Financial Markets and Economy

Charting the Markets: The Week to Forget for Global Stock Investors (Bloomberg)

Global stocks fall to one-month low, iron ore sinks for a 9th week to a record low and Japan's yen heads for biggest weekly gain in 3 months.

Wall St. Sinks, Following Oil Prices Down (NY Times)

Shares of Dow Chemical and DuPont were both down after the companies announced a huge merger.

China could give 100 million people new identities in a bid to save its economy (Business Insider)

China could give 100 million people new identities in a bid to save its economy (Business Insider)

Chinese officials are set to discuss ways to stimulate the country's sputtering housing market during its Central Economic Working Conference later this month, according to Chinese state media.

The goal will be to create demand for empty houses in second- and third-tier cities that overbuilt during the country's construction boom.

Demand for Treasuries surges as oil rout hits stocks (Market Watch)

Demand for Treasuries surges as oil rout hits stocks (Market Watch)

U.S. Treasury prices rose Friday, pushing yields to their lowest level in more than a week, as the crude-oil rout worsened, weighing on stock markets and driving investors into the perceived safety of government bonds.

Oil Investors Are $230 Billion Poorer a Week After OPEC Decision (Bloomberg)

Investors around the world have seen $230 billion wiped off the value of oil companies in the week since OPEC sent crude prices plunging to a seven-year low by abandoning its output limit.

3 charts on why oil could head lower in 2016 (Yahoo! Finance)

Crude prices have a lot more downside ahead, said Chad Morganlander, portfolio manager at Stifel Nicolaus’ Washington Crossing Advisors.

The Fed Awakens (Business Insider)

The Fed Awakens (Business Insider)

After years of waiting, it's finally here. No, not the new "Star Wars" movie: Fed week.

Barring a shock, the Federal Reserve will raise U.S. interest rates on Wednesday for the first time since June 2006, a full year before the global financial crisis began.

Amazon, Coach, Nike, TJX Companies are among Nomura’s 2016 top picks (Market Watch)

Amazon, Coach, Nike, TJX Companies are among Nomura’s 2016 top picks (Market Watch)

Amazon.com Inc., Coach Inc., Nike Inc. and off-price retail business TJX Companies Inc. are among Nomura’s top U.S. retail-stock picks for 2016, its analysts said in a report published Thursday.

The bank estimates that Amazon’s AMZN, -1.16% North American sales will reach about $100 billion by 2017 and Amazon Web Services will be a growth driver for the company. The bank raised Amazon’s price target on Wednesday.

Mens Wearhouse Confronts a New Label: 'Uninvestable' (Bloomberg)

Mens Wearhouse Inc. looks like its starting to unravel.

The Dow-DuPont deal is 'Financial Engineering 201' (Business Insider)

The Dow-DuPont deal is 'Financial Engineering 201' (Business Insider)

Chemical companies DuPont and Dow Chemical agreed to combine in a merger of equalson Friday, and Wall Street is reacting to the unusual structure of the deal.

Mario Gabelli, the founder and chief executive of GAMCO Investors and the best paid CEO on Wall Street, called it "Financial Engineering 201" in a tweet on Friday morning.

Traders Are Suddenly Getting Anxious About the Loonie's Plunge (Bloomberg)

Canada’s government bonds boast the world’s highest debt rating. The nation’s dollar is trading like it’s an emerging-market currency.

Stocks are getting crushed (Business Insider)

US stocks opened sharply lower and crude oil fell to new lows on Friday morning.

.png)

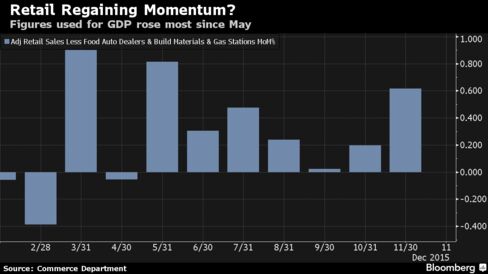

Retail Sales in U.S. Rise in November by Most in Four Months (Bloomberg)

Retail sales climbed in November by the most in four months as American consumers put to work some of the money saved from the cheapest gasoline since early 2009.

Jaguar Land Rover seals deal for $1.5 billion Slovak car plant (Business Insider)

Jaguar Land Rover seals deal for $1.5 billion Slovak car plant (Business Insider)

Luxury carmaker Jaguar Land Rover (JLR) confirmed on Friday it will build a car plant in Slovakia, beginning a 1 billion pound ($1.5 billion) project which will be one of the biggest ever foreign direct investments in the central European nation.

