Financial Markets and Economy

The US economy is telling 2 stories, and the good story is way better than the bad story (Business Insider)

The US economy is all about consumers.

On Tuesday, consumer confidence beat expectations while advance data on US trade in August showed a 3.2% decline in the nominal value of exports, which are down 10.4% over the prior year.

USDJPY Tumbles, Drags Futures Lower, After BOJ Said To See “Little Immediate Need” For More QE (Zero Hedge)

And it was going so well overnight: with the USDJPY surging as high as 120.25 overnight, before finding its prefered equilibrium spot at 120, the Yen carry was doing its centrally-planned and mandated job of supporting market… and then a Bloomberg headline yanked the carpet from underneath it:

- BOJ IS SAID TO SEE LITTLE IMMEDIATE NEED FOR ADDING STIMULUS

- BOJ OFFICIALS ARE SAID TO WANT CHANCE TO SEE MORE DATA

U.S. stocks set for third day of gains as China delivers some cheer (Market Watch)

U.S. stocks set for third day of gains as China delivers some cheer (Market Watch)

U.S. stocks were poised for another day with solid gains on Thursday, with futures tracking Asian and European shares higher after Chinese manufacturing data beat forecasts.

Investors were also waiting for factory data from the U.S. and weekly jobless claims for clues to the strength of the world’s largest economy.

Mild, Sunny Start to Winter Set to Curb European Energy Demand (Bloomberg)

A mild, sunny start to the winter may see Europeans delay switching on their heating, further damping the lowest power and natural gas prices this decade.

Miners propel FTSE 100 higher after China data beat forecasts (Market Watch)

U.K. stocks climbed Thursday, propelled by better-than-expected manufacturing data from China that calmed fears about the economic slowdown in the world’s second largest economy.

The FTSE 100 index UKX, +0.79% jumped 1% to 6,124.18, building on a 2.6% rally on Wednesday. Despite that rally, the U.K. stock benchmark ended the third quarter of the year Wednesday with its worst quarterly loss since September 2011.

In Shadow of Fed Liftoff, Treasuries Top All Other Investments (Bloomberg)

With the specter of a Federal Reserve interest-rate increase looming over global financial markets all year,the asset class most susceptible to rising rates — Treasuries — has topped other U.S. investments through the first three quarters of 2015.

Bombardier seeking investors for all business units – sources (Business Insider)

Bombardier seeking investors for all business units – sources (Business Insider)

Canada's Bombardier Inc <BBDb.TO> is exploring the sale of a stake in any of its business areas, not just its rail unit, to ensure it can finish development of its delayed CSeries jet, according to four sources familiar with the situation.

Japanese yen weakens on China data, Nikkei rally (Market Watch)

The yen weakened against major rivals in Asia trade Thursday, with risk sentiment improving on relatively solid Chinese economic data and robust stock-market performance, prompting selling of the perceived safety of the Japanese currency.

Only Bravest Borrowers Need Apply After Emerging-Market Rout (Bloomberg)

Only the bravest and strongest of borrowers are likely to keep emerging-market bonds from extending the slowest quarter in four years.

This chart is just the worst (Business Insider)

This chart is just the worst.

.jpg)

Startups could cost banks 60% of their profits (Market Watch)

Startups could cost banks 60% of their profits (Market Watch)

Banks are about to engage in a battle for survival against scrappy, digital competitors.

According to a report from consulting giant McKinsey, non-banks will threaten 10% to 40% of retail banks’ revenues across five sectors by 2025 — and 20% to 60% of bank profits. To win the battle, banks will have to get to know customers better and make digital banking a bigger part of the business.

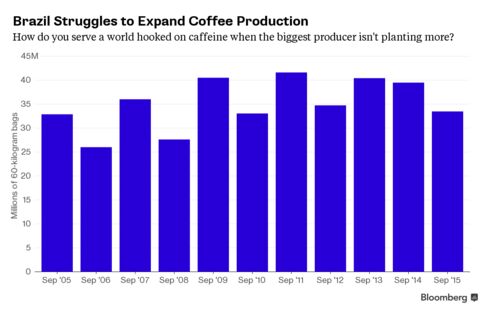

Global Coffee Shortage Looms as Market Braces for Climate Change (Bloomberg)

The coffee-drinking world needs another Brazil, the world’s top grower and exporter of the beans, if it’s to avoid a shortage.

