Financial Markets and Economy

Goldman Sachs to Turn Its Hedge Fund Research Into an ETF (Bloomberg)

Is Wall Street research the next frontier for ETFs?

China’s Foreign Exchange Reserves Dwindling Rapidly (NY Times)

As markets around the world have churned, China has long taken comfort in having what in the financial world amounts to a life preserver: its vast holdings of other countries’ money.

Core inflation rises by the most in four years (Business Insider)

Core inflation rises by the most in four years (Business Insider)

Core inflation rose by the most in four years in January, by 0.3%.

"Core" inflation excludes the volatile costs of food and energy.

‘Bearish engulfing’ pattern vies for financial-sector sway with bullish ‘abandoned baby’ (Market Watch)

A “bearish engulfing” reversal pattern appeared in the exchange-traded fund tracking financial stocks, to warn of a deeper selloff, less than a week after a bullish “abandoned baby” pattern suggested a bottom may be in place.

Investors Clamor for Energy-Share Offerings—Energy Journal (Wall Street Journal)

Investors Clamor for Energy-Share Offerings—Energy Journal (Wall Street Journal)

Investors buying new shares issued by energy companies are acting like they have detected a bottom in the market even though oil prices remain at low levels, Ryan Dezember and Corrie Driebusch report. North American oil-and-gas producers have sold more than $5 billion of new shares so far this year, in part to reduce debt and shore up their balance sheets. Devon Energy Corp. boosted the size of its Wednesday offering by 25%, to more than $1.2 billion, to meet investor interest.

Commodities' $3.6 Trillion Black Hole (Bloomberg)

Markets rallied this week after it became clear that some of the world's biggest oil producers were going to curb production to stop prices from dropping any further. The news also buoyed other commodities, from coal to iron ore. Then everything dropped on Thursday with oil.

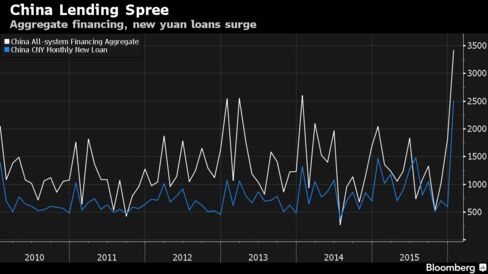

PBOC to Raise Reserve Ratios for Banks That Don't Meet Criteria (Bloomberg)

China’s central bank said some banks will be forced to lock away more reserves, a move that may contain credit growth after advances by smaller lenders jumped in January.

For the markets, 'a period of calm looks to be arriving' (Business Insider)

It's been a terrible year for financial markets, but according to Kit Juckes at Societe Generale, the worst of it might be over.

For now.

Oil Falls Near $30 as Rising U.S. Crude Stockpiles Expand Glut (Bloomberg)

Oil dropped near $30 a barrel in New York after U.S. crude stockpiles rose to the highest in more than eight decades as Saudi Arabia and Russia propose to freeze output amid a worldwide surplus.

Stock market on track for losses after inflation data (Market Watch)

U.S. stock futures pointed to losses for Wall Street on Friday, as oil prices moved lower on persistent oversupply concerns and a reading on inflation came in slightly above economists’ expectations.

OECD downgrades global growth, says world’s economy needs urgent fiscal response from governments (Financial Post)

The global economy is growing at a stubbornly weak pace and governments should be deploying fiscal tools alongside monetary policy to stoke growth, the Organisation for Economic Co-operation and Development said in its latest outlook Thursday.

A deadly combination of 2 things has wiped out $3 trillion from stocks (Business Insider)

A deadly combination of 2 things has wiped out $3 trillion from stocks (Business Insider)

Horrifically low oil prices and interest rates are a deadly combination when it comes to the markets.

In fact, Francisco Blanch and his commodities research team at Bank of America Merrill Lynch pointed out in a note Friday morning that "joint meltdown" in these two areas had wiped out $3 trillion (£2.1 trillion) in energy and financials' equity-market value.

This $9 Billion Fund Manager Says He's Sticking With Cash (Bloomberg)

Well before things went wrong for global stocks last year, one $9 billion fund manager decided it was time to play safer, and nothing he sees now convinces him to change that call.

Norway Central Bank Chief Warns on Oil Wealth as Coffers Raided (Bloomberg)

Norway’s central bank governor stepped up his warning on excessive use of the nation’s oil income as he predicted the government may need to withdraw almost $10 billion from its massive wealth fund this year.

Bear Markets Don’t Predict Recessions, But Liquidity Might (Bloomberg View)

As the world’s equities markets are buffeted by bouts of intensevolatility, analysts have started uttering a chilling phrase: bear market. China's markets have entered this territory, and the U.S.might not be too far behind.

