Well, you can't say we didn't see this coming.

Well, you can't say we didn't see this coming.

On Feb 27th, I said to our Members in our Live Chat Room:

I think we'll languish around 2,850 (100 points lower) on /ES for a couple of weeks and things will either get worse or better on the global front but that's mid-March and then we're about to get Q1 earnings, which will suck so, if the virus isn't significantly better in 2 weeks, we could be heading into a real catastrophe.

We're right on track and no, it's not me that's great at making these calls, it's or Fabulous 5% Rule™, which also told us to ignore the bounce off the -7.5% line (which was a 10% drop with an overshoot) and the quick recovery to the 5% line meant we ignored the additional 2.5% spike down and watched for 2% bounces off the 3,000 line which would take us to 3,060 (weak) and 3,120 (strong) and then the rule is that we don't believe in the strong bounce unless we close over it and then hold it for 2 full sessions without going under.

THAT is what keeps us out of trouble. So we haven't added many new posiitons in this downturn but, yesterday, we did add to some of the positions we already have, taking advantage of cheap rolls and cheap double-downs on value plays we believe have gotten too cheap. Not that they can't get cheaper – of course – but if we already doubled down we'll be happy to roll lower and if we only rolled lower, we'll be happy to doubled down – but not until we're a good 10% lower – which we don't think is very likely unless the virus gets much worse.

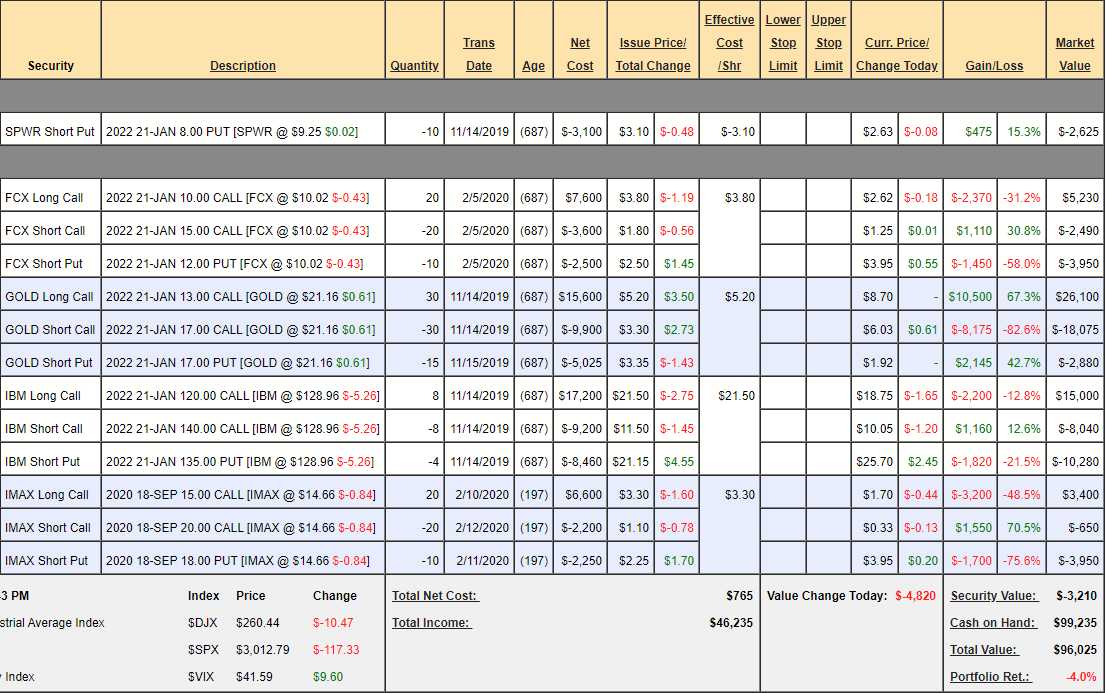

Fortunately, our portfolios are full of fantastic value positions and, for example, our Money Talk Portfolio, is only down 4% after being up as much as 10% for the year but the positions are very solid. We can't touch them unless we're on the show (next is April), so they are positions that are meant to be bullet-proof and this is a good test but also a great time for new Members to follow along so let's do a quick review.

- Sunpower (SPWR) – We would love to own them for net $4.90! Selling puts to initiate a position is a great way to put money in your pockets. We are promising to buy 1,000 shares of SPWR for $8 between now and Jan 2022 and, for the right to make us do that (at their discretion) the put seller is PAYING US $3.10 per share or $3,100 up front. If they assign us the stock (it would have to be below $8 for that to make sense), we end up owning it for net $4.90 or, if SPWR stays over $8, we get to keep the $3,100. This is our favorite way to enter a position as we either end up owning the stock for a big discount (38% in this case) or we get FREE MONEY!!! We expect this position to make the full $2,625 remaining.

- Freeport McMorRan (FCX) – They make about 1/3 of their income from Gold and Molybdenum mining, which are doing great and 2/3 from Copper, which is in the doldrums but that's no reason not to own them for the long-run and this trade is currently losing and would be a net $1,210 credit to initiate now and we do expect it to pay $10,000 for a gain of $11,210 by Jan 2022 as things get back to normal.

- Barrick Gold (GOLD) – Our Stock of the Year is doing well and we are on-track to make our full $12,000 on what is currently a net $5,145 position so $6,855 (133%) left to gain and all GOLD has to do is hold $17, which is $4 (19%) lower than it is now – how crazy is that? Aren't options fantastic?!?

