Financial Markets and Economy

Glencore's Deeper Debt Cuts Spurring Optimism on Credit Rating (Bloomberg)

Glencore Plcs aggressive approach to shrinking the industrys biggest debt pile is fueling optimism the trader and miner can retain its investment-grade credit rating amid the worst commodities rout in seven years.

Dollar gains traction, BOJ next up to the plate (Business Insider)

Dollar gains traction, BOJ next up to the plate (Business Insider)

The U.S. dollar stood at its highest in two weeks against a basket of currencies early on Friday, having made a decisive move a day after the Federal Reserve delivered a long-awaited hike in interest rates.

Commodity currencies were hardest hit as the firmer greenback took a toll on a range of commodities from oil to base metals and gold.

This Year's Worst Commodity Is One You Probably Can't Pronounce (Bloomberg)

An obscure metal used to make steel has become this year’s worst-performing commodity, after China’s stumbling economy and a collapse in the energy industry drove outsized losses.

In an e-commerce world, Pier 1 says improved brick-and-mortar business is key (Market Watch)

In an e-commerce world, Pier 1 says improved brick-and-mortar business is key (Market Watch)

Despite growth in its e-commerce business, furniture and home design retailer Pier 1 Imports Inc. said “the decline of casual store visits” had a negative impact on third-quarter performance.

“Our disappointing third-quarter sales results are largely attributable to decreases in store traffic,” said Alexander Smith, chief executive officer of Pier 1 PIR, -20.17% , said on the earnings call after hours on Wednesday.

History says this 6-year-old bull market is only getting started (Business Insider)

History says this bull market is not over.

Asian Shares to Mirror U.S. Retreat With BOJ Due After Fed Hike (Bloomberg)

Asian stocks were set to pace the pullback in the U.S. as the focus shifts back to the divergence in global monetary policy, with the Bank of Japan expected to hold fast to record stimulus following the Federal Reserves long-awaited interest-rate hike.

The Russian ruble just tumbled to a record low (Business Insider)

The Russian ruble just hit a record low against the dollar.

Mortgage rates higher for second week, Freddie Mac says (Market Watch)

Mortgage rates higher for second week, Freddie Mac says (Market Watch)

The 30-year fixed-rate mortgage averaged 3.97% in the December 17 week, up 2 basis points from the prior week. A year ago, those mortgages averaged 3.80%. The 15-year fixed-rate mortgage averaged 3.22%, up from 3.19% last week and 3.09% a year ago.

Junk-Bond Funds Lose $3.81 Billion in Biggest Withdrawal of Year (Bloomberg)

Investors pulled $3.81 billion from U.S. high-yield bond funds in the past week, the biggest withdrawal since August 2014, according to Lipper.

AB InBev seeks quick sales for Peroni and Grolsch: sources (Business Insider)

AB InBev seeks quick sales for Peroni and Grolsch: sources (Business Insider)

Anheuser-Busch InBev <ABI.BR>, which has agreed to buy rival brewer SABMiller <SAB.L>, plans to contact potential bidders for SABMiller's Grolsch and Peroni beers on Friday and wrap up deals in less than three months, sources close to the process said.

The Five Biggest China Deals This Year — And Five That Flopped (Bloomberg)

Chinas ravenous appetite for overseas assets is powering a record year for Asian dealmaking, with deal volumes in the region surpassing the $1 trillion mark annually for the first time.

Philadelphia Fed manufacturing index returns to negative level for December (Market Watch)

A measure of manufacturing activity in the Philadelphia area fell back into negative territory in December, another indicator of the difficult times facing the manufacturing sector.

U.S. stocks closed near session lows Thursday as investors eyed oil prices and economic data, after the Federal Reserve on Wednesday made the widely expected move of raising rates. ( Tweet This )

"The action we saw yesterday I think was a relief rally," said David Schiegoleit, managing director of investments at U.S Bank Private Client Reserve.

A lot of people are going to get rich(er) at this tiny Wall Street firm (Business Insider)

A lot of people are going to get rich(er) at this tiny Wall Street firm (Business Insider)

It has been an incredible year for Centerview Partners, the New York-based boutique advisory firm led by Blair Effron.

The firm has landed roles on some of the biggest deals of the year, working on the Pfizer-Allergan $160 billion megadeal.

