Are you ready to retire?

For most people, the purpose of investing is to build up enough wealth to allow you to retire. In general, that's usually enough money to reliably generate a year's worth of your average income, each year into your retirement so that that, plus you Social Security, should be enough to pay your bills without having to draw down on your principle.

Unfortunately, as the last decade has shown us, we can't count on bonds to pay us more than 3% and the average return from the stock market over the past 20 years has been erratic – to say the least – with 4 negative years (2000, 2001, 2002 and 2008) and 14 positives, though mostly in the 10% range on the positives. A string of losses like we had from 2000-02 could easily wipe out a decades worth of gains.

Still, the stock market has been better over the last 10 (7%) and 20 years (6.7%) than any other investing vehicle and, if that keeps up, a stock market portfolio may give you the best chance of obtaining a functional retirement. At 7% a year, if you want to generate a $70,000 annual income, you need to have $1M invested but it would be a tragedy if the market dropped 30% and then you had $700,000 and 7% of that is only $49,000 so you have less money coming in AND not enough to live on – keep that in mind when coming up with your "Comfort Number" and, by all means – speak to a Financial Professional who can help you plan by taking into account your own circumstances!

While some investors shy away from stock options because of their reputation for being akin to gambling, we disagree. Stock options are an important tool for supplementing your stock investing. Options, when used correctly and strategically, allow you to “Be the House, NOT the Gambler”. While no one in the casino always wins, the odds favor the dealer. We’ll show you how to structure your investments to keep the odds in your favor, like the dealer in a casino.

Even if we have a good system for wealth building – it's still not magic beans. YOU have to do the work and YOU have to make a plan and YOU have to stick to that plan. Despacito Investing is not a free ride – you have to work hard and you have to accept the fact that the money will accumulate SLOWLY but, as we know from our fables – "Slow and Steady Wins the Race."

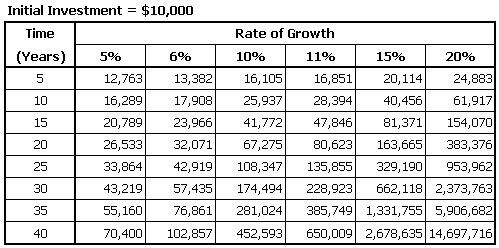

To win the retirement race, how do we get to $1M? Well, as you can see from this compound rate table, if we start with $10,000 and collect 6% interest for 40 years, we'll end up with $102,857 so, to get to $1M, we need to start with $100,000 and collect 6% for 40 years. Of course, if your average salary is $70,000, $100,000 is probably a lot of money but what you can do is start with $20,000 and add $3,500 a year (5% of your salary) and at 7% you would have $1.05M in 40 years (you can play with this calculator to get the idea under various conditions).

To win the retirement race, how do we get to $1M? Well, as you can see from this compound rate table, if we start with $10,000 and collect 6% interest for 40 years, we'll end up with $102,857 so, to get to $1M, we need to start with $100,000 and collect 6% for 40 years. Of course, if your average salary is $70,000, $100,000 is probably a lot of money but what you can do is start with $20,000 and add $3,500 a year (5% of your salary) and at 7% you would have $1.05M in 40 years (you can play with this calculator to get the idea under various conditions).

No that is, of course, at 7%. Should you be able to average 15%, in just 20 years you would have $740,000 and, in 40 years at that rate, you'll have $12.5M. THAT is the difference an additional 7% can make! At Philstockworld, we try to average closer to 20% annual returns but you don't make that kind of money just making deposits – you have to learn how to use stocks and options to your advantage…

Our goal is to slowly (not quickly!) accumulate wealth by selecting the right underlying stocks, at the right prices, and devising uniquely-structured option positions with favorable profits to risks metrics. One way to enhance your returns is by using dividend-paying stocks, like AT&T (T), which is back down at $30 as they are buying Time Warner (TWX) and will be doing some restructuring. The company pays a $2.04 dividend, which is 6.5% of the stock price but we can ENHANCE that through options, using the following combination:

- Buy 500 shares of T for $30 ($15,000)

- Sell 5 T 2021 $30 puts for $4.20 ($2,100)

- Sell 5 T 2021 $30 calls for $3 ($1,500)

That nets you into 500 shares of T for $11,400, which is net $22.80 per share. The put contracts force you to buy 500 more shares of T for $30 ($15,000) if T is below $30 at the Jan 15th, 2021 expiration date but it can be assigned to you at any time. If that happens, you have your first 500 at $11,400 and another 500 for $15,000 so $26,400 is your net cost of 1,000 shares or $26.40 per share. So the only "risk" you have selling the short puts is that you end up with 1,000 shares of T at a $3.60 discount (12%) to today's price.

On the upside, anything over $30 means you get called away, or paid $30 per share for your 500 shares ($15,000) and the short puts expire worthless and, in either case, you keep the money you collected plus any dividends you collect along the way. In the case of T, that's going to be $3,600 more than you paid plus 8 dividend payments totaling $4.08 x 500 shares is another $2,040 for a net gain of $5,040 in less than two years. That's 44.2% of the $11,400 you laid out and, even if you have an IRA and have to hold the other $15,000 against it for the put sale, it's still 19% of $26,400 – almost 10% a year!

That's a very basic, conservative trade using a blue-chip stock that's very unlikely to hurt you along the way. We will not only teach you basic trades like this one but more complex trades that can yield much better results. A healthy portfolio will have a mix of conservative and risky trades – depending on your financial needs.

Frontier Communications (FTR) is a regional carrier we feel is undervalued and you can buy that stock for $3, not $30. The don't pay a dividend so we don't need to own the stock but, risking owning just 15,000 (5,000 shares) worth of FTR, we can construct the following options spread:

- Sell 50 FTR 2021 $3 puts for $1.50 ($7,500)

- Buy 100 FTR 2020 $1 calls for $2 ($20,000)

- Sell 100 FTR 2021 $4 calls for $1.30 ($13,000)

The net cost of that spread is actually a $500 credit so your worst case is having to buy 5000 shares of FTR for $3 ($15,000) so you risk less on assignment than you do with T (but the trade is more risky as FTR could go bankrupt and T is not likely to) and the upside is tremendous as you make up to $30,500 at $4 and, even if FTR stays at $3, you are $10,000 in the money for a potential gain of $10,500 which is 1,100% of your $500 cash credit and 72.4% of your $14,500 maximum risk (if FTR were to go bankrupt and all your shares would be worthless).

Of course, we don't advocate putting ALL your money into the risker trade but putting just 10% of the AT&T risk into FTR would be $3,000 so 10 puts and 20 longs would be a net $100 credit and the upside potential would be $6,100 – that would still double the effective return of the T spread and bring you up to 20% annual returns on the same allocation (if all goes well).

Learning how to use options to enhance your stock portfolio’s returns is both practical and exciting. You only need a brokerage account, the motivation to learn, and the patience to wait for results (as opposed to over-active “trading”). Start SLOWLY, practice with play money, and get a feel for how options work. We'll help show you how. Ask us questions.