Gold likes it when the Fed stalls (Business Insider)

Markets have been struggling every since the Federal Reserve's decision not to raise the Federal funds interest rate, but there has been one winner: gold.

This contrarian S&P 500 indicator should flip your greed switch (Market Watch)

The stock market roared out of the gates on Wednesday, in a bid to trim what’s been a dismal third-quarter performance. Surprised by the bounce, considering the struggle the tail end of September typically brings? Well, maybe you shouldn’t be.

Our Struggles Develop Our Strengths (Trader Feed)

This is a very important principle: Our struggles develop our strengths. Winning is the result of strengths; the struggles of training build those strengths.

One of the more important Forbes articles I've written recently helps to explain why some people succeed through struggles and why some don't. When we train, we develop our capacity to endure; our ability to access willpower's second wind. We only get to that second wind if we're doing something we truly love. It takes passion and purpose to fuel persistence. If we're not doing what speaks to us, what we find intrinsically interesting and rewarding, we never pour ourselves into our work and never reach the second wind that enables us to persist where others give up.

U.K. Stocks Rally for a 2nd Day as Glencore Gain Lifts FTSE 100 (Bloomberg)

A jump in BP Plc and Royal Dutch Shell Plc pushed U.K. shares up for a second day, after the FTSE 100 Index ended the month yesterday with its biggest advance since August.

Biggest Wealth Fund Relies on Income Flows as Oil Cash Wanes (Bloomberg)

Norway’s $820 billion sovereign wealth fund is so far coping with the near halt in the inflow of oil cash by using its growing investment income to implement portfolio shifts.

From Bear to Bull, Palm Rallying on El Nino Bucks Commodity Rout (Bloomberg)

September was a rough month for commodities as China’s slowdown and excess supplies spurred losses in oil and industrial metal prices. Palm oil is a reminder that there’s still opportunities for commodity bulls with a 19 percent advance.

Emerging Stocks Rise After China Factory Data; Won Strengthens (Bloomberg)

Emerging-market equities rose for a second day as signs China’s manufacturing is stabilizing gave investors confidence to hunt for bargains after the worst quarter in four years. Currencies of commodity exporters including Russia and South Africa strengthened.

Gecamines Backs Glencore Decision to Suspend Congo Copper Output (Bloomberg)

Gecamines Backs Glencore Decision to Suspend Congo Copper Output (Bloomberg)

Gecamines SA, the Democratic Republic of Congo’s state-owned copper miner, backed Glencore Plc’s decision to suspend output at Katanga Mining Ltd., rebuffing criticism from the Carter Center that the halt will delay revenue for one of the world’s poorest countries.

“If Glencore feels that this is the best way to bring the mine back to profit, then we are confident in their decision,” Arthur Katalayi, senior executive adviser to Gecamines Chairman Albert Yuma, said in a phone interview from Kinshasa, the capital. Glencore declined to comment and Congo’s Mines Ministry didn’t respond to an e-mailed request for comment.

Worst Seen Coming for Currencies Ensnared in Commodities Fallout (Bloomberg)

To foreign-exchange traders, the currencies of commodity exporters are all in the same boat — and it’s going down.

These Charts Show the Big Change in Chinese Corporate Debt Since 2007 (Bloomberg)

Can you paint with all the colors of China's collapsing corporate commodities complex?

Yes, answered the analysts at Macquarie Research.

Wall Street’s obsession could cost it a stock-market rally (Market Watch)

Wall Street’s obsession could cost it a stock-market rally (Market Watch)

October/Christmas is finally here. Seriously, though, who isn’t cheered up by politically incorrect Halloween costumes and children pounding on your door for candy?

Maybe investors, who are hyper-aware that we’re at the start of the year’s most volatile and volume-packed month for stocks. And that’s something that could be a “dangerous mix for a ‘risk’-prone market,” like this one, John Kicklighter, chief currency strategist at DailyFX, told clients.

