Financial Markets and Economy

The Never-Ending Story: Europe’s Banks Face a Frightening Future (Bloomberg)

If you had to pick the moment when European banking reached the point of no return, which would you choose? The July day in 2012 when Bob Diamond resigned as Barclays’s chief executive officer amid the Libor rigging scandal? Or the fall morning later that year when UBS announced it was pulling out of fixed income and firing 10,000 employees? How about Sept. 12, 2010, when Basel III’s raft of costly capital requirements started upending the economics of global finance?

Global Stock Rally Starts to Fade (Wall Street Journal)

A rally in global stocks showed signs of fading Tuesday amid sharp swings in oil prices and a fresh slide in banking shares.

Stocks in Europe edged lower, despite a strong finish in Asian trade, while U.S. stock futures pared gains after Saudi Arabia, Russia, Qatar and Venezuela said they wouldn’t increase crude-oil output above January’s levels.

The company that found oil at Gatwick just pumped 'significant' amounts for the first time (Business Insider)

UK Oil and Gas Investments (UKOG), the small company which last year made one of the biggest onshore oil discoveries in British history, has finally struck oil, and its shares are going absolutely wild.

Anglo American Posts $5.6 Billion Loss for 2015 as Metals Plunge (Bloomberg)

Anglo American Plc is speeding up plans to pull out of coal and iron ore after losses bled into a fourth year and the company became the first major London-based miner to be rated junk.

Sell gold now as recent rally isn’t justified, says Goldman Sachs (Market Watch)

Gold prices have had a stellar run recently, but don’t get too excited about the outlook for the metal, according to analysts at Goldman Sachs.

Another Reason to Worry About Banks (Bloomberg View)

For investors seeking reasons to worry about banks, here's another: They’ve lent a lot of money in currencies that borrowers will have a hard time paying back.

High risk of bankruptcy for one-third of oil firms: Deloitte (Business Insider)

High risk of bankruptcy for one-third of oil firms: Deloitte (Business Insider)

Roughly a third of oil producers are at high risk of slipping into bankruptcy this year as low commodity prices crimp their access to cash and ability to cut debt, according to a study by Deloitte, the auditing and consulting firm.

ADT agrees to be bought by Apollo Global Management in a $6.93 billion deal (Market Watch)

ADT agrees to be bought by Apollo Global Management in a $6.93 billion deal (Market Watch)

ADT Corp. has agreed to be acquired by private-equity firm Apollo Global Management LLC in a deal that values the home-security company at about $6.93 billion, the latest sign market volatility hasn’t brought takeover activity to a halt.

Brazil's Retail Sales Fall More Than Forecast in December (Bloomberg)

Brazils retail sales fell more than forecast in December as a prolonged recession continues to eat into Brazilians purchasing power.

Secret Saudi-Russia oil meeting ends: production freeze, but no cut (Business Insider)

Saudi Arabia, Russia, Qatar, and Venezuela, have agreed to freeze oil production at the level of supply produced in January, dashing oil bulls' hopes of a cut that would have increased prices.

Treasuries Recover Loss as Oil Deal Seen Lacking `Shock and Awe' (Bloomberg)

Treasuries recovered as oil pared an advance and European stocks fell on the Saudi-Russian output deal.

Dow futures rally almost 200 points as investors warm to risk (Market Watch)

U.S. stock futures leaped higher on Tuesday as a recovery for global stock markets continued, partly fueled by a stabilization in oil prices and hopes that central banks will launch more easing.

Global investment banks' earnings may decline in 2016: JP Morgan (Business Insider)

Global investment banks' earnings may decline in 2016: JP Morgan (Business Insider)

Global investment banks' earnings may decline this year, given a challenging credit trading environment and low level of deal flow, said JP Morgan Securities analysts, who cut their 2016 earnings estimate for investment banks by an average 20 percent.

S&P 500 Futures Signal More Gains for Equities as Market Reopens (Bloomberg)

U.S. stock-index futures rose, signaling equities will climb for a second day as trading resumes after a holiday.

