Financial Markets and Economy

Apple Plans $12 Billion Bond Sale for Buybacks and Dividends (NY Times)

Apple Plans $12 Billion Bond Sale for Buybacks and Dividends (NY Times)

Apple announced plans on Tuesday to sell up to $12 billion in bonds to pay for share buybacks and dividends, as blue-chip companies test investors’ appetite for debt after two weeks of turbulent markets.

Jack in the Box is getting smashed after earnings disappoint (Business Insider)

Shares of fast food chain Jack in the Box are getting smashed after the company posted lower than expected earnings Wednesday afternoon.

Asian Futures Signal Stock Rally to Continue While Bonds Retreat (Bloomberg)

Asian stocks joined the global recovery as crude oil’s return to levels last seen at the start of February burnished sentiment, dimming the appeal of haven investments.

Investors Brace for a Financial Crisis Repeat (Wall Street Journal)

Heavyweight investors and economists have this week postulated that a recent selloff in global stock and bond markets may have been overdone.

But there are still plenty of individuals out there who have yet to see the light at the end of the tunnel.

It’s About Time: Smart Money Finally Nibbling at Pipeline MLPs (Charles Sizemore)

Midstream oil and gas pipeline MLPs have been just about the most despised asset class in recent memory. Yes they just got a major shot in the arm from two legendary investors, Warren Buffett and David Tepper.

The Disruptive Duo: Amazon and Netflix! (Musings on Markets)

Amazon and Netflix! Need I say more? Just the mention of those companies cleaves market participants into opposing camps. In one camp are those who believe that those who invest in these companies are out of their minds and that there is no way that you can justify buying these companies, perhaps at any price. In the other are those who argue that the old time value investors don't get it, that these companies are redefining old businesses and will emerge as winners, thus justifying their high prices.

The Fed is worried about risks to the economy (Business Insider)

Minutes of the Federal Reserve's January meeting showed that the policy-setting committee saw more downside risks for the US economy.

The Federal Open Market Committee (FOMC) acknowledged that the labor market had strengthened since its December meeting, even as economic growth slowed in the fourth quarter.

Here’s why speculation that China is mass-selling U.S. Treasurys could be true (Market Watch)

Speculation that China has been mass-selling U.S. Treasurys to boost its foreign-exchange reserves grew again Wednesday, after a report showed that Belgium’s Treasury holdings — viewed as a proxy for China’s holdings — declined sharply.

Gulf of Guinea Sees Piracy Drop as Oil Price Deters Looters (Bloomberg)

Piracy in West Africa’s Gulf of Guinea has declined as the price of oil plunged to the lowest level since 2002.

Gold: Hedging for WHAT, Exactly? (Charles Sizemore)

Gold: Hedging for WHAT, Exactly? (Charles Sizemore)

After looking dull for years, gold is finally sparkling again. With the market in convulsions and Fed Chair Janet Yellen broaching the possibility of negative interest rates, the yellow metal is up about 17% in 2016.

Are We Doomed to Slow Growth? (NY Times)

One day in 1980, when I was 10, I sat in my great-grandmother’s living room and poured out questions about what life was like for her as a girl in Belarus. At 90, she was still sharp and could answer my questions. But she didn’t betray any of the emotion I hoped for.

The markets are freaking out about a 'dangerous experiment' (Business Insider)

Negative interest rates, which have been implemented around the world in a bid to catalyze economic growth, are doing more harm than good.

They are a "dangerous experiment" for banks, according to Morgan Stanley analysts, who said they incentivize banks to shrink, erode profits and discourage cross-border lending.

The Stock Market Is Not the Economy (Strategy+Business)

After having run up about 180 percent between March 2009 and the middle of last year, the S&P 500 is off about 10 percent. The declines have been damaging to portfolios, to the egos of chief executives, to the bonuses of bankers, and to the confidence of many. And the incipient bear market has people fretting about the prospect of recession.

Are Low Interest Rates Driven by the Fed or by Fear? (CF Institute)

Are Low Interest Rates Driven by the Fed or by Fear? (CF Institute)

In the current environment of low real interest rates, investors are being forced to reach for yield. These investors are not happy, and many are looking to the US Federal Reserve to raise interest rates because Fed policy has pushed rates below their “fair” market value.

Why Is It So Hard To Believe That I Don’t Care About the Price of Gold? (Alpha Trends)

I am a trader. I trade individual stocks based in the United States and exchange traded funds of US equity indexes. I have traded US equities since 1991, it is my area of interest and expertise. That is what works for me. I have never told anyone else what they should be interested in or what they should trade, it is simply none of my business.

Build Your Own Benchmark (Morning Star)

How do you track your progress toward your financial goals? How do you assess your abilities as the manager of your personal portfolio? How do you measure the value of a trusted advisor? Do you have a benchmark? If your answer is no, then you may want to consider building one.