Visualizing The World's Stock Exchanges (Zero Hedge)

There are 60 major stock exchanges throughout the world, and their range of sizes is quite surprising.

Chilling ways the global economy echoes 1930s Great Depression era (Market Watch)

Chilling ways the global economy echoes 1930s Great Depression era (Market Watch)

One view of what caused the Great Depression in the 1930s is that the Federal Reserve failed to prevent a collapse in the money supply.

This is the famous thesis of Milton Friedman’s and Anna Schwartz’s A Monetary History of the United States, 1867-1960, and it was, more or less, the view of Ben Bernanke when he was chairman of the Federal Reserve.

Politics

The Foreign Travels of Bernie Sanders (The Atlantic)

The Foreign Travels of Bernie Sanders (The Atlantic)

For decades, Bernie Sanders has traveled the world, pursuing an unconventional approach to diplomacy. American politicians often visit other countries to project influence abroad and strengthen existing alliances. Foreign travel can also be leisurely, allowing elected officials to play tourist and spend time in luxury hotels. Of course, not everyone sticks to the same script. Sanders has charted a different course, traveling abroad to dissent against his own government, and critique the way America wields power on a global stage. He has risked controversy by extending an olive branch to left-leaning governments shunned by the American political establishment.

Donald Trump’s lead in South Carolina now just 5 points (Market Watch)

Donald Trump’s lead in South Carolina now just 5 points (Market Watch)

Donald Trump’s lead in South Carolina has narrowed ahead of Saturday’s primary, as many of the party’s most conservative voters turn instead to Sen. Ted Cruz, a Wall Street Journal/NBC News/Marist poll finds.

Technology

Volvo wants your phone to be the only car key you ever need (The Verge)

Volvo wants your phone to be the only car key you ever need (The Verge)

Drivers will be able to use the app (and a Bluetooth connection) to start their car, open the trunk, mess with the security system, or — like with a key fob — simply have the car unlock as you approach it. But the biggest implications of this change could be for ride-sharing. Customers (and manufacturers) have begun entertaining new ideas about how to use cars to get around without owning them outright, and something like a digital key makes it easier for multiple people to have control over one particular vehicle. That could mean something as simple as just sharing access with your family, but Volvo will also make it work on the cars it provides to Sunfleet, a Swedish car-sharing service.

We All Need a Robot Like This to Iron Our Clothes (Gizmodo)

We All Need a Robot Like This to Iron Our Clothes (Gizmodo)

Ironing sucks, but it’s the kind of precise activity that usually stumps robots. But no longer, because a wonderful team of engineers has developed a robot that can smooth the creases right out of your most wrinkled pair of pants.

The team has published a paper on the arXiv server that describes a new robotic system to smooth cloth using a regular iron.

Health and Life Sciences

Artificial Sweeteners and Weight Gain (NY Times)

Artificial Sweeteners and Weight Gain (NY Times)

Scientists are still scratching their heads over this question.

Artificial, or nonnutritive, sweeteners have no calories and are often used as diet aids. But while some well-designed trials have found that those randomly assigned to drink artificially sweetened beverages gained less weight than those given sugar-sweetened drinks, large population studies suggest that frequent consumption of artificial sweeteners may be linked with unanticipated consequences, including weight gain.

Stroke Risk May Be Greater for Certain Migraine Sufferers: Studies (Medicine Net Daily)

Stroke Risk May Be Greater for Certain Migraine Sufferers: Studies (Medicine Net Daily)

Migraine sufferers may face an increased risk of stroke if they suffer from visual symptoms called auras or if they take the female hormone estrogen, a pair of new studies suggests.

People who have migraine headaches with auras may be 2.4 times more likely to have astroke caused by a blood clot, compared to migraine patients who don't see auras, says one study scheduled for presentation Wednesday at the American Stroke Association's annual meeting, in Los Angeles.

Life on the Home Planet

Study Investigates Proliferation of Plastic in Waterways Around New York (NY Times)

Study Investigates Proliferation of Plastic in Waterways Around New York (NY Times)

At the office of NY/NJ Baykeeper, an environmental group, Sandra Meola spread out her haul. For six months last year, she plied the bays and rivers around New York City, skimming the shimmering surface with a fine-mesh net in search of her nemesis: plastic.

New phase in polar bear breeding plan (BBC)

New phase in polar bear breeding plan (BBC)

An attempt to breed polar bears in Scotland looks set to go ahead this year.

Polar bear cubs were last born in the UK almost 25 years ago.

The Royal Zoological Society of Scotland (RZSS) has begun preparations to pair up two bears at its Highland Wildlife Park near Aviemore.