Wow, what a day!

Wow, what a day!

Yesterday, in our pre-market Morning Report, we made a call to short the Nasdaq Futures (/NQ) if they failed to hold 6,700 and fail they did as we got a massive 200-point drop which paid us $20 per point per contract for $4,000 per contract same-day gains on the Futures – you're welcome! Our oil shorts also did nicely, racking up additional $1,500 per contract gains on the day as we pulled back from $69 to $67.50. This is why we take Monday's off now – we can make plenty of money on Tuesdays!

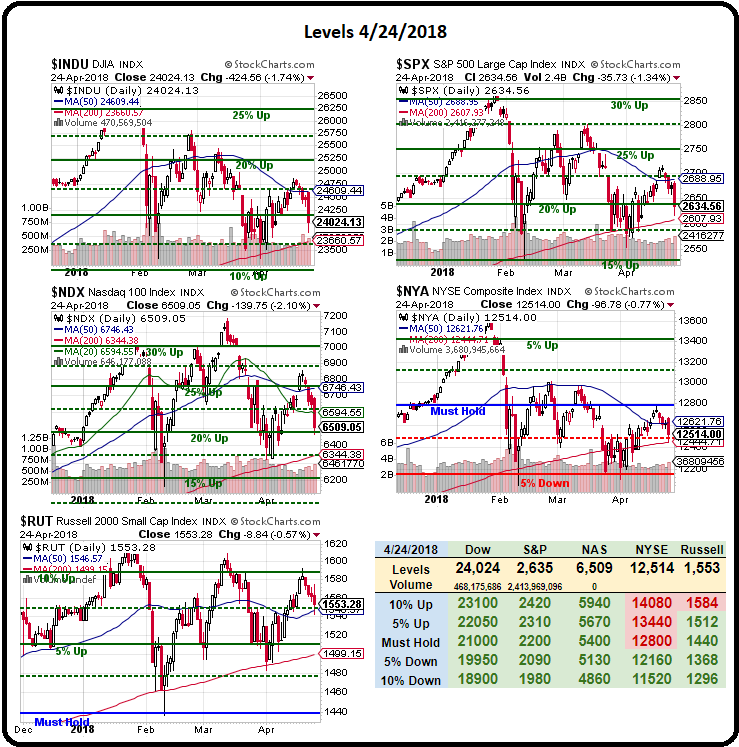

This morning we'll be looking for bounces but failing to hold the weak bounce lines will likely signal more pain ahead and, don't forget, we were already expecting a big move down on Thursday so this may be an early start to a proper 5% correction. I ran the numbers for our Members in yesterday's Live Chat Room into the close (3:40):

2,685 to 2,620 is 65 points so 13 points is 2,633 (weak), which is right where we failed.

24,600 to 23,800 is 800 points (wow) but I'll call it 150-point bounces to 23,950 and 24,100:

6,700 failed to 6,475 so 225 gives us 45-point bounces but call them 50 so 6,525 (weak) and 6,575 (strong)

In this case, it's worth noting that the exact line is 6,520 and that's exactly were we're failing. When the 5% Rule is predicting things that exactly, you know the Bots are driving the market!

1,575 to 1,545 is just 30 points so 6-point bounces to 1,551 and 1,557.

So why are we talking about Nasdaq 7,000 this morning? Because the Nasdaq we track in the Futures is the Nasdaq 100 (/NQ) and that's around 6,500 but the Nasdaq Composite Index, which holds about 3,000 stocks is at the very significant 7,000 line and to say that we MUST HOLD that level is a huge understatement. This is the same Nasdaq that famously tested 5,000 in March of 2000 – right before the collapse that took us to 1,140 (down 77%) in October of 2002 – 18 months of maket hell that those who went through it will never forget.

Now, 18 years later, we're 40% higher than the Top and 514% higher than the bottom but already having pulled back from 7,500 but one could argue that the fair value for the Nasdaq Composite, which was back at 1,300 as recently as March of 2009, is more like 5,000, not 7,000. You can get to that number very quickly by simply applying only a 50x multiple to Amazon (AMZN), which would drop the stock 80%, Netflix (NFLX), which would cut the stock 60%, Tesla (TSLA), which would cut the stock to zero… You get the idea – the index has some wildly overpriced companies at the same time as alternate investments – like Bonds – are becoming more attractive.

Stocks have been wildly inflated simply because money has had nowhere else to go. Real Estate got risky, the banks pay no interest, bonds pay no interest, commodities were in a downtrend – there was nothing else to do with money but plow it into equities and the people who did so have been rewarded for the past decade but now it may be time to pay the piper as rates cycle back up and money tightens up.

That means the DEMAND for money for housing, labor, commodites, bonds… will increase and that means the people who have CASH!!! will be able to demand more interest for their money and that puts upward pressure on rates as well. Despite the best efforts of the Central Banksters to flood the World with money – there's still a finite amount of it and, like BitCoin, it can rise in relative value when it gets scarce and demand picks up.

We were discussing the Dollar in Member Chat on the 17th and Grasshopper asked if I still like the Dollar (/DX) for a long play and I responed: "/DX/Grass – Same as last week, I like it at 89 with tight stops below and I'll like it again at 88 if that fails." On April 11th I had said to our Members: "Dollar tested 89, good long on /DX down there with tight stops below. " and that was good for a quick run to 89.50 or gains of $500 per contract and this run just hit the $2,000 per contract mark but 91 is a good place to take a profit and we'll see what kind of legs we have.