SoftBank leads $1 billion investment in U.S. fintech startup SoFi (Business Insider)

SoftBank leads $1 billion investment in U.S. fintech startup SoFi (Business Insider)

SoftBank Group Corp <9984.T> said it had led a $1 billion investment in U.S. financial technology startup SoFi, calling it the largest single financing round in the fintech space to date.

The deal is the latest in the sector, where relatively young companies offer financial services through software. In July, Spain's Banco Santander SA <SAN.MC> agreed to provide up to around $16 million for any opportunities it identifies with British mobile banking software partner Monitise Plc <MONI.L>.

Politics

Bernie Sanders’s $26 million cash haul is a major problem for Hillary Clinton (Washington Post)

Democratic presidential candidate Hillary Rodham Clinton technically beat Bernie Sanders by $2 million in the chase for campaign cash over the past three months. But that isn't the story — not even close.

Presidential candidate websites are terrible at privacy (CNN)

Presidential candidate websites are terrible at privacy (CNN)

That's according to a recent study from the Online Trust Alliance, a non-political group that advocates privacy in technology. The group quietly scanned the websites of every major presidential candidate.

It found that 17 candidates (of all parties) failed a basic privacy test. The good news is that making political donations appears to be safe. But there are other issues.

Putin created 'new rules of the game' in Syria (Business Insider)

On Wednesday, Russia began bombing Syrian rebels in a major escalation of the 54-month war that has the US searching for answers.

The bombing campaign, which apparently targeted rebels unaffiliated with ISIS, "completely bypasses every bit of legitimate discussion we've had with them so far," a defense official told Politico.

Technology

The artist who turned his dead cat into a drone is now building a helicopter out of a cow? (Business Insider)

The artist who turned his dead cat into a drone is now building a helicopter out of a cow? (Business Insider)

Meet Bart Jansen.

He's 36. He hails from the Netherlands. He fits solar panels on roofs for a living. He has kids.

And in his spare time, he turns dead animals into exotic remote-control vehicles.

Health and Life Sciences

'Good bacteria' key to stopping asthma (BBC)

Being exposed to "good bacteria" early in life could prevent asthma developing, say Canadian scientists.

The team, reporting in Science Translational Medicine, were analysing the billions of bugs that naturally call the human body home.

How to end your sugar addiction (CNN)

How to end your sugar addiction (CNN)

It's 3 p.m., and the sugar cravings are relentless. I've tried satisfying them with a handful of fresh blueberries and some chocolate-covered espresso beans that I found in the back of my desk drawer. But I'm still struggling not to sabotage my withdrawal progress with a chocolate shake from In-N-Out Burger…

Life on the Home Planet

Major Hurricane Bears Down On Bahamas, May Make US Landfall By Sunday (Zero Hedge)

Major Hurricane Bears Down On Bahamas, May Make US Landfall By Sunday (Zero Hedge)

It’s no secret that PhD economists employed both in the public and private sectors enjoy scapegoating the weather for bad economic outcomes (e.g. “snow in the winter,” “residual seasonality,” poor jobs data is all summer’s fault, etc.), and all sarcasm aside, natural disasters can and do occasionally wreak havoc on economies (not to mention people) and so it’s probably important to take note of Joaquin, the 10th storm of the season which is bearing down on the Bahamas, threatens the US East Coast, and has some folks buying Home Depot shares.

Second Massive Bomb Explosion Rocks Chinese City, Day After 17 Parcel Bomb Attacks Kill Seven (ZeroHedge)

Second Massive Bomb Explosion Rocks Chinese City, Day After 17 Parcel Bomb Attacks Kill Seven (ZeroHedge)

Yesterday, in the aftermath of the stunning report that 17 “massive” bomb explosions rocked Chinese city of Liuzhou, killing at least 7 and wounding at least 51, we asked if as a result of China’s economic hard-landing and the surge in layoffs, the widespread popular unrest – which we suggested over the weekend is due for a comeback – has finally landed in China with tragic consequences, especially since the incident is clearly being treated as a criminal act.

We further noted that “if there is one thing China’s politburo simply can not afford right now, is to layer public unrest and civil violence on top of an economy which is already in “hard-landing” move. Forget black – this would be the bloody swan that nobody could “possibly have seen coming.”