Why fund ratings could be misleading (Market Watch)

Why fund ratings could be misleading (Market Watch)

How helpful are mutual-fund rankings from research firms such as Morningstar Inc. and S&P Global Market Intelligence? New evidence suggests that for many investors, the answer may be “not very.”

Fund guides such as Morningstar’s popular rating system of one to five stars appeal to fund buyers because they transform complicated data into an easy-to-understand metric: A five-star fund is superior to a four-star fund, which is superior to a three-star fund, and so on.

Technology stocks selloff may turn IPO chill into IPO freeze (Business Insider)

Technology stocks selloff may turn IPO chill into IPO freeze (Business Insider)

This winter was supposed to be Nutanix's time to shine.

The high-tech computing and storage company filed for a hotly anticipated initial public offering in December, ready to woo investors early in the New Year.

Spanish Bonds Lead Drop in Euro Area as Qatar Oil Talks End (Bloomberg)

Spain’s bonds fell for the first time in three days as talks on crude output between Saudi Arabia and Russia failed to reassure investors on the outlook for global growth, sparking a selloff in higher-yielding assets.

Dollar edges back from ¥114 (Market Watch)

Dollar edges back from ¥114 (Market Watch)

The U.S. dollar stepped down slightly against the yen Tuesday following a recent run of safe-haven strength for Japan’s currency.

The U.S. dollar dipped to ¥113.78 after reaching as high as ¥114.87 earlier Tuesday. The dollar late Monday fetched ¥114.58.

GE explores oil and gas business in Iran with top executive visit (Business Insider)

GE explores oil and gas business in Iran with top executive visit (Business Insider)

General Electric Co is exploring potential business opportunities in Iran and the chief executive of its oil and gas division visited the country recently, a company spokeswoman said.

The visit by Lorenzo Simonelli, CEO of GE Oil & Gas, comes at a time when Iran is aiming to boost its crude oil exports and recover the oil market share it lost as a result of international sanctions imposed over its nuclear program.

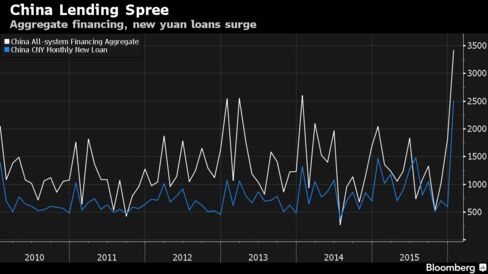

China Turns on Taps and Loosens Screws in Bid to Support Growth (Bloomberg)

China is stepping up support for the economy by ramping up spending and considering new measures to boost bank lending.

The weekend is over and stocks are surging (Business Insider)

The weekend* is over and stock futures in the US are higher.

Politics

George W. Bush Is a Mixed Blessing for Jeb (Bloomberg View)

George W. Bush Is a Mixed Blessing for Jeb (Bloomberg View)

Jeb Bush has had a brother problem from the start of his campaign. Asked about the 43rd president, George W. Bush, Jeb has always hemmed and hawed. He said, “I love my brother … but I’m my own man.” He noted that information on weapons of mass destruction from the intelligence community turned out “not to be accurate” and riffed that “there were mistakes made in Iraq, for sure.” Hesaid that looking back, “anybody would have made different decisions.”

Trump Is a Sinner Among Saints in South Carolina (The Atlantic)

There’s good news and there’s bad news for GOP front-runner Donald Trump as he wades into the treacherous South Carolina Republican presidential-primary waters this week. The good news is his opposition is splintered. The bad news is evangelical leaders don’t trust the stiffness of his moral compass.

Technology

Optical Data Storage Squeezes 360TB on to a Quartz Disc—Forever (Gizmodo)

Optical Data Storage Squeezes 360TB on to a Quartz Disc—Forever (Gizmodo)

Want to make sure you back something up indefinitely? Then you could do worse than a digital data storage technique that uses laser light to store 360 terabytes of information on nanostructured quartz for up to 14 billion years.

