Steve Mnuchin to the rescue?

Steve Mnuchin to the rescue?

Yes, I know it sounds ridiculous but that's why the market is up half a point this morning as our Treasury Secretary lands in Beijing this morning and maybe I'd be more optimistic if he wansn't accompanied by Trade Representative Robert Lighthizer, who lost the battle to keep China out of the WTO in 1997 and is now being given his chance at revenge by suggesting the US pursue WTO action against China and threatens to leave the WTO if China is not sanctioned – ie. bullying.

Politico describes Lightizer as "a decades-long skeptic of Beijing." He has accused China of unfair trade practices and believes that China needs to make "substantive and structural changes to its trade policies, as opposed to only minor changes it has offered in the past". He wrote: "The icon of modern conservatism, Ronald Reagan, imposed quotas on imported steel, protected Harley-Davidson from Japanese competition, restrained import of semiconductors and automobiles, and took myriad similar steps to keep American industry strong. How does allowing China to constantly rig trade in its favor advance the core conservative goal of making markets more efficient? Markets do not run better when manufacturing shifts to China largely because of the actions of its government."

Now, there's nothing wrong with sending a tough negotiator to China but Lighthizer is more of an anti-China negotiator but even that may have a place if you have a highly skilled person keeping him in line but there's no indication that's the case with Mnuchin and, even if it were, it is complete folly for the markets to believe that this duo is going to be able to quickly resolve the many issues that the US and China are very far apart on in trade.

Now, there's nothing wrong with sending a tough negotiator to China but Lighthizer is more of an anti-China negotiator but even that may have a place if you have a highly skilled person keeping him in line but there's no indication that's the case with Mnuchin and, even if it were, it is complete folly for the markets to believe that this duo is going to be able to quickly resolve the many issues that the US and China are very far apart on in trade.

And when I say the US, unfortunately, I mean President Trump because the US and China were very much together for the past decade as both countries prospered and the trade deficit was widely considered to be "just a number" and China may have "stolen" factory jobs but no more so than Detroit stole them from New York in the early 20th Century. Jobs move and economies move on – unless you elect leaders who are stuck in the past and look to right perceived wrongs from long ago.

NAFTA was negotiated in 1994 and was the result of negotiations that had begun in 1980 (under the most sainted Ronald Reagan, who campaigned on it in 1979) yet Trump undid that in a year – only to replace it with almost the exact same agreement rebranded "brilliantly" as the USMCA, which only means the "US, Canada and Mexico Agreement" – I mean, WOW, what an improvement, right?

"It's time we stopped looking at our nearest neighbors as foriegners." Shame on you, Republican Party for betraying everything you stood for – SHAME!!!

Our trade negotiations with China took DECADES to cobble together and Trump is very good at tearing things down but seems to suck at building them up – especially without his Mexican contractors… Anyway, the point is that it's not likely that there will be much progress in any meeting that involves Lighthizer and I think he's only there because Trump doesn't WANT any progress – he WANTS his Tariff money and he's already realized that the people he is taxing with these tariffs are so stupid that they don't even realize Trump is lying when he says the Chinese are paying for it.

Our trade negotiations with China took DECADES to cobble together and Trump is very good at tearing things down but seems to suck at building them up – especially without his Mexican contractors… Anyway, the point is that it's not likely that there will be much progress in any meeting that involves Lighthizer and I think he's only there because Trump doesn't WANT any progress – he WANTS his Tariff money and he's already realized that the people he is taxing with these tariffs are so stupid that they don't even realize Trump is lying when he says the Chinese are paying for it.

The Congressional Budget Office estimates that in the last three months of 2018, U.S. Tariff Revenue increased by $8 billion, 83% compared with the same period last year, largely due to the tariffs imposed by Trump but tariffs paid by American companies in October alone amounted to $6.2 billion, an increase of 104% over the same period in 2017. If November and December were $6.2Bn (and they should be much bigger with Christmas) it means US companies were paying close to $20Bn (probably over) in order for Trump to collect $8Bn for the quarter.

Clearly it's an idiotic system that doesn't work but, sadly, we know logic and evidence will not work on Donald Trump and, like the Hulk, it only makes him angry. Trump is, in fact, looking to double down on his tariffs and, if he doesn't, he will increase his budget deficit by 10% – right when the Democrats have oversight of his budget. If he does and the tariffs continue to hit US businesses 3 times worse than the money collected – he can single-handedly destroy the entire economy – finally undoing the last good thing Obama accomplished for us in 8 years of hard work.

