Financial Markets and Economy

Better Iran-Saudi Arabia ties would help oil prices – RIA (Business Insider)

Better Iran-Saudi Arabia ties would help oil prices – RIA (Business Insider)

Russia wants to see improved relations between Iran and Saudi Arabia at a time when joint action is needed to influence global oil prices, the RIA news agency on Monday quoted Zamir Kabulov, a senior official at Russia's Foreign Ministry, as saying.

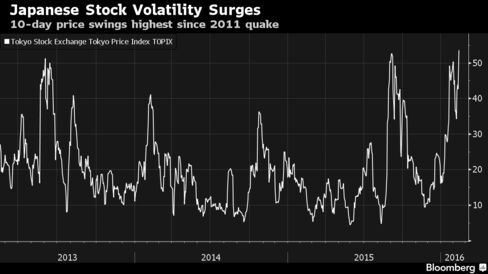

Japanese Stock Price Swings Are Wildest Since 2011 Quake: Chart (Bloomberg)

Stomach-churning moves in Japanese stocks have sent a gauge of volatility to the highest level since the March 2011 earthquake. The Topix index jumped as much as 5.5 percent in early Monday trading after falling more than 5 percent on two days last week.

Dividends, Wall Street’s Battered Status Symbol (NY Times)

Coca-Cola pays steady dividends. It has done so since 1920. In fact, it has increased dividends in each of the last 50 years.

“Investors look at that record, and they count on it,” said Douglas J. Skinner, an accounting professor at the University of Chicago. “After a while, the dividend becomes sacrosanct.”

Are too many choices costing 401(k) holders? (Market Watch)

Are too many choices costing 401(k) holders? (Market Watch)

In investing, choice usually is a good thing. But new research suggests that having too many choices in a 401(k) retirement plan could be costly for participants.

Researchers studied a 401(k)-type plan that reduced the number of mutual funds it offered by close to half. They found that investors who were forced to shift their money out of the funds being eliminated from the plan tended to move into funds with lower fees — even though the funds available after the plan was streamlined had almost exactly the same range of fees as the menu of funds before the choices were reduced.

AIG's Next Big Mistake (Bloomberg)

American International Group essentially just made a multibillion-dollar decision to sell low and buy high.

China shares resume with losses, yuan fixed at month-high (Business Insider)

China shares resume with losses, yuan fixed at month-high (Business Insider)

Chinese shares started lower on Monday as trading resumed after the long Lunar Holiday break and investors caught up with wild swings in global markets, while Beijing took another swipe at devaluation talk with a strong fix for the local currency.

The Shanghai Composite Index eased 2.6 percent in early trade in its first session since Feb. 5, while the CSI300 index of the largest listed companies in Shanghai and Shenzhen lost 2.4 percent.

Nuclear Fuel Storage in South Australia Seen as Economic Boon (Bloomberg)

The storage and disposal of nuclear waste in South Australia would probably deliver significant economic benefits to the state, generating more than A$5 billion ($3.6 billion) a year in revenue, according to the preliminary findings by a royal commission.

As Stocks Gyrate, It’s Time to Measure Your Risk Tolerance (NY Times)

It’s time you got to know yourself a little better.

China’s central bank sharply strengthens yuan (Market Watch)

China’s central bank sharply strengthens yuan (Market Watch)

China’s currency hit its strongest level this year after the central bank guided it sharply up Monday against a tide of stumbling global financial markets.

After opening stronger against the U.S. dollar, the yuan traded as much as 1.2% higher than the previous close, the largest such move since 2005. The yuan strengthened to 6.4988 against the U.S. dollar and last traded at 6.5014 against the U.S. dollar.

There has been brutal culling of Wall Street traders (Business Insider)

Wall Street is not what it once was.

Three Essential Ingredients Of Effective Trading Processes (Trader Feed)

Three Essential Ingredients Of Effective Trading Processes (Trader Feed)

As the quote from Peter Drucker suggests, efficiency is of limited value if we're not effective. We not only need to do things right, but ensure that we're doing the right things.

What goes into successful trading processes? Here are three hallmarks of effectiveness that I've observed across a variety of professional traders.

Oil Speculators Shrug Off Huge Stockpiles to Bet on Price Climb (Bloomberg)

Oil stockpiles at an 86-year high and warnings of a persistent glut werent enough to keep money managers from betting that prices are ready for a rebound.

Comparing Conoco Phillips with MLPs (SL Advisors)

Around ten days ago Conoco Phillips (COP) and Magellan Midstream (MMP) both released their 4Q15 earnings, and held conference calls on February 4th to discuss them. This coincidence of reporting is about all they have in common, but it caused us to look a bit more closely at an energy company (COP) that truly has commodity price exposure and what it’s doing about it.

European Stocks Rally Following Rebound in Japan (Wall Street Journal)

Stocks in Europe and Japan rallied Monday as investors bought recently battered banking and auto shares.

The Stoxx Europe 600 was up 2.7% in early trade, boosted by a strong finish on Wall Street on Friday.

