Financial Markets and Economy

Fed Ends Zero-Rate Era; Signals 4 Quarter-Point 2016 Increases (Bloomberg)

The Federal Reserve raised interest rates for the first time in almost a decade in a widely telegraphed move while signaling that the pace of subsequent increases will be gradual and in line with previous projections.

Oracle revenue falls 6.3 percent (Business Insider)

Oracle revenue falls 6.3 percent (Business Insider)

Business software maker Oracle Corp reported a 6.3 percent fall in quarterly revenue, hurt by a strong dollar and weak sales of traditional software licenses.

Net income fell to $2.2 billion, or 51 cents per share, in the second quarter ended Nov. 30, from $2.5 billion, or 56 cents per share, a year earlier.

Packer Holds Talks About Crown Investment, Says No Proposal Made (Bloomberg)

James Packer’s closely held investment company said it has held discussions with other entities about its stake in Crown Resorts Ltd. following media reports that he’s considering returning some of Crown’s casino assets to private ownership.

Shares of Crown, which is controlled by Packer’s Consolidated Press Holdings Pty, surged 11 percent Wednesday after Bloomberg News reported that Consolidated Press had been speaking with private equity firms and pension funds about a possible joint bid for some Crown assets.

FedEx crushes earnings expectations, stock pops 4% (Business Insider)

FedEx crushes earnings expectations, stock pops 4% (Business Insider)

FedEx crushed second-quarter earnings expectations.

On Wednesday, the world's second-largest shipping company said its results outpaced expectations despite an industrial slowdown that analysts had feared would hamper its performance.

Asian Futures Pace U.S. Stock Gains Amid Calm on Slow Rate Path (Bloomberg)

Stocks and the dollar climbed, while government bonds retreated as the most anticipated U.S. interest-rate increase in recent memory was greeted with a sense of relative calm in Asian markets.

Wall Street is getting bullish about itself (Business Insider)

Wall Street is getting bullish about itself (Business Insider)

Wall Street likes Wall Street as an investment pick.

The Federal Reserve hiked interest rates on Wednesday, putting an end to the zero interest rate policy era. Investors and analysts expect those higher rates to help banks' bottom lines.

This Fed Move Is Different as UBS Sees Pain in Emerging Markets (Bloomberg)

Historically, interest-rate increases from the Federal Reserve have been buy signals for emerging-market assets. This time looks different, even after a selloff that has pushed currencies to record lows and equities down to levels not seen since 2009.

The US oil glut is inching ever closer to a new record (Quartz)

The Energy Information Administration’s weekly look at oil in America just came out (pdf), and commercial crude stockpiles are at 490.7 million barrels. That’s just 200,000 barrels short of the record 490.9 million barrels set back in April.

Apple's stock dips as concerns mount about iPhone shipments (Business Insider)

Apple's stock dips as concerns mount about iPhone shipments (Business Insider)

Shares of Apple <AAPL.O> dipped on Wednesday on growing expectations that the consumer technology company may sell fewer iPhones next year than previously thought.

In a note to clients on Wednesday, Bank of America cut its estimate for fiscal 2016 iPhone shipments by 10 million to 220 million, pointing to a weakening among Apple's suppliers.

Delta to Buy Up to 40 Jets in Plan Once Shelved After Union Vote (Bloomberg)

Delta to Buy Up to 40 Jets in Plan Once Shelved After Union Vote (Bloomberg)

Delta Air Lines Inc. plans to add as many as 40 jetliners to refresh its fleet, reviving a plan that was scuttled earlier this year when pilots spurned a new contract agreement.

“The opportunity was still on the table, and we took advantage of it,” spokesman Michael Thomas said.

The aircraft deal will be split between new Boeing Co. 737-900ER single-aisle planes and smaller, secondhand Embraer SA E-190s, Delta said Wednesday. The Boeing craft have a list value of about $2 billion before the discounts that are customary in the industry.

Oil! (Business Insider)

The price of crude oil was tumbling Wednesday after the latest data from the EIA showed another increase in crude-oil inventories last week.

