Financial Markets and Economy

Asian Stocks Join Global Selloff on Fed Concern Before China CPI (Bloomberg)

Asian stocks joined a global selloff amid concern that U.S. policy makers will next month end an unprecedented era of record-low borrowing costs, and as investors awaited a Chinese inflation report. Material and technology shares led declines.

Bullish bets on the dollar doubled in the last 2 weeks (Market Watch)

Bullish bets on the dollar doubled in the last 2 weeks (Market Watch)

Speculators are flocking back to the dollar.

Hedge funds and other speculators increased their futures-market bets on further dollar strength to $27.7 billion in the week ended Tuesday, more than double the $13.1 billion total long position from two weeks ago, according to data collected by the Commodity Futures Trading Commission.

US Bank launches financial management service (Busines Insider)

US Bank announced plans to expand ScoreBoard — a finance management tool previously only available to small businesses — to any card-holding customer. The application allows users to monitor their spending by providing monthly snapshots of card spending on travel, home improvement, and gas. It also allows consumers to download spending reports and compare their own habits against those of others in their peer group. The service is available through US Bank’s online banking platform.

Japanese Stocks Slide as Topix Index Retreats From 11-Week High (Bloomberg)

Japanese stocks fell from the highest level in 11 weeks, tracking declines in global equities, as investors weighed profit reports at companies from Bridgestone Corp. to Japan Display Inc. and the OECD trimmed its global economic forecasts.

Gap got slammed by the Canadian dollar and the yen (Business Insider)

Gap got slammed by the Canadian dollar and the yen (Business Insider)

Gap shares fell by as much as 7% in after-hours trading on Monday after the company reported a third-quarter decline in sales.

Net sales in Q3 fell 3% to $3.86 billion, the retailer said in a statement. And on a constant currency basis, net sales were flat.

Scuffle Between Nevada Casino Company and Union Pulls In Deutsche Bank (NY Times)

The long-running fight between culinary workers and a casino owner in Las Vegas is about to go another round. And the workers are hoping the regulatory troubles faced by a German bank might give them the advantage they have been looking for.

Rout-Proof Oil Dividends Under Scrutiny as Small Companies Crack (Bloomberg)

Europe’s biggest energy companies are doing everything they can to keep paying dividends. If their smaller peers are anything to go by, they’re fighting a losing battle.

Ford to invest $9 billion — in U.S. plants this time (CNN)

Ford to invest $9 billion — in U.S. plants this time (CNN)

The investment pledge is part of the tentative labor agreement the automaker has reached with workers. The terms of the four-year pact were disclosed by the United Auto Workers union Monday.

The union seeks such commitments from every automaker because they tend to create and protect U.S. jobs.

There's one thing that everyone is getting wrong about the war between Walmart and Amazon (Business Insider)

There's one thing that everyone is getting wrong about the war between Walmart and Amazon (Business Insider)

A lot of people are betting against Walmart right now.

The retailer's stock price recently suffered its biggest one-day drop in 25 years after executives warned that annual growth over the next three years would range between 3% and 4% and profit would decline by up to 12% in 2017.

Five Economic-Policy Questions for Poland's Incoming Government (Bloomberg)

With Polands Law & Justice party set to take power after winning an unprecedented parliamentary majority in last months election, here are the main questions investors have for Beata Szydlos government.

Oil price to rise only gradually to $80 by 2020: IEA (Yahoo! Finance)

Oil price to rise only gradually to $80 by 2020: IEA (Yahoo! Finance)

Oil is unlikely to return to $80 a barrel before the end of the next decade, despite unprecedented declines in investment, as yearly demand growth struggles to top 1 million barrels per day, the International Energy Agency said on Tuesday. In its World Energy Outlook, the IEA said it anticipates demand growth under its central scenario will rise annually by some 900,000 barrels per day to 2020, gradually reaching demand of 103.5 million bpd by 2040. "Our expectation is to see prices gradually rising to $80 around 2020," Fatih Birol, the executive director of the IEA, told Reuters ahead of the release of the report.

