Financial Markets and Economy

Wall Street selloff relentless as oil prices sink (Reuters)

Wall Street selloff relentless as oil prices sink (Reuters)

Wall Street moved deep into the red in volatile trading on Wednesday, extending this year's selloff as oil prices continued to plummet unabated…

"The damage being done in energy is spreading," said Brian Fenske, head of sales trading at ITG in New York.

"Just getting up every morning and seeing the S&P futures down 1-2 percent has a near-term psychological impact and puts some investors into risk-off mode," Fenske said.

Bankers say end of loose monetary policy era has fuelled volatility (Reuters)

The end of ultra-loose monetary policy and the divergence between central banks in the United States and Europe are contributing to recent volatility in financial markets, top bankers at the World Economic Forum in Davos said.

Raghuram Rajan, the governor of India's central bank, acknowledged that we may now be experiencing the darker side of the massive monetary stimulus of past years.

Global Stocks Slide on Oil Rout (Wall Street Journal)

Global Stocks Slide on Oil Rout (Wall Street Journal)

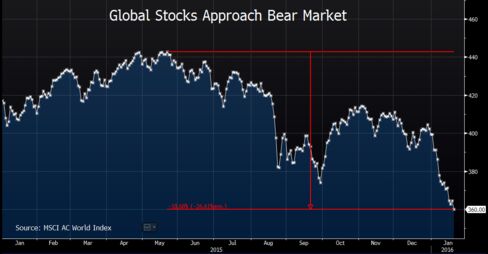

Global stocks resumed their recent selloff Wednesday as oil prices sank to a 12-year low and resurgent concerns about global growth snapped a brief bout of stabilization in financial markets.

Shares in Asia and Europe were sharply lower and investors favored perceived havens such as the yen, gold and U.S. Treasurys.

Japanese Stocks Plunge Into Bear Market as Global Rout Deepens (Bloomberg)

Japanese stocks plunged into a bear market amid a slump in equities across Asia as investor concerns over the global economic outlook outweighed technical signs that a China-fueled rout has gone too far.

Gold Forges Ahead as Citigroup Says Haven Role 'Back in Vogue' (Bloomberg)

Gold rallied toward $1,100 an ounce as equities dropped, investor holdings climbed to the highest level in two months and Citigroup Inc. said that bullion’s role as a haven asset was now back in vogue.

China's slowing economy overshadows U.S. business lobby survey (Business Insider)

China's economic slowdown is hitting profits at more foreign companies, a survey by an American business lobby showed, while the vast majority of respondents believed China's growth in 2016 would fall short of the central bank's forecast.

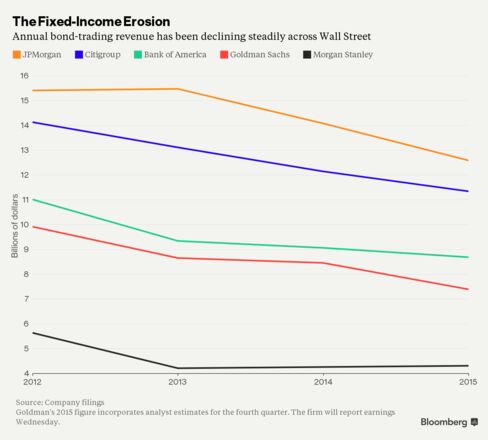

Wall Street's Bond-Trading Slump Extends Into Third Year: Chart (Bloomberg)

Once Wall Street’s most lucrative business, fixed-income trading revenue declined for the third straight year in 2015. Net income from trading bonds, currencies, commodities and derivatives linked to them has fallen between 18 percent and 25 percent at five top banks since 2012.

Oil Market Tests Banks’ Ability to Weather Losses (NY Times)

Oil Market Tests Banks’ Ability to Weather Losses (NY Times)

Banks of all sizes are marking down the value of loans and setting aside reserves to absorb additional losses as oil producers struggle to pay their debts.

