Financial Markets and Economy

Charting the Markets: Countdown to Fed Decision (Bloomberg)

The U.S. dollar rises for first day in three, iron ore drops for a second day and BASF earnings are hurt by oil price slump.

Yuan Bears Denounced as Delusional, Doomed by China State Media (Bloomberg)

China’s leading state media are becoming more vociferous in their support for the yuan, having been fired up in the past week by George Soros’s observation that the economy is headed for a hard landing.

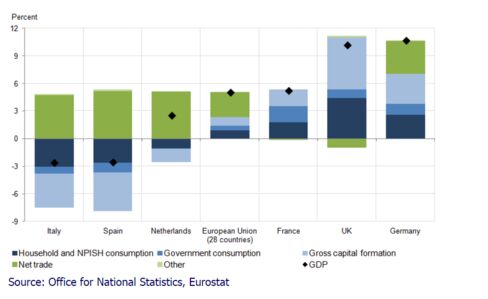

Cheap Oil Bails Out Free-Spending U.K. Consumers (Bloomberg)

By one measure, British household savings is at its lowest level in 50 years. So what happens if interest rates or commodity prices rise?

European stocks slump as earnings take a toll (Market Watch)

European stocks slump as earnings take a toll (Market Watch)

Stocks across Europe fell Wednesday, as investors assessed corporate earnings while keeping in mind the U.S. Federal Reserve policy statement due later in the day.

The Stoxx Europe 600 fell 0.8% to 336.38 after edging into positive territory earlier in the session. Only the telecommunications and defensive utility sectors posted gains.

Fed seen keeping interest rates steady amid market volatility (Yahoo! Finance)

Fed seen keeping interest rates steady amid market volatility (Yahoo! Finance)

The Federal Reserve is expected to leave interest rates unchanged on Wednesday and acknowledge that turmoil in financial markets threatens its upbeat view of the U.S. economy, leaving the chances of a March hike diminished but alive. All 69 analysts in a Reuters poll see the central bank keeping its key overnight lending rate in a range of 0.25 percent to 0.50 percent when it issues its policy statement following a two-day meeting. A month-long plunge in U.S. and world equities has raised concerns that an abrupt global slowdown could act as a drag on the U.S. economy, with investors now betting on only one quarter-point rate hike in 2016 instead of the four signaled in Fed policymakers' economic forecasts last month.

You could shut down all the steel plants in Western Europe and prices still wouldn't return to normal (Business Insider)

You could shut down all the steel plants in Western Europe and prices still wouldn't return to normal (Business Insider)

Of all the hard commodities, steel has suffered one of the worst rides of the crash.

It has nearly halved in price over the past couple of years, leading to thousands of job losses at steel plants in the UK and elsewhere.

Steel consumption has collapsed as economic growth in China, one of the biggest buyers, has slowed.

World's Best-Performing Currency May Be Set for Pullback: Chart (Bloomberg)

The Mozambican metical’s turnaround from being one of Africa’s biggest losers last year to the best performer globally so far in 2016 probably won’t last.

Global Stocks Lower Ahead of U.S. Interest Rate Decision (Wall Street Journal)

Global stocks followed oil prices lower on Wednesday, while investors wait for the Federal Reserve’s first monetary policy decision of the year.

Though no change to interest rates is expected, the U.S. central bank’s policy statement will be closely parsed later in the day to see if recent concerns around China’s economyand falling oil prices have affected its assessment of the U.S. economy.

The world's largest chemical producer is expecting its balance sheet to crumble on low oil prices (Business Insider)

The world's largest chemical producer is expecting its balance sheet to crumble on low oil prices (Business Insider)

The world's largest chemical company BASF warned investors that it expects to book a €600 million impairment charge because of cripplingly low oil prices.

The German chemical giant said in its preliminary 2015 statement that “prices for oil and gas will remain at a low level in 2016. The assumptions for oil and gas prices have also been reduced for subsequent years."

Stocks, dollar struggle ahead of Fed as oil falters (Yahoo! Finance)

Stocks, dollar struggle ahead of Fed as oil falters (Yahoo! Finance)

European stocks succumbed to another slide in oil prices on Wednesday as markets waited cautiously to see what the Federal Reserve's reaction will be to what has been a brutal start to the year for world markets. There was still some grogginess after gadget giant Apple (AAPL.O) forecast its first revenue drop in 13 years on Tuesday, but the main pressure was once again from oil which sank back towards $30 a barrel following its latest attempt at a bounce. Bond markets were firmly focused on the Fed's post-meeting statement, due at 1900 GMT.

Here’s one top investor’s odds of a market meltdown (Market Watch)

Investors often are psychologically scarred by the financial traumas they’ve lived through. So it’s not without reason that the global markets’ gyrations of the past few weeks should trigger a fear of another 2008-like financial crisis.

Toyota Stays Top-Selling Carmaker for Fourth Year as VW Retreats (Bloomberg)

Toyota Motor Corp. stayed the worlds top-selling automaker for the fourth straight year and only company to deliver more than 10 million vehicles as Volkswagen AG fell back amid its emissions scandal.

U.S. shale firms, struggling to profit with $30 oil, slash spending more (Business Insider)

U.S. shale firms, struggling to profit with $30 oil, slash spending more (Business Insider)

Three major U.S. shale oil companies have slashed their 2016 capital spending plans more than expected in a bid to survive $30 a barrel oil prices, with one of them saying prices would need to rise more than 20 percent just to turn a profit.