Bitcoin: What's in Store for 2016 (Bloomberg)

While the hype may have faded a bit, 2015 was still a busy year for bitcoin. Venture capital investments topped $1 billion for the first time. People are finding it easier to invest in the digital currency, thanks to the debut of firms such as Bitcoin Investment Trust. Big financial companies—Nasdaq, American Express and Visa— invested in bitcoin startups, "a game changer in terms of attitude towards the technology," said Gil Luria, an analyst at Wedbush Securities.

Junk bonds are flashing their biggest warning sign since 2009 (Business Insider)

The US economy is changing gears, and some parts of the bond market are feeling the pressure.

Brazil Stocks Slump on Moody's Downgrade Signal, Political Fight (Bloomberg)

Brazil’s stocks fell after Moody’s Investors Service downgraded miner Vale SA, the world’s biggest iron-ore producer, and said it would review lenders including Banco Bradesco SA for cuts.

Asia stocks head for weekly loss as commodity rout saps confidence (Business Insider)

Asia stocks head for weekly loss as commodity rout saps confidence (Business Insider)

Asian shares edged higher on Friday but remained on track for a weekly loss as lower crude prices kept markets on edge after a broad rout in commodities heightened fears about receding global growth.

U.S. Index Futures Decline as Investors Brace for Fed Decision (Bloomberg)

Bearish sentiment is persisting, with U.S. stock-index futures pointing to a fourth day of losses in five, as investors prepare for next weeks Federal Reserve interest rate decision.

Activist pressure helps reshape U.S. corporates, from Yahoo to Dow (Business Insider)

Activist investors are building bigger stakes in bigger companies and their influence is helping reshape the landscape of corporate USA.

U.K. Inflation Outlook Drops to Three-Month Low as Oil Tumbles (Bloomberg)

A gauge of the bond markets outlook for U.K. consumer-price growth dropped to the lowest level since August as crude oil extended its decline into a sixth day, the longest losing streak in 18 months.

South Africa Faces Watershed as Investors Despair of Zuma (Bloomberg)

Investors are giving up on South African President Jacob Zuma and his ruling African National Congress.

Russian Central Bank Leaves Key Interest Rate Unchanged (Bloomberg)

Russias central bank left its benchmark interest rate unchanged for a third consecutive meeting as a slump in oil prices triggered a new bout of ruble weakness, raising the risk of faster inflation.

Gold loses luster as inflation hedge as crude oil tumbles (Market Watch)

Gold loses luster as inflation hedge as crude oil tumbles (Market Watch)

Gold futures were once again falling Friday, on track for the their worst weekly performance since late November.

February gold lost $5.70, or 0.5%, to trade at $1,066.60 an ounce, with the precious metal on track to register a weekly decline of about 1.5%. That weekly drop would mark gold’s worst weekly performance since the week ended Nov. 27, according to FactSet.

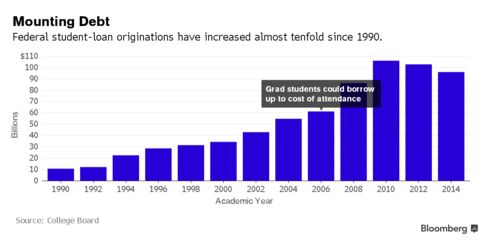

A $144,000 Student Default Shows Who Profits at Taxpayer Expense (Bloomberg)

Jody Sofia borrowed $92,500 to get a degree fromFlorida Coastal School of Law. Now shes in default, her outstanding balance having ballooned to almost $144,000, and she spends her days fielding calls from government-contracted debt collectors.

IEA Sees Oil Glut Lasting Until Late 2016 as OPEC Keeps Pumping (Bloomberg)

The global oil surplus will persist at least until late 2016 as demand growth slows and OPEC shows renewed determination to maximize output, according to the International Energy Agency.

European Stocks Fall for 4th Day as Selloff Worsens Before Fed (Bloomberg)

European stocks extended their lowest level in almost two months, on track for a second weekly decline.

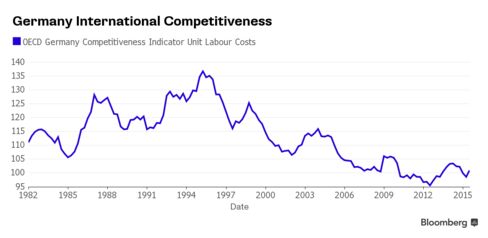

The Changing Face of the German Economic Miracle? (Bloomberg)

For decades the image of the archetypal German household has been one of thrifty stoicismin the popular imagination – a stereotype that has been actively encouraged by Angela Merkel, who has often paid homage to the proverbial schwbische Hausfrau.

