Financial Markets and Economy

Crude Falls Below $30 a Barrel for the First Time in 12 Years (Bloomberg)

Oil dropped below $30 a barrel in New York for the first time in 12 years on concern that turmoil in Chinas markets will curb fuel demand.

This is the first thing investors should look at every morning (Business Insider)

This is the first thing investors should look at every morning (Business Insider)

In the early days of 2016, volatility in China has dominated global markets.

That means that to stay ahead, US traders have to start looking at something new when they wake up: the spread between the onshore and offshore yuan (or renminbi).

YouTube’s new paid service might become Google’s big growth driver (Quartz)

YouTube’s new paid service might become Google’s big growth driver (Quartz)

Even conservative forecasts for YouTube’s new paid service could mean a significant impact on Google’s bottom-line, Credit Suisse said in a note to clients Tuesday (Jan. 12). It’s so bullish on Google’s prospects as a result that it lifted its price target for Class A shares in Alphabet, Google’s holding company, from $850 to $900. The stock currently trades at less than $750.

Apple is sole winner in otherwise dismal holiday for PCs (Market Watch)

Apple is sole winner in otherwise dismal holiday for PCs (Market Watch)

Apple Inc. once again stepped up as the lone winner in the PC industry despite a broader market contraction in the fourth quarter, according to data released Tuesday by Gartner and IDC.

IDC reported a 10.6% quarterly decline for personal computers during the holiday shopping season, marking the biggest year-over-year decrease in the PC market’s history. Gartner said shipments fell 8.3% to 75.7 million units. On an annual basis, PC shipments fell below 300 million units for the first time since 2008, IDC said.

Asian Index Futures Point to Rally as U.S. Shrugs Off Oil Slump (Bloomberg)

Asian stocks are poised bounce after a rally in the U.S. gathered strength amid speculation the selloff that has wiped out more than $5 trillion from global equity values this year has gone too far. American oil halted its drop just above $30 a barrel.

At last, the 10-year yield will go up (Business Insider)

2016 could be the year the 10-year Treasury yield finally rises.

The Fed says it’s worried about low inflation, but it isn’t worried enough (Quartz)

The Fed says it’s worried about low inflation, but it isn’t worried enough (Quartz)

The minutes from the Federal Reserve’s December meeting of its policy-setting committee are out. You’ll remember that after that meeting, the Fed announced an increase to its target short-term interest rate for the first time in nearly a decade. It was a big moment. (So big, we made t-shirts.)

The move wasn’t without controversy. While the US job market has improved quite a bit since the worst of the Great Recession, there are still indications that more people would get back to work if the economy generated jobs for them.

SocGen perma-bear Albert Edwards sees S&P plunging 65% (Market Watch)

SocGen perma-bear Albert Edwards sees S&P plunging 65% (Market Watch)

If a 6% slide in the S&P 500 in only the fist six days of trading in 2016 didn’t scare investors, then Albert Edwards’s recent prediction might.

According to Edwards, global strategist at Société Générale and prominent perma-bear, the stock benchmark SPX could fall around 65% from current trading levels. Edwards argues that stocks are already in a bear market—commonly defined as a 20% fall from a recent high—and that U.S. industrial production is shaky and could represent the beginning phases of a recession.

Yum's China Sales Rose 1% in December Ahead of Proposed Spinoff (Bloomberg)

Yum's China Sales Rose 1% in December Ahead of Proposed Spinoff (Bloomberg)

Yum! Brands Inc., the operator of KFC, Taco Bell and Pizza Hut, said December same-store sales rose 1 percent in China, where the company is spinning off its operations.

KFC comparable-store sales gained 5 percent in the country, the Louisville, Kentucky-based company said in filing on Tuesday. Though they fell 11 percent at Pizza Hut, the overall performance represents an improvement from November, when sales in China declined about 3 percent.

If manufacturing isn't a good indicator of the US economy, then explain this chart (Business Insider)

The ISM manufacturing index tumbled to 48.2 in December. This was the lowest reading since December 2009. Importantly, it's well below the 50, which means the industry is contracting.

But does this mean the overall US economy is doomed for a recession?

Most economists have found comfort in that manufacturing represents a little over 10% of the economy.

10 oil companies that will thrive as crude prices rebound (Market Watch)

10 oil companies that will thrive as crude prices rebound (Market Watch)

If you ignore the daily headlines about the beleaguered energy sector, invest in companies with low debt and wait for the inevitable rebound in oil prices, you could eventually make a lot of money.

Oil news has been grim, as analysts rush to lower their crude-price predictions week in and week out. Wolfe Research, in a shocking report, is expecting as many as a third of U.S. oil and natural gas producers to go bankrupt.

