Financial Markets and Economy

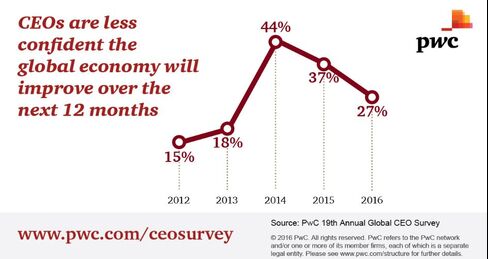

CEOs Downbeat on Global Growth With Just 27% Seeing Acceleration (Bloomberg)

Chief executive officers have turned pessimistic on global economic growth, according to a new survey by PricewaterhouseCoopers LLC.

Netflix soars on earnings beat (Business Insider)

Netflix soars on earnings beat (Business Insider)

Netflix crushed its fourth quarter earnings and the stock is up almost 9%.

The streaming video service massively outperformed Wall Street estimates on international subscriber growth, though it missed on US subscriber growth.

The global economy is looking worse by the day (Market Watch)

The global economy is looking worse by the day (Market Watch)

The International Monetary Fund just cut its expectations for global output by 0.2 percentage points for both 2016 (now 3.4%) and 2017 (now 3.6%). It’s the third time the IMF has cut its forecast in less than a year.

As it turns out, folks in DC are worrying about the same issues troubling Wall Street(paywall): A heady combination of fears over slowing growth in China, continued declines in oil prices, and a dissolving consensus on global monetary policy.

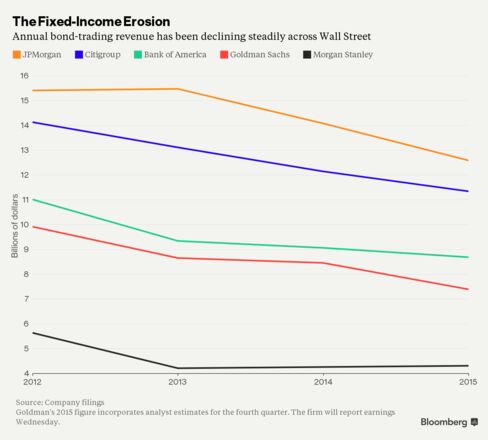

Wall Street's Bond-Trading Slump Extends Into Third Year: Chart (Bloomberg)

Once Wall Street’s most lucrative business, fixed-income trading revenue declined for the third straight year in 2015. Net income from trading bonds, currencies, commodities and derivatives linked to them has fallen between 18 percent and 25 percent at five top banks since 2012.

Here’s why 2016 has been especially tough on younger investors (Market Watch)

Here’s why 2016 has been especially tough on younger investors (Market Watch)

The stock market has been getting absolutely destroyed so far this year, with both the S&P SPX, +0.05% and Dow DJIA, +0.17% turning in their worst start ever. But it’s been particularly painful for one demographic.

According to the Openfolio Investor Index, the average investor lost 8.56% over the first 10 trading days of 2016. (The S&P 500 was down 8% in that same period.) This after Openfolio, a site where users share information about their investments, found that nearly 70% of all investors lost money last year.

How 3 stocks decimated David Einhorn's investment performance (Business Insider)

How 3 stocks decimated David Einhorn's investment performance (Business Insider)

Hedge fund billionaire David Einhorn, founder of Greenlight Capital, had a year to forget in 2015.

"We have never had a year where so little went right," he wrote in letter to his investors on Tuesday.

Einhorn's Greenlight Capital fell 3.8% in the fourth quarter, ending 2015 down 20.2%. Einhorn's only previous down year was in 2008, when his fund lost 23%.

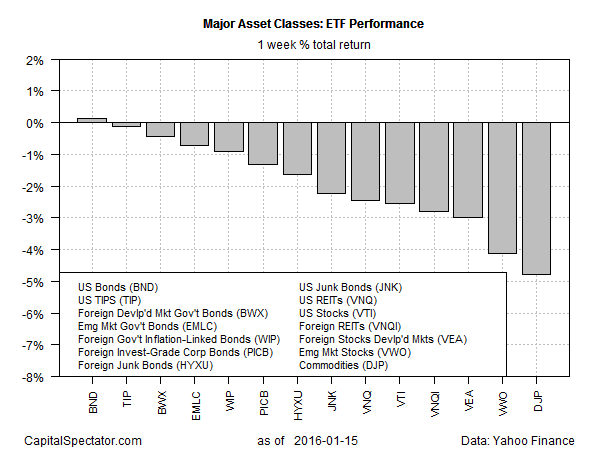

Red Ink Spreads Across All The Major Asset Classes For 1yr Returns (Capital Spectator)

Last week’s selling wave pushed most of the major asset classes into the red for the five trading days through Jan. 15, based on a set of proxy ETFs. For the one-year trailing period, everything has lost ground. Negative momentum, in other words, is in high gear.