Amid China's Crackdown, Securities Reform Quietly Gathers Pace (Bloomberg)

Brokerage executives have been detained, futures markets have been more or less shut down and tougher rules may squeeze out algorithmic trading. Yet behind the scenes, China’s securities market reforms are picking up speed again, six months after being set back by a $5 billion equities rout.

These Inflation Gauges Will Inform the Pace of Future Fed Rate Increases (Bloomberg)

The Federal Reserve raised interest rates Wednesday for the first time since 2006, turning everyone's attention to how quickly subsequent rate hikes will occur. The best way to gauge that will be to track the progress of inflation.

Huge Beer Merger’s Cast-Offs Could Attract a Private Buyer (NY Times)

Huge Beer Merger’s Cast-Offs Could Attract a Private Buyer (NY Times)

Anheuser-Busch InBev has barely concluded its $106 billion deal to buy SABMiller and now is planning its next deal: a sale of Peroni and Grolsch, which it will acquire in the SAB deal. SAB’s dregs might attract a rival, but a private buyer may find those brands more to its taste.

Though SABMiller is huge, its brands mostly aren’t. Peroni is big in Italy and almost nowhere else. Grolsch has some scale in the Netherlands, but no more than 1 percent market share by volume in any other market, according to Susquehanna Financial. Both are under pressure from craft beers. They may worry antitrust regulators, but the two brands don’t really worry SAB’s bottom line.

Pier 1 Tumbles After Decline of `Casual Shopper' Weighs on Sales (Bloomberg)

Pier 1 Imports Inc. plunged as much as 15 percent in late trading after the furniture chain cut its forecast, citing a decline in casual in-store shoppers.

Here's What Traders Were Doing Minutes Before the Rate Hike (Bloomberg)

Here's What Traders Were Doing Minutes Before the Rate Hike (Bloomberg)

Seconds before liftoff — perhaps the most talked-about, chewed-over, let’s-get-this-over-with decision in Federal Reserve history — the jokes were flying at Drexel Hamilton, a broker-dealer in lower Manhattan.

“Any more bets anyone wants to place?” one trader asked.

GE Rallies to Seven-Year High as $26 Billion Seen for Investors (Bloomberg)

General Electric Co. will hand back $26 billion through dividends and stock repurchases in 2016 as the company rewards shareholders after tilting the business back toward manufacturing and away from finance.

Can a Santa rally chase away the bears? (Market Watch)

Can a Santa rally chase away the bears? (Market Watch)

A rather severe oversold condition, coupled with a VIX buy signal, resulted in a strong rally Tuesday and into Wednesday. Has the market recovered from the nasty beating it took last Friday? On the surface, it might seem so, but there are still causes for worry.

Historically, the action so far this fall is very similar to that of 2014 (see SPX chart). In both 2014 and 2015, there was a strong rally in late November followed by a sharp decline in early December. In 2014, the market then recovered to new highs very quickly — shortly before year end — before succumbing again in January. Whether that pattern will repeat again is unclear, but it’s certainly a possibility.

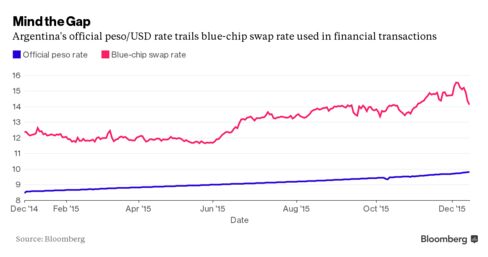

Grain Prices Drop as Argentina Plans to Scrap Currency Controls (Bloomberg)

Grain prices fell on the Chicago Board of Trade on expectations that Argentina will ease currency controls, leading to an increase in shipments from one of the worlds largest exporters of corn and soybeans.

Metals Hold Gains After Policy Makers Raise U.S. Interest Rates (Bloomberg)

Gold maintained gains after the Federal Reserve boosted U.S. interest rates for the first time since 2006while signaling that the pace of subsequent increases will be gradual. Silver and copper also held on to earlier increases.

Dollar Gains as Fed Raises Interest-Rate Target From Record Low (Bloomberg)

The dollar rose after the Federal Reserve raised interest rates for the first time in almost a decade, adding to the allure of assets denominated in the U.S. currency as it ends an unprecedented period of near-zero rates.

