Now we'll see.

Now we'll see.

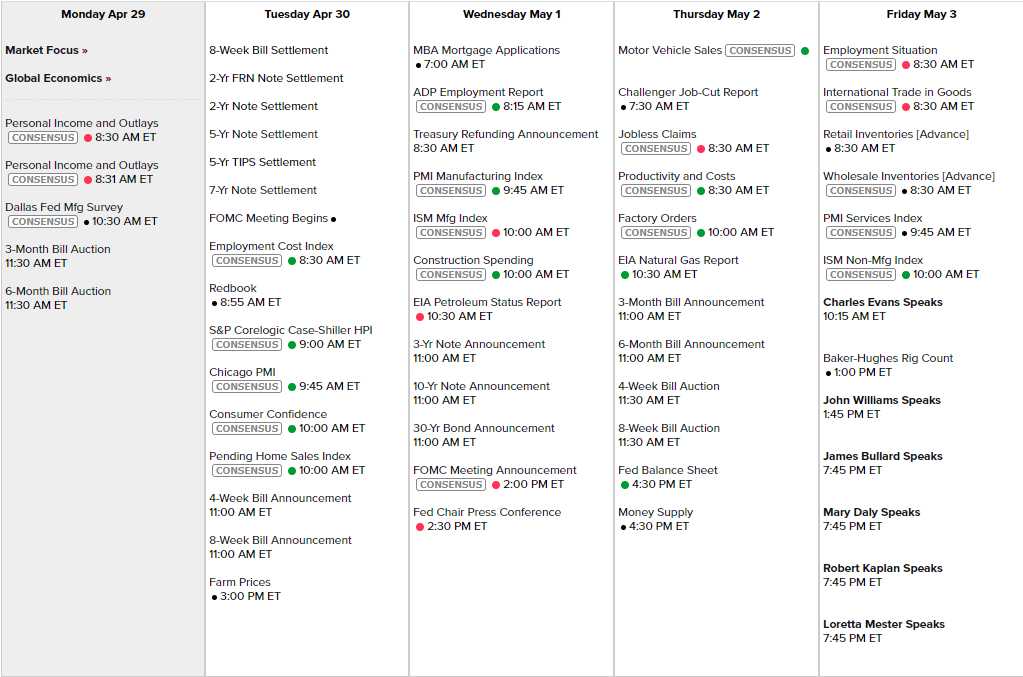

30% of the S&P 500 report this week and we'll have more than 2/3 reporting by the end of the week so, hopefully, we'll have a good handle on what's going on by then. We also have a Fed Meeting on Wednesday and Non-Farm Payrolls on Friday AND the month ends on Tuesday yet I'm VERY concerned because there are SIX (6) Fed speeches scheduled for Friday – that's a lot and it seems like they must be thinking they'll have something to spin with that schedule.

Apple (AAPL) announces their earnings tomorrow, after the bell and this evening we hear from Google (GOOGL) followed by several heavy-hitters lined up tomorrow morning. It will be nice to get a fuller picture of how the S&P stocks are performing but, generally, it's so far, so good on earnings reports – with not too many areas of serious concern.

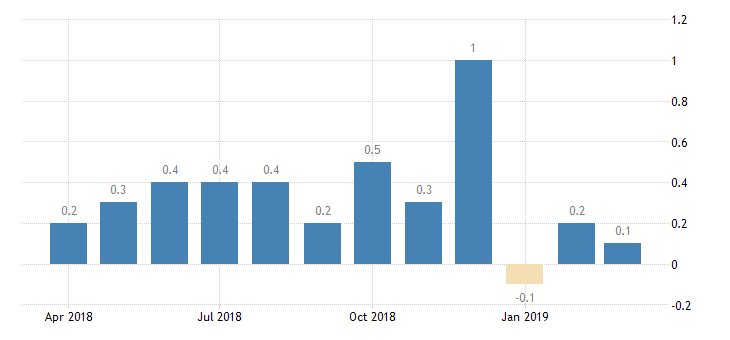

Unfortunately, our first data point of the week is not that good. Personal Income only went up 0.1%, indicating wage growth is not keeping pace with even the low inflation we supposedly have while Personal Spending blasted up 9% and that means consumers are plunging deeper and deeper into debt, trying to keep up with the inflation the Fed pretends not to see while the economy continues to run on borrowed money.

The December bump in personal income reflects all the bonus money paid out on Wall Street, not raises on Main Street and, since the turn of the year, Income Growth has died and automation will continue to kill it as companies spend more and more on machines and less and less on people. Notice in the above chart that Real Disposable Income has gone negative as rising gas prices along with inflation in other essentials is leaving consumers with less and less to spend (except on Avengers Endgame tickets, of course).