For Bond Dealers, It's Not Too Soon to Lower 2016 Treasury Calls (Bloomberg)

Less than three weeks into the new year, two of Wall Street’s biggest bond dealers are already dialing back the 2016 Treasury yield calls they made at the end of 2015.

How to emerge from a ‘death spiral’ in stocks (Market Watch)

How to emerge from a ‘death spiral’ in stocks (Market Watch)

As stocks give up their early session gains Tuesday and continue to race south, strategists are reminding investors that a big correction was overdue in the current bull market and that high quality is key for those who want to stay in equities.

The way investors are feeling about the market is getting extreme (Business Insider)

The stock market is off to its worst start to a year ever, and that has some investors worried.

Stock Market Sell-Offs Without a Recession (A Wealth of Common Sense)

The stock market is a forward looking indicator. Markets are meant to discount future cash flows and events to a present value. It’s not always right — stocks have predicted four out of the last eight recessions and so on — but investors are constantly looking for signals in stock prices to shape their current outlook.

Billions of Dollars at Stake in Supreme Court Power Market Fight (Bloomberg)

Power generators may see billions of dollars in new revenue if the U.S. Supreme Court strikes down a federal rule that pays factories and office buildings to dim the lights when energy is most needed.

Bank of America’s stock drops to more than 2-year low (Market Watch)

Bank of America’s stock drops to more than 2-year low (Market Watch)

Bank of America Corp.’s shares turned sharply lower Tuesday and were in danger of the lowest close in more than two years, after the banking giant missed fourth-quarter revenue expectations.

The stock BAC, -1.52% slid 2.9% in active midday trade, after being up as much as 2.3% early in the session. That puts the stock on course to close at the lowest level since Nov. 13, 2013.

A single, hotly debated assumption is at the heart of every Wall Street stock market forecast right now (Business Insider)

A single, hotly debated assumption is at the heart of every Wall Street stock market forecast right now (Business Insider)

"Barring recession, pain should be limited to correction," Charles Schwab's Liz Ann Sonders said on Tuesday (emphasis added).

"Barring recession" — or something worded similarly — is the hot caveat that Wall Street's stock market strategists are inserting into their research notes to clients.

China Is Getting Less and Less Bang for Its Credit Buck (Bloomberg)

Behind the numbers showing China’s continued slowdown at the end of last year lies a warning for Communist Party leaders who have been equally determined to embrace economic change and to ensure a rapid pace of growth.

The Mark of a Truly Great Investor (The Reformed Broker)

I’ve read all fifty years’ worth of Warren Buffett’s Berkshire Hathaway annual letters to shareholders. You can too, for just three dollars. His latter-day letters are the more well-known ones, as he really hit his stride as a quipster in the 1980’s. But the earlier ones are a lot more interesting.

The oil crash is crushing Houston's housing market (Business Insider)

The oil crash is crushing Houston's housing market (Business Insider)

The oil crash has hit Houston, Texas so hard that virtually nobody wants to buy a house there anymore.

A report from Wall Street Journal on Monday examined how sellers are cutting home prices to make them more attractive to now-scarce buyers.

Where Is All the World’s Money Going? (The Atlantic)

Where Is All the World’s Money Going? (The Atlantic)

Wealth just keeps growing for the 62 richest people in the world. Collectively, this ultra-wealthy group controls $1.76 trillion, which is about the cumulative worth of the poorer half of the world’s population, or around 3.5 billion people. And since 2010, wealth has become more and more concentrated in favor of the richest of the rich while those on the lower rungs of the economic ladder have seen their positions worsen, according to a new report from Oxfam International.

Canadian Stocks Rise for Third Time This Year on China Optimism (Bloomberg)

Canadian stocks rose for only the third time this year, as Chinese economic-growth data eased investor concern over a hard landing.

Square is down 10% and close to dropping below its IPO price (Business Insider)

Shares of Square slid 10% on Tuesday, and the stock is now close to falling below its $9 IPO price.

