Financial Markets and Economy

Perfect Earnings Season Record for S&P 500 Stocks Is on the Line (Bloomberg)

One of the best ways for investors to have made money in U.S. stocks last year was to acquire them just before earnings season began. Bulls need that trade to work now more than any time in the past few years.

Get ready for a crappy Q4 earnings season (Business Insider)

Earnings season kicks off this week. And that means corporate America will announce the financial results of their fourth quarter.

Treasury yields rebound from 3-month lows (Market Watch)

Treasury yields rebound from 3-month lows (Market Watch)

Treasury prices fell Monday, pushing yields higher, as markets shrugged off a plunge in China’s stock market and weakness in oil prices to focus on a slight turnaround in global stocks.

Deutsche Bank: Some of the Things You've Been Told About Buybacks Are Wrong (Bloomberg)

Monday myth busting.

Chinese Shares Remain Volatile; Europe Markets Are Steady (NY Times)

Chinese Shares Remain Volatile; Europe Markets Are Steady (NY Times)

Chinese stocks plunged again on Monday, as jittery investors worried about whether the authorities could manage the financial market turmoil and a broader economic slowdown.

Following steep losses last week, the main Shanghai share index fell 5.3 percent on Monday. The benchmark Shenzhen index ended the day down 6.6 percent.

The first mega-takeover of 2016 just landed (Business Insider)

The first mega-takeover of 2016 just landed (Business Insider)

The first big pharma deal of 2016 just landed.

After a months-long effort, Shire has agreed to buy the biopharmaceutical company Baxalta for about $32 billion, in a bid to become the No. 1 maker of drugs to treat rare diseases.

Oil could fall toward $20, but not for the reason you think (Market Watch)

Oil could fall toward $20, but not for the reason you think (Market Watch)

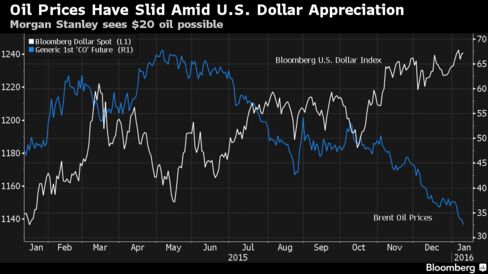

The oil-in-the-$20s club just got a new member. But Morgan Stanley’s case for another leg lower has less to do with a global glut of crude than it does with a strengthening U.S. dollar.

In a Monday note by analysts including Adam Longson, head of energy commodity research, Morgan Stanley argues that traders have put too much of the blame for recent weakness in commodities, especially oil, on market fundamentals. Instead, they contend that the primary driver over the last several months has been a strengthening U.S. dollar.

Morgan Stanley Sees $20 a Barrel Oil on U.S. Dollar Appreciation (Bloomberg)

A rapid appreciation of the U.S. dollar may send Brent oil as low as $20 a barrel, according to Morgan Stanley.

Yahoo’s plan A, B, C, D, and E for appeasing frustrated investors (Quartz)

Spinoff? Reverse spinoff? Something else altogether?

The never-ending Yahoo saga keeps dragging out. According to a Jan. 8 report from Bloomberg, Yahoo is now exploring an outright sale of its web business—the latest in a series of attempts to appease investors frustrated with the company’s lagging performance.

Rock legend David Bowie was a financial innovator, too (Market Watch)

Rock legend David Bowie was a financial innovator, too (Market Watch)

Rock legend David Bowie’s death at the age of 69 has prompted an outpouring of tributes to the late singer-songwriter.

But Bowie’s influence reached beyond the impact of his music, which remained on the cutting edge throughout his 40-plus-year career: He was also a financial innovator.

China's Demand for Crude is Showing Signs of Cracking (Yahoo! Finance)

China's Demand for Crude is Showing Signs of Cracking (Yahoo! Finance)

When looking for the prime culprit behind widespread weakness in commodity prices, fingers often point squarely at China.

On the supply side, especially in select metals, the world's second-largest economy deserves a hefty portion of the blame for the rout.

Gold back to 2-month high as stock bearishness grows (Market Watch)

Gold back to 2-month high as stock bearishness grows (Market Watch)

Gold futures pitched higher Monday morning, pushing the precious metal back to its highest levels since November as sentiment around stocks dimmed.

Morgan Stanley's worst case scenario for oil 'turned out to be too optimistic' (Business Insider)

The "oil price downturn is now deeper and longer than any of the previous downturns since 1970," according to Morgan Stanley.

Dollar firms against yen after shaky start to 2016 (Market Watch)

Dollar firms against yen after shaky start to 2016 (Market Watch)

The dollar firmed against the Japanese yen on Monday after its biggest weekly loss against the currency since August 2013.