On Tuesday, Bank of America said provisions for credit losses increased $264 million in the fourth quarter, driven by the downturn in the energy sector. Citigroup, Wells Fargo and JPMorgan Chase reported last week that oil issues also weighed on fourth-quarter earnings.

FTSE 100 dives nearly 3% as oil slide deepens (Market Watch)

FTSE 100 dives nearly 3% as oil slide deepens (Market Watch)

U.K. stocks were sinking Wednesday, as the continuing rout in oil drove losses across the board.

Europe Panics (Business Insider)

European markets are diving into the red on Wednesday morning.

For Bond Dealers, It's Not Too Soon to Lower 2016 Treasury Calls (Bloomberg)

Less than three weeks into the new year, two of Wall Street’s biggest bond dealers are already dialing back the 2016 Treasury yield calls they made at the end of 2015.

Shell expects 4th Q profits to drop at least 40 percent (Yahoo! Finance)

Shell expects 4th Q profits to drop at least 40 percent (Yahoo! Finance)

Royal Dutch Shell expects its fourth quarter profits to drop at least 40 percent to between $1.6 billion and $1.9 billion after a sharp drop in crude oil prices, but underscored its determination to press ahead with the proposed mega-merger with BG Group plc.

The Anglo-Dutch energy giant said Wednesday it released the figures for shareholders ahead of a vote next week on the proposed combination, a 47-billion-pound ($69.7 billion) deal widely seen as an effort to adapt to lower prices.

Dow Falls 300 Points as Global Rout Deepens Amid Plunge in Crude (Bloomberg)

Turmoil returned to global markets as oil plunged and the Dow Jones Industrial Average sank more than 300 points, fueling a rush into haven assets.

Japan’s Nikkei enters bear market as Asian stocks fall (Market Watch)

Japan’s Nikkei enters bear market as Asian stocks fall (Market Watch)

Hong Kong stocks hit a 3½-year low and Japan’s Nikkei closed in bear market territory, as this year’s global selloff resumed in the region on Wednesday.

Oil crashes past $28 (Business Insider)

Oil crashed past the $28 per barrel mark in overnight trading, hitting $27.82 (£19.64).

Billions of Dollars at Stake in Supreme Court Power Market Fight (Bloomberg)

Power generators may see billions of dollars in new revenue if the U.S. Supreme Court strikes down a federal rule that pays factories and office buildings to dim the lights when energy is most needed.

U.S. and Europe could be biggest winners from China’s slower growth (Market Watch)

U.S. and Europe could be biggest winners from China’s slower growth (Market Watch)

An annual growth rate of 6.9%. Retail sales growth of more than 8%, and online growth of more 25% a year.

They are the kind of booming economic numbers that most central bankers, and presidents and prime ministers, would kill for. Except that is the latest data out of China — and because it is the slowest annual rate of economic growth since way back in 1990, it is taken as a major disappointment.

Market tailspin hastens the economic shock it fears (Business Insider)

Market tailspin hastens the economic shock it fears (Business Insider)

One of the biggest worries about this month's sudden seizure in world markets is how puzzled investors have been left by it, and how many are just wishing it away as a temporary blip.

History suggests governments and central banks would do well to sit up and take notice, but with policy coordination at its lowest ebb in decades, a coherent response is unlikely.

Oil prices fall further on glut worries; U.S. crude slumps below $28 (Business Insider)

Oil prices fall further on glut worries; U.S. crude slumps below $28 (Business Insider)

Crude futures slumped again in early Asian trade on Wednesday, with U.S. oil falling to its lowest since September 2003 below $28 a barrel on worries over a global supply glut.

That came as the International Energy Agency, which advises industrialized countries on energy policy, warned on Tuesday that oil markets could "drown in oversupply".

Politics

Bernie Sanders compares Hillary Clinton to Dick Cheney (Market Watch)

Bernie Sanders compares Hillary Clinton to Dick Cheney (Market Watch)

Sen. Bernie Sanders, gunning for back-to-back wins in the first two presidential contests, stepped up his attacks on rival Hillary Clinton, comparing her to former Vice President Dick Cheney on foreign policy and suggesting she is in the pocket of a big Wall Street bank.

