Financial Markets and Economy

Five Mind-Blowing Stats from the Selloff in the Biggest Junk Bond ETF (Bloomberg)

The world’s largest junk bond exchange-traded fund had one hell of a day last week, after the closure of a Third Avenue bond mutual fund sparked a wider sell-off in the credit market.

Ad tech company OpenX is meeting with rival businesses because it wants to be acquired (Business Insider)

Ad tech company OpenX is meeting with rival businesses because it wants to be acquired (Business Insider)

Ad tech company OpenX is looking to be acquired and has met with potential buyers both within the ad tech sector and in the marketing cloud space, people familiar with the discussions told Business Insider.

Top Trader Says Commodity Hedge Funds Shrink by 80% Since 2008 (Bloomberg)

The biggest commodities meltdown in a generation has cost hedge funds more than $40 billion in seven years.

When do markets close for Christmas? (Market Watch)

When do markets close for Christmas? (Market Watch)

Many investors are waiting for their Santa rally — and for Santa.

U.S. markets will close early on Christmas Eve, while some of the European markets will already be on break.

Stocks are red around the world (Business Insider)

Stocks are red around the world (Business Insider)

US stocks look set to open lower while stocks in Europe and Asia were also selling off in a rough start to the week for markets.

iPhone sales will drop in 2016 for the first time ever (Business Insider)

Morgan Stanley just published a bombshell report about Apple: chief financial analyst Katy Huberty predicts that — for the first time ever — sales of the iPhone will drop in 2016.

‘Dude, what happened to my bond portfolio?’ (Market Watch)

‘Dude, what happened to my bond portfolio?’ (Market Watch)

Bonds, supposedly the safer alternative to stocks, aren’t looking so safe right now. While the S&P 500 index is up 1.6% this year, many fixed-income funds have negative returns—particularly those that own a lot of lower-rated bonds. Some are down 4% or more.

U.S. Stock-Index Futures Signal Relief Before Fed Rate Decision (Bloomberg)

Bearish sentiment is subsiding two days before the Federal Reserves interest-rate decision, with U.S. index futuresadvancing after equities posted their worst week since August.

Futures little changed as investors focus on Fed meet (Business Insider)

Futures little changed as investors focus on Fed meet (Business Insider)

U.S. stock index futures were little changed on Monday as investors brace for a widely expected interest rate hike in more than a decade.

The Federal Reserve will begin its two-day meeting on Dec. 15 to decide on the rate hike.

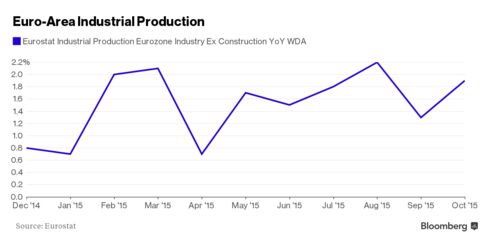

Euro-Area October Industrial Production Rises 1.9% From Year Earlier (Bloomberg)

Euro-area industrial production climbed 1.9 percent in October from a year earlier, surpassing economists' forecasts.

The biggest oil deal of the decade just cleared a major hurdle (Business Insider)

The biggest oil deal of the decade just cleared a major hurdle (Business Insider)

China on Monday gave the thumbs up to Shell's plans to swallow up the oil explorer BG Group in a deal that will create a £224 billion ($340 billion) oil giant.

Charting the Markets: Return of the Rand (Bloomberg)

China gets a bump, oil heads lower, and the rand rebounds. Oh, and it's Fed week, too…

We are now in the 'final countdown' (Business Insider)

We are now in the 'final countdown' (Business Insider)

After keeping interest rates near-0% for exactly seven uninterrupted years, it appears the Federal Reserve will finally hike rates.

"We are now in the final countdown," Stifel's Lindsey Piegza said on Friday.

Bank of England Inflation Anxiety Mounts With Oil Below $40 (Bloomberg)

The Bank of Englands inflation worries may already be coming to fruition.

What the Economy Gets When Colleges Invest in Mental Health (The Atlantic)

What the Economy Gets When Colleges Invest in Mental Health (The Atlantic)

In response to rising rates of depression among students and increased demand for therapy, many American universities have been ramping up their mental-health services. These colleges surely want to take care of their students, but it has other benefits too: Mental-health disorders can hinder educational outcomes, lowering grades, delaying students’ graduations, and causing students to drop out.

U.S. Natural Gas Falls to Lowest Intraday Level Since 2002 (Bloomberg)

U.S. natural gas tumbled to the lowest intraday level since January 2002 amid forecasts that mild weather will persist through the end of the month.

U.K. Stocks Rebound From Worst Week Since August as Anglo Rises (Bloomberg)

Britains shares advanced for the first time in eight days as almost all FTSE 100 Index companies climbed.

