Financial Markets and Economy

Goldman Sachs sold 1.3 million of the Valeant CEO's shares of his company yesterday (Business Insider)

Goldman Sachs sold 1.3 million of the Valeant CEO's shares of his company yesterday (Business Insider)

Embattled Canadian drug company Valeant Pharmaceutical's CEO J. Michael Pearson got a collateral call from Goldman Sachs.

On April 22, 2014, when Valeant's share price was $206.93, Pearson pledged two million shares to Goldman in exchange for a $100 million loan "that he used for, among other things, financing charitable contributions, including to Duke University, and helping to fund a community swimming pool, purchasing Valeant shares, and meeting certain tax obligations related to the vesting and payment of Valeant compensatory equity awards."

Euro-Area Bond Yields Have a Long Drop Ahead, HSBC's Major Says (Bloomberg)

Euro-area government bond yields have a long descent ahead of them, according to Steven Major, HSBC Holdings Plc’s head of fixed-income research.

Crude oil prices edge up; but oversupply, strong dollar drag (Business Insider)

Crude oil prices edge up; but oversupply, strong dollar drag (Business Insider)

Crude oil prices edged up on Friday after falling as much as 2 percent the previous session, with analysts saying oversupply and a strong dollar would continue to weigh on fuel markets.

U.S. crude futures were trading at $45.46 a barrel at 0829 GMT, up 26 cents from their last settlement, while Brent crude rose 18 cents to $48.16 a barrel.

Miners Unable to Reverse Platinum Rout Putting Lonmin on Brink (Bloomberg)

Lonmin Plcs warning that it may be forced out of business shows just how dire the situation has become for some of the worlds biggest mining companies.

Why you shouldn’t buy small-cap stocks until 2016 (Market Watch)

Don’t buy any small-cap stocks until next year.

The Real Economic Recovery Is Finally Here (Time)

The Real Economic Recovery Is Finally Here (Time)

Is a real recovery finally here? That’s what the latest U.S. employment data appears to be telling us. Not only did payrolls come in dramatically higher than expected, workers finally got a bit more money in their pockets–wage growth, which had been hovering a little above 2 %, kicked up to 2.5%—a 6 year high. That’s modest by historical standards, particularly at this stage of a recovery. But it’s a shift in the right direction for the continued strength of an economy made up of 70% consumer spending.

AstraZeneca buys ZS Pharma for $2.7 billion, pips Actelion (Business Insider)

AstraZeneca buys ZS Pharma for $2.7 billion, pips Actelion (Business Insider)

Britain's AstraZeneca <AZN.L> said on Friday it had agreed to buy U.S biotech company ZS Pharma <ZSPH.O> for $2.7 billion, pipping Swiss firm Actelion <ATLN.VX> to the prize in the latest bout of deal-making for the hyperactive healthcare sector.

Chile Inflation Slows to Top of Target in Temporary Respite (Bloomberg)

Chile’s inflation rate dipped to the top of the target range for only the second time in 19 months in October in what the central bank President Rodrigo Vergara has said will be a temporary respite for policy makers.

China gets its mojo back, as Asia markets take differing paths (Market Watch)

China gets its mojo back, as Asia markets take differing paths (Market Watch)

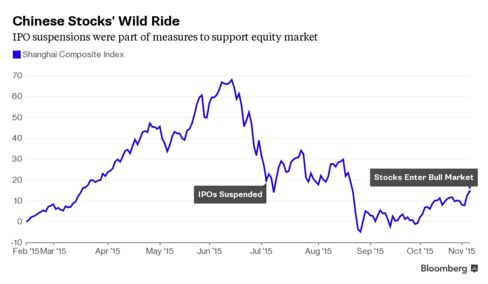

Chinese shares regained momentum this week, having crossed into a bull market, while Japan shares closed at a two-month high.

But unlike October, when Asian markets marched higher to the drumbeat of global-central bank moves, benchmarks in the region are responding to idiosyncratic drivers in the first week of November.

Toshiba tries to sell down $7 billion U.S. gas commitment (Business Insider)

Toshiba tries to sell down $7 billion U.S. gas commitment (Business Insider)

Japan's Toshiba, struggling with a major accounting scandal, is trying to sell down a $7.4 billion commitment to U.S. liquefied natural gas (LNG), which it signed two years ago as part of a plan to sweeten sales of turbines for power plants.

Zambia Kwacha Weakens to Breach 13 Per Dollar for First Time (Bloomberg)

Zambia’s currency weakened, breaching 13 per dollar for the first time, on concern that the government may increasingly intervene in the economy before elections in 2016.

British industry is doing worse than we thought (Business Insider)

The UK's industrial economy is doing alright. But not great.

