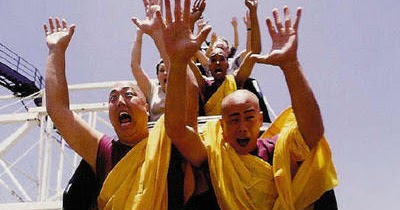

Wheeeee – what a ride!

Wheeeee – what a ride!

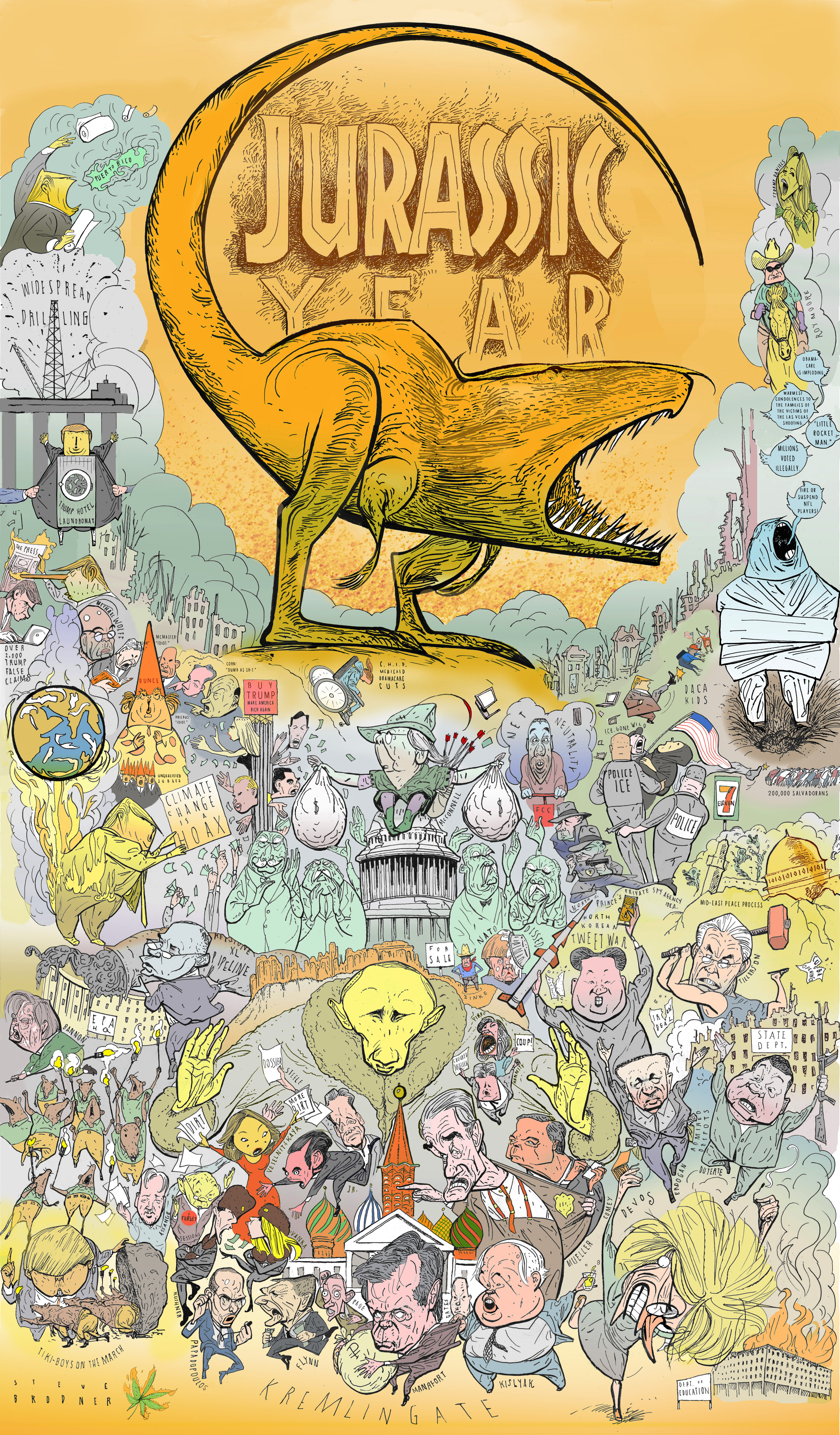

Down 800, up 700, what a fun day in the market. Now we're only down 750 from Monday's open so we can make that up by 11, right? I certainly hope you have your hedges as we literally could go 750 points either way off the Non-Farm Payroll Report at 8:30 this morning – especially if it shows more than 250,000 jobs created as that would mean the Fed really needs to raise rates before wages start eating into Corporate Profits and spur inflation. Even though wage inflation is "the good kind" that makes the economy stronger – the Fed doesn't give a crap about that – the Fed is a banking cartel, not some Government entity there to help you and they are only interested in protecting Corporate Profits, specifically Banking profits, they could care less whether or not you have a job – what they care about is that, if you do have a job, you are paid as little as possible so you have to take out lots of loans and pay interest to the Banksters. That is literally their primary function.

Why does the Fed not want inflation? Because you take a fixed loan on your home of, for example, $250,000 and put down a $50,000 deposit and, at 4.5%, you pay $1,266.71/month (not including taxes, insurance, etc) for 360 months which works out to $458,933 (plus your $50,000 deposit) paid out on your $300,000 home. The problem the Banksters have, however, is that the last $1,266.71 you pay them isn't worth as much as the first $1,266.71 you paid them due to inflation so they want inflation to be as low as possible to maximize your effective payments. THAT is what the Fed is concerned about.

Why does the Fed not want inflation? Because you take a fixed loan on your home of, for example, $250,000 and put down a $50,000 deposit and, at 4.5%, you pay $1,266.71/month (not including taxes, insurance, etc) for 360 months which works out to $458,933 (plus your $50,000 deposit) paid out on your $300,000 home. The problem the Banksters have, however, is that the last $1,266.71 you pay them isn't worth as much as the first $1,266.71 you paid them due to inflation so they want inflation to be as low as possible to maximize your effective payments. THAT is what the Fed is concerned about.

Keeping inflation down means keeping wages down, which has the side-benefit of keeping you perpetually in debt and, hopefully, they can one day sock you with a 8 or 10% mortgage and then they really start raking in the profits! At 8%, that same $300,000 house with a $250,000 mortgage goes up to $1,834.41/month and that's $665,596.45 paid over 30 years on that $250,000 you borrowed. Sucker!!!

By the way, funny thing – did you know the US Government has borrowed $21Tn on your behalf and, at 2.1% average interest, they have to pay $441Bn a year in interest payments alone and Trump is already running a $1Tn annual deficit (when there is no war and no recession) and the only reason the rates are so low is because we borrow mostly short-term notes that we constantly roll over – which then makes us subject to immediately be affected by rate increases – THAT is why Trump is freaking out about the Fed raising rates. Like the Fed, he doesn't give a crap about you – he just doesn't want his budget to blow up.

That's also why Trump purposely sabotaged the trade deal with China by kidnapping the daughter of the head of China's biggest tech company. That would be like China arresting Tim Cook's daughter. No matter what the charges – US citizens would be outraged and demand action. Why do we think Chinese people will not? They are human beings, just like us, not aliens from another planet. They like the Avengers movies just like we do (but they hated "Crazy Rich Asians") so why do you think they aren't going to be pissed off just like we would be to see America arresting it's citizens on what they consider trumped-up charges?

Anyway, so Trump is sabotaging the Trade talks so he has an excuse to keep taxing you with his tariffs (the Chinese don't pay them – you do – sucker!) which are already dropping $67Bn into the Treasury Budget and will rise to $125Bn if China doesn't sign an agreement by March – which is highly unlikely. So Trump will have another $125Bn he can use to give more tax cuts to himself, his family and his friends but that $125Bn is threatened by just a 0.5% rise in interest rates. THAT is why Trump is so angry at Powell and why Trump is willing to stab President Xi in the back while they are sitting down for dinner. It's not for you – it's for Trump!

8:30 Update: Non-Farm Payroll additions for November came in at an anemic 155,000 which was huge miss of the 200,000 jobs expected and October was revised down from 250,000 to 237,000 so 63,000 jobs disappeared in the last 30 days. That's good news for low rates as the Fed doesn't need to raise rates if people are going on unemployment at a good clip – they can let Trump's terrible economy do the work of impoverishing the people for them!

Also good news for the market that's bad for consumers – OPEC has agreed with Russia (OPEC+) to cut another 1.2Mb/d of production and that's sending oil back to $54 this morning, up $3,000 per contract from our call to go long at $51 yesterday. In fact, if you follow me over at Seeking Alpha, I reiterated the long call at $50 at 3:08 pm in that Comment Section – so good for gains of $4,000 per contract for the people who were more patient than we were with our first entry!

I have about 63,000 followers over at Seeking Alpha so – you're welcome!

We'll be taking those quick gains off the table and relying on our short Ultra-Short Oil ETF (SCO) calls to do their work for us. We originally sold the SCO Jan $20 calls on 11/14 for $4 and, as of yesterday's close they were $5.75 but we were confident that $50 would be a good floor so now we look for a bounce back over $20 so the short calls will expire worthless and we get to keep the $16,000 we sold 40 contracts for (they were part of a bullish spread we already cashed in as oil bottomed out).

So I still like that short sale as a new play or you can sel the July $25 calls for $6 because if oil is under $50 in July, I will eat my hat! That was going to be our fallback roll if oil didn't bounce but now it's bouncing so I'm very excited about this position as it's currently showing -$23,000 in our Short-Term Portfolio so, if they expire worthless, it will be a $23,000 gain in 42 days.

We also have a bullish play on the Gasoline ETF (UGA), which was also taking lumps as we have the Jan $28 calls, now just 0.60 and I love those as a new trade – also for July – where we can pick up 20 of the July $23 calls for $4 and sell 20 of the July $30 calls for $1.25 for net $2.75 on the $7 spread so we'd lay out $5,500 for a potential $14,000 payout if UGA is over $30 in July. That would make a gain of $8,500 (154%) and no margin would be required for the trade.

Going back to last October, Gasoline (/RB) had fallen to $1.49 but jumped up to $1.80 on the original OPEC cuts in November and /RB contracs pay $420 per penny per contract so that 0.30+ move was good for $12,600 per contract. So of course I like /RB long as it crosses over $1.50 with tight stops below – again – as the reward outweighs the risk by a country mile!

So lot's of fun things to trade but we won't be getting too excited until we see our bounce lines holding up and we're certainly not going to get all long into the weekend while we wait for the Chinese reaction to the Huawei kidnapping (and here's a nice background article on Huawei from 2011, where you can see that accusing them of selling spyware has always been a way the West has competed against what has become the World's 3rd largest hardware company anyway).

Have a great weekend,

– Phil