Short-Term Rebounds Along Downtrends Are Common (Price Action Lab)

The S&P 500 gained 3.63% in the last two trading sessions. About 75% of back-to-back gains of more than 3.62% have occurred along downtrends. Therefore, a case for a bottom cannot be based solely on performance.

The Big Long: Making a Killing in Market Everyone Left for Dead (Bloomberg)

First came the big short. Then, for Milan Patel, came the big long.

With the financial crisis raging in January 2009, Patel and a handful of colleagues hit upon the trade of their life: They would put up their own money to buy the complex securities that everyone else was dumping.

Politics

Rubio's Winning Endorsements, If Not Votes (Bloomberg View)

Governor Nikki Haley is set to endorse Marco Rubio, joining Senator Tim Scott and Representative Trey Gowdy as the Big Three of South Carolina conservative Republicans in his corner.

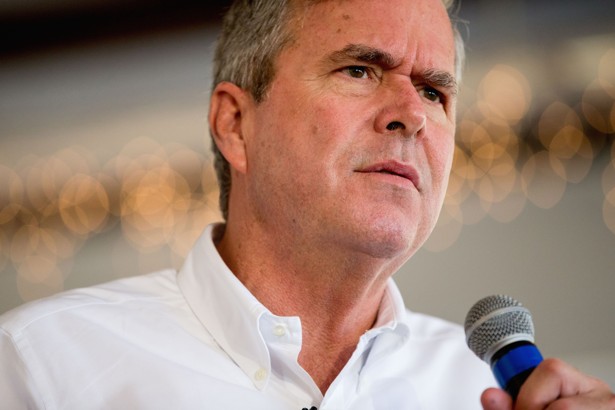

Jeb Bush Could Really Use a Hug Right Now (The Atlantic)

Jeb Bush Could Really Use a Hug Right Now (The Atlantic)

Ahead of the South Carolina Republican primary, Governor Nikki Haley will endorse Florida Senator Marco Rubio for president. Apple’s CEO Tim Cook said the company will fight an order to unlock an iPhone that belonged to one of the San Bernardino attackers. Secretary of State John Kerry is initiating a “serious conversation” with China over the militarization of the South China Sea. Several UN aid convoys have arrived in some of the most devastated regions of Syria, and the pope is attending mass on the border between Mexico and the U.S.

Technology

This Super-Futuristic Skyscraper for Brooklyn Will Probably Never Get Built (Gizmodo)

This Super-Futuristic Skyscraper for Brooklyn Will Probably Never Get Built (Gizmodo)

An awesome-looking 73-story tower planned for downtown Brooklyn could add hundreds of apartments to a city that desperately needs more housing. Too bad the proposal will likely be denied.

Super-smart AI epically fails 8th grade science test (The Next Web)

Super-smart AI epically fails 8th grade science test (The Next Web)

For every person who is afraid that robots are suddenly going to become sentient and we’ll have to fight a liquid robot sent from the future to kill us and our moms, this story will give you hope that we still stand a chance. MIT Tech Review reports that the Allen Institute for Artificial Intelligence held a global contest to see whether modern AI could go beyond “superficial intelligence” — i.e. recognizing a photo of a dog or completing repeating tasks like playing endless games of chess.

Health and Life Sciences

A Vaccine That Makes Your Body Destroy Opioids (Popular Science)

A Vaccine That Makes Your Body Destroy Opioids (Popular Science)

Overdoses from opioids like painkillers might become a thing of the pas–a vaccine to combat drug overdose is on the horizon.

The U.S. is currently embroiled in an opioid epidemic—the drugs were involved in 28,647 deaths in 2014, up 200 percent from the year 2000. And while researchers have developed painkillers that are harder to abuse and medications that reduce the effects of opioids once a person has overdosed, there is currently nothing on the market to stop opioids’ effects altogether. Now a team of researchers is hoping to change that.

Foods High in Cholesterol Don’t Raise Heart Risks (NY Times)

A new study provides more evidence that eating high-cholesterol food does not increase the risk for heart disease.

Life on the Home Planet

Record January Heat Is First Sign Of Another Hot Year (The Huffington Post)

Record January Heat Is First Sign Of Another Hot Year (The Huffington Post)

NASA's announcement that last month was hottest January ever recorded foreshadows some sizzling months ahead and sets a pace for 2016 that may rival 2015 for the title ofhottest year on record.

January was 1.13 degrees Celsius warmer than the world's average for the month from 1951 to 1980, NASA's Goddard Institute for Space Studies revealed on Tuesday.

Which Species Will Survive Climate Change? (Scientific American)

Which Species Will Survive Climate Change? (Scientific American)

It’s mid-February and along Britain’s south coast gilt-head bream are drifting from the open sea into the estuaries. Meanwhile, thousands of little egrets are preparing to fly to continental Europe for breeding season, though a few hundred will remain in the UK.