TLT/Pat - Auction isn't at 1pm, results are announced at 1pm but participants already know if it went bad (it did) because the market wasn't scary enough to get enough people ($20Bn) to decide to park their money in TBills for 10 years rather than letting Ford pay them a 5% dividend. The same Government backing the TBills is backing Ford!

CVX/Scott - Oil at $38, what's not to love. Unless, of course, you understand math, then it might bother you that the stock is at all-time highs selling oil and /NG when oil is about 1/2 the 3-year average ($70) and Nat Gas also about 1/2 of $3 average. Up $5 today is adding 40 Dow points out of 27 - otherwise we'd be negative.

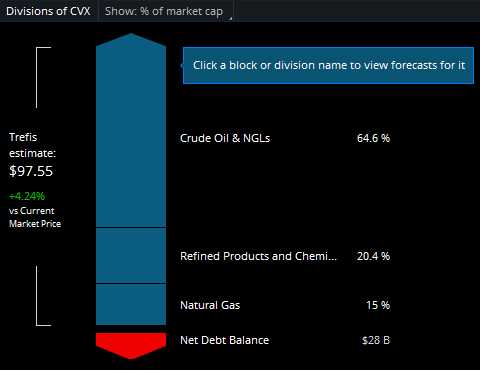

Let's see how they look inside:

Wow, Revenues down 35% in 2015 and down to -50% this year - strike one. Proifts down 75%, on the way to down 86% this year - strike two. Cash flow -$5Bn, twice as bad as 2014 - much worse in 2016 - strike 3. WTF are people buying? Huge overreaction to $38 oil.

We HAVE to short them - they are giving us no choice!

- In the STP, we can sell 10 CVX April $92.50 calls for $3.90 ($3,900)

- We can also buy 20 CVX April $90 puts for $2.20 ($4,400)

That's net $500 and, if CVX is back at $85, we're be $10,000 in the money. I don't consider this very risky because, even at $100, we're only down $7,500 + the $500 cash and it's rollable. It's a great hedge against our bullish oil bets and I'm tempted to do twice as much, but let's see how it goes.