Dollar gains came as China stocks tumbled and oil prices fell. U.S. stock futurespointed to a higher open for Wall Street.

China Isn't Headed for a Financial Crisis (Business Insider)

China Isn't Headed for a Financial Crisis (Business Insider)

Ever since the 2008 global financial crisis, pundits have tried to guess which country could set off the next implosion. Last week, China seemed to put itself forward as a pretty good candidate, as markets around the world panicked over the risks posed by its slowing economy. Those fears, while valid, are overdone.

Deal or No Deal? The Numbers That Matter for Shell's BG Takeover (Bloomberg)

Royal Dutch Shell Plc is a month away from completing its biggest acquisition, which would vault it over Chevron Corp. to become the world’s second-biggest non-state oil company.

The long view: This ‘baby bull’ is just giving investors a chance to buy the dip (Market Watch)

The long view: This ‘baby bull’ is just giving investors a chance to buy the dip (Market Watch)

If you’re looking at last Friday as a potential bottom for this market… don’t. Friday’s don’t mark bottoms, says Jeff Macke of the iBankCoin blog. He points out that selloffs in excess of 5% have smacked up against lows on a Friday exactly twice in the last 15 years. So not likely.

The 'fear in China' boiled down into 2 perfect sentences (Business Insider)

The biggest issue in economics right now is China: Its growth is slowing. Its population is ageing. Its debt — $28 trillion — is getting worse.

Brazil's Stocks Rise as Low Valuations Lure Investors to Banks (Bloomberg)

Brazil’s stocks rebounded from the lowest level since 2009 as buyers took advantage of low valuations, offsetting a slide in raw-material producers.

This investment bank just slashed its oil price prediction for 2016 (Business Insider)

This investment bank just slashed its oil price prediction for 2016 (Business Insider)

Oil are crashing once again and are now trading at terrible lows of around $32.50 per barrel.

While the chief executive of Shell Ben van Beurden made a pretty bullish call on the price of oil, by saying “the oil prices we are seeing today are not sustainable and are going to settle at higher levels ,” the data says otherwise.

Charting the Markets: The 2016 Stock Rout Enters Its Second Week (Bloomberg)

Global stocks fall for a sixth day, the rand plummetsand commodities slump to 16-year low.

The Farce Awakens (The Reformed Broker)

The Farce Awakens (The Reformed Broker)

One of the worst starts to a calendar year in stock market history. The S&P 500 plunges straight out of the gate and is now 11% off its record high set last year.

Volatility brings out the most counterproductive behavior in investors and, almost without fail, brings out the worst sort of advice. Farcical advice, the kind that would be laughed out of the room in the company of wealthy people or successful investors who’ve been around for a few cycles.

Oil is diving (Business Insider)

Oil is tumbling once again as the market rout which kicked off 2016 looks set to continue into a second week.

Wall Street's Big Ax Seen Reaping Best Year-End Profit Since '06 (Bloomberg)

In their quest for higher profits, the biggest U.S. banks have seized on the one thing they can reliably control: cutting costs.

Even an outright bear market fits into the bull market narrative (Business Insider)

It's been a rough couple of days in the global financial markets.

Rand Slump May Force More Aggressive SARB Action as Risks Climb (Bloomberg)

The rands crash to a new low against the dollar drove South African inflation expectations to the highest in at least three-and-a-half years and fueled speculation the central bank will act more aggressively at its policy meeting this month.

There is a war for talent on Wall Street (Business Insider)

There is a war for talent on Wall Street (Business Insider)

The fintech industry's budding startups keep bringing on Wall Street establishment firms as investors.

And they are hiring big Wall Street names, too.

Global Turmoil Darkens Path to Bank of England Rate Increase (Bloomberg)

If Mark Carney made a New Year’s resolution to raise U.K. rates, the rest of the world isn’t helping.

This amazing chart shows just how badly pretty much every asset is getting slammed this year (Business Insider)

This amazing chart shows just how badly pretty much every asset is getting slammed this year (Business Insider)

The start of 2016 witnessed a markets bloodbath.

Four days into trading this year, and already the price of oil is tanking, China's stock market "circuit breaker" has been triggered twice, and assets all over the world are on a downward spiral.

But how bad are things really? Well, the answer is very, according to Bank of America Merrill Lynch.

Marchionne Embarks on Final Mission Impossible at Fiat Chrysler (Bloomberg)

As Fiat Chrysler Automobiles NV Chief Executive OfficerSergio Marchionne starts to look beyond his reign at the carmaker, hes betting he can silence naysayers one more time.