Japan economy shrinks more than expected, adds to fears of global slowdown (Business Insider)

Japan economy shrinks more than expected, adds to fears of global slowdown (Business Insider)

Japan's economy contracted an annualized 1.4 percent in the final quarter of last year as consumer spending slumped, adding to headaches for policymakers already wary of damage the financial market rout could inflict on a fragile recovery.

The data underscores the challenges premier Shinzo Abe faces in dragging the economy out of stagnation, as exports to emerging markets fail to gain enough momentum to make up for soft domestic demand.

Dollar Fragile to China Return as Hedge Funds Sour on Greenback (Bloomberg)

The dollar rose against the euro and yen after China boosted the yuan following a week-long holiday, helping ease global financial turmoil that had spurred investors to bet the Federal Reserve will delay raising U.S. interest rates.

Weighing the Week Ahead: What are the Biggest Market Worries? (Dash of Insight)

In my last WTWA I predicted that everyone would be talking about the high and rising worry about a recession. That was one of the most frequent media topics for the week, with some sources even choosing “looming” as part of the description. Fed Chair Yellen grabbed the spotlight for her testimony, but even that centered on economic concerns and what the Fed might do.

If we have a U.S. recession this year, it will be a risk-based recession (Marginal Revolution)

U.S. consumers showed signs of strength in January, taking advantage of low oil prices to increase their spending and offering a welcome counterpoint to the gloom that has gripped investors and roiled markets since the start of the year.

Gold drops $30 as investor appetite for riskier assets grows (Market Watch)

Gold drops $30 as investor appetite for riskier assets grows (Market Watch)

Gold futures dropped sharply on Monday on signs of growing appetite for riskier assets as Japanese stocks surged 7%.

April gold fell $30, or 2.4%, to $1,209.40 an ounce. On Friday, gold finished down $8.40, or 0.7%, at $1,239.40 an ounce, but logged its best weekly gain since Dec. 12, 2008, rising 7.1%, according to FactSet data.

What Investors Should Ask Themselves (Bloomberg View)

What Investors Should Ask Themselves (Bloomberg View)

I love this question, but in a very counterintuitive, non-obvious way. It is the logical follow up to yesterday’s post on forecasting.

Almost 100 people responded to Cowen with answers like the Standard & Poor's 500 Index, commodities, the euro-dollar exchange rate, Google, Apple, milk, local real estate prices, the MSCI World Total Return Index, copper and more.

Tech Stocks Are Bruised But Not Cheap (Bloomberg)

You may have heard technology stocks have had an ugly startto the year. But while they're battered, they still aren’t cheap.

Politics

The Pragmatic Case for Bernie Sanders (The Atlantic)

The Pragmatic Case for Bernie Sanders (The Atlantic)

As Bernie Sanders defies expectations with a resounding New Hampshire victory and a virtual tie in Iowa, Democratic Party leaders still insist Hillary Clinton is the pragmatic choice to beat Republicans and bring effective leadership and change—if incremental—to Washington. Clinton and her supporters frame the race, and her appeal, as a matter of “ready on day one” leadership and “get things done” practicality. But what does the record show, and what do leadership and pragmatism really mean?

The Two Republican Debates (Bloomberg View)

The Two Republican Debates (Bloomberg View)

There were two Republican debates on Saturday night, just as there are two Republican nomination battles right now.

One of them is the reality TV show, starring Donald Trump.

Technology

What Would the World Look Like If Half of All Jobs Were Held by Robots? (Gizmodo)

What Would the World Look Like If Half of All Jobs Were Held by Robots? (Gizmodo)

Numerous intelligent people have now claimed that within the next few decades, robots will automate half of all existing jobs. Whether or not that will pan out—or whether you’re in the luckless 50 percent— will only be determined by time. But either way, what would that world look like?

Health and Life Sciences

Mental health care 'fails most people' (BBC)

Mental health care 'fails most people' (BBC)

Inadequate and underfunded mental health care in England is leading to thousands of "tragic and unnecessary deaths" a review has found.

The report – by a taskforce set up by NHS England – said around three-quarters of people with mental health problems received no help at all.

Life on the Home Planet

An Iceberg Collision Is Responsible For The Near Destruction Of A Penguin Colony (Gizmodo)

An Iceberg Collision Is Responsible For The Near Destruction Of A Penguin Colony (Gizmodo)

The population of a colony of Adélie penguins located in Commonwealth Bay, Antarctica has steeply fallen following the arrival of a massive iceberg, which has dramatically changed the local conditions favorable to the birds.

Will there be more fish or plastic in the sea in 2050? (BBC)

Will there be more fish or plastic in the sea in 2050? (BBC)

A recent claim that there will be more plastic than fish in the sea by 2050 was intended to highlight a pollution crisis in the oceans. The problem really does exist, but do the figures hold water, or is there something fishy going on?

The prediction was made by the Ellen MacArthur Foundation and the World Economic Forum, in a report called The New Plastics Economy, which looks at the amount of plastic that ends up in the sea.