Financial Markets and Economy

Trader Who Made 6,200% on China Futures Says Go Short or Get Out (Bloomberg)

Huang Weimin, the hedge fund manager whose Chinese stock-index futures wagers returned more than 6,200 percent last year, has some advice for investors in 2016: Sell your shares now, before its too late.

So Far, Amazon and Netflix Are Sundance’s Top Buyers (NY Times)

It was the independent film equivalent of a crack of thunder.

After its Sundance premiere on Saturday, “Manchester by the Sea,” a buzzy drama starring Casey Affleck as a handyman coping with family strife, sold not to a traditional studio distributor but to a streaming service. Amazonpaid a hefty $10 million for the movie, beating out the likes of Fox and Universal.

How the Oil Bust Wiped Out One North Dakota Oil Refiner's Profit (Bloomberg)

For the first new refinery in the U.S. in seven years, the idea was simple: Buy cheap oil from shale producers, then score a quick profit by selling it right back to them as more expensive diesel needed to power their trucks and drilling rigs.

U-Turn: Is Federal Reserve’s Next Move A Rate Cut? (Investors)

U-Turn: Is Federal Reserve’s Next Move A Rate Cut? (Investors)

As other central banks around the globe re-double efforts to fight deflation and stem a financial-market rout, the Federal Reserve is arguably working at cross purposes.

The Fed is expected to take no action at its two-day policy meeting starting Tuesday. But some market players see the central bank ultimately reversing course and easing policy. That would be embarrassing to Fed Chairwoman Janet Yellen and other policymakers, but it wouldn’t be unique.

The Fed: Slight shifts in Fed statements often have big impact, analyst says (Market Watch)

Shifts in a new quantitative hawk-dove score of Fed policy statements precede actual policy decisions by four to seven months, according to economists at Deutsche Bank.

Wall Street got the China oil story wrong, and it will make everything that's happening now much worse (Business Insider)

If you are concerned about the declining price of oil, you should probably know what China — the world's second-largest oil consumer — has been doing with its oil industry for the past year.

Johnson Controls to Combine With Tyco in Tax-Inversion Deal (NY Times)

Johnson Controls has agreed to combine with Tyco, the latest deal that moves the address of a storied American company to Ireland to lower its tax bill.

Johnson Controls, whose shareholders will own about 56 percent of the combined company, will join Tyco, which will own 44 percent, in Cork, Ireland.

Mr. Shkreli Goes to Washington and Mocks Ghostface Killah (Bloomberg)

Mr. Shkreli Goes to Washington and Mocks Ghostface Killah (Bloomberg)

Disgraced biotech executive Martin Shkreli has shifted into full attack mode, simultaneously taking on the U.S. Congress and Ghostface Killah. Which antagonist poses more of a threat is open to debate.

A brief recap: Shkreli, 32, ran hedge funds and a pair of biotech drug manufacturers before gaining extreme notoriety last year for raising the price of a lifesaving AIDS drug by more than 5,000 percent. Then he got indicted for securities fraud.

One Chart That Terrifies Emerging-Market Investors (Bloomberg View)

If you’re wondering why investors seem so worried about China and other emerging markets, consider this: Companies there have piled on more risk than at any point in at least the past decade.

Apple Analysts Predict Biggest March-Quarter Decline In 18 Years (Investors)

Apple Analysts Predict Biggest March-Quarter Decline In 18 Years (Investors)

Wall Street analysts are making their final wagers on Apple’s (AAPL) fiscal Q1 report and guidance before the betting window closes Tuesday.

Tired of the negative speculation, many analysts say they just want to get the report over with and move on. Apple is due to release its December-quarter results and give fiscal Q2 guidance after the market close Tuesday.

One major oil CEO thinks the industry is going to have 'a tough slog through the mud' in 2016 (Business Insider)

One major oil CEO thinks the industry is going to have 'a tough slog through the mud' in 2016 (Business Insider)

Oil had a pretty rough 2015.

