Financial Markets and Economy

IEA Says Record 3 Billion-Barrel Oil Stocks May Weaken Prices (Bloomberg)

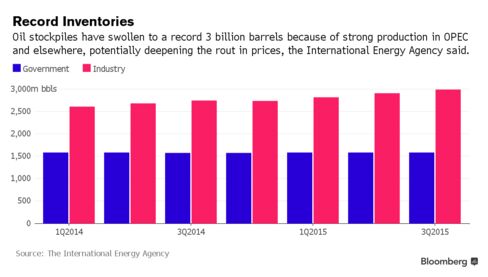

Oil stockpiles have swollen to a record of almost 3 billion barrels because of strong production in OPEC and elsewhere, potentially deepening the rout in prices, according to the International Energy Agency.

An ex-Facebook exec just launched a $70 million fund for tech startups (Business Insider)

White Star Capital on Friday announced a new $70 million (£46 million) fund for investing in early stage startups in Europe and the East Coast of the US.

It's White Star's first institutional fund and has been raised from backers including the Canadian government, the chair of auction house Christie's, and the founder of Cirque du Soleil, among others.

U.S. dollar wavers against the yen ahead of retail sales reading (Market Watch)

U.S. dollar wavers against the yen ahead of retail sales reading (Market Watch)

The U.S. dollar wobbled against the yen, but edged up against the euro Friday, as investors get ready to assess retail sales data that should give a clue to the health of the U.S. economy.

The ICE U.S. Dollar index DXY, +0.22% a measure of the greenback’s strength against a basket of six rival currencies, was flat at 98.66. At the same time, the WSJ Dollar Index BUXX, +0.22% a measure of the dollar against a basket of major currencies, was up 0.1% at 90.06.

U.S. Futures Fall After S&P 500 Drop; Cisco Sinks on Forecasts (Bloomberg)

U.S. stock-index futures were little changed as investors weighed yesterday’s rout in commodities against the prospects of the first potential rise in interest rates since 2006.

Hedge funds are fighting a million pound battle over Britain's fate in Europe (Business Insider)

Hedge funds are fighting a million pound battle over Britain's fate in Europe (Business Insider)

Battle lines are being draw in London's small hedge fund community over the issue of whether Britain should stay within the European Union or not.

And the deep pockets of those on either side means they could decide the argument.

Charting the Markets: Global Stocks Continue to Fall (Bloomberg)

Commodities sink to 1999 low, European stocks head for a 2 percent weekly decline and Syngenta shares surge.

The Santa Claus rally in stocks will miss Christmas (Market Watch)

The much-vaunted Santa Claus rally is coming up — after Christmas.

Investors flee Toshiba as hopes fade for quick scandal closure (Business Insider)

Investors flee Toshiba as hopes fade for quick scandal closure (Business Insider)

Investors dumped shares in Japan's Toshiba Corp on Friday, as closure on the company's $1.3 billion accounting scandal appeared further out of reach after new revelations of losses at its U.S. nuclear unit Westinghouse.

The laptops-to-nuclear conglomerate confirmed an earlier media report saying the Westinghouse nuclear business had booked losses in fiscal years 2012 and 2013.

Money Managers Are Stuffed With Corporate Bonds (Bloomberg)

The proportion of corporate bonds in buy-side portfolios is close to a new record.

U.S. oil prices fall to over two-month lows on rising inventories (Business Insider)

U.S. oil prices fall to over two-month lows on rising inventories (Business Insider)

U.S. crude oil dipped further in early trading on Friday to over two-month lows as prices fall over 10 percent since the beginning of November.

Benchmark U.S. crude futures were at $41.70 a barrel at 0021 GMT (2021 EDT), down five cents from Thursday when prices tumbled 4 percent on the back of high rising U.S. stocks.

Key Manufacturing Industry Crumbles To Post-Crisis Lows (Dana Lyons' Tumblr)

Key Manufacturing Industry Crumbles To Post-Crisis Lows (Dana Lyons' Tumblr)

Aluminum stocks are hitting their lowest levels since 2009.

The past few weeks have brought a resurgence of the deflation theme. All matters of commodities and their associated equities have, to varying degrees, resumed the selling pressure that has characterized much of the past 18 months. The aluminum industry is no exception. In fact, using the Dow Jones U.S. Aluminum Index as a gauge, aluminum stocks closed today at their lowest levels since April 2009.