China's Currency Isn’t Dominant Yet (Bloomberg View)

China's Currency Isn’t Dominant Yet (Bloomberg View)

Despite growing concerns that China's economy is in trouble, the country's currency is widely seen as a contender to oust the U.S. dollar from its dominant position in international trade. Judging from data on money transfers, it has a very long way to go.

Next Move for Stocks Is 5% Advance Says Deutsche Bank's Bianco (Bloomberg)

While falling oil may erase earnings in the energy industry this year, the reaction in the stock market has been too severe and the next move in shares will be a 5 percent advance, according to David Bianco, Deutsche Bank AG’s chief U.S. equity strategist.

World oil supply and demand (EconBrowser)

According to the Energy Information Administration’s Monthly Energy Review database, world field production of crude oil in September was up 1.5 million barrels a day over the previous year. More than all of that came from a 440,000 b/d increase in the U.S., 550,000 b/d from Saudi Arabia, and 900,000 b/d from Iraq. If it had not been for the increased oil production from these three countries, world oil production would actually have been down almost 400,000 b/d over the last year.

Gold Daily and Silver Weekly Charts (Jesse's Cafe Americain)

Sorry for the brief comments but I have an appointment with the vet and so must leave early. I have been caring for a sick pooch for several days now and she is really not recovering as quickly as we would like.

Politics

Why Precisely Is Bernie Sanders Against Reparations? (The Atlantic)

Why Precisely Is Bernie Sanders Against Reparations? (The Atlantic)

No, I don’t think so. First of all, its likelihood of getting through Congress is nil. Second of all, I think it would be very divisive. The real issue is when we look at the poverty rate among the African American community, when we look at the high unemployment rate within the African American community, we have a lot of work to do.

Palin endorses Trump as Iowa governor blasts Cruz (Market Watch)

Palin endorses Trump as Iowa governor blasts Cruz (Market Watch)

Sen. Ted Cruz is facing pressure ahead of the key Iowa caucus on two fronts, as former Alaska Gov. Sarah Palin endorsed his chief rival Donald Trump and the Hawkeye State’s governor called on voters not to vote for the Texan.

Technology

Better Living Through Robots (Bloomberg)

Better Living Through Robots (Bloomberg)

Robert Gordon, an economist at Northwestern University, likes to play a game he calls Find the Robot. As he goes about his everyday life—shopping, traveling through airports—he looks for machines performing tasks that humans once handled. Most of what he sees doesn’t impress him. ATMs, self-checkout kiosks, and boarding pass scanners have been around for years. Beyond that, not a lot has changed. “It’s very hard for robots to do things that are extremely ordinary for humans,” Gordon says. “Turns out that teaching machines to do something like folding laundry is almost impossible.”

The Soldier of Tomorrow Will More Easily Navigate the Fog of War (PSFK)

The Soldier of Tomorrow Will More Easily Navigate the Fog of War (PSFK)

Technology and warfare have always been inextricably linked. Compare contemporary soldier and his-her gear to a World War II GI, and you’ll think you’re looking at something out of a science-fiction movie. Today’s warriors wear body armor, carry personal GPS receivers, use light-enhancing scopes and goggles. But even these advances are becoming outdated as new systems are devised and implemented, giving better protection, capabilities, and communications than ever before.

Health and Life Sciences

Most stillbirths 'preventable' (BBC)

Most stillbirths 'preventable' (BBC)

Over 3,000 lives are lost to stillbirth a day across the world – most of which are preventable, according to studies published by The Lancet.

Two-thirds of last year's 2.6 million stillbirths were in Africa.

Life on the Home Planet

LA's Water District Forced to Name Those Who Received Turf-Removal Incentives (Gizmodo)

LA's Water District Forced to Name Those Who Received Turf-Removal Incentives (Gizmodo)

One of the biggest battles of the drought in the Western US has been over the flow of data—namely, who is using (and wasting) the region’s scarcest resource. Now a victory on thewater data front has been claimed with Los Angeles’s water district ordered to hand over the names and addresses of homeowners who received incentives to drought-proof their yards.

Eye-in-sky offers UK floods insight (BBC)

Eye-in-sky offers UK floods insight (BBC)

Images from an unmanned aerial vehicle suggest excessive management of floodplains limit their ability to hold water and slow the flow of floodwater.

Drainage channels on floodplains meant water was returned to rivers too quickly, exacerbating flooding further downstream, researchers observed.