Powell speaks!

Powell speaks!

We have a new Fed Chairman and clearly the bets are he'll be the same as the old boss as the markets have now recovered to within 3% of their all-time highs ahead of his 10 am address to Congress, led by Global Tech stocks Facebook (FB), Alibaba (BABA), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL) as well as Bidu (BIDU), Nvidia (NVDA), Tesla (TSLA) and Twitter (TWTR).

Those stocks are up just under 20% for the year, more than recovering from the 10% dip we had earlier in the month – up almost 15% since Feb 7th though, once again, I feel like we're simply back to being overbought and haven't learned any lessons. We'll have to see though, clearly we broke over our bullish technical "strong bounce" lines and now we'll see if the indexes can complete the round-trip back to their highs or if Powell sends us scurrying back below where we started the day yesterday.

"I would think there's no upside for [Powell] making a splash because he's dealing with a committee that's in flux, just coming together," said Robert Tipp, chief investment strategist at PGIM Fixed Income. "The market tends to do a good job of panicking and defining the range you're likely to be in … Once the taper tantrum got going, 3 percent was the watermark." That seems to sum up the general sentiment, which is assuming a very gradual return to normal interest rates.

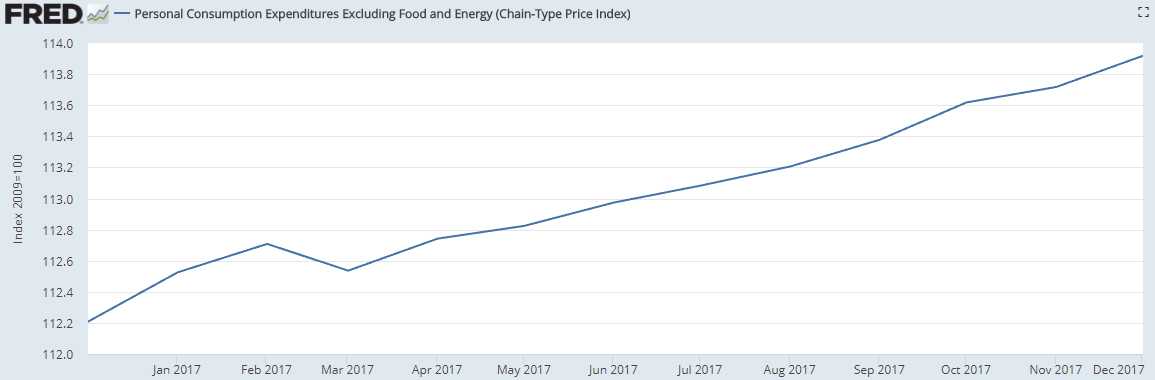

What we're expecting to hear from Powell is whether the Fed is more worried about overshooting (too loose) or undershooting (too tight) their 2% inflation target (just right) and the nuance will be whether Powell indicates concern about the recent bump in inflation – especially ahead of Thursday's PCE numbers, which are expected to come in hot, around 0.4%, which would pop the Fed's chart from 113.9 to 114.3 and that would be up 2.1% for the year – magic time!

What we're expecting to hear from Powell is whether the Fed is more worried about overshooting (too loose) or undershooting (too tight) their 2% inflation target (just right) and the nuance will be whether Powell indicates concern about the recent bump in inflation – especially ahead of Thursday's PCE numbers, which are expected to come in hot, around 0.4%, which would pop the Fed's chart from 113.9 to 114.3 and that would be up 2.1% for the year – magic time!

Since the PCE was at 105.4 in Jan 2013 and took 4 years to get to 112.2 (6.8), the prior pace of PCE inflation has been 1.7% so jumping to 2.1% is already a 23% increase in rate and jumping 0.4% in a month, as expected, is pointing towards another double so I'm going to be concerned if Powell isn't concerned about inflation. And don't forget, the PCE excludes food and energy – both of which have also gone up sharply.

I lost yesterday's Trader Challenge at the Money Show because I shorted the Nasdaq (/NQ) at 6,950 and, as you can see from the chart, it went the wrong way on me and I ran out of time before it came back my way. I was still down about $1,500 at 10:30 but jumped to up $2,000 to close out 10 minutes later (I lost to a guy who only lost $100 at the buzzer!) but it was a fun contest and it emphasized what I always tell people about Futures trading – DON'T FORCE YOUR TIME-FRAME!

A lot of traders pick a certain time of day they are going to trade (like this challenge) and that's no way to trade things as you end up picking the best of a bad lot as often as not. What we didn't force was our long trade on General Electric (GE) as we grabbed 100 March $13.50 calls for 0.95 as the stock plunged at the open. Again, it was not in time to help us in the challenge but they finished the day at $1.25 – up 0.30 (31%) or up $3,000 for the day.

We discussed a GE play in yesterday's morning Report and, just as we expected, traders and algos freaked out over GE's 2-year restated earnings but we already accounted for them and called GE to be at least $15 after the news so the $14 entry was a gift and, because we were prepared, we were able to jump right into that trade but again – you can't force the timing and it didn't help us by 10:30 though, frustratingly for my competitive nature – it too turned right up as soon as the contest was over.

This is why I don't day trade!

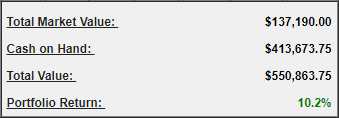

We didn't have to touch our Long-Term Portfolio and, after yesterday's excitement, it's now up 10.2% for the year so YAY!, I guess, but our paired Short-Term Portfolio (which is also up 10% on $100,000) has plenty of hedges to protect our gains – just in case. We'll see how much Powell's testimony affects the markets this morning and I'll be going over our positions in our Live Member Chat Room (I put up 5 FREE new trade ideas yesterday – so don't be greedy!).

We didn't have to touch our Long-Term Portfolio and, after yesterday's excitement, it's now up 10.2% for the year so YAY!, I guess, but our paired Short-Term Portfolio (which is also up 10% on $100,000) has plenty of hedges to protect our gains – just in case. We'll see how much Powell's testimony affects the markets this morning and I'll be going over our positions in our Live Member Chat Room (I put up 5 FREE new trade ideas yesterday – so don't be greedy!).

Keep in mind, in our LTP, we made that $50,863 on only $137,190 worth of positions – tons of room to get more bullish as we're still 80% in CASH!!!

If the Nasdaq stops us out over that 7,000 line, the sky is the limit as we're back to a buying frenzy that will only stop when it stops – so we might decide to get a little more aggressive with some of our Watch List plays but I'm miles away from cutting back on the hedges – as there are still plenty of looming threats out there that are being completely ignored by traders.

Still, you gotta go with the flow, right?