Here's our collection of timely articles about the markets and other interesting items for today.

Financial Markets and Economy

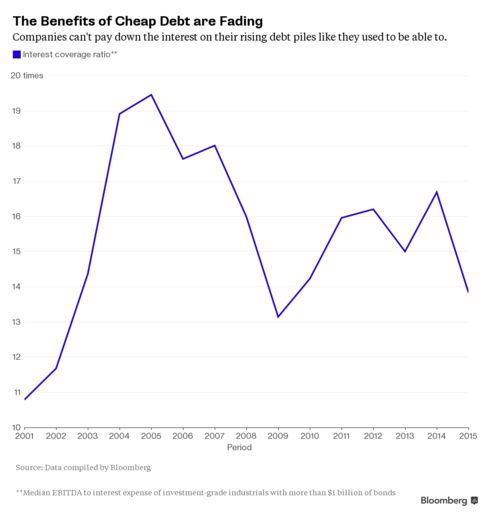

Corporate America's Epic Debt Binge Leaves $119 Billion Hangover (Bloomberg)

The Federal Reserve’s historically low borrowing rate isn’t benefiting corporate America like it used to.

Who’s afraid to buy this high-risk, high-reward commodity stock? (Market Watch)

Who’s afraid to buy this high-risk, high-reward commodity stock? (Market Watch)

Every investor should know the perils of commodity stocks by now.

Commodity prices are in free fall, with everything from oil to copper tumbling for the past year or so. And given the slowdown in China, it’s safe to expect that trend to continue as supplies remain big and global demand remains soft.

U.S. consumer prices fall on cheaper gasoline (Business Insider)

U.S. consumer prices fall on cheaper gasoline (Business Insider)

U.S. consumer prices recorded their biggest drop in eight months in September as the cost of gasoline fell, but a steady pick-up in underlying price pressures should allay fears that a disinflationary trend was reasserting itself.

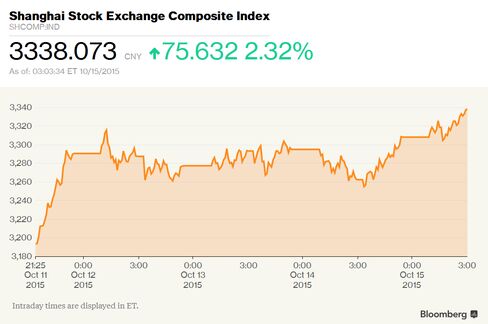

Chinese Stocks Climb in Hong Kong as Telecom Companies Advance (Bloomberg)

Chinese stocks rose to an eight-week high as a government plan to reorganize the telecom industry raised speculation policy makers will accelerate reforms of state-owned companies to stem slowing economic growth.

Dollar claws back ground against yen, but drops versus euro (Market Watch)

Dollar claws back ground against yen, but drops versus euro (Market Watch)

The dollar recouped some of its overnight losses on Thursday, bouncing back against the yen but losing further ground against the euro and the Australian dollar, amid increasing expectations that the Federal Reserve may wait longer before it starts raising short-term rates.

Inflation fell as expected in September (Business Insider)

The consumer price index fell as expected in September.

Wal-Mart's Stock Got Crushed and Wall Street Has A Few Things To Say About it (Bloomberg)

Retail giant Wal-Mart saw its stock fall 10 percent on Wednesday after saying earnings will decrease by 6 percent to 12 percent in the fiscal year ending January 2017. The lower guidance surprised analysts, as they were expecting a gain of 4 percent on average for the period, according to data compiled by Bloomberg.

Kenya’s central bank is trying to stop a mid-size bank failure from triggering panic (Quartz)

Kenya’s central bank is trying to stop a mid-size bank failure from triggering panic (Quartz)

Kenyan regulators and bankers are scrambling to quell panic over the suspension of a mid-sized retail bank earlier this week, the second lender to be put under management by government authorities in three months.

One company is making a killing from Glencore's problems (Business Insider)

One company is making a killing from Glencore's problems (Business Insider)

The commodity price slump this year has put enormous pressure on mining giant Glencore and it has led to tonnes and tonnes of assets like copper and steel being stockpiled until the market picks up.

Companies like Glencore have a huge pile of debt and can't shift those assets when prices are so low because it's not cost-effective. Those stockpiled goods are basically used as collateral against their loans.