And according to the CEO of one industry giant, 2016 could be just as bad.

Why Chicago's best traders are moving into venture capital (Chicago Business)

Chicago's traders long have injected money into the city's economy, but now they're becoming bona fide venture capitalists.

The founders of some of the city's most successful trading companies, including Getco, DRW Holdings and Jump Trading, have created separate entities for VC investing and recently began pouring tens of millions of dollars into startups.

U.S. Stocks, Once Among World's Priciest, Now Cheapest (Bloomberg)

Stocks in the Standard & Poor’s 500 Index have become some of the developed world’s cheapest, even though their collective price-earnings ratio hasn’t changed much from when they were among the most expensive five years ago.

The bond market is going to get ugly if there isn't a rebound soon (Business Insider)

The high-yield market needs to see a broad-based, solid rebound soon, or things are going to get a lot worse.

One measure of just how extreme panic among junk-bond investors has gotten is thedifference between yields on high-yield bonds and comparable US Treasuries.

So yes, the oil crash looks a lot like subprime (Yahoo Finance)

One year ago, analysts at Bank of America Merrill Lynch drew a parallel between the subprime mortgage crash and the disorderly fall in the price of oil.

Led by Chris Flanagan, a veteran of the securitization space, the team drew attention to Markit's ABX Index, better known as the mother of all synthetic subprime credit indexes.

Sanders rips merger as 'disaster' for taxpayers (The Hill)

Sanders rips merger as 'disaster' for taxpayers (The Hill)

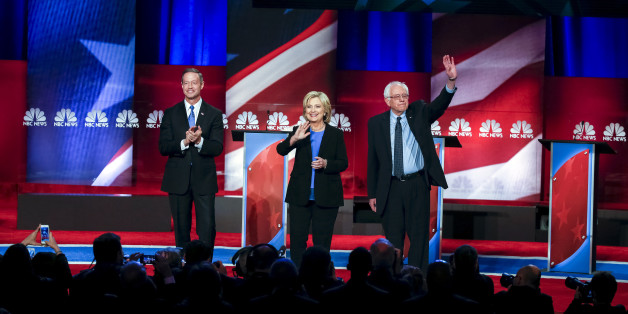

Democratic presidential candidates Bernie Sanders and Hillary Clinton on Monday blasted the latest planned merger that would result in a U.S. company reincorporating overseas to lower its taxes.

Milwaukee-based Johnson Controls, a multi-industrial company, and Irish-based Tyco, a fire and security provider, announced Monday that they will merge, with the new firm keeping Tyco's Irish legal residence.

All Dressed to Short and Nowhere to Go (Bloomberg)

It’s been a terrible two years for the $800 billion leveraged-loan market, judging by the steady stream of withdrawals from funds that invest in the debt.

China's economy has been slowing down for years — but it's still growing like it's 2007 (Business Insider)

China started 2016 with mini stock crashes and a currency devaluation.

Asian Stocks Follow Oil Lower as Japanese Shares Lead Declines (Bloomberg)

Asian stocks fell, halting a two-day rebound, as oil slipped back below $30 a barrel and Japanese shares led losses.

How Big Is The Gig Economy? The Government Is Finally Going To Find Out (Fast Company)

How Big Is The Gig Economy? The Government Is Finally Going To Find Out (Fast Company)

The gig economy has launched a healthy "future of work" panel circuit amid a roaring debate over whether apps like Uber, Postmates, and Handy—which farm their work out task by task to an army of independent contractors instead of hiring workers as employees—represent a return to the sweatshop or a new freedom to work when and how one pleases. But all sides of the debate face the same dilemma: When they propose a new policy or launch a new initiative, they have only a vague idea of how many workers it could impact.

Politics

Winning or Losing Isn't Everything in the Primaries (Bloomberg View)

Winning or Losing Isn't Everything in the Primaries (Bloomberg View)

As Elaine Kamarck recounts in the Washington Post, winning isn’t all that matters in the early contests on the presidential nomination calendar. Candidates seek to beat expectations, and the press and the parties judge the results against what they thought would happen.

