)

In one segment of the market—where the cash bonds sold by companies are traded—spreads rose sharply as investors fretted over the impact of lower oil prices on energy companies. In a more obscure corner of the market, the spread on an index comprising a type of derivative known as a credit default swap (CDS) was falling.

Gold turns lower as dollar strengthens (Market Watch)

Gold turns lower as dollar strengthens (Market Watch)

Gold futures retreated in early Monday trade as strength in the U.S. dollar dragged the precious metal lower along with other precious metals.

Gold futures for December delivery GCZ5, -1.52% gave up $13.40 or 1.2%, to trade at 1,132.20, while December silver SIZ5, -3.71% lost 49 cents, or 3.3%, to trade at $14.62 an ounce.

Here's what Alcoa is worth when you split up the company (Business Insider)

Here's what Alcoa is worth when you split up the company (Business Insider)

Aluminum giant Alcoa announced Monday that it will split into two publicly traded companies.

It's essentially a partitioning of its upstream and downstream businesses: The Upstream Company will be involved in mining and production, while Value-Add Co. will work on turning the raw material into products that aerospace and other industrial customers use.

The Cities Where Millennials Are Taking Over the Housing Market (Bloomberg)

Millennials are dominating the Des Moines housing market. That’s an odd piece of information that seems a little less odd—and a little more important—the longer you ponder it.

U.S. stock futures fall as investors wait for cues to shake off China gloom (Market Watch)

U.S. stock futures fall as investors wait for cues to shake off China gloom (Market Watch)

U.S. stock futures tracked European markets lower on Monday as investors continued to fret over slowing economic growth in China.

A raft of U.S. data and speeches from several Federal Reserve members also kept traders on edge ahead of the open.

Shell shares just hit a 6-year low (Business Insider)

Shell shares are at their lowest level since June 2009.

Goldman: The Options Market Says the S&P 500 Is Poised for a Major Move this Week (Bloomberg)

Goldman: The Options Market Says the S&P 500 Is Poised for a Major Move this Week (Bloomberg)

Options markets are pricing in a big swing for the S&P 500 this week, according to Goldman Sachs.

Just don't ask which direction the move will be in.

Goldman Equity Derivatives Strategist Krag "Buzz" Gregory observes that the S&P 500 straddle — a trade that profits if the market goes at least a certain magnitude either up or down — is pricing in a gain or loss of 2.4 percent this week, based on options set to expire on Friday. As such, the S&P 500, which closed at 1,931 on Friday, would have to fall below 1,885 or rise above 1,978 this week for options traders to make a positive return on the straddle trade.

European stocks wrapped in red as China growth fears linger (Market Watch)

European stocks wrapped in red as China growth fears linger (Market Watch)

European stock markets kicked off the week in negative territory on Monday, with trading sentiment hurt by another weak data release from China and a continued slide in car stocks.

The Stoxx Europe 600 index SXXP, -1.23% fell 0.4% to 347.97, after closing lower for a second straight week on Friday. The pan-European benchmark, however, trimmed its weekly loss in Friday’s session after U.S. Federal Reserve Chairwoman Janet Yellen eased concerns about lackluster global economic and hinted interest rates could rise this year.

Futures down ahead of consumer spending data (Business Insider)

Futures down ahead of consumer spending data (Business Insider)

U.S. stock index futures were lower on Monday as investors awaited consumer spending data for August amid uncertainty around the timing of an interest rate hike.

Several Federal Reserve officials are scheduled to speak this week, including New York Fed President William Dudley on Monday.

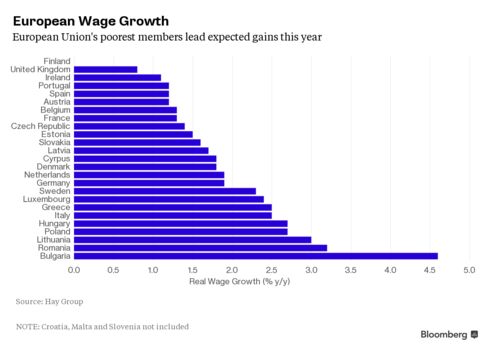

Fastest Wage Growth in EU Unmasks Poorest Nation's Grey Economy (Bloomberg)

Bulgarian wages are growing at the fastest pace in the European Union, and it’s not workers who’re benefiting the most.