Here's the inflection everyone in the stock market is praying for (Business Insider)

Earnings and expectations for earnings are the most important drivers of stock prices.

Asian Futures Signal More Stock Losses Ahead of Chinese CPI Data (Bloomberg)

The global equity selloff looked set to continue in Asia, with Japanese shares to join declines sparked by anxiety that the era of cheap money out of the U.S. will end as soon as December.

Swiss watchmaker Tag Heuer teams up with big tech for smartwatch (Yahoo! Finance)

Swiss watchmaker Tag Heuer teams up with big tech for smartwatch (Yahoo! Finance)

LVMH's Tag Heuer became on Monday the first Swiss watchmaker to offer a "smartwatch" to customers that combines Swiss design with U.S. technology, seeking to tap a growing market for wearable devices amid flagging sales of traditional watches. Co-developed with Google (GOOGL.O) and Intel (INTC.O), the "Tag Heuer Connected" will cost $1,500…

Short seller who crushed Valeant just slammed another pharma stock (Business Insider)

Shares of pharmaceutical company Mallinckrodt tanked after Citron Research, a short-selling firm led by Andrew Left, tweeted that it has "more downside than Valeant."

Gundlach Says December Rate Increase a Threat to Stocks, Bonds (Bloomberg)

A December interest rate increase would threaten U.S. stock and bond markets while potentially driving up the value of the dollar to the point where it weakens the economy, according to Jeffrey Gundlach, chief executive officer of DoubleLine Capital.

Here are 14 great stocks with fat dividends and huge buyback plans (Business Insider)

Here are 14 great stocks with fat dividends and huge buyback plans (Business Insider)

Companies are sitting on record piles of cash, and that's good news for investors in certain companies.

According to David Kostin at Goldman Sachs, S&P 500 companies will spend $2.2 trillion in excess cash in 2016 and 46% of that will be returned to shareholders in the form of dividends ($432 billion) or buybacks ($608 billion).

RCS Capital Shares Fall After Apollo Scuttles Investment Plans (Bloomberg)

RCS Capital Corp., a network of brokers that sell real estate investment trusts to individual investors, plunged after Apollo Global Management scaled back plans to invest in the company and another entity associated with Nicholas Schorsch.

Expectations for inflation are up (Business Insider)

One of the biggest concerns for the Fed as they decide whether or not to raise interest rates this year is expected inflation. While prices and wages have been pretty stable over the last few years, if consumers and investors think the inflation rate will rise in the near future, the Fed might consider raising interest rates in response.

Egypt Stocks Plunge as Foreigner Selloff Fuels Devaluation Bets (Bloomberg)

Egypts stocks fell the most in two months as foreign investors dumped the most shares since April, intensifying speculation that the country will devalue its currency.

Goldman: This Is How S&P 500 Companies Will Use Their Cash in 2016 (Bloomberg)

Goldman: This Is How S&P 500 Companies Will Use Their Cash in 2016 (Bloomberg)

Companies in the Standard & Poor's 500-stock index will spend $2.2 trillion next year, according to Goldman Sachs.

Goldman's Chief U.S. Equity Strategist David Kostin and his team figure 54 percent of that total spending amount will go toward "growth" activities such as capital expenditure, research and development, and mergers and acquisitions — up 3 percent compared with 2015…

U.S. government, Electrolux argue at trial over GE appliance deal (Business Insider)

U.S. government, Electrolux argue at trial over GE appliance deal (Business Insider)

The government argued Monday that U.S. consumers would pay 5 percent more for ranges and wall ovens if AB Electrolux was allowed to buy General Electric's appliance business but the companies accused antitrust enforcers of failing to acknowledge powerful and growing competition from overseas manufacturers.

Politics

Your state is probably even more corrupt than you thought (Market Watch)

Michigan may be the worst, but no state was spared a lousy grade in a recent study from the Center for Public Integrity, a Washington, D.C.-based nonprofit that took a look at rules and systems on government transparency and accountability across the country.