Gold Daily and Silver Weekly Charts – Gold and Silver Rally Back From Antic Lows (Jesse's Cafe Americain)

And so the Fed raised rates, in the manner in which you would have expected if you frequent this site.

Politics

The Immigration Game Rubio and Cruz Can't Win (Bloomberg)

The Immigration Game Rubio and Cruz Can't Win (Bloomberg)

Tuesday night's Republican debate proved once again that there is no way for a Republican — any Republican — to truly win a debate on immigration.

Yes, Republicans of all stripes can score partisan points when they talk about the border. The sizable decline in illegal migration coming across from Mexico during the Obama administration is a fact aggressively, almost universally, unacknowledged in Republican circles. So clamoring for a militaristic crackdown on the spectral hordes crossing the Rio Grande is a certain winner. Heck, it's so easy that even Jeb Bush, who memorably described illegal immigration as an "act of love," can fake it.

Homeland Security terrorist-threat alerts to be revamped (Market Watch)

Homeland Security terrorist-threat alerts to be revamped (Market Watch)

The Department of Homeland Security is revamping its system for issuing alerts about terrorism threats out of concern that the current system doesn’t tell the public enough about the type of danger posed by self-radicalized suspects and others.

Under the new system, the Department of Homeland Security will issue bulletins designed to update the public on the changing nature of terrorism threats. The department already issues bulletins to law enforcement agencies about specific cases or types of threats, but the new system is designed to provide more general information to the public about the overall threat environment, officials said.

Technology

If you worship speed, the McLaren 675LT is the supercar for you (Business Insider)

If you worship speed, the McLaren 675LT is the supercar for you (Business Insider)

McLaren builds supercars for people who love technology. Ferrari builds them for people who are into a sexy, screaming engine and breathtaking styling, and Lamborghini builds them for people who had Lamborghini posters on their bedroom walls as teenagers. Pagani builds them for artists. Porsche builds them people who … I guess like Porsches a whole lot and need Porsche to have a supercar. Ford builds them when it wants to remind everyone that it has beaten Ferrari at what Ferrari does best. And Corvette builds them because Corvette wants us to be happy and not have to spend $300,000 for the privilege.

Health and Life Sciences

This Transparent Patch Will Deliver Thirty Percent More Ibuprofen Through Your Skin (Forbes)

This Transparent Patch Will Deliver Thirty Percent More Ibuprofen Through Your Skin (Forbes)

Researchers at the University of Warwick in the United Kingdom say they’ve created have a new way to deliver Ibuprofen for up to 12 hours through your skin in the form of a patch.

The new transparent patch, expected on the market within the next two years, will deliver 30 percent more Ibuprofen than what’s currently available in medical gel and patches. Researchers say the patch delivers a consistent dose of the pain reliever in the exact spot you have the pain, right through your skin.

Cancer 'not just down to bad luck' (BBC)

Cancer 'not just down to bad luck' (BBC)

Cancer is overwhelmingly a result of environmental factors and not largely down to bad luck, a study suggests.

Earlier this year, researchers sparked a debate after suggesting two-thirds of cancer types were down to luck rather than factors such as smoking.

The new study, in the journal Nature, used four approaches to conclude 10-30% of cancers were down to the way the body naturally functions or "luck".

Life on the Home Planet

Mercury Found In Fog Off California Coast (Popular Science)

Mercury Found In Fog Off California Coast (Popular Science)

Fog in San Fransisco

Fog is a hazard to ships, but it might also be a problem for the food web.

Today at the American Geophysical Union's fall meeting, researchers discussed new evidence that the amount of coastal fog is not only increasing, but in some areas of California at least, it contains a surprising amount of a form of mercury called monomethylmercury.

Nepal quakes 'could have been worse' (BBC)

Nepal quakes 'could have been worse' (BBC)

The impacts stemming from the big earthquakes that struck Nepal earlier this year could have been much, much worse, say scientists.

An international team has just published a review of the events, showing the number of landslides was far lower than people had feared.