- IBM (IBM) – Last year's Stock of the Year is still a good one though it took a big hit (better entry!) and it's still right in the middle of our range (we were conservative) at net $3,320 credit on the $16,000 spread so this position will make $19,320 at our $140 goal and we're very confident about that.

- IMAX (IMAX) – Back to the bottom of our range and I'm not sure we're going to fully recover by September – it depends how things play out into the rest of March but the box office is down almost 50% world-wide from last year and China, which is IMAX's biggest base, is effectively closed so they are going to have a very rough Q1 and Q2 so we're very likely to adjust this position in April to a lower, longer-term spread but, long-term, I still like them but we're not going to count on any profits from this spread, which is currently a net $3,350 loss.

So, despite IMAX, our other 4 positions are likely to make $40,010 over the next 2 years and we still have a ton of cash to deploy on new positions and hopefully there will still be some bargains to be found in April, when I'm back on the show.

At the moment, things are getting cheaper and cheaper and we're doubling down on Oil (/CL) at $43.50 to bring our average down to about $45 (down $5,000 on 4 contracts at the moment) and we can play the Nasdaq (/NQ) to bounce off 8,350 but tight stops below. I'm not expecting a big recovery, just bounce this morning and we might finish the day very close to that 2,850 line.

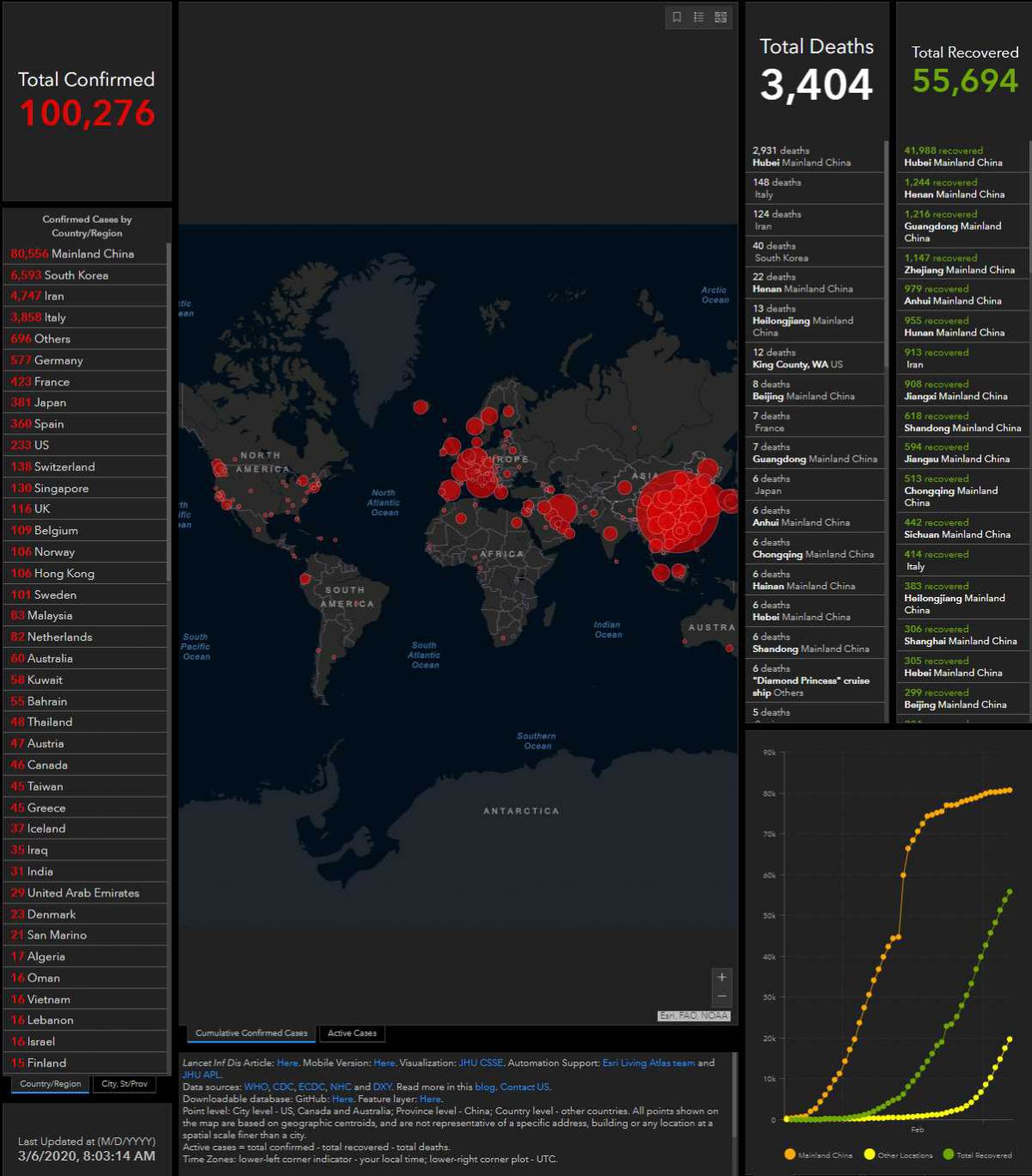

As we discussed during Wednesday's Webinar, we now have over 100,000 infections (with an alarming jump of infections outside of China) and that's going to make for lots of headlines over the weekend so the panic will continue BUT we can also expect some big Government action over the weekend to calm the markets down next week. Whether or not it will be effective remains to be seen.

Have a great weekend,

– Phil