Toyota to Drop Takata as Supplier of Airbag Inflaters (NY Times)

Toyota to Drop Takata as Supplier of Airbag Inflaters (NY Times)

The president of Toyota Motor said on Friday that his company would drop the embattled safety equipment maker Takata as a supplier of airbag inflaters, after a similar move by Honda, a decision that widens the fallout from the largest auto safety recall in history.

A Money-Managing Robot Is About to Join BofA's Thundering Herd (Bloomberg)

Bank of America Corp.s thundering herd of Merrill Lynch financial advisers is about to be joined by a robot.

Germany got some terrible economic news (Business Insider)

German industrial production figures were unexpectedly poor on Friday.

China to Resume IPOs by Year-End After Stocks Enter Bull Market (Bloomberg)

China will lift a five-month freeze on initial public offerings by the end of the year, removing one of its key measures of support for the stock market as equities recover from a $5 trillion rout.

China's 'YouTube' sold for $3.6 billion (CNN)

China's 'YouTube' sold for $3.6 billion (CNN)

The online shopping giant is buying China's YouTube-like service Youku Tudou (YOKU) in an all-cash deal that values the company at $4.4 billion.

Alibaba (BABA, Tech30) first invested in the site in 2014, paying $30.50 per share for just over 18% of the New York-listed company.

U.K.s Real Yields May Perk Up as Markets Mask Reality: Analysis (Bloomberg)

U.K.’s real yields have room to rise over the medium to longer term as the rates markets, particularly the front-end, are underpricing the evolving growth and inflation dynamics, Bloomberg strategist Tanvir Sandhu writes.

Economic Report: U.S. creates 271,000 jobs in October as labor market heats back up (Market Watch)

Companies added new jobs in October at the fastest pace of 2015, knocking the U.S. unemployment rate down to a seven-year low and setting the stage for the Federal Reserve to raise interest rates before year end.

Swiss Pray for Rhine Rain as Fuel Stays Stuck in Netherlands (Bloomberg)

The Swiss are praying for rain on the Rhine River before winter as low water levels restrict barges transporting supplies of heating oil to the land-locked European country. A tax rise on the fuel that takes effect next year makes the need even more acute.

Pimco fallout keeps piling pressure on Allianz earnings (Market Watch)

Pimco fallout keeps piling pressure on Allianz earnings (Market Watch)

German insurer Allianz SE said Friday it was sticking with its full-year profit outlook despite continuing pressure on earnings from its Pacific Investment Management Co. business, known as Pimco.

ArcelorMittal Cuts 2015 Profit Target as Quarterly Earnings Fall (Bloomberg)

ArcelorMittal is taking the latest knock from record Chinese steel exports hurting producers across the globe.

A December hike? More investors think that sounds about right (Market Watch)

Investors are increasingly betting that the Federal Reserve will hike interest rates in December, according to Bank of America Merrill Lynch strategists.

Indonesia Needs Rupiah-Bear Retreat for Rate Cuts to Lift Growth (Bloomberg)

The impact of any Indonesian interest-rate cuts depends on how hard the central bank has to work to fight off rupiah bears.

DuPont, Syngenta in deal talks as low crop prices pressure profits (Market Watch)

DuPont, Syngenta in deal talks as low crop prices pressure profits (Market Watch)

Some of the world’s largest agricultural companies are looking to combine with one another as three years of shriveling crop prices have pressured profits, in what would be the industry’s first big shake-up in at least a decade.

Jobs to Call Shots as Dollar Set for Four-Week Gain Versus Euro (Bloomberg)

The dollar was set for its fourth weekly gain versus the euro before U.S. jobs data which may further boost investor expectations the Federal Reserve will raise interest rates next month.

Japan Post Frenzy Shows Signs of Abating After $36 Billion Surge (Bloomberg)

Japan Post Frenzy Shows Signs of Abating After $36 Billion Surge (Bloomberg)

After two days as a listed entity, Japan Post Group was worth $36 billion more than the price tag the government put on it. Shinzo Abe will soon find out if the financial sacrifice was worth it.

Shares of Japan Post Insurance Co. surged 77 percent through Thursday, while Japan Post Bank Co. jumped 22 percent and the parent company climbed 30 percent. All three slid on Friday. If the government had priced the roughly 11 percent stakes it offloaded in the IPO at Thursday’s closing levels, an extra $4 billion would have gone into its coffers to fund the rebuilding of areas devastated by the 2011 earthquake and tsunami.

Chinese Stocks Fall in Hong Kong as Energy Producers Slump (Bloomberg)

China’s stocks extended a bull-market rally, led by brokerages and technology companies, as ordinary investors returned to the market and speculation grew the government will take more measures to keep economic growth on track.