China Beige Book Shows Disturbing Deterioration on All Fronts (Bloomberg)

China's economic conditions deteriorated across the board in the fourth quarter, raising doubts over whether its successfully transitioning from manufacturing to services-led growth, according to a private survey from a New York-based research group.

State lender says doesn't rule out investing in Telecom Italia (Business Insider)

State lender says doesn't rule out investing in Telecom Italia (Business Insider)

Italian state lender Cassa Depositi e Prestiti does not rule out investing in Telecom Italia <TLIT.MI> if talks between the latter and CDP-controlled firm Metroweb over joining forces to build an ultrafast nationwide fiber optic network succeeds, its chairman said.

Metroweb, a small fiber optic company controlled by infrastructure fund F2i and CDP, has long been seen as the corporate vehicle for realizing the Italian government's multi-billion-euro plan for the nationwide fiber network.

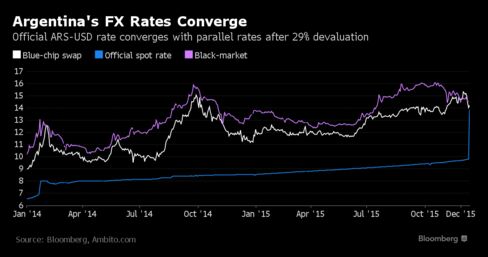

No Mad Rush for Dollars Seen in Argentina After Peso Devaluation (Bloomberg)

Argentina's finance minister declared the first day of a free-floating peso a success, saying its decline was in line with his expectations and showed theres no outsize demand for dollars in the country.

Stocks and gold are falling (Business Insider)

Stocks were falling in morning trading on Thursday, a day after the Federal Reserve raised interest rates.

Falling Oil Cushions Asia Economies as Fed Threatens Currencies (Bloomberg)

The slump in crude prices is hardly a silver bullet for Asian economies bracing for the fallout from rising U.S. interest rates. But it’s a welcome cushion.

3 Things: Tick-Tocks, Stocks, & Shocks (Real Investment Advice)

Yesterday, Janet Yellen announced the first hike in the Fed Funds rate in eleven years from .25% to .50%. When asked about why the Fed decided to raise rates now, Ms. Yellen responded by suggesting that the “odds were good” the economy would have ended up overshooting the Fed’s employment, growth and inflation goals had rates remained at low levels. She then went on to state that it was a “myth” that economic growth cycles die of “old age.”

SP 500 and NDX Futures Daily Charts – Quad Witching Expiry Tomorrow (Jesse's Cafe Americain)

All the gains from yesterday were swept aside.

Learning Finance via The Big Short (The Atlantic)

Learning Finance via The Big Short (The Atlantic)

Most Americans probably hadn’t heard the phrase “mortgage-backed securities” until around 2008, when the subprime-mortgage crisis erupted and sent the U.S. financial system into chaos.

But what exactly happened? That’s the central question of the film The Big Short, an adaptation of Michael Lewis’s 2010 book about a handful of Wall Streeters who uncovered the underlying problems in the mortgage market and bet against (or shorted) the securities made up of subprime debt before all hell broke loose. These underdogs become the winners of the financial crisis. Kind of.

Chile Raises Key Interest Rate for Second Time This Year to 3.5% (Bloomberg)

Chile raised borrowing costs for the second time this year following a pause in November, as central bankers continue to see inflation in the South American country running above target in 2016.

Overstock Wins SEC's Nod To Upend How Companies Issue Shares (Bloomberg)

Overstock Wins SEC's Nod To Upend How Companies Issue Shares (Bloomberg)

Overstock.com Inc. has a plan to refashion how companies go public and dole out shares in secondary offerings. The online discounter moved a step closer when its strategy of using bitcoin-based technology won permission last week from the top U.S. securities regulator.

The idea, according to a filing with the U.S. Securities and Exchange Commission, is to issue company stock using blockchain, the underlying software that governs how bitcoins work.

Shell calls for tougher regulation of Dubai oil benchmark (Yahoo! Finance)

Shell calls for tougher regulation of Dubai oil benchmark (Yahoo! Finance)

"Regrettably, there have been times in recent months where the price of Dubai (crude) was assessed well in excess of the fundamental refining value of other comparable Middle Eastern crudes," Shell said in a statement. The Dubai benchmark, which is assessed by oil pricing agency Platts, is comprised of the three grades of Middle Eastern crude.

