Financial Markets and Economy

Wall Street had a disastrous year (Business Insider)

The numbers are in, and it's official: Wall Street had a horrible 2015.

Poor trading results and low client activity in the second half of the year led to an overall drop in revenues for Wall Street banks.

The FTSE 100 is ignoring Brexit fears right now (Business Insider)

The FTSE 100 is popping after largely ignoring Brexit fears and recovering from trading weakness at the end of last week.

Market Calm May Be Short-Lived (Bloomberg View)

Market Calm May Be Short-Lived (Bloomberg View)

Last week, global equity investors got a much-needed reprieve from volatile, loss-inflicting markets. But rather than signaling the start of a calmer market phase, this may well prove a prelude to renewed volatility in the weeks ahead.

HSBC Posts Surprise Fourth-Quarter Pretax Loss of $858 Million (Bloomberg)

HSBC Holdings Plc, Europes largest bank, reported a surprise fourth-quarter pretax loss of $858 million.

The relationship between stocks and oil prices (Brookings)

The past decade has been a roller coaster for oil prices, one that market participants have probably not much enjoyed riding (Figure 1). The period includes much volatility and two sharp crashes. One crash, in 2008, was associated with the financial crisis and the Great Recession. The second may still be going on: Oil prices have fallen from over $100 per barrel in mid-2014 to around $30 per barrel recently.

Global Stocks Gain on Rising Commodities Prices, China (Wall Street Journal)

Global Stocks Gain on Rising Commodities Prices, China (Wall Street Journal)

Global stocks rekindled their rally on Monday, spurred by rising commodities prices and upbeat news from China.

The Stoxx Europe 600 was up 1.4% halfway through the session, following a strong finish in Asia. Futures pointed to a 1.2% opening gain for the S&P 500. Changes in futures don’t necessarily reflect market moves after the opening bell.

U.S. Index Futures Point to Gain After Stocks' Best Week in 2016 (Bloomberg)

U.S. index futures advanced, indicating equities will extend gains after posting their strongest week since November.

Scalia's Pro-Business Legacy (The Atlantic)

Scalia's Pro-Business Legacy (The Atlantic)

Justice Antonin Scalia took his seat on the bench in 1986, during one of the greatest bull markets and the heyday of corporate mergers and acquisitions. In the three decades he served on the high court, he helped raise barriers for employees and consumers and he helped strike down limits on corporate political spending in our democracy. He will be remembered for his intellect and personality, but he should also be remembered for increasing the power of business in society.

Oil prices stay weak on ongoing overproduction, brimming crude stocks (Business Insider)

Oil prices clung to steep losses in early Asian trading on Monday as production outpaces demand and U.S. crude stocks swelled to record levels.

Real Money Moves Into Real Assets (SL-Advisors)

It was a busy week of news in Master Limited Partnerships (MLPs). Although there were several earnings announcements, perhaps most notable was the disclosure of new investments by Berkshire Hathaway (BRK), David Tepper’s hedge fund Appaloosa and George Soros in much maligned Kinder Morgan (KMI).

Shipowners Feeling Scrapyard Blues as Steel Plummets: Chart (Bloomberg)

It may be time for shipowners to join Europes protest against Chinese steel-price dumping that mobilized thousands of people to march in Brussels last week.

Down but not out, U.S. economy still a beacon of growth (Market Watch)

Down but not out, U.S. economy still a beacon of growth (Market Watch)

The United States is still a sheltered harbor in a world of economic tossing and turning, but fresh worries about the way forward are likely to keep the guardians of U.S. growth — aka the Fed — on edge.

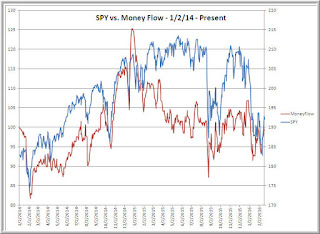

Avoiding Confirmation Bias With Market Money Flow And Breadth (Trader Feed)

Confirmation bias is the tendency to seek information that fits our preexisting views. The opposite of confirmation bias is open mindedness and the commitment to seek information that counters one's perspectives.

Investment banks' trading revenue declined 9 percent in 2015: survey (Business Insider)

Investment banks' trading revenue declined 9 percent in 2015: survey (Business Insider)

Revenue at the world's 12 largest investment banks from trading fixed income, currencies and commodities, known as FICC, fell 9 percent in 2015 compared with a year before, a survey showed on Monday, dragged down by regulatory changes and retrenchment.

For Silicon Valley, the Hangover Begins (Wall Street Journal)

For Silicon Valley, the Hangover Begins (Wall Street Journal)

Not long ago, employees at Practice Fusion Inc. reveled in the technology boom, munching daily on free healthy food, enjoying “Phenomenal Friday” gatherings and racing around the office on tricycles.

Today, the Silicon Valley extravaganza is waning. The San Francisco electronic medical-records company has booted its founding CEO, laid off a quarter of its staff and cut back on projects to save costs.

