Financial Markets and Economy

FTSE 100 Heads for Biggest Jump in 6 Weeks; Smiths Group Soars (Bloomberg)

Britains FTSE 100 Index rose for a second day, helped by the biggest rally in Smiths Group Plc since 2011.

Fines are heaping even more misery on these struggling mining companies (Business Insider)

Fines are heaping even more misery on these struggling mining companies (Business Insider)

The mining industry is going through a pretty horrendous time right now. Commodity prices have been slumping for years, and economies driven by resource extraction are struggling. But two mining firms have it even worse.

BHP Billiton and Vale have been fined a 1 billion Brazilian reals ($171 million; $260 million) for their roles in the collapse of a damn at an iron ore mine in the Brazilian state of Minais Gerais.

The yuan as a global reserve currency? Don’t hold your breath (Quartz)

The yuan as a global reserve currency? Don’t hold your breath (Quartz)

The IMF is already clearing a berth in its basket of reserve currencies for the Chinese yuan. Once official, the yuan will be the first new currency to be added to the IMF’s special drawing rights (SDR) currency basket since the modern SDR system began in 1981. (The euro replaced the Deutsche mark and the French franc in 1999). The Wall Street Journal hails the approval (paywall) as a “milestone in China’s efforts to establish the country as a global economic power.”

TIAA-CREF, U.S. Investment Giant, Accused of Land Grabs in Brazil (NY Times)

TIAA-CREF, U.S. Investment Giant, Accused of Land Grabs in Brazil (NY Times)

As an American investment giant that manages the retirement savings of millions of university administrators, public school teachers and others, TIAA-CREF prides itself on upholding socially responsible values, even celebrating its role in drafting United Nations principles for buying farmland that promote transparency, environmental sustainability and respect for land rights.

But documents show that TIAA-CREF’s forays into the Brazilian agricultural frontier may have gone in another direction.

German Discounters Reach U.K. Milestone With 10% Market Share (Bloomberg)

German Discounters Reach U.K. Milestone With 10% Market Share (Bloomberg)

German discounters Aldi and Lidl attained a landmark in their invasion of the U.K. grocery market, reaching a combined 10 percent share for the first time.

Data from researcher Kantar Worldpanel showed that the budget chains have doubled their share in little more than three years, with Lidl making particularly strong progress. Its sales growth accelerated to 19 percent in the 12 weeks to Nov. 8, giving the company a record market share of 4.4 percent. Aldi’s sales rose 17 percent, meaning its percentage was unchanged from the previous month at 5.6 percent.

Investors are now a lot more worried about a geopolitical crisis (Business Insider)

Investors are now a lot more worried about a geopolitical crisis (Business Insider)

Of all the possible fears out there, one has increased the most for investors in the past month – geopolitical risk.

According to Bank of America Merrill Lynch's monthly fund survey, a geopolitical crisis is the biggest tail risk for 18% of investors, up from 13% last month.

Investors Cool on Vonovia Bid to Create German Mega-Landlord (Bloomberg)

Deutsche Wohnen AG Chief Executive Officer Michael Zahn said in March hed be open to a takeover by a larger competitor. Now theres an offer on the table fromVonovia SE he doesnt like it — and neither do some of the largest shareholders.

Home Depot quarterly same-store sales beat estimates (Yahoo! Finance)

Home Depot quarterly same-store sales beat estimates (Yahoo! Finance)

Home Depot Inc (HD.N), the world's No. 1 home improvement retailer by revenue, reported better-than-expected quarterly same-store sales, helped by strong demand from both retail customers and professional contractors and builders.

Consumers spent more on houses, home improvement products, appliances and autos than on discretionary items such as apparel in the August-October quarter, analysts said.

The Fallout From Attacks Is Measured in More Than Stock Markets (NY Times)

What is the economic cost of terrorism?

It feels frivolous to ask that question after the horrific Paris attacks, but it is one of the central issues with which policy makers and investors are grappling.

Here's how investment bank analysts expect ISIS' new strategy to affect stocks and the economy (Business Insider)

Here's how investment bank analysts expect ISIS' new strategy to affect stocks and the economy (Business Insider)

Analysts at Citi just released two notes in the aftermath of the brutal attacks in Paris, looking at both whether the violence marks a change in strategy for ISIS , and what the stock market reaction might be if that's the case.

The authors, led by chief global political analyst Tina Fordham, see the attacks on Paris as part of a recent and concerning change of strategy from the group.

Emerging Stocks Head for Biggest Gain in Month as Won Climbs (Bloomberg)

Emerging-market stocks climbed from a six-week low as receding concerns over the fallout from the terror attacks in Paris spurred a hunt for riskier assets. South Koreas won halted a three-day slide.

World markets are higher this morning following Wall Street's best day in three weeks, and stock index futures are pointing to more gains at the U.S. open. Though the Paris attacks are still very much at center stage in the news cycle, investors are focusing on key economic numbers and earnings that will be out in the trading day ahead.