Politics

Ben Carson predicts he’d be a one-term president (Market Watch)

Ben Carson predicts he’d be a one-term president (Market Watch)

Carson, the retired neurosurgeon who’s running for the Republican nomination, told a group of Nevada Republicans on Wednesday: “If I’m successful in this endeavor to become president of the United States, it’s very likely I would be a one-term president.” According to the Washington Post, Carson said, “There are some tough things that need to be done.” Carson’s admission that implementing his policies to fix the economy would probably doom his re-election chances was unusual for a presidential candidate, The Wall Street Journal wrote in a separate report.

Putin Praises `Absolute Leader' Trump as Colorful, Talented Guy (Bloomberg)

Putin Praises `Absolute Leader' Trump as Colorful, Talented Guy (Bloomberg)

President Vladimir Putin hailed Donald Trump as the “absolute leader” in the U.S. presidential contest, praising the candidate’s talk about building a deeper relationship with Russia.

The Republican candidate is “a very colorful character and talented,” Putin said after concluding his three-hour annual press conference in Moscow.

Technology

Is the future of music a chip in your brain? (Market Watch)

Is the future of music a chip in your brain? (Market Watch)

The year is 2040, and as you wait for a drone to deliver your pizza, you decide to throw on some tunes. Once a commodity bought and sold in stores, music is now an omnipresent utility invoked via spoken- word commands. In response to a simple “play,” an algorithmic DJ opens a blended set of songs, incorporating information about your location, your recent activities and your historical preferences—complemented by biofeedback from your implanted SmartChip. A calming set of lo-fi indie hits streams forth, while the algorithm adjusts the beats per minute and acoustic profile to the rain outside and the fact that you haven’t eaten for six hours.

Knowledge Work Has Had Its Day (Bloomberg View)

Knowledge Work Has Had Its Day (Bloomberg View)

What will we do to keep busy after the computers and robots have learned to do most work better than humans do?

Well, maybe we’ll talk to each other.

I’m pretty sure I first encountered the idea that the Information Age would elevate the value of person-to-person interaction in a long-ago essay by economist Paul Krugman.

Health and Life Sciences

Early Detection of Ovarian Cancer May Become Possible (NY Times)

Early Detection of Ovarian Cancer May Become Possible (NY Times)

A new version of a screening test for ovarian cancer may reduce deaths from the disease, but it needs more study to determine whether the benefits hold up, researchers reported on Thursday.

The findings come from a 14-year study of more than 200,000 women in Britain, published in The Lancet.

Lifestyle gets blame for 70% to 90% of all cancers (Market Watch)

Lifestyle gets blame for 70% to 90% of all cancers (Market Watch)

Do most people who get cancer simply have bad luck? Or is cancer something they might be able to prevent? A new study suggests the latter.

The study, whose results have just been published in Nature, revealed that it is mostly environmental and external factors like smoking, drinking, diet, getting too much sun and exposure to toxic chemicals that cause cancer, rather than intrinsic factors like random cell mutations.

Life on the Home Planet

Inside The Secret World Of Freemasonry (Fast Company)

Inside The Secret World Of Freemasonry (Fast Company)

Freemasonry, the world's oldest and largest fraternity, has been around for over two centuries. George Washington and Benjamin Franklin were members, as were Mozart, Winston Churchill, and Steve Wozniak. Today, their mysterious traditions and grandiose rituals endure in Masonic lodges across the country (and their symbols are rumored to be everywhere), but membership has been steadily declining due to lack of interest from younger generations. Photographer Jamie Kripke captures this strange world in his series Freemasonry, giving us a window into an organization with a rich past and uncertain future.

Size of manmade earthquakes gets bigger over time (Futurity)

Size of manmade earthquakes gets bigger over time (Futurity)

Earthquakes triggered by human activity follow several indicative patterns that could help scientists distinguish them from naturally occurring temblors, new research suggests.

Scientists analyzed a sequence of earthquakes on an unmapped basement fault near the town of Guy, Arkansas, from 2010 to 2011. In geology, “basement” refers to rock located beneath a sedimentary cover that may contain oil and other gas reserves that can be exploited through drilling or hydraulic fracturing, also known as “fracking.”

Human water use 'greater than thought' (BBC)

Human water use 'greater than thought' (BBC)

New calculations show that our already sizeable water footprint is 18% bigger than we thought.

The study is based on a century's worth of observational data drawn from 100 river basins across the world.