Economic data this week to reflect impact of market turmoil (Market Watch)

While earnings season doesn’t kick into full gear until mid-October, next week will give investors a wealth of economic data covering the period where U.S. stocks started sliding into correction territory.

Volkswagen is crashing hard after Audi got dragged into the emissions scandal (Business Insider)

The weekend break has not helped Volkswagen.

Charting the Markets: China Concerns Dampen Monday Mood (Bloomberg)

China is hogging the headlines once again. Data showing industrial profits fell the most in at least four years are adding to concern about the nation's economic slowdown. Asian stocks fell, compounding the worst quarter since September 2011.

There Is No New Doing Without New Viewing (Trader Feed)

One of the most common mistakes traders make is that they want to do new things–find fresh opportunities, change the way they manage trades or themselves–while retaining their existing ways of seeing the world. If we look at the world through the same lenses, we'll pretty much see the same things and respond in the usual ways. New doing requires fresh viewing–the ability to wear a different set of lenses.

Here's your preview of this week's big market-moving events (Business Insider)

"Last week, Fed drama; next week, fiscal drama," Bank of America Merrill Lynch's Savita Subramanian quipped.

Expect lots of drama. Then again, drama and uncertainty define the nature of the economy and the markets. It's always been that way.

On Thursday, Fed Chair Janet Yellen told an audience at UMass Amherst that while current inflation readings remain low, those numbers are being held down mostly be "transitory" special factors.

Glencore Plunges Record 17% in London Trading (Bloomberg)

Glencore Plc tumbled the most ever to a record low as Investec Plc warned that there was little value for shareholders should low commodity prices persist.

How GDP shares have shifted across the world since 1000 AD (Business Insider)

It's no secret that the world's economic center of gravity has been shifting east ever since the 1950's.

Bond Investors Win No Matter Who Loses the Portuguese Election (Bloomberg)

One group is a sure winner of Portugal’s election: bond investors.

The markets might look 'messy,' but now is a great time to buy (Business Insider)

Markets around the world are whipsawing back and forth, throwing asset prices all over the place.

That doesn't have to be a bad thing, according to Luke Hickmore, a senior investment in fixed income at the $483.3 billion Aberdeen Asset Management.

He told Business Insider that investors should "look to the opportunity rather than just watching the screens."

Glencore Drops to Record Low as Investec Sees Value Evaporating (Bloomberg)

Glencore Plc plunged as much as 27 percent, extending a rout that’s wiped more than $13 billion off its value this month and highlighting investor concerns that it’s not cutting its debt load quick enough.

A radical shift is coming to the markets (Business Insider)

A radical shift is coming to the markets (Business Insider)

The days of double-digit returns are over.

Lisa Shalett, head of investment/portfolio strategies for Morgan Stanley Wealth Management, said at a press briefing on Tuesday that since the end of the financial crisis, investors have enjoyed healthy returns on stocks and bonds, partly because of the Federal Reserve.

Profit Pessimism Rivals Crisis Days as Stocks Support Erodes (Bloomberg)

Any hopes that investors had of earnings growth salvaging what is poised to be the first down year for stocks worldwide since 2011 are quickly fading.

Investors to Washington: You're confusing us (CNN)

Investors like clarity, and Washington hasn't been serving up a lot of it.

The Federal Reserve has kept everyone guessing when it will start raising interest rates. It wasn't September, as many expected? Maybe in October? Maybe in December?

Swiss Competition Body Probes Banks in Precious Metals Trading (Bloomberg)

Swiss Competition Body Probes Banks in Precious Metals Trading (Bloomberg)

Switzerland’s competition regulator identified seven banks that are being investigated as part of a probe into whether companies in Europe, the U.S. and Japan colluded to manipulate the prices of gold, silver and other precious metals.

Hedge Funds Primed for Oil Rebound With Increase in Bullish Bets (Bloomberg)

The momentum behind wagers on rising oil prices picked up steam as U.S. drilling slows and producers face potential credit line cuts.

