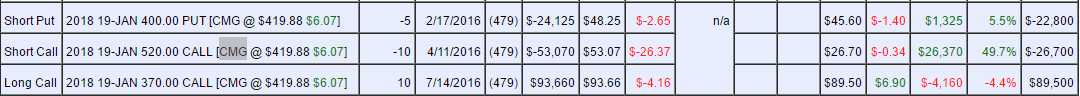

CMG/Hanj - We sure like them in the LTP!

It's tempting to buy the short $520s back at this point.

You know me, all I care about is 10% sales growth last year and down a bit this year due to issues that are fading away. Even with the trouble, they only had one losing Q and back on track now to get back to $400M next year, which justifies a $12Bn valuation at $400 (p/e 33) given their growth and lack of debt. They are only just now starting in Europe and, though their Chinese thing is a flop, I think their Pizza idea may do well.

So, like our play in the LTP, I wouldn't get crazy aggressive but I do like having my finger in the pie and, as a new trade for CMG, I like this:

- Sell 5 CMG 2018 $350 puts for $28 ($14,000)

- Buy 10 CMG 2018 $420 calls for $60 ($60,000)

- Sell 10 CMG 2018 $520 calls for $28 ($28,000)

That's net $18,000 in the $100,000 spread and certainly, when 2019 comes out, you can roll the puts for more money and maybe roll the calls for position as well. Upside potential is $82,000 at $520 (455%) but it's definitely a trade you should expect to be building in case CMG takes longer than a year to pick up speed.

You can even pay yourself to wait by selling 3 short Jan $450 calls for $15 and that's $4,500 in your pocket (1/4 of what you laid out) and you can set stops at $20, $25, and $30 and you risk just $3,000 but, if you lose that, your spread will be nicely in the money and then you can sell the April $500 calls (or roll, of course) and get $4,500 back.