U.S. oil prices edge up on Paris attack tensions, but market remains oversupplied (Business Insider)

U.S. oil prices edge up on Paris attack tensions, but market remains oversupplied (Business Insider)

U.S. crude oil prices edged up in early trading in Asia on Tuesday, lifting it further away from over two-months lows seen last week, as traders price in a risk premium following the Paris attacks and the resulting French airstrikes in Syria.

Despite the lift, analysts said that prices would likely remain at low levels as oil markets remain oversupplied, with most estimates for 2015 ranging from production outpacing demand by 0.7-2.5 million barrels per day, and many speculators have positioned themselves for further price falls.

What Wall Street's Return to Central Banking May Mean for Policy (Bloomberg)

Wall Street is again leading to the corridors of central banks.

From Philadelphia to Paris, investors and financiers are increasingly being hired to help set monetary policy less than a decade since the banking crisis roiled the world economy and chilled their public-sector employment prospects.

This craft brewery just sold for $1 billion (CNN)

This craft brewery just sold for $1 billion (CNN)

Constellation Brands (STZ), the company that makes Corona Extra and Modelo Especial, announced Monday that it was paying $1 billion for craft brewer Ballast Point Brewing & Spirits.

The purchase is the latest example of a major brewer paying an eye-popping amount for a piece of the fast-growing craft beer segment.

Tackling Huge Debt, Chairman Keeps Up Tata's Growth Trajectory (Bloomberg)

At the helm of the Tata Group for more than two decades, Ratan Tata took a biggest-is-best approach. Putting India’s largest conglomerate on steroids, he propelled Tata onto the world stage by adding marquee brands such as Land Rover, Jaguar, Tetley tea and New York’s Pierre hotel to the group producing much of the nation’s salt, steel, trucks, electricity, fertilizer and other basic goods. He also increased debt 11-fold in his final 10 years.

These are the only three S&P 500 companies with 100% ‘buy’ ratings (Market Watch)

These are the only three S&P 500 companies with 100% ‘buy’ ratings (Market Watch)

It’s easy — and fun — to bash Wall Street analysts.

The securities industry helps companies set up earnings “beats” by lowering estimates heading into earnings season. Some analysts even hold on to “buy” ratings long after a company has started to crash and burn.

Indian Stocks Climb for Second Day as Metal Producers Advance (Bloomberg)

Indian stocks rose for a second day, led by metal producers and lenders, as fading concern about the geopolitical impact of the attacks in Paris lifted Asian equities.

Wall Street eyes stronger start with Wal-Mart, inflation data ahead (Market Watch)

Wall Street eyes stronger start with Wal-Mart, inflation data ahead (Market Watch)

U.S. stock futures were eyeing a positive start on Tuesday, taking a cue from European stocks where oil companies continued to trek higher.

Results from Wal-Mart Stores Inc., inflation data and a house price index could help set the tone for markets. Dow Jones Industrial Average futures rose 84 points, or 0.5%, to 17,519, while those for the S&P 500 index ESZ5, +0.39% tacked on 10 points, or 0.5%, to 2,058.25. Futures for the Nasdaq-100 index were up 24.5 points, or 0.6%, to 4,578.25.

China Seen Hogging Asia Bond Fund Pie as IMF Entry to Lure Flows (Bloomberg)

China and India opening their bond markets threatens to lure funds from the rest of Asia, pushing up regional borrowing costs.

10 favorite stocks of value-fund managers Market Watch)

10 favorite stocks of value-fund managers Market Watch)

Mutual fund managers have a difficult job, especially those overseeing funds with long-term objectives, because their performance is judged on an annual basis.

Another big problem for managers is that investors have a tendency to pour money into their funds when stock markets are strong, and vice versa. That can force them to buy high and sell low, hurting performance. Yes, they can sit on a mountain of cash to keep their options open, but that may also erode returns.

Qantas Regains Investment Grade as Balance Sheet Improves (Bloomberg)

Qantas Airways Ltd. has regained its investment-grade credit rating after Standard & Poors upgraded the airlines score to BBB-, citing a strengthened balance sheet.

Stock diversification can get you the opposite result (Market Watch)

If you own more than five to 10 stocks, you may own too many.

Fed-Ready Currency Traders Calm About December After Stormy 2015 (Bloomberg)

Currency traders are giving the Federal Reserve a green light for its first interest-rate increase in almost a decade.

These investments can help you profit from global warming (Market Watch)

These investments can help you profit from global warming (Market Watch)

The literal rocket scientists at NASA say so. In fact, 97% of scientists think so. Even the majority of those who describe themselves as “conservative Republicans” say so.

The debate we should be having, then, isn’t whether climate change deniers should be given equal time, but what we should be doing about the scientifically proven trend of global warming.

Silver Is Near 2-Month Low After Longest Losing Run in 65 Years (Bloomberg)

Silver traded near a two-month low after capping the longest run of losses on record as its appeal as a precious and industrial metal declined. Gold slipped for a sixth day.

Japan Stocks Follow U.S. Equities Higher as Paris Impact Fades (Bloomberg)

Japanese stocks rose, following U.S. equities higher, after the yen weakened as the fallout on Asian financial markets from the Paris attacks faded.

