Financial Markets and Economy

Yuan Overtakes Yen as World's Fourth Most-Used Payments Currency (Bloomberg)

China’s yuan overtook Japan’s yen to become the fourth most-used currency for global payments, shrugging off a surprise devaluation to rise to its highest ranking ever and boosting its claim for reserve status.

Volkswagen will put nonessential projects, investments under review (Market Watch)

Volkswagen will put nonessential projects, investments under review (Market Watch)

Volkswagen AG will put all nonessential projects and investments under review as it contends with the diesel emissions scandal, the company’s new chief executive officer and its top labor official told staff Tuesday.

“We have to question everything that no longer makes economic sense,” Bernd Osterloh said at a briefing on the situation in Wolfsburg.

AirAsia sounding out investors to take company private – sources (Business Insider)

AirAsia sounding out investors to take company private – sources (Business Insider)

Founders of Asia's No.1 budget carrier AirAsia Bhd are sounding out investors to take the company private in a management-led buyout, after its shares took a beating this year following a critical research report, people familiar with the matter said.

AirAsia <AIRA.KL> boss Tony Fernandes and his long-time business partner Kamarudin Meranun are working with banks to secure financing for the transaction, which could be launched over the next few months, said the people, who did not want to be identified as the discussions are confidential.

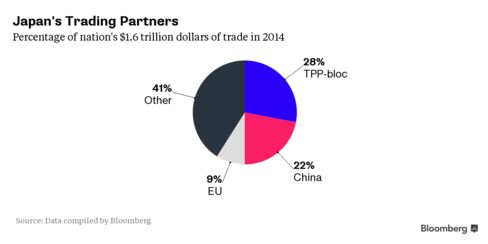

TPP Trade Deal: Who Stands to Benefit, Suffer in Asia-Pacific (Bloomberg)

The Trans-Pacific Partnership is the biggest trade agreement in history, reducing tariffs and other forms of protectionism in a dozen countries making up about 40 percent of the global economy with economic output of almost $30 trillion.

IBM sets up Watson-focused unit to tap the AI boom (Market Watch)

IBM sets up Watson-focused unit to tap the AI boom (Market Watch)

International Business Machines Corp. has formed a new business unit to capitalize on the recent groundswell in artificial intelligence.

The new Cognitive Business Solutions group will be run by Stephen Pratt, previously an executive in the consulting practice at Indian outsourcer Infosys. The new division’s 2,000 employees will advise companies in how to take advantage of IBM’s IBM, +3.08% Watson artificial-intelligence software.

Don't be afraid — there's still life in the global bull market (Business Insider)

Don't be afraid — there's still life in the global bull market (Business Insider)

Financial news at the moment seems to be full of death crosses, quantitative easing traps and market corrections. Most asset classes have slumped this year and the general atmosphere is considerably more bearish than it was a year ago.

Some of that is for good reason — the eurozone's recovery is still extremely modest, China's growth is slowing (along with most other emerging markets) and investors are uncertain over the ability of the halfway-recovered US and UK economies to sustain higher central bank interest rates.

Charting the Markets: Global Stocks Enjoy Best Run Since April (Bloomberg)

Indonesia's rupiah surges, global volatility fallsfor a fourth day, and German factory orders unexpectedly drop.

PepsiCo Earnings Drop, Weighed Down by Overseas Markets (NY Times)

Weakness in the international economy and the stronger dollar depressed earnings at PepsiCo in its third quarter.

Sales at the giant food and drinks company dropped 5 percent, to $16.3 billion, in the quarter that ended Sept. 5, the company reported on Tuesday. Earnings fell, too, to $533 million, or 36 cents a share, compared with $2 billion, or $1.32 a share, in the same period last year.

U.S. stock futures retreat after rally, as earnings loom (Market Watch)

Wall Street was set for a slightly lower open on Tuesday as investors take a breather after a recent bout of solid stock-market gains, ahead of the start of third-quarter corporate results.

SABMiller shares are tanking after reports it knocked back a takeover offer (Business Insider)

Shares in beer maker SABMiller are diving on Tuesday amid signs its mooted $250 billion merger with ABInBev could fall apart.