Global PC Shipments Fall 8.3% in Fourth Quarter, Gartner Says (Bloomberg)

Worldwide personal-computer shipments dropped 8.3 percent in the fourth quarter, ending the year at fewer than 300 million units for the first time since 2008, researcher Gartner Inc. said.

Ford declares new $1 billion dividend, expects to earn at least $10 billion in 2016 (Business Insider)

Ford declares new $1 billion dividend, expects to earn at least $10 billion in 2016 (Business Insider)

Ford Motor Co said on Tuesday it was declaring a $1 billion supplemental cash dividend and that it expected to have operating profit of at least $10 billion in 2016, roughly the same as its earnings in 2015.

Ford shares were down about 3 percent from Tuesday's close to $12.45 in post-market trading.

Tech Funding Slowdown Hits Venture Capital Firms (Bloomberg)

The number of venture funds that closed last year decreased 13 percent.

The must-read guide to the key issues at every major Wall Street bank (Business Insider)

The must-read guide to the key issues at every major Wall Street bank (Business Insider)

Wall Street banks had a rough end of 2015, and now analysts are looking ahead at what's to come this year.

Societe Generale bank analyst Geoff Dawes and his team put together a "Banks Handbook" for the year ahead and took a deep dive into the issues facing the top banks in the US and Europe.

Time Warner Investors Forget Cord-Cutting, Follow Merger Rumors (Bloomberg)

Wall Street may have found a balm to soothe its cord-cutting fears: merger rumors.

Alcoa’s stock plunges to near 7-year low (Market Watch)

Alcoa’s stock plunges to near 7-year low (Market Watch)

Alcoa Inc.’s stock dropped to the lowest price seen since the Great Recession on Tuesday, as the aluminum giant’s mixed fourth-quarter results failed to lift the spirits of investors or analysts.

That doesn’t bode well for investor sentiment in the coming weeks. Alcoa’s results are seen as marking the start of the quarterly earnings reporting season, which was already expected to be the worst for the S&P 500 companies in over six years. Read more about 5 spooky headwinds expected for this earnings season.

There’s no need to freak out about how few stock market winners there were in 2015 (Business Insider)

We'll admit it: we're guilty, too.

Canada Dollar Falls Below 70 U.S. Cents, Recalling Pre-Oil Boom (Bloomberg)

The top forecaster of the Canadian dollar said the currency will fall to a record 59 U.S. cents by the end of the year as further weakness in the energy sector saps growth in an economy already stretched by a heavily indebted consumer and the Bank of Canada cuts interest rates for a third time.

U.S. oil rises for first time in eight days after stocks fall (Reuters)

U.S. oil futures rose on Wednesday for the first time in eight days, pulling further back from the widely watched $30-per-barrel level breached the previous session, after industry data showed crude stocks unexpectedly fell last week.

U.S. West Texas Intermediate crude (WTI) CLc1 was up 30 cents at $30.74 a barrel at 0033 GMT (1933 EDT). On Tuesday, it fell 97 cents to close at $30.44 a barrel, after touching a low of $29.93, which was last seen in December 2003.

With Indexing, Being Dumb Can Be Smart (Morning Star)

In the early 1990s, Morningstar created the Morningstar Style Box to describe U.S. equity funds. The style box sorted stocks by two dimensions: by size, from large to small, and by cost, from growth to value. (In this column, I reword what typically is called "style" as "cost" because that is ultimately what distinguishes growth from value stocks, the cost of the stock.) Measuring size was straightforward. Determining the cost axis was a bit trickier. Some value managers sought cheap earnings, while others hunted for bargain assets. Cost, it seemed, could be defined by either price/earnings or price/book ratios.

Credit Suisse Has a Trio of Non-FANG Tech Stocks to Buy (Bloomberg)

Look to the less-loved in 2016.

Etsy’s stock tumbles to record low (Market Watch)

Etsy’s stock tumbles to record low (Market Watch)

Etsy Inc.’s stock continued its slide Tuesday, hitting the lowest price in its nine-month history in intraday trade, as part of broad weakness in the shares of companies that recently turned public.

Shares of the online crafts marketplace ETSY, -1.21% tumbled as much as 7.4% to an intraday low of $6.89 before paring some losses in afternoon trade, a day after shares of a number of recent initial public offerings, including those of Fitbit Inc.FIT, +4.14% Twitter Inc. TWTR, -0.15% and GoPro Inc. GPRO, -4.33% hit record lows.

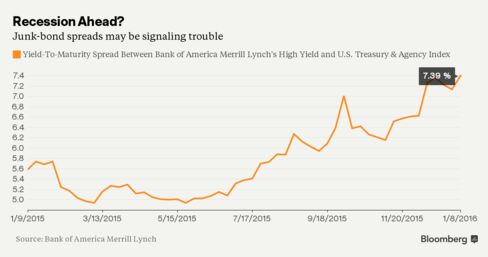

Junk Bonds Signal 44% Chance of Recession in 2016, Fridson Says (Bloomberg)

The junk-bond market is indicating a 44 percent chance of a recession in the U.S. within one year, according to Martin Fridson, a money manager at Lehmann, Livian, Fridson Advisors LLC.