Japan Said to Plan 100 Billion Yen Investment in Mitsubishi Jet (Bloomberg)

Japan Said to Plan 100 Billion Yen Investment in Mitsubishi Jet (Bloomberg)

The Development Bank of Japan is in talks with Mitsubishi Heavy Industries Ltd. to invest 100 billion yen ($831 million) in its development of the nation’s first passenger plane in more than 40 years, two people familiar with the situation said.

Junk Bond Rout Pushes Yields Past 8% as Diam Underweight Credit (Bloomberg)

Treasuries gained, extending this month’s advance, as stocks declined with European commodity producers heading for their lowest level since 2009…

Dollar Holds Gain as Focus Returns to Signs of Economic Growth (Bloomberg)

The yen strengthened against most major peers on demand for haven investments as stocks in Asia and Europe declined.

Oil Traders May Look to the Sea for Profit Amid Price Collapse (Bloomberg)

The global oil glut may soon expand to the ocean.

Here comes personal income and spending (Business Insider)

Here comes personal income and spending (Business Insider)

The Department of Commerce will release the latest data on personal income and spending at the bottom of the hour.

The consensus forecast among economists is that, in August, personal income rose 0.4% while personal spending rose 0.3%, both unchanged compared to the prior month.

Politics

Mexico's president appears to be fudging numbers about the biggest threat to the country (Business Insider)

Mexico's president appears to be fudging numbers about the biggest threat to the country (Business Insider)

During his third state of the union speech earlier this month, Mexican President Enrique Peña Nieto acknowledged the social and political struggles the country has faced over the past year.

But he touted the performance of his government in its fight against crime, saying, “it is a fact that violence is diminishing in Mexico.”

John Boehner says there won’t be a government shutdown (Market Watch)

John Boehner says there won’t be a government shutdown (Market Watch)

The federal government is funded only through Wednesday but House Speaker John Boehner says there won’t be a government shutdown.

Speaking on CBS’ “Face the Nation,” Boehner confirmed plans to pass a short-term funding bill with Democrats’ help. The Ohio Republican, who announced Friday he is resigning from Congress at the end of October, also said he will set up a committee to investigate Planned Parenthood…

Technology

Do we really need to fear AI? (BBC)

Do we really need to fear AI? (BBC)

Picture the scenario – a sentient machine is "living" in the US in the year 2050 and starts browsing through the US constitution.

Having read it, it decides that it wants the opportunity to vote.

Oh, and it also wants the right to procreate. Pretty basic human rights that it feels it should have now it has human-level intelligence.

Large semi-structured manufacturing spaces present serious challenges to robot mobility and reliability. This is certainly the case in modern shipbuilding, which makes considerable use of prefabricated sections. Entire multi-deck segments of the hull or superstructure are built in shipyards, transported to the building dock and then lifted into place.

Health and Life Sciences

Rare 'healthy' smokers' lungs explained (BBC)

Rare 'healthy' smokers' lungs explained (BBC)

The mystery of why some people appear to have healthy lungs despite a lifetime of smoking has been explained by UK scientists.

The analysis of more than 50,000 people showed favourable mutations in people's DNA enhanced lung function and masked the deadly impact of smoking.

Dieselgate Is A Cancer Problem (Forbes)

Dieselgate Is A Cancer Problem (Forbes)

Emissions from diesel engines cause lung cancer. The World Health Organization’s confirmed the long-suspected fact that diesel engine exhaust (DEE) is a human carcinogen in 2012.

Like others, I’m concerned about the environmental ramifications and all else that’s wrong about the VW emission scandal. But primarily I see this as a public health issue. As with most environmental toxins, the clearest risk of disease from exposure applies to people working or living in places with frequently-high levels. Although everyday (non-occupational) exposure to diesel engine exhaust is hard to gauge, the effects are real.

Life on the Home Planet

Stargazers observe 'supermoon' eclipse (BBC)

Stargazers observe 'supermoon' eclipse (BBC)

People around the world have observed a rare celestial event, as a lunar eclipse coincided with a so-called "supermoon".

A supermoon occurs when the Moon is in the closest part of its orbit to Earth, meaning it appears larger in the sky.