The ratio of inventories to sales climbs to highest since recession (Market Watch)

The ratio of inventories to sales climbs to highest since recession (Market Watch)

The ratio of inventories to sales rose slightly in October to the highest level since the recession, a potentially worrying sign that companies are having trouble selling what they are producing.

Politics

Trump won't be 'welcome' in Muslim countries (CNN)

Trump won't be 'welcome' in Muslim countries (CNN)

A Qatar airline executive warned Donald Trump Thursday "he will not be welcome" in Muslim countries where he has investments following Trump's call to ban Muslims from entering the U.S.

Qatar Airways CEO Akbar Al Baker told CNN's Richard Quest that he is friends with Trump.

Dictatorships, Double Standards and Ted Cruz (Bloomberg View)

Dictatorships, Double Standards and Ted Cruz (Bloomberg View)

Remember when Republicans opposed dictators? It was 2005. Netflix only mailed DVDs, everyone seemed to have a blog and George W. Bush was president. Saddam Hussein was in the dock in Baghdad. In Egypt, Hosni Mubarak was under pressure from the State Department to allow members of the Muslim Brotherhood to run for parliament. Even Saudi Arabia was being pushed to let people vote in local elections.

Hillary Clinton says Donald Trump isn’t funny anymore (Market Watch)

Hillary Clinton says Donald Trump isn’t funny anymore (Market Watch)

“You know, I have to say, Seth, I no longer think he is funny,” Clinton told Seth Meyers on his late-night NBC show. Clinton, the front-runner for the Democratic presidential nomination, was referring to Trump’s recent proposal to ban all Muslims from entering the U.S. Clinton said Trump, who’s leading for the Republican nomination, “has gone way over the line.” To comedian Meyers, she said: “I think for weeks you and everybody else were just bringing folks to hysterical laughter.” But what Trump is saying now is “not only shameful and wrong, it is dangerous,” she said.

Technology

Check Out The Robots That Make Steam Controllers (Gizmodo)

Check Out The Robots That Make Steam Controllers (Gizmodo)

When I talked to Valve about the Steam controller earlier this year, they told me they were manufacturing the divisive hunk of owl-shaped plastic in their own machine factory, one of the biggest in the nation. Here’s what the process looks like.

The ultimate window seat is a glass bubble on top of a plane (Mashable)

The ultimate window seat is a glass bubble on top of a plane (Mashable)

In a 21st century, aviation special of Pimp My Ride: Airplane owners could soon install glass bubbles on top of their planes

SkyDeck, a 360 degree, tear-shaped bubble — in other words, the ultimate window seat — is ready for order.

Health and Life Sciences

Cooling Cap to Reduce Chemo-Linked Hair Loss OK'd (Medicine Net)

Cooling Cap to Reduce Chemo-Linked Hair Loss OK'd (Medicine Net)

The Dignitana Cooling System cap has been approved by the U.S. Food and Drug Administration to help prevent hair loss in women undergoing chemotherapy for breast cancer.

Is Amgen's Prolia A Better Drug For Reducing Fractures And Recurrence After Breast Cancer? (Forbes)

Is Amgen's Prolia A Better Drug For Reducing Fractures And Recurrence After Breast Cancer? (Forbes)

As people age, the risk of fracturing a bone – whether it’s a hip, a wrist, vertebrae, an ankle or toe, climbs steadily. For women and men who live after a cancer diagnosis, the risk of breaking bone is greater.

At this year’s San Antonio Breast Cancer Symposium, Dr. Michael Gnant of Vienna gave an update on a major trial of denosumab in its capacity to reduce fractures and possibly stave off metastases. This drug is manufactured and sold by Amgen in a low-dose form as Prolia. Prolia is a monoclonal antibody that doesn’t require intravenous administration; it’s injected under the skin, just twice each year.

Life on the Home Planet

If the Paris Climate Talks End in an Agreement, Thank the French (Wired)

If the Paris Climate Talks End in an Agreement, Thank the French (Wired)

Draft three of the Paris climate document is here, but it ain’t over yet. The delegates still have plenty of sleepless hours between now and Friday night.

And they have plenty of brackets to argue over, too. Those areas of disagreement—especially in the three seemingly intractable topics of finance, differentiation, and loss and damage.