OPEC chief: Oil prices will rebound as investment is slashed (Market Watch)

OPEC chief: Oil prices will rebound as investment is slashed (Market Watch)

Oil prices are set to rebound as steep cuts in global oil investments crimp supplies, OPEC’s chief said Tuesday, and added that he was open to discussing the current oil market turmoil with the U.S.

The remarks come as many members of the Organization of the Petroleum Exporting Countries have been running deficits as they fight for market share against American tight oil instead of oil prices CLX5, -0.22% .

As U.S. Market Nears Ceiling, Southwest Goes Abroad for Growth (Bloomberg)

As U.S. Market Nears Ceiling, Southwest Goes Abroad for Growth (Bloomberg)

Since its start in 1971, Southwest Airlines Co. has stuck to its knitting, emphasizing discounts, short U.S.-only flights and cattle-call boarding. The strategy worked: It’s been profitable for 42 straight years.

So why mess with success?

Starting Oct. 15, Southwest will embark on a major expansion in flying abroad, with daily nonstop departures to six cities in Latin America and the Caribbean from a new concourse in Houston’s William P. Hobby Airport. A second international terminal will open in 2017 in Fort Lauderdale, Florida.

Crude up slightly in early Asian trade, Russia mulls oil talks (Business Insider)

Crude up slightly in early Asian trade, Russia mulls oil talks (Business Insider)

Crude oil prices rose in early Asia trade, adding to gains in the previous session, after Russia signaled it was willing to meet with other big oil producers to discuss the market following the decline in prices in the last quarter.

But gains were limited with investors awaiting U.S. government data on crude inventories this week. Some analysts are predicting the data will show further builds in crude stocks, putting oil prices under renewed pressure.

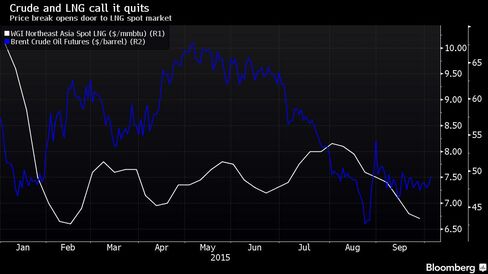

Buyers Market for LNG Turns Tables on Producers Amid Supply Glut (Bloomberg)

Encouraged by the plunge in commodity prices, the world’s biggest buyers of liquefied natural gas are demanding more say in negotiations with their suppliers.

Asian shares rise on fading Fed tightening view (Business Insider)

Asian shares rise on fading Fed tightening view (Business Insider)

The prospect of a delay in the U.S. Federal Reserve's plan to raise interest rates and signs of some stability in oil and commodity markets boosted Asian stocks on Tuesday.

MSCI's broadest index of Asia-Pacific shares outside Japan <.MIAPJ0000PUS> rose 0.7 percent to two-week high.

Covestro Jumps on First Day of Trading in Frankfurt After IPO (Bloomberg)

Covestro Jumps on First Day of Trading in Frankfurt After IPO (Bloomberg)

Covestro AG gained as much as 12 percent on the first day of trading after slumping global stock markets forced the plastics maker owned by Bayer AG to cut the size of its initial public offering by 40 percent.

The stock rose 11 percent at 26.55 euros at 10:39 a.m. in Frankfurt. Shares in the Leverkusen, Germany-based company had been priced at 24 euros after cutting the range from an originally targeted 26.50 euros to 35.50 euros. The sale was more than three times over-subscribed, Chief Financial Officer Frank Lutz said on Tuesday.

Japan's 'Abenomics' experiment is on the rocks (CNN)

Japan's 'Abenomics' experiment is on the rocks (CNN)

Now, there's a growing consensus that the prime minister's program is on the rocks.

Known as "Abenomics," it included three so-called arrows: massive monetary stimulus, increased government spending and significant economic reforms.

Glencore Shares Fall for First Time in Three Days in London (Bloomberg)

Glencore Plc, the commodity trader and producer that’s had record price swings in the past week, fell in London as mining companies and metals prices retreated.

Activist investor ValueAct turns up pressure on Baker Hughes (Market Watch)

Activist investor ValueAct turns up pressure on Baker Hughes (Market Watch)

ValueAct Capital Management on Tuesday turned up the heat on Baker Hughes Inc., which is awaiting regulatory approval for its tie-up with Halliburton Co., after taking a stake in the oil-field servicer earlier this year.