U.K. Stocks Slide for Second Day; G4S Shares Decline to 2013 Low (Bloomberg)

Britain’s FTSE 100 Index retreated for a second day, heading for its third weekly drop, after yesterday falling the most since September.

Asian shares fall sharply as Fed keeps markets on edge (Market Watch)

Asian shares fall sharply as Fed keeps markets on edge (Market Watch)

Increasing odds of a December rate increase in the U.S. is pushing Asian shares lower this week, overshadowing global central banks’ stimulus cues, which drove a rebound in the region just last month.

Individual stock benchmarks in Australia, South Korea and Hong Kong all lost more than 2% this week. The Shanghai Composite Index SHCOMP, -1.43% fell 0.3%.

Banks expected to adopt new technologies rather than be overrun (Business Insider)

Banks expected to adopt new technologies rather than be overrun (Business Insider)

New technology firms are battering all kinds of companies, but banks will remain as financial intermediaries, due to the regulations and duties governments have put on them, says a proponent of the technology behind the bitcoin cryptocurrency.

"Regulation keeps them in place. Regulation requires them to perform certain functions," said Mark Smith, chief executive of Symbiont.io, a startup that has emerged from Bitcoin 2.0 and MathMoney f(x) Inc to build a securities trading platform using blockchain technology like that behind bitcoin.

Emerging Stocks Head for Weekly Loss as Chinese Shares Decline (Bloomberg)

Emerging-market stocks headed for the biggest weekly drop since September and currencies slid as the worsening commodities rout and slowing credit growth in China undermined the outlook for global economic expansion and trade.

The Root of Gold Conspiracy Theories (Sprott Money)

The Root of Gold Conspiracy Theories (Sprott Money)

Most people who own or trade gold have a higher price in mind, a price determined by what they think the metal is worth in dollar terms. That’s normal. However, some make a leap from the fact that gold doesn’t trade at this price today, to belief in manipulation. Short sellers—who are sometimes supposed to be illegally profiting, and sometimes said to be not-for-profit—come in to the market and sell the metal down. Or so the theory claims.

Speaking of Revamping Coal Mines, Check Out This Federal Prison (Bloomberg)

As part of her $30 billion proposal to help towns hit hard by coals collapse, U.S. presidential candidate Hillary Clinton said shed help to revive the prime real estate of shut coal mines and coal-fired power plants.

Stock futures drop ahead of retail sales, consumer sentiment data (Yahoo! Finance)

Stock futures drop ahead of retail sales, consumer sentiment data (Yahoo! Finance)

Wall Street suffered its worst session in over a month on Thursday as lower commodity prices weighed on energy and materials stocks and comments by a Federal Reserve policymaker hinted at an approaching interest-rate hike. * The Dow and S&P 500 closed below their 200-day moving averages, which some traders believe portends additional declines. * Concerns of a global economic slowdown continued to weigh on commodity prices on Friday, but crude prices recovered slightly from a sharp drop on Friday.

Mind the Gap as Currency Markets Shrivel for All But Biggest Few (Bloomberg)

Even the world’s biggest financial market can’t escape the global liquidity drought.

Public Goes Missing From Hong Kong IPOs as State Giants Buy (Bloomberg)

Companies in Hong Kong are increasingly leaving the public out of their initial public offerings.

Japan Stocks Fall as Yen Holds Gains Before Megabank Earnings (Bloomberg)

Japanese stocks trimmed a fourth week of gains as shares in Tokyo joined a global selloff and investors dissected earnings at industrial robot manufacturers and instant noodle makers.

U.S. stocks set for lower open as investors eye retail’s health (Market Watch)

U.S. stocks set for lower open as investors eye retail’s health (Market Watch)

U.S. stock futures fell Friday, as signs of pain in the retail sector put a monthly retail sales report and consumer sentiment index in the spotlight for Federal Reserve-watching investors.

Futures for the Dow Jones Industrial Average DJIA, -1.44% were down 37 points, or 0.2%, at 17,361.00 while those for S&P 500 index ESZ5, -0.23% lost 3.6 points, or 0.2%, at 2,037.00. Nasdaq 100 futures NQZ5, -0.39% were also in the red, shedding 14 points, or 0.3%, at 4,571.00.