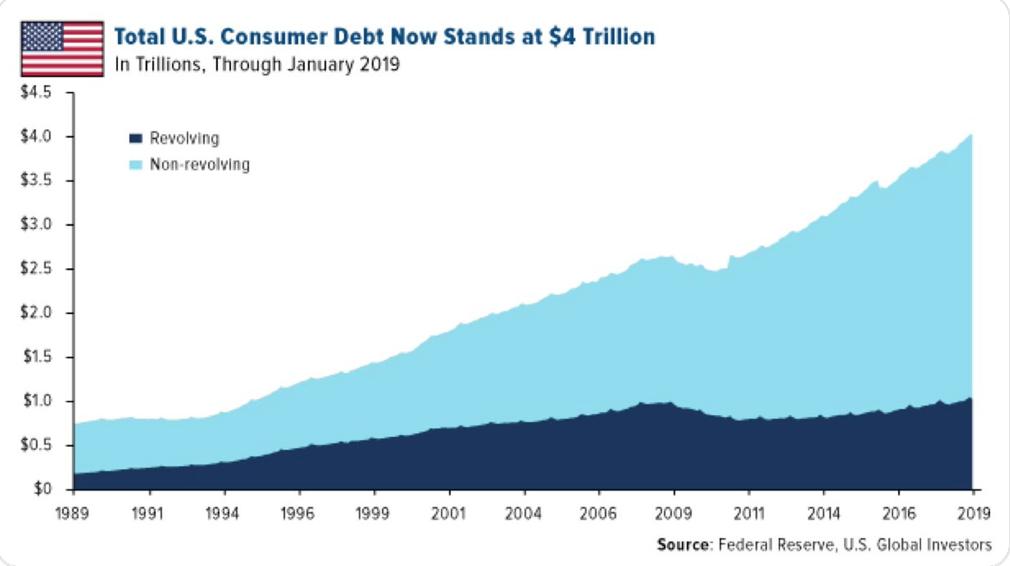

To me, this is not a recipe for a record-high stock market. If the US consumer breaks (and they are certainly stretched to the breaking point), then there's no one left in the World to pick up the slack as WE are currently the growth-driving economy in the World. We've already seen several F500 companies blame slowdowns in China for sales misses in Q1 and Europe is just limping along and Japan is a total disaster so it's up to US to carry the weight – and it's crushing our consumers in debt to try to do it.

To me, this is not a recipe for a record-high stock market. If the US consumer breaks (and they are certainly stretched to the breaking point), then there's no one left in the World to pick up the slack as WE are currently the growth-driving economy in the World. We've already seen several F500 companies blame slowdowns in China for sales misses in Q1 and Europe is just limping along and Japan is a total disaster so it's up to US to carry the weight – and it's crushing our consumers in debt to try to do it.

US Consumers are $1.5Tn MORE in debt than we were when the economy collapsed in 2008 and Corporate Debt is also at record highs – as well as Government debt. We're sitting on an ultra-low interest house of cards that can topple at the slightest increase – no wonder Trump is constantly hammering at the Fed to maintain or even lower rates – this country can't possibly afford a rate hike, it would be a disaster!

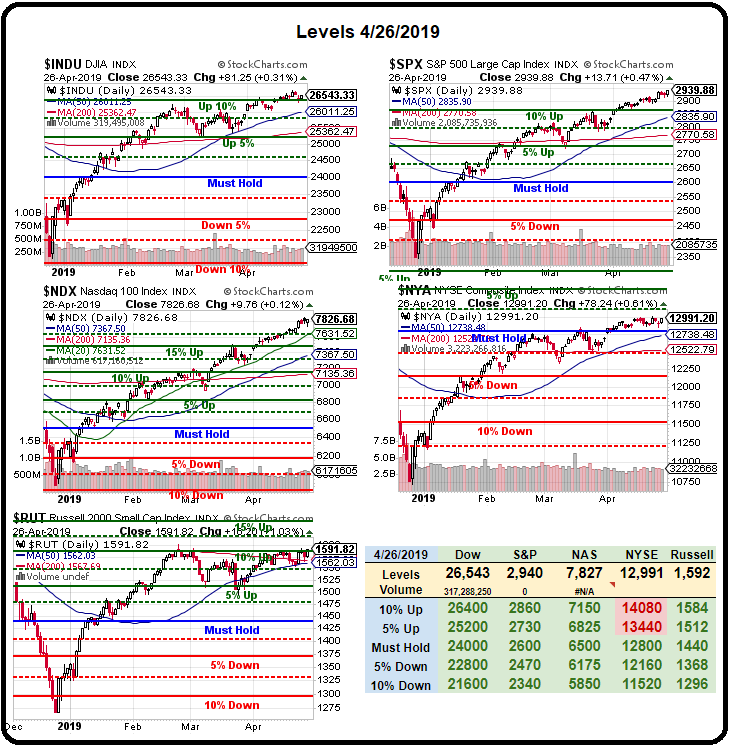

Meanwhile, you can't fight the tape and we're still pushing those record highs and, so far, we haven't seen anything that seems to be able to derail this rally. Of course, that's the trick – it's usually something you don't expect but we've been expecting a lot and a lot has happened, but nothing that's actually stopped the rally. To some extent, it's because money has nowhere else to go with Europe and Japan pushing negative yeilds on their bonds and other economies looking scary. Where can you go but US Equities?

It's a crappy investing premise – but it's the best one we have…