Bears Are Keeping Their Record Grip on U.S. Gas Futures in 2016 (Bloomberg)

Bearish speculators who dominated the U.S. natural gas market last year are showing no signs of backing off.

Glencore Rebounds 87% From Low to $2.5 Billion Sale Price: Chart (Bloomberg)

Investors appear to have renewed faith in Glencore Plc Chief Executive Officer Ivan Glasenberg’s plan to turn around the fortunes of the embattled commodity trader and miner.

How America Is Putting Itself Back Together (The Atlantic)

How America Is Putting Itself Back Together (The Atlantic)

When news broke late last year of a mass shooting in San Bernardino, California, most people in the rest of the country, and even the state, probably had to search a map to figure out where the city was. I knew exactly, having grown up in the next-door town of Redlands (where the two killers lived) and having, by chance, spent a long period earlier in the year meeting and interviewing people in the unglamorous “Inland Empire” of Southern California as part of an ongoing project of reporting across America.

Yen slips against dollar with Tokyo stocks on the rise (Market Watch)

Yen slips against dollar with Tokyo stocks on the rise (Market Watch)

The yen was weaker against its rivals during Asian trade Monday, as investors opted to sell the safety of the Japanese currency amid Tokyo stocks’ steady gains.

The Japanese currency weakened against the dollar, which gained to ¥112.90 from ¥112.65 late Friday in New York. But the greenback failed to stay above the ¥113-mark after advancing to ¥113.05 earlier in the session.

Politics

Preparing for the Collapse of the Saudi Kingdom (The Atlantic)

Preparing for the Collapse of the Saudi Kingdom (The Atlantic)

For half a century, the Kingdom of Saudi Arabia has been the linchpin of U.S. Mideast policy. A guaranteed supply of oil has bought a guaranteed supply of security. Ignoring autocratic practices and the export of Wahhabi extremism, Washington stubbornly dubs its ally “moderate.” So tight is the trust that U.S. special operators dip into Saudi petrodollars as a counterterrorism slush fund without a second thought. In a sea of chaos, goes the refrain, the kingdom is one state that’s stable.

Inside Jeb Bush's $150 Million Failure (Politico)

Inside Jeb Bush's $150 Million Failure (Politico)

Jeb Bush, the Republican establishment’s last, best hope, began his 2016 campaign rationally enough, with a painstakingly collated operational blueprint his team called, with NFL swagger, “The Playbook.”

On page after page kept safe in a binder, the playbook laid out a strategy for a race his advisers were certain would be played on Bush’s terms — an updated, if familiar version of previous Bush family campaigns where cash, organization and a Republican electorate ultimately committed to an electable center-right candidate would prevail.

Technology

This 4.7-Inch Organic LCD Wraps Right Around Your Wrist (Gizmodo)

This 4.7-Inch Organic LCD Wraps Right Around Your Wrist (Gizmodo)

Your smartwatch screen may soon be rather more impressive: This 4.7-inch organic LCD display is flexible enough to wrap right around a wrist.

AT&T is using LTE to control drones from miles away (The Verge)

AT&T is using LTE to control drones from miles away (The Verge)

Drones are developing so rapidly that the Federal Aviation Authority can't keep up, but most unmanned aerial vehicles are still hamstrung by a limited range, forcing pilots to keep them in view. AT&T and Intel are hoping to change that. The two companies are testing drones on AT&T's LTE network, more commonly used by cellphones, tablets, and other devices on the ground, to see how it performs at altitude.

Health and Life Sciences

Is There a Better Way to Diagnose Psychosis? (Scientific American)

Is There a Better Way to Diagnose Psychosis? (Scientific American)

If you are unfortunate enough to develop acute chest pain this winter, you will probably be assessed by a clinician who will order a battery of tests to determine if your symptoms result from pneumonia, bronchitis, heart disease or something else. These tests can not only yield a precise diagnosis, they ensure you will receive the appropriate treatment for your specific illness.

Doctors are reaching past the symptoms of mental illness to fix the circuits that breed them (Washington Post)

She relaxed in the recliner, her eyes closed, her hands resting lightly in her lap. The psychiatrist’s assistant made small talk while pushing the woman’s hair this way and that, dabbing her head with spots of paste before attaching the 19 electrodes to her scalp.

Life on the Home Planet

What sparked the Cambrian explosion? (Nature)

What sparked the Cambrian explosion? (Nature)

A series of dark, craggy pinnacles rises 80 metres above the grassy plains of Namibia. The peaks call to mind something ancient — the burial mounds of past civilizations or the tips of vast pyramids buried by the ages.

The Case of the 150,000 ‘Dead’ Penguins (The Daily Beast)

The Case of the 150,000 ‘Dead’ Penguins (The Daily Beast)

Some good news for 150,000 dead penguins in Antarctica: They might not be dead. Bad news: There may not be any hope for the rest of us.

Major news outlets ran with a widely mischaracterized study from Australian and New Zealand researchers in Commonwealth Bay, Antarctica, saying enough penguins to fill three Yankee Stadiums had been trapped by an iceberg and, unable to fend for themselves, died.