The cuts on Monday from Hess Corp, Continental Resources and Noble Energy ranged from 40 percent to 66 percent. This marks the second straight year of pullbacks by a trio of companies normally seen as among the most resilient shale oil producers.

This market indicator is flashing a warning sign about U.S. growth (Market Watch)

A series of stock-market selloffs amid a rout in commodity prices and concerns over China’s economic slowdown have recently fueled demand for haven investments, like U.S. Treasurys.

Emerging Stocks to Currencies Gain Before Fed Concludes Review (Bloomberg)

Emerging-market stocks rose before the Federal Reserve concludes its first policy meeting of the year and amid speculation its Japanese and European counterparts will bolster their record stimulus.

Precious Metals Glitter as Haven in Rubble of Resources: Chart (Bloomberg)

As oils slump prolongs the worst resources rout since the 2008 financial crisis, the allure of precious metals is at least giving some commodity investors a return on their money.

The Market's Troubling Message (Bloomberg View)

Amid one of the worst market routs on record, a chorus of reassuring economic commentators insists that global fundamentals are sound and investors are overreacting, behaving like a panicked herd. Don’t be so sure.

Consider how wrong economists have been about the effects of the 2008 financial debacle. In April 2010, the International Monetary Fund declared the crisis over and projected annualized global growth of 4.6 percent by 2015. By April 2015, the forecast had declined to 3.4 percent. When the weak last quarter’s results are released, the reality will probably be 3 percent or less.

Politics

Is Bernie Sanders Really Naive About Iran? (The Atlantic)

Is Bernie Sanders Really Naive About Iran? (The Atlantic)

In the final days before she and Bernie Sanders face the voters of Iowa, Hillary Clinton is leveling the same attack she leveled against Barack Obama. She’s saying that on foreign policy, she’s the only adult in the race.

In their January 17 debate, Sanders declared that, “What we’ve got to do is move as aggressively as we can to normalize relations with Iran. … Can I tell you that we should open an embassy in Tehran tomorrow? No, I don’t think we should. But I think the goal has got to be, as we’ve done with Cuba, to move in warm relations with a very powerful and important country in this world.”

This French Philosopher Is The Only One Who Can Explain Why Trump Is Skipping The Republican Debate (Think Progress)

This French Philosopher Is The Only One Who Can Explain Why Trump Is Skipping The Republican Debate (Think Progress)

Donald Trump announced Tuesday evening that he would skip the next Presidential debate, which will take place January 28 on Fox News.

It is a move, much like his campaign, that defies traditional political analysis.

Technology

A New Sensor Turns Old Microscopes Into Super-Resolution Devices (Gizmodo)

A New Sensor Turns Old Microscopes Into Super-Resolution Devices (Gizmodo)

‘Image enhance’ just got a little more real, for microscopes at least. A team of researchers form UCLA have developed a new sensor and software that turns an optical microscope into a super-resolution imaging device.

This smart padlock unlocks using just your fingerprint, what could go wrong? (The Verge)

This smart padlock unlocks using just your fingerprint, what could go wrong? (The Verge)

If you use a padlock on a regular basis — at the gym or locking up your bike — then you'll know the annoyance of misplacing your key or forgetting your combination. (It's stupid but it happens.) Canadian tech firm Pishon Lab wants to solve this by kitting out padlocks with a security measure that's become almost essential on smartphones: the fingerprint sensor. The company has launched an Indiegogo crowdfunding campaign for its fingerprint-secured TappLock padlock, which Pishon claims is "the ultimate in security and convenience."

Health and Life Sciences

Why the Calorie Is Broken (Gizmodo)

Why the Calorie Is Broken (Gizmodo)

Calories consumed minus calories burned: it’s the simple formula for weight loss or gain. But dieters often find that it doesn’t work. The calorie is broken—and this is why.

“For me, a calorie is a unit of measurement that’s a real pain in the rear.”

Free Nicotine Patches by Mail May Help Smokers Quit (Medicine Net Daily)

Helping smokers quit may be as easy as mailing them free nicotine-replacement patches, even in the absence of counseling or other support, a new Canadian study shows.

The finding didn't surprise one expert in lung health, Dr. Len Horovitz.

Life on the Home Planet

Do Workers Slack Off More When the Economy's Better? (The Atlantic)

There’s something that nearly every manager worries about and no employee can honestly deny doing at least a little bit: not working at work.

Smugglers are using Thailand's 'child dolls' as drug mules (Mashable)

Smugglers are using Thailand's 'child dolls' as drug mules (Mashable)

Airlines will no longer be able to sell tickets for passengers' child dolls after authorities discovered one was used to carry drugs.

Police in Chiang Mai, Thailand, found 200 methamphetamine "speed" pills stuffed inside a child doll on Tuesday. The doll was discovered in a bag left at the airport carpark, and the owner has not yet been traced.

Chinese musician plays the guitar while undergoing brain surgery (Mashable)

Chinese musician plays the guitar while undergoing brain surgery (Mashable)

A musician from China lay on the operating table while strumming on his guitar, as doctors performed brain surgery on him on Tuesday.

The 57-year-old musician, identified by the Chinese press [link in Chinese] as Mr. Li, was suffering from a rare neurological condition called musician's dystonia. The disease causes muscle stiffness in sufferers, who gradually find themselves less able to play their instruments like they used to.