The charges came on a day of repeated barbs between the Clinton and Sanders camps and as a new poll in New Hampshire showed the Vermont senator’s lead widening in the nation’s first primary contest.

The Trump-Cruz Brawl Ramps Up (The Atlantic)

The Trump-Cruz Brawl Ramps Up (The Atlantic)

Donald Trump and Ted Cruz are escalating their feud in Iowa.

It makes sense that the gloves would come off between the Republican presidential rivals as the clock ticks down to the start of primary voting season. Animosity between the candidates boiled over on the national stage at last week’s Republican primary debate. Cruz denounced Trump for his so-called “New York values,” implying that the real-estate mogul just might be a bleeding-heart liberal. Trump shot back, suggesting that Cruz’s Canadian birth could disqualify him from the presidential race.

Technology

Russia’s War Robots Are Less Than They Appear (Popular Science)

Russia’s War Robots Are Less Than They Appear (Popular Science)

Most war robots aren’t. The icon of highly advanced machines at war is the modern combat drone, a sleek gray warplane with an unblinking eye and a bundle of missiles held under wing. Strip away the modern trappings, though, and they reveal themselves to be highly refined versions of slow airplanes with fancy cameras, remote controls, and some stabilizing software. And that’s in the United States, where the Pentagon has continuously invested billions of dollars into unmanned vehicles over the past several decades. So when Russia claims that it has working war machines, and it’s using them in Syria, its time to be skeptical.

Designing a Non-Creepy Humanoid Robot Is a Delicate Affair (PSFK)

Designing a Non-Creepy Humanoid Robot Is a Delicate Affair (PSFK)

We locked eyes—Pepper’s glimmered blue in recognition. “Bump it bro,” I said to its head, and it rolled up its five fingers into a fist, reached out toward me, and we pounded it.

I met Aldebaran’s humanoid robot Pepper at CES this year to find out if a machine could really delight me enough to convince me to live with it. Pepper stands out from the JIBOs and the iRobots and the Makr Shakrs in that it isn’t designed to serve any particular purpose (personal assistant, cleaner, bartender) beyond being your buddy.

Health and Life Sciences

Women May Have Better Flu Defenses (Medicine Net Daily)

Women May Have Better Flu Defenses (Medicine Net Daily)

When it comes to fending off the flu, women may have an advantage over men, new research suggests.

The study found that the female sex hormone estrogen helps keep the flu virus somewhat at bay, which may help explain why flu appears to be harder on men than women.

Are beards good for your health? (BBC)

Are beards good for your health? (BBC)

If you were in search of a new, disease-fighting antibiotic, where might you start? In a swamp? A remote island? Well, how about combing beards? Michael Mosley investigates.

On Trust Me I'm a Doctor we do experiments which sometimes throw up genuinely new science. In a previous series, for example, we discovered you can cut the calories in pasta by cooking, cooling and then reheating it.

Life on the Home Planet

Militants kill at least 19 as they storm Pakistan university (Reuters)

Armed militants stormed a university in volatile northwestern Pakistan on Wednesday, killing at least 20 people and wounding dozens a little more than a year after the massacre of 134 students at a school in the area, officials said.

A senior Pakistani Taliban commander claimed responsibility for the assault in Khyber Pakhtunkhwa province, but an official spokesman later denied involvement, calling the attack "un-Islamic".

Demand For ‘Aquatic Cocaine’ Is Killing Marine Animals (Think Progress)

Demand For ‘Aquatic Cocaine’ Is Killing Marine Animals (Think Progress)

He drove to the port of entry after midnight, transporting a cargo as lucrative and illegal as any cartel-produced drug. As it’s customary in border ports, the U.S. officer asked the driver if he had anything to declare. Song Shen Zhen, then 75, said no.