To some extent, we can blame the 2% rise in the Dollar for the 5% drop in the Nasdaq as the stocks are traded in Dollars and a stronger Dollar means you need less of them to buy the same stock. Also, the rising Dollar reduces the value of overseas earnings if you collect them in Euros or Yen or whatever – that's a factor too. Let's call the Dollar rise a contributing factor but not THE factor driving the market. This evening we get earnings from Facebook (FB) and Apple (AAPL) reports next week (5/1) and THOSE factors are going to drive the market up or down more than anything else.

Apple has fallen from $180 to $162 in the past week and that's 10% and AAPL is 15% of the Nasdaq so 1.5% of the Nasdaq's drop was caused by AAPL and add another 0.5% for the suppliers that were taken down in Apple's wake and now we can see why the Nasdaq fell a quick 5%. A full correction will take the Nasdaq down another 5% or 350 more points to 6,650 and that will be roughly 6,200 on /NQ.

Apple has fallen from $180 to $162 in the past week and that's 10% and AAPL is 15% of the Nasdaq so 1.5% of the Nasdaq's drop was caused by AAPL and add another 0.5% for the suppliers that were taken down in Apple's wake and now we can see why the Nasdaq fell a quick 5%. A full correction will take the Nasdaq down another 5% or 350 more points to 6,650 and that will be roughly 6,200 on /NQ.

Yesterday morning, we drew this Nasdaq 100 (NDX) chart for you, predicting a test of our 20% line at 6,480 and the low of the day was 6,464 and we closed at 6,509 so take it seriously when I tell you that, if the weak bounce line at 6,525 fails to hold today, we are very, VERY likely to be testing that 6,200 line by next week.

A miss by Apple would do the trick by itself but disappointing results from Facebook could make people question the runaway valuations of the entire tech sector as there may indeed be more risk factors than the models have been predicting. Fortuntately the Nasdaq is our primary hedge and our Member Portfolios use the Nasdaq ultra-short (SQQQ) to protect our long positions. Even our low-touch Money Talk Portfolio has an SQQQ hedge, one that has been performing quite well for us:

| Security | Description | Quantity |

Trans Date |

Age |

Net Cost |

Issue Price/ Total Change |

Effective Cost /Shr |

Lower Stop Limit |

Upper Stop Limit |

Curr. Price/ Change Today |

Gain/Loss |

Market Value |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Short Put | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short Put | 2020 17-JAN 60.00 PUT [ALK @ $65.26 $0.00] | -5 | 2/1/2018 | (632) | $-4,100 | $8.20 | $-0.95 | n/a | $7.25 | $0.75 | $475 | 11.6% | $-3,625 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Bull Call Debit Spread | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long Call | 2018 21-SEP 16.00 CALL [SQQQ @ $18.53 $0.00] | 40 | 2/1/2018 | (149) | $12,080 | $3.02 | $0.98 | n/a | $4.00 | $0.77 | $3,920 | 32.5% | $16,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short Call | 2018 21-SEP 23.00 CALL [SQQQ @ $18.53 $0.00] | -40 | 2/1/2018 | (149) | $-9,000 | $2.25 | $-0.20 | $2.05 | – | $800 | 8.9% | $-8,200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

That was our hedging idea for the $50,000 Money Talk Portfolio as we announced it on the show (1/31) and the idea was to sell puts against a stock we really liked (ALK) to pay for the SQQQ spread so that, if the market did not go down, at least we would probably offset the cost of the insurance. As it stands, Alaska Air just had good earnings so no danger on the short put and the 40 SQQQ Sept $16 calls are $2.50 in the money so net $10,000 if they were to expire at this level but still $18,000 more upside should the Nasdaq fall further.

Just last Thursday, we reitereated our short idea for SQQQ in the Morning Report – hedging is a vital part of our long-term investing strategy and times like these we are reminded why. Back on 3/29, also in the Morning Report, we called the following hedge for our Short-Term Portfolio:

That's the strategy we were discussing in yesterday's Live Trading Webinar so this was a good opportunity to go over an example in detail. With our early-round entries, we almost prefer the market takes a dip and "forces" us to build larger, lower positions as it really amplifies our returns – IF things improve down the road. If not, the hedges are key and the hedge we added yesterday was:

As an additional hedge, at the moment, I like for the STP:

- Sell 4 WHR 2020 $125 puts for $12.50 ($5,000)

- Buy 50 SQQQ May $16 calls for $3.90 ($19,500)

- Sell 50 SQQQ May $20 calls for $2.20 ($11,000)

That's net $3,500 on the $20,000 spread that's almost all in the money to start and the only way to lose is if the Nas goes up quite a bit from here which, with all these headwinds, doesn't seem too likely.

That should be very easy to buy this morning as SQQQ should open lower and I don't think Whirlpool (WHR) is going anywhere. WHR is simply a stock we'd like to own if it gets cheaper (now $151) so promising to buy 400 shares for $125 (17% discount) puts $5,000 in our pocket but it could be any stock you REALLY want to buy if it gets cheaper (see our Watch List for dozens of possibilities).

Though we haven't moved much (net) on SQQQ since 3/29, the short time-frame on the spread works to our advantage as we were "Being the House – NOT the Gambler" and selling more premium than we bought and, with 23 days until expiration, the May $16 calls are now $2.80 and the May $20 calls are just 0.85 so net $1.95 is $9,750 and the short puts are $11 ($4,400) so net $5,350 is already up $1,850 (52%) out of a potential gain of $16,500 so plenty of room left to run on this one (and Whirlpool already had earnings so we're not worried about a nasty surprise there).

Remember, I can only tell you what the market is likely to do and how to profit from it – the rest is up to you!

Meanwhile, bounce or not bounce, it don't mean a thing if the indexes can't swing back over those 50-day moving averages and, the longer they stay below them, the more likely it is we have a "death cross" that brings the 50 dma below the 200 dma and that, my friends, is the first step back to Nasdaq 5,000 – so let's be careful out there!