Politics

Hillary Clinton email companies rebuff Senate investigators (Market Watch)

Hillary Clinton email companies rebuff Senate investigators (Market Watch)

Several companies that worked on Hillary Clinton’s private email server are refusing interview and document requests from congressional investigators, Politico reports, even as they cooperate with the FBI.

Denver-based Platte River Networks, which housed Clinton’s server after she left the State Department in 2013, has declined requests by a Senate committee to interview five employees about the security of the system, Politico reports. And Platte is blocking another tech company, Connecticut-based Datto Inc., from answering questions about its cloud backup of the Clinton emails.

Suu Kyi's Election Victory Masks Lingering Power of Myanmar Army (Bloomberg)

Suu Kyi's Election Victory Masks Lingering Power of Myanmar Army (Bloomberg)

It’s been a long time coming. Aung San Suu Kyi has been waiting for this for more than a quarter of a century, the jubilant crowds in Yangon and across Myanmar have sensed it over the past weeks of campaigning, and now the electoral commission has confirmed it: Myanmar is returning to democracy.

Technology

This smart helmet gives you eyes in the back of your head (Venture Beat)

This smart helmet gives you eyes in the back of your head (Venture Beat)

For Marcus Weller the idea started off with an accident. He was riding a motorcycle in Barcelona when he took his eyes off the road to look at a road sign and smashed into the back of a car. A couple of years later he dreamt about that accident, but in the dream Weller didn’t crash.

Virtual Reality Further Democratizes the Jazz Venue (PSFK)

Virtual Reality Further Democratizes the Jazz Venue (PSFK)

Virtual reality technology makes what was once exclusive accessible for everyone. While the Internet makes music available and easy to share, the live concert experience is still one-of-a-kind and irreplaceable. However, what if VR could bring us the immersion of concerts from the best music venues from all over the world? This is a question best suited for VR and 360-degree content creator Rivet.

Self-folding Graphene Machines Inspire Work on Real Transformers (Scientific American)

Self-folding Graphene Machines Inspire Work on Real Transformers (Scientific American)

Self-folding machines made from graphene oxide paper are inspiring some researchers to dream of a future with real-life Transformers and autonomous search-and-rescue robots.

Many large engineering hurdles stand between humanity and an origami Optimus Prime, but the researchers who developed the new machines say that their innovations could find more immediate uses in sensors, artificial muscles, and wearable devices.

Health and Life Sciences

Homeopathy 'could be blacklisted' (BBC)

Homeopathy 'could be blacklisted' (BBC)

Ministers are considering whether homeopathy should be put on a blacklist of treatments GPs in England are banned from prescribing, the BBC has learned.

The controversial practice is based on the principle that "like cures like", but critics say patients are being given useless sugar pills.

Newborn Probiotic Use Tied to Lower Risk of Type 1 Diabetes (Business Insider)

Newborn Probiotic Use Tied to Lower Risk of Type 1 Diabetes (Business Insider)

Adding probiotics — good bacteria — to an infant's feedings in the first month of life may reduce the risk of type 1 diabetes for those genetically predisposed to getting the disease, new research suggests.

Supplementing with probiotics later in infancy didn't seem to confer the same benefit, the researchers noted.

Life on the Home Planet

The Drone Economy (The Atlantic)

The Drone Economy (The Atlantic)

Every other Tuesday, a small crowd forms across the street from the Hancock Air National Guard base here, a few hundred yards from where big letters proclaim this the home of the 174th Attack Wing. They are protesting the National Guard troops on the base, who control the Reaper drones used in military operations overseas.

“Ban Killer Drones,” their signs say, and the protesters wave them as cars rush by on a busy road.

Kurdish Forces Rout Islamic State From Iraqi City of Sinjar (Bloomberg)

Kurdish Forces Rout Islamic State From Iraqi City of Sinjar (Bloomberg)

Kurdish Peshmerga forces drove Islamic State fighters from the center of the northern Iraqi town of Sinjar on Friday, a significant advance in a campaign to fracture territory held by the militant group.

“ISIL is defeated and on the run,” the Kurdistan Region Security Council said in a statement, using an earlier acronym for the militant group. A 100-meter-long Kurdish flag was displayed in Sinjar, local television showed. Its hospital along with factories and several public buildings were all cleared of jihadists, while Kurdish forces worked to remove explosive devices.