Agecroft Partners’ Top 10 Hedge Fund Industry Trends for 2016 (Hedge Think)

Agecroft Partners’ Top 10 Hedge Fund Industry Trends for 2016 (Hedge Think)

Each year, Agecroft Partners predicts the top hedge fund industry trends through their contact with more than 2,000 institutional investors and hundreds of hedge fund organizations. The hedge fund industry is very dynamic and both managers and investors can benefit from anticipating, and preparing for, what changes are likely to occur. Those who effectively evolve with the industry will succeed, while stagnant firms will be left behind. Below are Agecroft’s predictions for the biggest trends in the hedge fund industry for 2016.

Shanghai Composite Index Extends Drop to 5% (Bloomberg)

China's benchmark equity gauge is heading for its lowest close since September.

Rand Faces More Manic Mondays as Japan Currency Romance Unwinds (Bloomberg)

Theres more Monday morning pain to come for South Africas rand as Japanese retail investors are forced to end their romance with the currency, Macquarie Bank Ltd. says.

Philippine Stocks Head for Bear Market Amid Foreign Selloff (Bloomberg)

Philippine stocks are poised to enter a bear market as the nations benchmark equity index sank for a fourth day amid a selloff by foreign investors.

Politics

Can the Government Fix Its Corps of Managers? (The Atlantic)

Can the Government Fix Its Corps of Managers? (The Atlantic)

Forty years ago, Congress set out to fix the government’s broken bureaucracy. It worried that the political appointees who head federal agencies didn’t have solid relationships with the civil servants below them. So it established a new corps of government workers, called the Senior Executive Service, to be the executive branch’s expert managers, linking appointees to the rank-and-file. But today, a new report finds, the corps isn’t operating the way it’s supposed to be.

Hillary Clinton: Donald Trump’s attacks on Bill Clinton won’t work (Market Watch)

Hillary Clinton: Donald Trump’s attacks on Bill Clinton won’t work (Market Watch)

Here’s what Hillary Clinton has to say to Donald Trump over his repeated attacks on Bill Clinton’s personal life: “Didn’t work before, won’t work again.”

Trump, the front-runner for the Republican nomination for president, has spent weeks attacking former President Bill Clinton on the campaign trail, calling him “one of the great abusers of the world” and even comparing him to Bill Cosby, who is facing allegations of sexual assault. Hillary Clinton, the leader for the Democrats’ nomination, said on CBS’ “Face the Nation” that such attacks are a “dead end.”

Technology

Tesla wants to take self-driving cars to a whole new level (Business Insider)

Tesla wants to take self-driving cars to a whole new level (Business Insider)

Tesla Model S owners woke up this weekend with some new tricks up their sleeves.

The Elon Musk-run automaker released it latest software — version 7.1 — in an over-the-air update on Saturday. This update features several major changes to the company's Autopilot system.

Everyone has the same personality online (Quartz)

Everyone has the same personality online (Quartz)

Ever notice how the same jokes, phrases and hashtags keep cropping up again and again on social media? All those “I can’t even…” comments on Facebook, the emojis on Slack or Gchat, that endlessly snarky tone on Twitter. We all sound exactly the damn same.

Even larger-than-life personalities, such as Sarah Silverman or Amy Schumer, lose their idiosyncrasies on Twitter. They might write clever jokes that fit into the 140-character word limit, but there’s no silliness or slapstick.

Health and Life Sciences

Why stress might make it harder to lose fat (Futurity)

Why stress might make it harder to lose fat (Futurity)

Chronic stress may stimulate production of a protein that then goes on to block an enzyme that breaks down body fat, new evidence suggests.

Its role in stress brings new attention to the protein, called betatrophin, which was once hailed by researchers as a breakthrough therapy for diabetes, but later deemed ineffective.

Silence Is the Enemy for Doctors Who Have Depression (NY Times)

Silence Is the Enemy for Doctors Who Have Depression (NY Times)

In my first year of training as a doctor, I knew something was wrong with me. I had trouble sleeping. I had difficulty feeling joy. I was prone to crying at inopportune times. Even worse, I had trouble connecting with patients. I felt as if I couldn’t please anyone, and I felt susceptible to feelings of despair and panic.

Alcohol limits cut to reduce risks (BBC)

Alcohol limits cut to reduce risks (BBC)

Tough new guidelines issued on alcohol have cut recommended drinking limits and say there is no such thing as a safe level of drinking.

The UK's chief medical officers say new research shows any amount of alcohol can increase the risk of cancer.

Life on the Home Planet

U.S. may send more strategic weapons to Korean peninsula: South Korea (Reuters)

The United States and its ally South Korea were discussing on Monday sending more strategic U.S. weapons to the Korean peninsula, a day after a U.S. B-52 bomber flew over South Korea in response to North Korea's nuclear test last week.

North Korea said it set off a hydrogen bomb last Wednesday, its fourth nuclear test since 2006, angering China, the North's main ally, and the United States, which said it doubted the device was a hydrogen bomb.