Financial Markets and Economy

Selling Equities on Falling Oil Is Mistake, Goldman's Cohn Says (Bloomberg)

Investors selling equities because oil prices are tumbling are making a mistake, Goldman Sachs Group Inc. President Gary Cohn said.

“People are confusing the supply-demand picture in oil,” Cohn said Friday in an interview on Bloomberg Television at the World Economic Forum in Davos. Many investors are concluding based on falling oil prices that consumption is declining and the global economy is slowing, Cohn said.

Kerry Says Don’t Believe the Hype: World Changing for the Better (Bloomberg)

Much of the talk in Davos is of doom and gloom. One man isn’t so downbeat.

U.S. Secretary of State John Kerry struck a rare note of optimism Friday in a speech to executives preoccupied by the faltering world economy, China’s woes and the rise of geopolitical risk.

Oil is now rocketing (Business Insider)

After a volatile week, in which oil slammed past the $28 (£19) per barrel mark, the commodity is finally rallying back to $30.

AmEx shares fall as 2016 earnings outlook disappoints (Yahoo! Finance)

AmEx shares fall as 2016 earnings outlook disappoints (Yahoo! Finance)

AmEx shares fell about 3.7 percent to $60.35 in extended trading following the company's 2016 earnings forecast of $5.40-$5.70 per share. Chief Executive Officer Kenneth Chenault did not specify he size of the expected gain from the Costco portfolio sale during the company's earnings conference call.

Dollar boosted across the board on eurozone stimulus hopes (Market Watch)

The dollar was higher against the euro and the yen in Asia trade Friday, as investors shed caution following signs that the European Central Bank may provide more stimulus and after a sharp recovery in Tokyo stocks.

The dollar was stronger against the euro EURUSD, -0.3035% which weakened to $1.0837 from $1.0888 late Thursday in New York.

A top Apple analyst agrees iPhone sales will fall, but says that's a huge buying opportunity (Business Insider)

A top Apple analyst agrees iPhone sales will fall, but says that's a huge buying opportunity (Business Insider)

Piper Jaffray analyst Gene Munster agrees with other analysts that Apple is about to experience a grim milestone: sales of the iPhone will experience their first ever year-on-year decline when the company reports its quarterly earnings report next week.

This widespread sentiment has sent Apple shares 28% from their 52-week high.

Plunge Drives $9 Billion Norway Fund Back to Buying Stocks (Bloomberg)

The $9 billion tactical asset allocation unit of Norway’s largest listed life insurer, Storebrand ASA, is buying stocks again after a four-month hiatus in a bet that a fear-driven rout has gone too far.

Crazy market selloff doesn’t signal a recession (Yahoo! Finance)

Here's why the decline in the S&P does not portend a recession.

Big tech firms have chance to gobble up cash-poor cloud rivals (Market Watch)

Big tech firms have chance to gobble up cash-poor cloud rivals (Market Watch)

The recent market selloff is pummeling the business-technology sector, but it may come with a silver lining for its top players: an opportunity to buy cash-poor upstarts that have been eating away at their business.

Enterprise-technology giants like International Business Machines Corp. IBM, +0.86% , Cisco Systems Inc. CSCO, +0.00% and Hewlett Packard Enterprise Co. HPE, +2.90% have all seen their market value shrink by at least 9% in the past month — underperforming the S&P 500 index, which fell 7% over the same period.

U.S. crude prices stabilize after jumping from 2003 lows (Business Insider)

U.S. crude prices stabilize after jumping from 2003 lows (Business Insider)

U.S. crude oil prices were stable in early Asian trading on Friday after bouncing away from 12-year lows the previous day as rallying financial markets gave some traders reason to cash in on record short positions.

Front-month West Texas Intermediate (WTI) crude futures

were trading at $29.82 per barrel at 0056 GMT (1956 EDT), up 29 cents from their last settlement and over $3.50 above 2003 lows reached earlier this week.

Europe Shares Jump Second Day Amid Central Bank Aid Speculation (Bloomberg)

European stocks advanced for a second day, erasing a weekly decline, amid increased investor confidence that central banks will act to support markets.

Asia stocks up after ECB signals easing, oil extends rally (Business Insider)

Asian stocks gained early on Friday, after the markets were given some breathing space when the European Central Bank hinted of more monetary policy easing, while crude oil extended an overnight rally.

Markets in Asia and Europe Rally as Investors Seek Bargains (NY Times)

Markets in Asia and Europe Rally as Investors Seek Bargains (NY Times)

Surging Japanese shares led a strong rebound in markets across Asia and Europe on Friday as investors buffeted by days of volatility saw opportunity amid the recent sell-offs.

Following mild gains Thursday on Wall Street, Japan’s benchmark Nikkei 225 index staged a forceful rally, closing 5.9 percent higher. It was the biggest single-day increase in Japanese shares since September.

China's Intervention Vow Seen Making Stocks Even Less Attractive (Bloomberg)

The last thing China’s stock market needs is more meddling by the state.

Commodity Rout Spurs Moody's to Put Dozens of Ratings on Review (Bloomberg)

Moody’s Investors Service said that it is reviewing the credit ratings of dozens of energy and mining companies worldwide after cutting its outlook for oil prices and warning the slump triggered by China wasn’t a normal downturn but a fundamental shift.

Rand's Plunge Is Pushing Platinum Lower, Sibanye CEO Says (Bloomberg)

The collapse in the currency of the worlds largest platinum producer is dragging down themetals price with it, according to Neal Froneman, chief executive officer of Sibanye Gold Ltd., which will enter the sector for the first time this year.