In a regulatory filing, ValueAct said it believes shares are undervalued and, as such, the firm intends to discuss with Baker Hughes’s board ways to enhance shareholder value–including potentially adding a ValueAct representative to the company’s board. ValueAct said it will also discuss the company’s mergers and acquisitions strategy, executive compensation and capital allocation, among other items.

Apple Pay Faces Tough Crowd in First Year (Bloomberg)

Apple Pay Faces Tough Crowd in First Year (Bloomberg)

Apple Inc. Chief Executive Officer Tim Cook has called 2015 the “year of Apple Pay.” So far it’s been underwhelming.

The mobile-payments system, which marks its one-year anniversary this month, has failed to catch on with consumers, accounting for only 1 percent of all retail transactions in the U.S., according to researcher Aite Group. The service — which allows users to pay for purchases by tapping their iPhone or Apple Watch on a device at cash registers — has suffered from a lack of promotion and limited number of terminals available in stores. Plus Apple Pay is only available on newer iPhones.

Tech companies are evolving fast — and Wall Street bankers are trying to keep up (Business Insider)

Tech companies are evolving fast — and Wall Street bankers are trying to keep up (Business Insider)

Technology companies are evolving at an incredible rate — and Wall Street investment banks are having to adapt to keep up with them.

Consumer technology companies can hit the 100 million user mark – an important milestone – in no time at all. Enterprise companies are getting hold of exciting new technology at earlier stages in their development too.

Politics

Hillary Clinton faults Barack Obama’s deportation policies (Market Watch)

Hillary Clinton faults Barack Obama’s deportation policies (Market Watch)

Hillary Clinton says she would be “much less harsh” on deportation policy than President Barack Obama if she wins the White House.

Clinton, the front-runner for the Democratic presidential nomination, was critical of Obama’s enforcement of deportation laws in an interview with Telemundo. “I think he’s done a lot,” she said. She added Obama enforced the laws “very aggressively during the last 6½ years” in part to get Republicans to go along with comprehensive immigration reform.

The Fringe Candidates Running for President (The Atlantic)

On the outskirts of the political mainstream, in the cavernous recesses of American democracy, lie the solitary fringe presidential aspirants: more than 1,200 of them.

Technology

The Pantry of the Future is Public and Robotic (PSFK)

The Pantry of the Future is Public and Robotic (PSFK)

Eating healthily while on-the-go and especially when time is limited can be difficult. A new startup named Pantry, aims to combat this problem by introducing an innovative way to ensure fresh meals are easily, constantly accessible.

Health and Life Sciences

There Is a Fine Line between Love and Drunk (Scientific American)

Many studies trumpet the positive effects of oxytocin. The hormone facilitates bonding, increases trust and promotes altruism. Such findings earned oxytocin its famous nickname, the “love hormone.” But more recent research has shown oxytocin has a darker side, too: it can increase aggression, risk taking and prejudice. A new analysis of this large body of work reveals that oxytocin's effects on our brain and behavior actually look a lot like another substance that can cut both ways: alcohol. As such, the hormone might point to new treatments for addiction.

The 4 Main Reasons People Don't Vaccinate (Forbes)

The 4 Main Reasons People Don't Vaccinate (Forbes)

Despite what seems like relentless and growing anti-vaccine rhetoric in recent years, vaccination rates among children have not fallen off. In fact, in a recent report by the Centers for Disease Control and Prevention (CDC), shows that immunization rates among toddlers remained stable from 2013 to 2014 with more than 90% of children receiving all the recommended childhood vaccines.

As in previous years, the report notes that only about 1% of all children in the United States have received no vaccines. Perhaps surprisingly, most of those aren’t due to parents that harbor staunch anti-vaccine views, a new study suggests. Researchers identified four main reasons why people do not vaccinate.

Life on the Home Planet

3 Million More Refugees Could Flee Syria, E.U. Official Warns (Time)

3 Million More Refugees Could Flee Syria, E.U. Official Warns (Time)

Up to 3 million additional refugees could flee the fighting in Syria, E.U. Council President Donald Tusk warned in remarks to European lawmakers Tuesday.

The wave of refugees could worsen a migration crisis that has put pressure on European border facilities and strained relations between EU member states. There are currently around 2 million refugees from Syria in Turkey.