After market crash, China mulls single 'super-regulator' – sources (Business Insider)

After market crash, China mulls single 'super-regulator' – sources (Business Insider)

China is deliberating bringing together its banking, insurance and securities regulators into a single super-commission, sources told Reuters, following the summer's stock market crash that was blamed in part on poor inter-agency coordination.

Politics

Yale's Activists Deserve Constructive Criticism (The Atlantic)

In The New Republic, Roxane Gay comments on student protests at the University of Missouri and Yale University with characteristic thoughtfulness and a powerful anecdote.

“I attended Yale from 1992 to 1994,” she writes. “While I was there, I understood that, as a black woman, I was regarded as a usurper on hallowed Ivy grounds. Either I was a scholarship student or a New Haven local—no one could believe that I was there, like the others, simply to learn.

Technology

How Islamic State Teaches Tech Savvy to Evade Detection (Wall Street Journal)

How Islamic State Teaches Tech Savvy to Evade Detection (Wall Street Journal)

Terror groups have for years waged a technical battle with Western intelligence services that have sought to constrain them through a web of electronic surveillance.

The Paris attacks, apparently planned under the noses of French and Belgian authorities, raise the possibility that Islamic State adherents have found ways around the dragnet.

This Street Stretches Out Between Electricity Pylons (Gizmodo)

This Street Stretches Out Between Electricity Pylons (Gizmodo)

This is a hazy, early morning view of Fert? Street located in the 10th district of Budapest, Hungary. This spectacular row of steel gate towers support a 120 kV power line—directly over the heads of people and the traffic.

The daring piece of engineering creates a quite unique street scene. Do you know any similar cityscapes anywhere around you? If so, please post it in the comments—photos or Google street views are welcome!

Health and Life Sciences

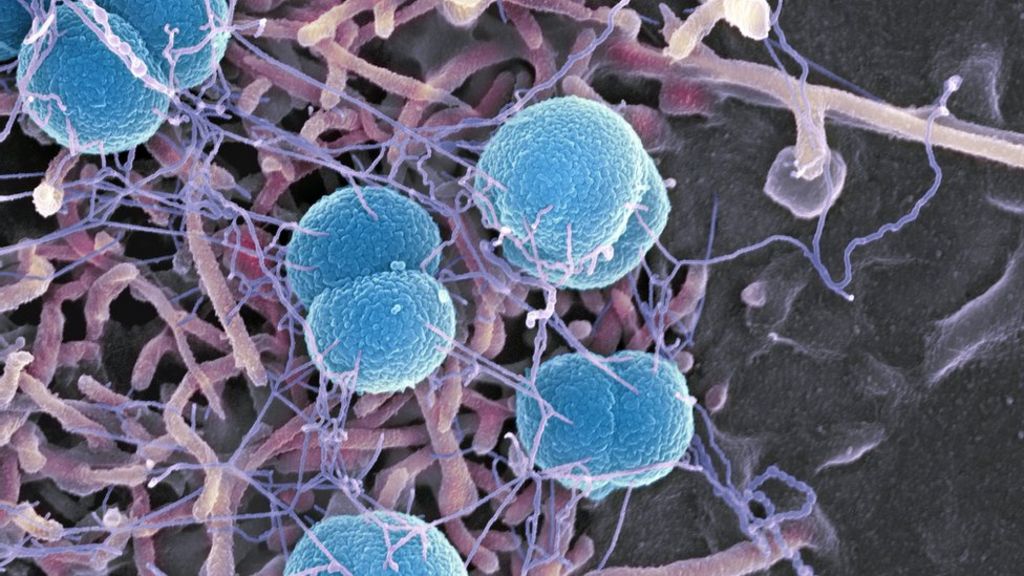

Drugmakers urge new antibiotics funds (BBC)

Drugmakers urge new antibiotics funds (BBC)

UK pharmaceutical company AstraZeneca and industry bodies have warned of a "terrible human cost" unless new ways of funding antibiotics are found.

They said the government should take urgent action to help UK companies working in this area.

Vitamin D Deficiency Might Be Tied to Erectile Dysfunction (Medicine Net)

Vitamin D Deficiency Might Be Tied to Erectile Dysfunction (Medicine Net)

Low levels of vitamin D may be associated with erectile dysfunction, a new study suggests.

Researchers analyzed data from more than 3,400 American men, age 20 and older, who did not have heart disease. Thirty percent were vitamin D deficient, which means their levels of the "sunshine vitamin" were below 20 nanograms per milliliter of blood. And 16 percent had erectile dysfunction.

Life on the Home Planet

Belgium Raises Terror Threat Level, Deploys More Soldiers (Bloomberg)

Belgium Raises Terror Threat Level, Deploys More Soldiers (Bloomberg)

Belgium raised the terror threat level for the whole country and is deploying extra soldiers to help the police after the deadly attacks in Paris.

The government in Brussels increased the threat level to 3 or “serious, probable” from “moderate, less probable” throughout the country.

Earth's underground water quantified (BBC)

Earth's underground water quantified (BBC)

The total amount of groundwater on the planet, held in rock and soil below our feet, is estimated to be 23 million cubic km.

If this volume is hard to visualise, imagine the Earth's entire land surface covered in a layer some 180m deep.