Commodity Funds Fall Short, Study Says (Wall Street Journal)

Sobering news for investors in specialty-commodity mutual funds: On average, they fall short on key measures, new research has found.

Gold Daily and Silver Weekly Charts – Utopia for the Paper Gold Alchemists (Jesse's Cafe Americain)

There were no deliveries in precious metals at The Bucket Shop yesterday.

Politics

Clinton steps up attacks on Sanders as polls show tight Iowa race (Market Watch)

Clinton steps up attacks on Sanders as polls show tight Iowa race (Market Watch)

Former Secretary of State Hillary Clinton on Tuesday stepped up her attacks on Bernie Sanders as two polls showed momentum with the Vermont senator.

In a poll from Quinnipiac in Iowa, Sanders leads Clinton by a 49%-to-44% margin. In a poll released by Public Policy Polling, Clinton has the lead in Iowa, 46% to 40%, though that represents a 6-point swing for Sanders.

Is Cruz 'Natural Born'? Well … Maybe (Bloomberg View)

Is Cruz 'Natural Born'? Well … Maybe (Bloomberg View)

As just about everyone knows by now, Senator Ted Cruz was born in Canada, to a Cuban-born father and a mother who was a U.S. citizen. Cruz held Canadian citizenship for nearly all of his life, relinquishing it only in 2014, when he was planning to run for the presidency. Is he eligible to hold the office he seeks?

This is a question of constitutional law, not of politics; it should be approached as such. Respected analysts have shown that the question is not simple to answer. The Constitution states that the president must be “natural born,” but doesn’t define that term.

The Brutalism of Ted Cruz (NY Times)

…Ted Cruz is now running strongly among evangelical voters, especially in Iowa. But in his career and public presentation Cruz is a stranger to most of what would generally be considered the Christian virtues: humility, mercy, compassion and grace. Cruz’s behavior in the Haley case is almost the dictionary definition of pharisaism: an overzealous application of the letter of the law in a way that violates the spirit of the law, as well as fairness and mercy.

North Korea's Kim calls for expansion of nuclear arsenal (Reuters)

North Korean leader Kim Jong Un called for an expansion of the size and power of his country's nuclear arsenal, state media said on Wednesday, a week after a nuclear test that drew condemnation from its neighbors and the United States.

Technology

Smart Scanner Will Make It Easier To Digitize Archaeological Relics (Popular Science)

Smart Scanner Will Make It Easier To Digitize Archaeological Relics (Popular Science)

New software could help make this archeologist's job a little easier.

Working as an archeologist can be long and grueling–sifting through the dirt out in the field, then fitting together tiny shards of shattered artifacts in the lab.

Samsung Watch Turns Your Fingertips Into Earbuds (PSFK)

The TipTalk, unveiled by Samsung during CES 2016, can effectively bolster smartwatch appeal towards the sky above. Cooler than an invisible phone, it uses your finger to conduct sound directly to your ear canal. That’s right—the next time you get a call or need to check your voicemail, you can use your empty finger as a real phone.

Health and Life Sciences

How Safe Are Heartburn Medications? (Forbes)

How Safe Are Heartburn Medications? (Forbes)

This news may give you some heartburn. A study found that a commonly used type of heartburn medication (proton pump inhibitors or PPIs) may be associated with chronic kidney disease. Any concern about PPI safety raises the question of whether more effort should be made to tackle some root causes of heartburn such as obesity and stress. This is the latest burp in a class of medications that was considered safe enough to transition from being a prescription medication to an over-the-counter one (starting with Prilosec in 2003).

Life on the Home Planet

Protesting Nude in Portland Should Be Protected (Bloomberg View)

Protesting Nude in Portland Should Be Protected (Bloomberg View)

The First Amendment protects your right to burn the flag in protest. What about getting naked to draw attention to your cause? An Oregon man is intent on finding out — and so far, the courts have ruled against him. His case deserves attention because of the light it sheds on a core question of free speech.

This car is frozen solid thanks to wild weather around Lake Erie (Market Watch)

This car is frozen solid thanks to wild weather around Lake Erie (Market Watch)

No, it’s not an ice sculpture — that’s an actual car covered in ice.

Thanks to 40 mph wind gusts in the Buffalo, N.Y., area, Lake Erie is producing some pretty massive waves. So massive, in fact, that water was spilling over and freezing cars parked nearby.

The Arctic blast triggered what’s called “lake-effect snow.” It’s where cold air masses move over warmer lake waters, creating a “wall of white” — a blizzard of heavy snowfall, with clear, sunny skies on the other side of the blizzard.