Clearly it's an idiotic system that doesn't work but, sadly, we know logic and evidence will not work on Donald Trump and, like the Hulk, it only makes him angry. Trump is, in fact, looking to double down on his tariffs and, if he doesn't, he will increase his budget deficit by 10% – right when the Democrats have oversight of his budget. If he does and the tariffs continue to hit US businesses 3 times worse than the money collected – he can single-handedly destroy the entire economy – finally undoing the last good thing Obama accomplished for us in 8 years of hard work.

It's very easy to tear down, it's the building that's hard and, speaking of building, where's that Infrastructure? In your dreams when we already have a $1.2Tn deficit on tap for 2019. That's my estimate. Trump's team, projects "only" a $985Bn deficit, including tariffs which assumes no damage to collections from the tariffis. In other words, Trump's budget mirrors Trump's words and works under the assumption that China will magically pay for the tariffs the way Mexico is paying for the wall!

Speaking of the wall, Team Trump can't even get a country that's already $22,000,000,000,000 in debt with a $1,200,000,000,000 deficit agree to spend $5,700,000,000 (seems like nothing, right?) on the first stage of a border wall to keep out the evil Mexicans and their caravan of 2,000 people seeking refuge in a country with 326,000,000 people that has a pressing need for workers and 1,367,793 unoccupied homes. In Flint Michigan alone, 7.5% of the homes are vacant and in Detroit 1 in 20 homes (5%) are unoccupied yet these are cities that march to keep out immigrants?

Speaking of the wall, Team Trump can't even get a country that's already $22,000,000,000,000 in debt with a $1,200,000,000,000 deficit agree to spend $5,700,000,000 (seems like nothing, right?) on the first stage of a border wall to keep out the evil Mexicans and their caravan of 2,000 people seeking refuge in a country with 326,000,000 people that has a pressing need for workers and 1,367,793 unoccupied homes. In Flint Michigan alone, 7.5% of the homes are vacant and in Detroit 1 in 20 homes (5%) are unoccupied yet these are cities that march to keep out immigrants?

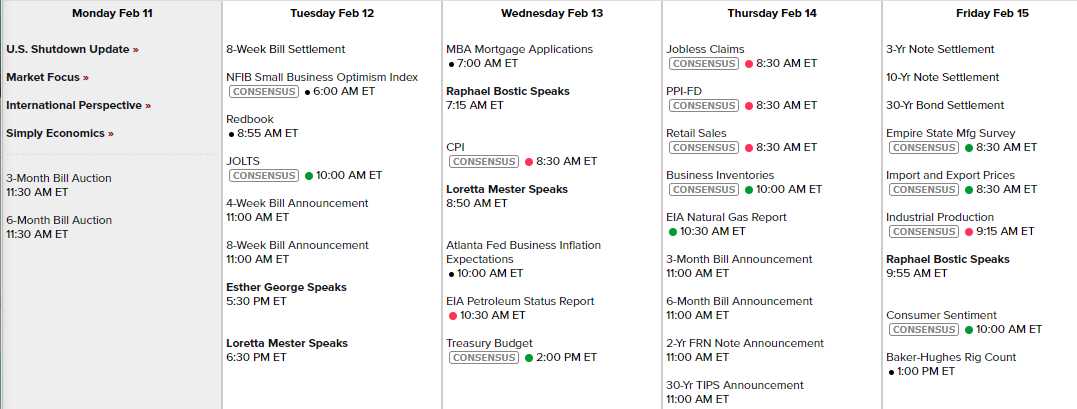

So I wouldn't get too excited about today's rally, it's Monday and Monday's don't matter (and next Monday is a holiday!) and tomorrow we'll be looking to see if the 200-day moving averages hold up. We have 5 Fed speakers this week and, finally, the Retail Sales Report on Thursday as we missed the critical Christmas Report due to the shutdown. Other than that, the big excitement is the Altanta Fed (Weds) and the Empire State Manufacturing Report with Industrial Production and Consumer Sentiment on Friday – so the most exciting day of the week will be the one before the 3-day weekend!

Also this week, we begin to wind our way down through the last of the 1,000 companies to report over the next three weeks. Still some big ones out there: