What's wrong with small caps?

All the other indexes seemed pretty happy yesterday but the Russell 2000 fell 1.5% and are down even more this morning in a non-stop UGLY day of trading where almost every candle formed on the hourly chart was a down one (and the up ones were pathetic). Volume was also almost all red and much stronger than Friday's up volume, which was completely reversed by noon.

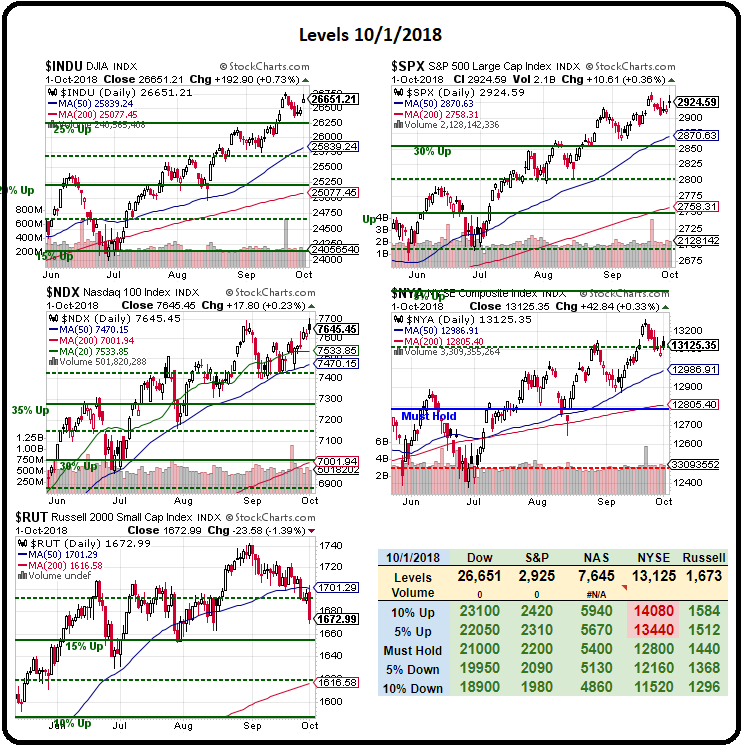

So far, this is just a natural rejection of the Russell's 10% run for the year, which began at the 1,550 line on Jan 2nd so 10% from there is 1,705 and that's why we have been shorting the Russell below the 1,700 line, looking for that rejection. According to our 5% Rule and rounding off to the more significant 1,700 mark, a 150-point run expects a 30-point (20% of the run) rejection so 1,670 should be a weak retrace and that's all this is so far. Another 30 points would be a strong retract (1,640) and still not really bearish unless we fail it. As noted in Friday morning's PSW Report:

Notice on our Big Chart that the Russell has failed its 50-day moving average at 1,700. There's nothing bullish about the market until it takes that back and watch out below if any of the others fail to confirm a new downtrend but, as I said, not today – today we have to make the quarter look pretty so we can bring some fresh retail suckers in to hold the bags next quarter…

Remember, I can only tell you what is likely to happen and how to make money trading it. A 30-point drop in the Russell is good for gains of $1,500 per contract and, since we expect a bounce off the weak retrace at 1,670 – we already know where we're likely to stop out. Now that we have that range, we look at the 40-point drop from 1,710 (because we can't round off in the short-term picture) to 1,670 (but we do use the goal line – even if it doesn't actually hit) and now we look for a weak bounce – which is 20% of the 40-point drop – to 1,678 and a strong bounce to 1,686, which we have to clear before looking bullish again.

Failure at those lines – especially if it's exactly at those lines – would be a good indication that the 5% Rule™ is working and then we take those failures very seriously as we may be consolidating for a break below 1,670 and on to 1,640 – another 1.8% drop that would be good for another $1,500. So we have that to possibly look forward to!

Failure at those lines – especially if it's exactly at those lines – would be a good indication that the 5% Rule™ is working and then we take those failures very seriously as we may be consolidating for a break below 1,670 and on to 1,640 – another 1.8% drop that would be good for another $1,500. So we have that to possibly look forward to!

The 5% Rule is not TA – it's just math! It's the math that governs the behavior of the Bots that do most of the trading in the market. The more Bots trade – the better the 5% Rule works and it works best on heavily traded securities like indexes but it can be applied to anything with a decent volume of trading.

The catalyst for the Russell's failure yesterday was the new NAFTA/USMCA deal being no better at all for US businesses except for, perhaps, dairy farmers, who will benefit from Canada easing requirements on milk imports. Other than that, it's the same agreement Trump hated 2 years ago and I suppose the small caps were trading up in anticipation of getting a deal that was going to be as pro-America as Trump claims this deal is but, in reality, he got nothing from Canada and simply waster 2 years huffing and puffing over a milk trade.

For the large-caps, it's all about CHINA!!! and whether or not we work out a deal with them and whether or not Trump begins a trade war with Europe as well. 60% of the S&P 500s profits come from overseas – foreign markets are more important to them than the domestic market so they are obviously relieved when they think they can continue doing business as usual but I still think China will escalate and become a big problem in 2019.

For the large-caps, it's all about CHINA!!! and whether or not we work out a deal with them and whether or not Trump begins a trade war with Europe as well. 60% of the S&P 500s profits come from overseas – foreign markets are more important to them than the domestic market so they are obviously relieved when they think they can continue doing business as usual but I still think China will escalate and become a big problem in 2019.

Meanwhile, there's nothing weak about the other indexes and even the very broad NYSE is holding it's 50-day moving average, which is rising to the 13,000 line so anything above that (now 13,125) is going to be bullish but, if the NYSE turns down to confirm the Russell's weakness – then we can go back to aggressively shorting the indexes but, until then, use caution in either direction.

Fed Chairman Powell speaks today at 12:30 and we had a very sharp drop in the markets when he spoke last Wednesday but then recovered – though I though it was just window-dressing at the time but we continued to rally yesteray to start October off with a bang so we'll see if the markets can shake him off this afternoon as well.

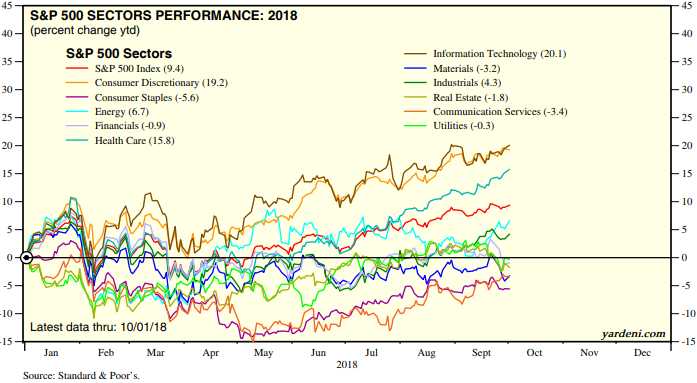

The Fed has been widening the definition of "Big Banks" in order to offer more regulatory relief to more Banksters under the direction of the Trump Administration but the real concern for the Banking Sector is rising rates and the Financial Spider (XLF) has been off a cliff since last week, back near the February lows and that's been a bit of a drag on the S&P while the surprising stars of the year have been Consumer Discretionary and Consumer Staples sectors:

Rising wages are good for the overall economy and good for the overall market though they will negatively impact companies with lots of low-wage employees like Wal-Mart (WMT) with 2M low-wage workers. Amazon has 575,000 employees and not all that many low-wage ones though their venture into retail and groceries is what got Bernie and his time to turn their attention on the very rich company paying very low (though competitive) wages to their new employees.

Expect WMT and others to come under a lot more pressure now and, once again, wages are going to be an election issue as they have done nothing under two years of Trump and the voters are understandably disappointed. To some extent, all this nonsense with Kavanaugh is a huge distraction away from discussing other issues ahead of the election (and here's a great summary of where we stand).