In fact, beating expectations can matter even more than the raw results because it affects the amount and tone of the coverage candidates get. Those, in turn, can affect voters in the next state on the calendar.

The Volcanic Core Fueling the 2016 Election (Huffington Post)

The Volcanic Core Fueling the 2016 Election (Huffington Post)

Not a day passes that I don't get a call from the media asking me to compare Bernie Sanders's and Hillary Clinton's tax plans, or bank plans, or health-care plans.

I don't mind. I've been teaching public policy for much of the last thirty-five years. I'm a policy wonk.

What Donald Rumsfeld Knew We Didn’t Know About Iraq (Politico)

What Donald Rumsfeld Knew We Didn’t Know About Iraq (Politico)

On September 9, 2002, as the George W. Bush administration was launching its campaign to invade Iraq, a classified report landed on the desk of the chairman of the Joint Chiefs of Staff. It came from Defense Secretary Donald Rumsfeld, and it carried an ominous note.

Technology

Gaze Inside The Mind Of Artificial Intelligence With This Neural Network Visualizer (Popular Science)

Gaze Inside The Mind Of Artificial Intelligence With This Neural Network Visualizer (Popular Science)

Adam Harley's 3D Visualization of a Convolutional Neural Network lets you look inside the inner workings of artificial intelligence.

Grid for Renewables Could Slash Emissions (Scientific American)

Grid for Renewables Could Slash Emissions (Scientific American)

Carbon dioxide emissions from generating electricity could be cut by 78 percent within the next 15 years if the country makes the same Herculean effort to expand solar and wind technology that it did to build the Interstate Highway System.

That’s the conclusion of a National Oceanic and Atmospheric Administration (NOAA) study published Monday in Nature Climate Change, which shows that a new system of transcontinental transmission lines connected to wind and solar farms nationwide is the key to dramatically reducing emissions from the nation’s power plants.

Health and Life Sciences

Your 'Sweet Tooth' Is Really Your Brain Out To Get You (Huffington Post)

Your 'Sweet Tooth' Is Really Your Brain Out To Get You (Huffington Post)

Having trouble keeping your New Year's resolution to ditch the sweets? Blame your brain.

A new study from researchers at Duke University finds that a sugar habit leaves a lasting imprint on certain brain circuits, making it incredibly difficult to stop eating sweet food. These marks, in turn, prime us to give into our cravings.

As Population Ages, Where Are the Geriatricians? (NY Times)

Ruth Miles, 83, sat in a wheelchair in a small exam room, clutching a water bottle, looking frightened and uncomfortable.

She was submitting to the tender scrutiny of Dr. Elizabeth Eckstrom, who scooted her stool so close that she was knee to knee with her patient.

Life on the Home Planet

Here's how the massive blizzard affected travel this weekend (Business Insider)

Here's how the massive blizzard affected travel this weekend (Business Insider)

The US Northeast continues to dig out from the monumental amount of snow that fell this past weekend.

Given the ferocity of the blizzard, it's remarkable that the entire transportation grid of the US East Coast isn't shut down. But on Monday, much of the region was getting back to normal.

Ben & Jerry’s co-founder unveils ‘Bernie’s Yearning’ ice cream flavor (Yahoo)

Ben & Jerry’s co-founder unveils ‘Bernie’s Yearning’ ice cream flavor (Yahoo)

Ben & Jerry’s co-founders Ben Cohen and Jerry Greenfield introduced Bernie Sanders at his campaign launch in Burlington, Vt., last year, and now they’ve introduced “Bernie’s Yearning,” a new, extremely limited-edition ice cream flavor inspired by the Vermont senator and 2016 Democratic presidential hopeful.

“Nothing is so unstoppable as a flavor whose time has finally come,” Cohen wrote on his Facebook page Monday. The pint of plain mint ice cream topped by a chocolate disk that, according to its description, represents “the huge majority of economic gains that have gone to the top 1% since the end of the recession.”