Why Puerto Rican Statehood Matters So Much Right Now (The Atlantic)

Why Puerto Rican Statehood Matters So Much Right Now (The Atlantic)

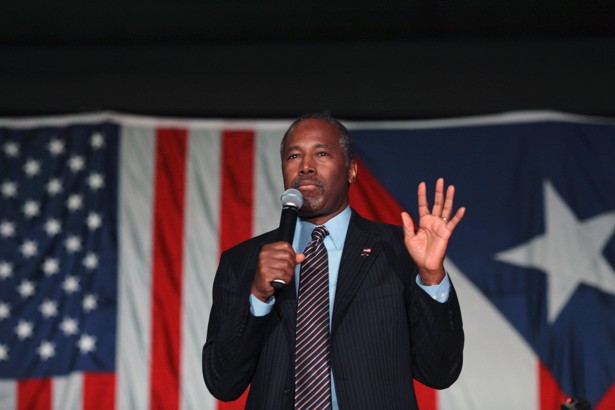

If Ben Carson becomes president, he plans to add one more star to the American flag.

During a New Progressive Party rally in Puerto Rico, Carson said, “Mis hermanos Americanos, my campaign is built around the premise of ‘We the People,’ and through such lens, I view the statehood question in Puerto Rico as settled."

Technology

MIT’s experimental 3D-printed sneaker shape-shifts to fit your foot (Quartz)

MIT’s experimental 3D-printed sneaker shape-shifts to fit your foot (Quartz)

At the moment, 3D printing is still mostly about experimentation. While it hasn’t quite taken off to revolutionize the way consumer products are made just yet, it does offer a lot of exciting, innovative ideas, especially in the realm of sneakers.

Google Seeks to Influence AI Research by Giving Software Away (Bloomberg)

Google wants to set the standard on artificial intelligence.

The Web company, seeking to influence how people design, test, and run artificial-intelligence systems, is making its internal AI development software available for free.

Adidas's Latest "Futurecraft" Shoes Are Made From One Seamless Piece Of Leather (Fast Company)

Adidas's Latest "Futurecraft" Shoes Are Made From One Seamless Piece Of Leather (Fast Company)

By carefully shaving away layers of leather, Adidas can make one piece work like many.

At first glance, Adidas's new shoe looks like their iconic Superstar, just sewn up in leather. That is, until you look closer at the toe box, ankle, those three stripes. You see that's not stitching holding the shoe together. Actually, that's not anything holding the shoe together.

Health and Life Sciences

Scientists make skin’s stretchy stuff in the lab (Futurity)

Scientists make skin’s stretchy stuff in the lab (Futurity)

Extracellular matrix is the material that gives tissues like skin, cartilage, or tendon their strength and stretch. It’s been hard to make well in the lab, but scientists report new success.

The key was creating a culture environment that guided cells to make extracellular matrix (ECM) themselves.

Data on Benefits of Lower Blood Pressure Brings Clarity for Doctors and Patients (NY Times)

When the federal government announced in September that it had abruptly halted a large blood pressure study because its results were so compelling, doctors were left in frustrating limbo.

The announcement said researchers had found that driving systolic blood pressure to levels far below what current guidelines recommend — less than 120 instead of 140 or 150 millimeters of mercury — can save lives and prevent heart disease and strokes.

Life on the Home Planet

What Would A Bodhisattva Do? (Huffington Post)

What Would A Bodhisattva Do? (Huffington Post)

From the fourth perspective you look at the world through the mind; from the fifth perspective, you look at the world through the heart. In the fourth perspective you identify with no one; in the fifth perspective, you identify with everyone. The fourth perspective is wisdom; the fifth perspective is compassion. In the fourth perspective you are no one to become everyone; in the fifth perspective, you are the only One.

Johannesburg limits water use as drought worsens (Phys)

Johannesburg limits water use as drought worsens (Phys)

Johannesburg, South Africa's largest city and economic hub, on Monday imposed emergency water restrictions as supplies deteriorated due to a drought, the worst to ravage the country in three decades.

"We are pleading with our customers to take more precautionary measures on how to use the water," the city's environmental affairs spokesman Anda Mbikwana told AFP.