Have we finally gone too far?

Have we finally gone too far?

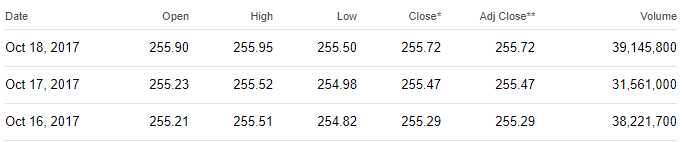

Of course we have, what kind of question is that? On the right is the SPY volume for the week and we haven't cracked 40M shares trading vs. an average of 62M this year, which is already half of last year. This came on a day, yesterday, when the Dow popped 160 points but, as we noted in yesterday morning's PSW Report (and in our Live Trading Webinar), it was on the backs of just IBM and GS, while the other 28 stocks in the index were effectively flat. So the very, very narrow "rally" continues but it can very easily be overwhelmed by any kind of volume selling and we called for more CASH!!! in our porfolios during yesterday's webinar – as this market may finally be approaching peak ridiculous.

If it's not, we'll get back in but yesterday our Webinar Trade Idea was to short the Russell (/TF), which was 1,510 at the time (1-3pm) and this morning we fell all the way to 1,495, which is up $750 per contract and we took a $7,320 gain and ran in our Morning Alert to Members (also tweeted out) on our 12 contract play near the bottom (our average entry was 1,503.27 as we started earlier than the Webinar). Still, it's not bad for a day-trade, right?

If it's not, we'll get back in but yesterday our Webinar Trade Idea was to short the Russell (/TF), which was 1,510 at the time (1-3pm) and this morning we fell all the way to 1,495, which is up $750 per contract and we took a $7,320 gain and ran in our Morning Alert to Members (also tweeted out) on our 12 contract play near the bottom (our average entry was 1,503.27 as we started earlier than the Webinar). Still, it's not bad for a day-trade, right?

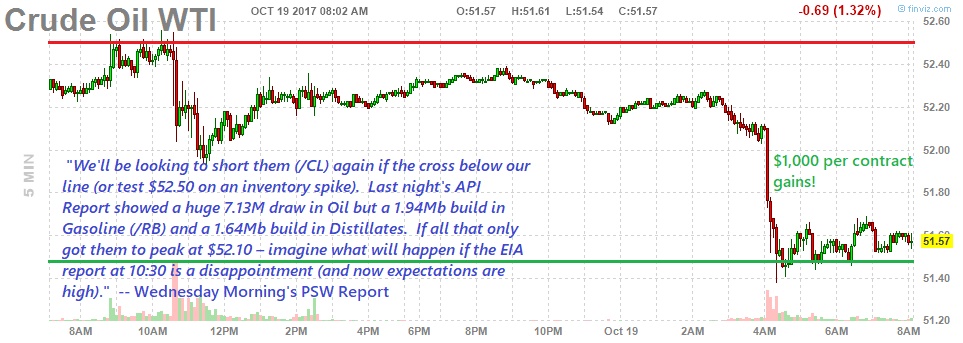

We also played the Dow (/YM) Futures short at 23,100 and the Dow fell below 22,900 this morning and that was good for gains of $1,000 per contract and Oil (/CL), which we discussed shorting in yesterday morning's report (subscribe here so you don't miss them) which fell from our predicted spike of $52.50 on inventories all the way back to $51.50 this morning, also good for $1,000 per contract gain while our Webinar Gasoline shorts (/RB) at $1.65 are already up $840 per contract at $1.63 so – you're welcome!

We also called a long on Silver (/SI) at $17 and that's popping this morning and Coffee (/KCH8) is already moving up but Natural Gas (/NGV8) is still under $3 and we love those next October contracts, especially in light of this mornings note from the EIA, which shows Natural Gas demand growing much faster than oil, up 1.6% a year for the next 5 years. Until 2022, the IEA sees gas gaining a firmer foothold in South and East Asia as the availability of ample, competitively priced supply would help to expand opportunities. China and India will lead the demand growth in Asia, but other countries such as Pakistan and Bangladesh “show a similar picture of strong growth underpinned by cheaper LNG and incremental gas use for power and industry.”

Cheaper isn't a bad thing for /NG as the US is, by far, the low-cost supplier. We are the Saudi Arabia of Natural Gas and, as we bring LNG capacity on-line, we are exporting more and more of it overseas, where markets pay as much as double what producers get in the US. As our natural gas becomes easier to export, Global Prices should fall while our prices rise a bit to equalize as the exports become demand drivers within the US market. That's our long-term premise on Natural Gas.

Cheaper isn't a bad thing for /NG as the US is, by far, the low-cost supplier. We are the Saudi Arabia of Natural Gas and, as we bring LNG capacity on-line, we are exporting more and more of it overseas, where markets pay as much as double what producers get in the US. As our natural gas becomes easier to export, Global Prices should fall while our prices rise a bit to equalize as the exports become demand drivers within the US market. That's our long-term premise on Natural Gas.

Still, we would rather play the Futures (/NG) than the ETF (UNG) as UNG tends to get chewed up by fees and contract rollover costs while our Futures contracts allow us to take quick advantage of short-term spikes. Chenier Energy (LNG) is a big player in this space and we have owned it in the past (when it was much cheaper) but we still like it at $47.50 for the long-term. Perhaps they will have issues as they ramp up production and get cheap again…

Earnings have been coming in pretty good so far though guidance continues to trend to the downside. Over in the UK, this morning, Retail Sales were down 0.8% in September and they didn't have a hurricane to blame, yet their markets are just as over-priced as ours are, with the FTSE up 12% since Trump's election. China is up 30% since Trump's election while their GDP growth is slowing to 6.8% for Q3 (not that you can belive Chinese data, of course).

Today is the actual anniversary of the great crash of '87 and, as we discussed in yesterday's Webinar – I'm not looking for a crash – just a 5-10% correction which we will quickly buy into. Until it comes, we will be playing the market very cautiously.

Today is the actual anniversary of the great crash of '87 and, as we discussed in yesterday's Webinar – I'm not looking for a crash – just a 5-10% correction which we will quickly buy into. Until it comes, we will be playing the market very cautiously.

Unlike 1987, we have a market now that is dominated by over 2,000 ETFs with over $3.2 TRILLION in assets and that puts a floor on the market with the daily inflows from 401Ks and IRAs but, for example, I just called the broker for my kids' college accounts and moved them to CASH!!! into this quarter's uncertainty. It's doubtful I'll go back in until March – unless we do get that correction. There's no good way to hedge a 529 plan so cash was a good alternative but our portfolios are, as we've noted, very well hedged into earnings and our concerns run through Q1, when we expect to see some profit-taking.

Meanwhile, we're still bargain-hunting for value stocks.