Financial Markets and Economy

Capital flight pushes China to the brink of devaluation (The Telegraph)

China is perilously close to a devaluation crisis as the yuan threatens to break through the floor of its currency basket, despite massive intervention by the central bank to defend the exchange rate.

The country burned through at least $120bn of foreign reserves in December, twice the previous record, the clearest evidence to date that capital outflows have reached systemic proportions.

Wall Street Traders Can't Afford to Sleep as China Rout Deepens (Bloomberg)

With China's stock market in disarray, American investors are finding out just how long their day can last — before they even get to work.

Silicon Valley is going to be visiting Wall Street more often (Business Insider)

Silicon Valley is going to be visiting Wall Street more often (Business Insider)

We all know tech initial public offerings, or IPOs, were a bust in 2015.

But Deutsche Bank's tech equity capital markets team — that is, the team that runs tech IPOs — has an argument for why that could change this year.

The team, led by Kristin DeClark, explained in a note to clients that both sides of the supply and demand equation would suggest an uptick in 2016.

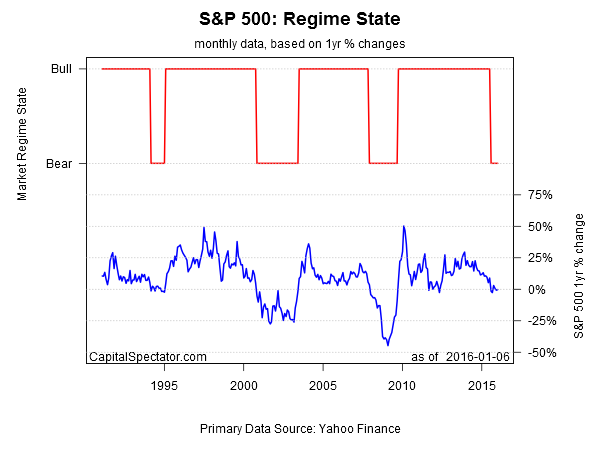

Is A Bear Market Growling For US Stocks? (Capital Spectator)

UBS strategists also see elevated risk of a new bear market. Unfortunately, there’s econometric support for the negative outlook via a Hidden Markov model (HMM), which has proven to be a relatively reliable metric for monitoring regime shift in the market in real time.

Dollar plunges against the yen as China sparks global rout (Market Watch)

Dollar plunges against the yen as China sparks global rout (Market Watch)

The U.S. dollar plunged against the yen Thursday after a report surfaced that Chinese policy makers were being pressured to allow a sharp drop in the yuan.

The report, published by Reuters, drove the buck back toward its lowest level against the Japanese currency in more than four months.

Another Day of Market Turmoil (The Atlantic)

Another Day of Market Turmoil (The Atlantic)

Chinese stocks plunged 7 percent Thursday, closing markets 29 minutes after trading began, and raising more fears about the health of what by some measures is the world’s largest economy. Consequently, markets across Asia and Europe slid, and U.S. stocks, which have already seen their worst three-day opening since the recession in 2008, extended that losing streak.

A New Economic Era for China Goes Off the Rails (NY Times)

A New Economic Era for China Goes Off the Rails (NY Times)

When President Xi Jinping of China convened a group of top officials to discuss the economy last month, the highly publicized meeting was seen as a moment of triumph.

A stock market plunge last summer, and a messy currency devaluation that followed, had faded from global view. In the relative calm, he seemed to usher in a new era of economic management, promising policy coordination at the highest levels to prevent another bout of turmoil.

Apple Falls Third Day as IPhone Woe Cuts $40 Billion in Value (Bloomberg)

Apple Inc. fell for a third straight day amid concern that demand is waning for the iPhone, its bestselling product, shaving about $40 billion from the companys market capitalization so far this year.

These 9 stocks are the best value on the market (Business Insider)

These 9 stocks are the best value on the market (Business Insider)

Even though Goldman Sachs doesn't think the market has a lot of room to grow, it does think certain stocks can climb.

David Kostin and his team at Goldman have assembled a list of stocks with the most upside in his new chartbook for the first quarter. These are stocks whose current price is incredibly low compared to Goldman Sachs' analysts' price targets.

Charts to Make You Go: 'ARGGHHHH' (Bloomberg)

A painful paradigm shift.

The Fed: Why the Fed isn’t running to the rescue of the ailing stock market (Market Watch)

The Fed: Why the Fed isn’t running to the rescue of the ailing stock market (Market Watch)

The stock market is off to a rocky start this year, as the Dow industrials continued to slide on Thursday and touched a three-month low.

But there is hardly any sign of concern from any Federal Reserve officials.

15 Ways for Oil to Bottom (The Reformed Broker)

Oil seems to be racing toward $30 this morning, which is wrecking the confidence of people who demand to pay more for gasoline. It’s quite a crisis.

Here are 2 things the oil bulls could be wrong about (Business Insider)

Crude oil cratered to a 14-year low on Thursday.

Strategists Are Growing Increasingly Negative About U.S. Markets and Growth (Bloomberg)

Strategists Are Growing Increasingly Negative About U.S. Markets and Growth (Bloomberg)

We're a week into the new year, and analysts are already ratcheting down their expectations for U.S. stocks, while various economic models are also moving downwards.

Investment banks, including RBC Capital Markets and Citigroup, have been growing more cautious on U.S. stocks and telling clients to look for better opportunities elsewhere. "Fading [earnings per share] momentum and rising Fed funds mean that, after six consecutive years of outperformance, we cut the U.S. to 'underweight,'" Citi said this week.