Gold Holds Weekly Drop as Investors Count Down to U.S. Payrolls (Bloomberg)

Gold headed for the biggest weekly drop since July as investors awaited U.S. jobs data for more indications on when the Federal Reserve will raise interest rates.

Wage growth is finally happening (Business Insider)

All eyes continue to be on the Fed as they decide whether to raise interest rates by the end of this year, and Chairwoman Janet Yellen has repeatedly hammered home the idea that they will raise rates when they feel confident that the US labor market is back to full health and inflation is coming.

Confronting the Coming Liquidity Crisis (Project Syndicate)

Confronting the Coming Liquidity Crisis (Project Syndicate)

This month, G-20 leaders will meet in Antalya, Turkey, for their tenth summit since the 2007 global financial crisis. But, despite all of these meetings – high-profile events involving top decision-makers from the world’s most influential economies – no real progress has been made toward reforming the international financial architecture. Indeed, the group has not seriously engaged with the subject since the 2010 summit in Seoul. Put simply, the G-20 is failing in its primary and original purpose of enhancing global financial and monetary stability.

Technology

Ultrasonic Levitation (Scientific American)

Ultrasonic Levitation (Scientific American)

Nature Video finds out how to levitate objects using sound waves. Scientists can float objects in mid-air, using just the power of sound. Now, using ultrasonic speakers, they can levitate things with more control than ever before, moving small objects in three dimensions even with the whole array turned upside down. They have also developed virtual ‘holograms’ to visualise how the shapes made by the sound waves can ‘grab’ objects.

It's Amazing How Far Digital Photography Has Evolved Since 1998 (Gizmodo)

It's Amazing How Far Digital Photography Has Evolved Since 1998 (Gizmodo)

This isn’t art, though it may look like it. Instead, it’s a striking look at 17 years of progress in snapping digital photos in low light. How times have changed.

San Francisco based photographer Jim Goldstein took the first professional Canon DSLR camera, the Canon D2000 from 1998, and the Japanese company’s latest product, the Canon 5DS R from 2015, and compared their abilities in a new video.

Health and Life Sciences

Vaccine for Deadly Respiratory Virus Shows Promise in Early Trial (Medicine Net)

Vaccine for Deadly Respiratory Virus Shows Promise in Early Trial (Medicine Net)

Another research team is reporting progress toward developing a vaccine to prevent respiratory syncytial virus (RSV), a common lung infection that can cause deadly complications in infants and the elderly.

Scientists think a proven vaccine could still be years away. But the new findings add to a growing list of recent advances toward routine immunizations against the disease.

Dawn of gene-editing medicine? (BBC)

Dawn of gene-editing medicine? (BBC)

Does the smiling face of Layla Richards mark a new era in genetic medicine that could change all our lives?

Her story is simply remarkable and a world first.

Soda and junk foods are not making you fat (Market Watch)

Soda and junk foods are not making you fat (Market Watch)

Soda, candy and fast-food are often blamed for the rising rates of obesity in America and, while eating any one high-calorie or high-sugar food to excess is obviously unhealthy and will not help you lose weight, a major new study found that consumption of these foods is not related to Body Mass Index in 95% of the population. The report was published by the Food & Brand Lab at Cornell University in Ithaca, N.Y. “While a diet of chocolate bars and cheese burgers washed down with a Coke is inadvisable from a nutritional standpoint, these foods are not likely to be a leading cause of obesity,” the study said.

Life on the Home Planet

Metrojet Plane Crash Probe May Impact U.S. Airport Security (Huffington Post)

Metrojet Plane Crash Probe May Impact U.S. Airport Security (Huffington Post)

The outcome of the investigation into the Metrojet airline crash that killed 224 people over Egypt's Sinai Peninsula will directly impact safety protocols within the United States, a leading U.S. air security official said.

As the probe inches closer to the possibility of an onboard bomb, John Pistole, former administrator of the Transportation Security Administration and deputy director of the FBI, said investigators' work is just beginning. Evidence is still limited. Two black boxes have been collected and officials are on the scene.

Absurd Creature of the Week: The Mystery of the Arctic’s Toxic, Lethargic Shark (Wired)

Absurd Creature of the Week: The Mystery of the Arctic’s Toxic, Lethargic Shark (Wired)

In Iceland they have this delicacy called hákarl that recently initiated diners describe as “the worst tasting food on Earth,” “the world’s foulest food,” and “the worst thing I have ever had in my mouth.” To say it smells like a urinal would be generous. Not that anyone should be surprised, considering hákarl is rotten shark meat fermented in the dirt or open air for months on end.