Health and Life Sciences

Organic Meat and Milk Higher in Healthful Fatty Acids (NY Times)

Organic Meat and Milk Higher in Healthful Fatty Acids (NY Times)

Organic meat and milk differ markedly from their conventionally produced counterparts in measures of certain nutrients, a review of scientific studies reported on Tuesday.

In particular, levels of omega-3 fatty acids, beneficial for lowering the risk of heart disease, were 50 percent higher in the organic versions.

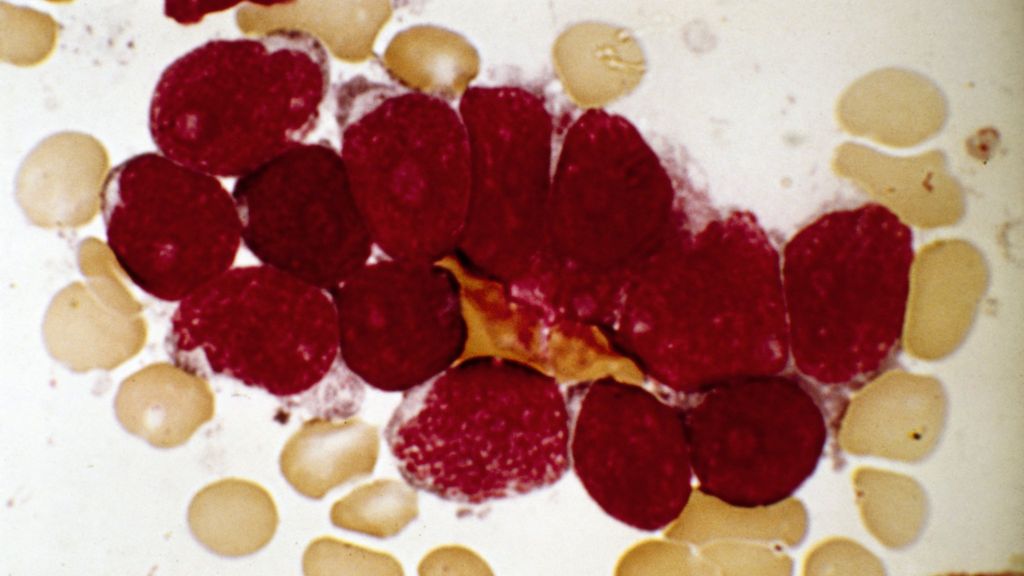

Forever young—how stem cells resist change (Phys)

Forever young—how stem cells resist change (Phys)

This 'before and after' image could be thought of as stem cells' equivalent of an advert for anti-wrinkle cream: 'look how cells stay young!' It shows that a molecule called microRNA-142 allows stem cells to remain unchanged, instead of growing into specialised cell types. Given the right conditions, stem cells with low levels of microRNA-142 (green, left) grow into neurons (pink, right). But stem cells with high levels of the molecule (red, left) remain unchanged (blue, right), scientists at EMBL in Heidelberg, Germany, have found.

Excitement at new cancer treatment (BBC)

Excitement at new cancer treatment (BBC)

A therapy that retrains the body's immune system to fight cancer has provoked excitement after more than 90% of terminally ill patients reportedly went into remission.

White blood cells were taken from patients with leukaemia, modified in the lab and then put back.

But the data has not been published or reviewed and two patients are said to have died from an extreme immune response.

Life on the Home Planet

Is Urban Farming Only for Rich Hipsters? (PSFK)

Is Urban Farming Only for Rich Hipsters? (PSFK)

Spending on ethical food and drink products – including organic, Fairtrade, free range and freedom foods – hit £8.4bn in the UK in 2013, making up 8.5% of all household food sales.

By leveraging environmental credentials, such as local, sustainable and transparent production, a new wave of urban agriculture enterprises are justifying a premium price.

Turkey seeks allies' support for ground operation as Syria war nears border (Reuters)

Turkish artillery has returned fire "in kind" into Syria, military sources said on Tuesday, marking its fourth straight day of shelling across the border.

Turkey on Monday warned Kurdish militia fighters in northern Syria they would face the "harshest reaction" if they tried to capture a town near the border, and accused Russia of a missile attack there that killed at least 14 civilians.