Charting the Markets: Burberry and Bonds Not as Good as Gold (Bloomberg)

As the odds of a U.S. rate hike in the next six months lengthen, global equity investors have a renewed spring in their step after two days of losses. Fed fund futures put the probability of a move this month at just 4 percent, versus 10 percent on Tuesday. March 2016 is also now looking less certain, with the likelihood of a policy change below 50 percent compared to 59 percent a couple of days ago. Asian and emerging market stocks rallied as much as 2 percent, while European equities gained for the first day in four.

Bond investors shouldn’t fear the Fed (Market Watch)

Bond investors shouldn’t fear the Fed (Market Watch)

Over the past few years, the overwhelming consensus among gurus, pundits and commentators (including me) has been that interest rates will rise, so you should avoid holding long-term bonds, especially Treasuries.

Tesco CEO Lewis Shuns More Quick Fixes to Retailer's Debt Woes (Bloomberg)

Tesco Plcs plan to cut debt without selling any more major assetsis raising questions over the U.K. supermarket leaders ability to recapture investment-grade status if it doesnt sell shares first.

Why the Fed is wrong about deflation (Market Watch)

But so far, evidence is scarce that the inflation rate is sinking into a depressing new normal near zero, even as the consumer price index dropped into negative territory again in September.

Politics

Obama to abandon plan to withdraw most U.S. troops from Afghanistan (Market Watch)

Obama to abandon plan to withdraw most U.S. troops from Afghanistan (Market Watch)

U.S. President Barack Obama will say Thursday that he has ordered a significant slowdown in the withdrawal of American troops from Afghanistan, senior administration officials said, a decision that marks a major reversal in his war plan and effectively hands the conflict over to his successor.

Why Hillary Clinton Can't Win by Going After the NRA (Bloomberg)

Why Hillary Clinton Can't Win by Going After the NRA (Bloomberg)

For the first time in 16 years, guns will play a prominent role in the presidential election. In 2000 energized gun-rights activists helped cost Al Gore his home state of Tennessee and Bill Clinton’s home state of Arkansas. As much as Florida’s hanging chads and Ralph Nader’s third-party self-indulgence, pro-gun agitation put George W. Bush in a position to enjoy the Supreme Court’s delivery of the White House in Bush v. Gore.

Technology

Tesla’s Coolest Feature Isn’t the New Autopilot System (Time)

Tesla’s Coolest Feature Isn’t the New Autopilot System (Time)

Thursday morning, many Tesla owners woke up to a treat: Their expensive all-electric rides can now change lanes, find a parking spot and handle stop-and-go traffic with minimal, if any, input from the driver.

Hendo 2.0: Tony Hawk Helped Design a New Hoverboard That Actually Hovers (Gizmodo)

Hendo 2.0: Tony Hawk Helped Design a New Hoverboard That Actually Hovers (Gizmodo)

This time last year, we reviewed the Hendo—a real-life hoverboard that actually levitates off the ground (as opposed to whatever this thing is.) The same company’s new and improved model looks and feels more like a skateboard—with help from Tony Hawk. The image above is just an illustration, since the real thing will be revealed later this month. But it looks rad as hell.

Health and Life Sciences

Ask Well: Taking Heartburn Drugs Long-Term (NY Times)

Ask Well: Taking Heartburn Drugs Long-Term (NY Times)

The most popular acid reflux medications — proton pump inhibitors like Nexium, Prilosec and Prevacid, which are taken daily — can have serious side effects and “are not the benign drugs the public thinks they are,” said Dr. Shoshana J. Herzig of Harvard Medical School.

Why hasn't the US eradicated the plague? (BBC)

Why hasn't the US eradicated the plague? (BBC)

It's nearly 50 years since the US landed men on the moon, but Americans are still dying from a disease that ravaged Europe in the Middle Ages. Why hasn't the US eradicated the plague?

The Black Death caused about 50 million deaths across Africa, Asia and Europe in the 14th Century. It wiped out up to half of Europe's population.

Life on the Home Planet

The Ankara Bomber Owned One of Turkey's Most Well-Known ISIS Hangouts (Bloomberg)

The person named as a suicide bomber in Turkey’s deadliest terror attack was the owner of an Islamic State gathering place well known to Turkish authorities and Turkish media, which had been sounding the alarm about his cell for more than two years.