Wall Street's nightmare stock crashed 35% (Business Insider)

SunEdison, a solar-manufacturing company, fell 35% on Thursday after the company announced that it intends to raise money and restructure its debt in order to pay back $738 million.

Treasuries Gain as Haven Bid Outweighs Speculation China Selling (Bloomberg)

Treasuries rose, staging their longest winning streak in a year, as safe-haven buying outweighed speculation China is selling Treasuries.

Here are 2 completely different ways of thinking about the exact same chart (Business Insider)

In the US economy, the big story is the divergence between the manufacturing and services sectors.

What investors should (and shouldn’t) do in this market (Market Watch)

What investors should (and shouldn’t) do in this market (Market Watch)

Global markets are in a rout that some are calling reminiscent of the 2008 financial crisis.

Investors scarred by the recession may be cringing at the comparison and wondering whether to wait out the gyrations or run the other way. Here’s what financial experts say to skittish investors: Relax, because investing should be a long-term plan.

This Industry's Junk Bonds Fared Even Worse Than Energy: Chart (Bloomberg)

Things were bad for energy companies in 2015. By at least one measure, miners had it worse.

SP 500 and NDX Futures Daily Charts – Out on the Lows (Jesse's Cafe Americain)

As far as equities are concerned it is mostly if not all about China. The huge bubble in their paper assets is deflating, in a nutshell as the reality of SIX PERCENT growth and a change to a domestic, rather than an export dominated, economy continues.

A cold chill is blowing through the bond market (Business Insider)

A cold chill is blowing through the bond market (Business Insider)

It is getting chilly out there.

UBS credit strategists Stephen Caprio and Matthew Mish put out a note Thursday titled "Non-Bank Liquidity Chilled by Macro Shocks."

By "non-bank," the strategists basically mean the bond market. And it isn't looking good.

The 'Average' Stock Is Already in a Bear Market (Bloomberg)

While the major equities indexes might not yet be in a bear market, that's not necessarily the case for the 'average' stock.

Gap Shares Tumble After Sales Plunge at Once-Hot Old Navy Brand (Bloomberg)

Gap Inc. fell as much as 9.1 percent in late trading after December sales tumbled at its Old Navy chain, which was long seen as the companys brightest star.

Politics

Trump Will Still Lose. Here's How. (Bloomberg View)

Trump Will Still Lose. Here's How. (Bloomberg View)

True, turnout for primaries is better than in caucuses, but it’s still not high. New Hampshire has higher turnout figures for its primary than most states. Yet in 2008, the total primary tally (about 527,000) was still lower than the general election vote (about 708,000). Trump isreportedly relying on first-time voters and others who don't regularly vote in Republican primaries. We don't know yet if they'll show up, but habitual voters are disproportionately the ones who usually take part in primaries.

Africa’s Growing War on Corruption (Project Syndicate)

To the chagrin of most Africans, the world has long viewed their continent through the prism of the three “Cs” – conflict, contagion, and corruption.

Technology

MIT Media Lab Star Reveals His First Project With Samsung (Fast Company)

MIT Media Lab Star Reveals His First Project With Samsung (Fast Company)

Jinha Lee gave us some of the world's most exciting interfaces. Then he disappeared.

In 2013, Jinha Lee was one of the biggest names in experimental user interface. At MIT's Tangible Media Group, he created a magnetically levitating display that allowed you to rearrange objects in midair and a monitor that you could reach your hands into, letting you touch information itself.

Health and Life Sciences

If The New Dietary Guidelines Are Hard To Digest, Here's Some Simpler Advice (Forbes)

If The New Dietary Guidelines Are Hard To Digest, Here's Some Simpler Advice (Forbes)

As it does twice a decade, the government has issued its new dietary guidelines, based on the recommendations of the Dietary Guidelines Advisory Committee (DGAC), a group of researchers assembled to advise it. There had been a lot of optimism leading up to today, based on the DGAC’s recommendations, which included some good science-based changes–like avoiding added sugar and scrapping an upper limit on total dietary fat intake altogether. However, some of the committee’s recommendations are oddly absent from the guidelines, which are vague, noncommittal and difficult to parse.

Saliva test to detect GHB and alcohol poisonings (Phys)

Saliva test to detect GHB and alcohol poisonings (Phys)

Scientists working at Loughborough University, UK, and the University of Cordoba, Spain, have developed a new method for the rapid diagnosis of poisoning in apparently drunk patients.

The saliva-based test offers the potential to screen for poisons commonly associated with the cheap or imitation manufacture of alcohol, and γ-hydroxybutyric acid, the so-called 'date rape' drug GHB.

Life on the Home Planet

Welcome to the Anthropocene: Five Signs Earth Is in a Man-Made Epoch (Bloomberg)

Welcome to the Anthropocene: Five Signs Earth Is in a Man-Made Epoch (Bloomberg)

More than two dozen scientists have spent at least six years debating whether humanity's wear and tear on the planet qualifies as a new geological epoch that deserves its own name.

The origins of coal date back to the Carboniferous Period 350 million years ago. Dinosaurs roamed the earth until a meteor brought an end to their Cretaceous Period 66 million years ago. Civilization grew up in the Holocene, which started only 11,700 years ago. Now, these researchers argue, human industry and population have created the Anthropocene, or human epoch.

Humans Leave a Telltale Residue on Earth (Scientific American)

Humans Leave a Telltale Residue on Earth (Scientific American)

Evidence for a new geologic epoch continues to accumulate, like layers of sediment that over time harden into strata. Although those who study the branch of geology known as stratigraphy—the study of those strata and their resolution into Earth's vast geologic time scale—will continue todebate the idea of the Anthropocene for what may seem like eons, the record in the rock continues to pile up.