Stocks Propelled by Oil-Price Bounce (Wall Street Journal)

Stocks Propelled by Oil-Price Bounce (Wall Street Journal)

Global stocks rallied Friday as oil prices staged a recovery and investors bet more stimulus from the world’s central banks could help lift financial markets out of their new year’s malaise.

Stocks in Europe moved higher for a second day, while stocks in Japan and Hong Kongsoared on expectations of more stimulus from the European Central Bank and Bank of Japan.

Esteves Is Out of Jail, BTG's Up 24% and Traders Want Much More (Bloomberg)

As quickly as the crisis and volatility erupted at Brazils Banco BTG Pactual SA, they have faded. No longer do daily swings in the banks stock regularly surpass 10 percent. On a typical day this month, the move has been more like 3 percent.

Top-Ranked Analyst Says BHP May Need $10 Billion Stock Sale (Bloomberg)

BHP Billiton Ltd. needs to raise as much as $10 billion in a sale of new stock to its investors if it wants to keep its credit rating, according to the top-ranked analyst covering the world’s biggest mining company.

Weak U.S. corporate profits offer no rescue to sinking stocks (Yahoo! Finance)

Weak U.S. corporate profits offer no rescue to sinking stocks (Yahoo! Finance)

Investors who hoped U.S. corporate earnings could dig stocks out of their deep hole may find themselves sorely disappointed. The outlook for corporate profits continues to deteriorate, and earnings growth is now unlikely to revive before the summer. Thanks to rapidly dimming forecasts for energy, materials, finance and technology sectors, year-over-year profit declines for Standard & Poor's 500 companies are now expected until the second quarter of 2016 at the earliest, according to data from Thomson Reuters Proprietary Research.

Island of Nickel Losing Money as World's Mines Shun Output Cuts (Bloomberg)

On a remote island in the Pacific Ocean, mine owners like Glencore Plc and Vale SA are losing money on every ton of nickel they unearth in what amounts to a contest to see who can endure the agony longer.

Politics

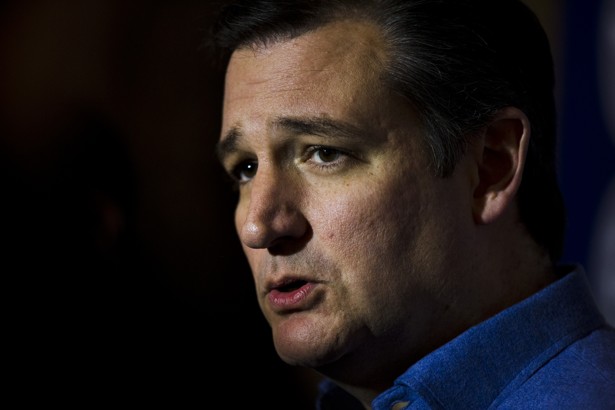

Is the Republican Establishment Ganging Up on Ted Cruz? (The Atlantic)

Is the Republican Establishment Ganging Up on Ted Cruz? (The Atlantic)

There’s a parlor game going around among D.C. Republicans: If you had to choose, who would you pick to be the Republican nominee—Donald Trump or Ted Cruz?

It’s a choice that’s becoming increasingly real as establishment Republicans confront the twin terrors atop their presidential field. On Wednesday, I put the question to Trent Lott, the former Senate majority leader from Mississippi who’s now a D.C. lobbyist.

National Review Booted From GOP Debate After 'Against Trump' Issue (The Huffington Post)

National Review Booted From GOP Debate After 'Against Trump' Issue (The Huffington Post)

Editors of the National Review on Thursday night published their "Against Trump Symposium," a collection of essays in which conservative luminaries teamed up to decry the prospect of Donald Trump becoming the GOP's presidential nominee and, by extension, the party's standard-bearer of conservatism. There were immediate consequences: The magazine was "disinvited" from participating in an upcoming debate.

Technology

Skype Finally Hides Your IP Address (Gizmodo)

Skype Finally Hides Your IP Address (Gizmodo)

Way back in 2012, it came to light that a flaw in Skype made it easy for hackers to acquire your IP address. Now, finally, Microsoft has updated the software so those details are hidden by default.

Skype has offered the option to hide your IP address for a little while, but the update which is being rolled out today means that it’s a standard feature.

Health and Life Sciences

A New Way To Curb Marijuana Use Among Young Smokers? (Forbes)

Treatments for curbing marijuana dependence have been mainly based on psychosocial approaches, until now — sort of.

Published in Addiction Biology, a new study suggests that the combination of topiramate — an anticonvulsant drug, which can also prevent migraine headaches — and psychological counseling limits marijuana use among young smokers more than counseling alone.

Study Pinpoints Best Timing for Rectal Cancer Surgery (Medicine Net Daily)

Researchers say they've pinpointed the best length of time to wait to perform surgery for rectal cancer afterchemotherapy and radiation treatment have been completed.

The researchers examined outcomes among 11,760 U.S. patients with stage 2 or 3 localized rectal cancer who had combined chemotherapy and radiation therapy (chemoradiotherapy) and surgery between 2006 and 2012.

Life on the Home Planet

A Question of Environmental Racism in Flint (NY Times)

A Question of Environmental Racism in Flint (NY Times)

If Flint were rich and mostly white, would Michigan’s state government have responded more quickly and aggressively to complaints about its lead-polluted water?

'Extinct' frog rediscovered in India (BBC)

'Extinct' frog rediscovered in India (BBC)

An extraordinary tree frog thought to have died out more than a century ago has been rediscovered in India.

The discovery was made by renowned Indian biologist Sathyabhama Das Biju and a team of scientists, in the jungles of north-eastern India.