Misbehaving Markets Seen No Barrier This Time to Unstoppable Fed (Bloomberg)

Once again, the Federal Reserve is about to make a historic interest-rate decision against a backdrop of rising equity volatility, tumbling commodity prices and jitters in credit markets. This time, investors expect policy makers to pull the trigger.

Asian Bond Risk Surges to Two-Month High on Contagion Concerns (Bloomberg)

Asian bond risk surged to a two-month high after Third Avenue Managements decision to freeze redemptions at a high-yield credit fund underscored concern about reduced market liquidity and a potential exodus of investors.

Market bear: December 16 will be the day the bubble finally bursts (Market Watch)

Market bear: December 16 will be the day the bubble finally bursts (Market Watch)

Let’s see how dedicated the wavering buy-the-dip crowd is to this market. After the worst week for U.S. stocks since August, investors now have to grapple with a looming Fed meeting while still coming to grips with danger signs in the commodities and credit markets.

Jack Ma Got a Better Deal Than Bezos With $266 Million SCMP Deal (Bloomberg)

Jack Ma’s Alibaba Group Holding Ltd. looks to be getting a better deal in its acquisition of the South China Morning Post and related assets, compared with other recent sales such as the amount Amazon.com Inc.’s Jeff Bezos paid for the Washington Post.

Asian Stocks Join Global Selloff as Commodity Producers Retreat (Bloomberg)

Asian stocks joined a global selloff as concern about turmoil in the credit and commodities markets ahead of this weeks Federal Reserve meeting overshadowed a batch of better-than-expected Chinese economic data.

Wall Street's 2016 Currency Consensus Is All About the Dollar (Bloomberg)

Buy the dollar. Again. Thats the message for next year from the biggest banks tradingin the $5.3-trillion-a-day currency market.

Miners Shoveling Furiously Prop Up Aussie GDP as Iron Melts (Bloomberg)

The price of Australias top export has been almost slashed in half this year. That makes it all the more surprising economists increasingly see iron ore propping up growth as they assemble their 2016 forecasts.

Gold prices drop as market tenses up ahead of Fed meeting (Market Watch)

Gold prices drop as market tenses up ahead of Fed meeting (Market Watch)

Gold prices came under pressure on Monday, as oil plunged anew and investors braced for Wednesday’s policy decision by Federal Reserve policy makers.

Gold for February delivery GCF6, -0.24% fell $6, or 0.6%, to $1,069.70 an ounce, after losing 0.8% last week. Prices have been under pressure from weak oil prices, and there was no letup on Monday as U.S. crude futures CLF6, -1.49% dropped below $35 a barrel.

Politics

New Hampshire Will Weed Republican Field (Bloomberg View)

New Hampshire Will Weed Republican Field (Bloomberg View)

The New Hampshire presidential primary vote usually breaks late. This time, not unusually, it will break a few candidates.

Merkel is shutting the door on Germany's 'open-door' refugee policy (Business Insider)

Merkel is shutting the door on Germany's 'open-door' refugee policy (Business Insider)

Chancellor Angela Merkel is shutting the door on her open door policy for refugees coming to Germany — the very policy that got her nominated for a Nobel Peace Prize and her accolade as Time's Person of the Year.

She said on Sunday she wanted to "drastically decrease" the number of refugees coming to Germany, signaling a compromise to critics of her open door policy from within her own conservative party on the eve of a party congress.

Technology

In Virtual Reality Headsets, Investors Glimpse the Future (NY Times)

In Virtual Reality Headsets, Investors Glimpse the Future (NY Times)

Magic Leap, a secretive company making wearable technology for mixing digital imagery with the real world, is seeking to raise $827 million. Jaunt, maker of a 3-D camera for filming virtual reality video, has nabbed a total of $100 million, including $65 million in September. And 8i, which makes technology that lets people interact with video of humans as though they were in the same room, has raised nearly $15 million.

Health and Life Sciences

PepsiCo Is Revamping Vending Machines After Backlash Over Health (Bloomberg)

PepsiCo Inc., facing an anti-soda backlash and health concerns about snack foods, is looking to make a comeback in an especially hard-hit part of the industry: vending machines.

The company is rolling out several thousand dual-temperature machines that offer both food and drinks under the new Hello Goodness brand, according to a statement. The units will include healthier products from PepsiCo’s beverage and Frito-Lay divisions, including Naked Juice, Lays Oven Baked chips and Sabra hummus cups.

Life on the Home Planet

'Airpocalypse' Is an Opportunity for China and India (Bloomberg View)

'Airpocalypse' Is an Opportunity for China and India (Bloomberg View)

Even as negotiators were completing a new global accord on climate change last week, a lung-burning haze choked two major world capitals, infuriating residents and reigniting debate about the costs of headlong development. As China and India rush to clean their cities' hazardous air, they can take this opportunity to make progress against climate change as well.