Virus cases are down.

Virus cases are down.

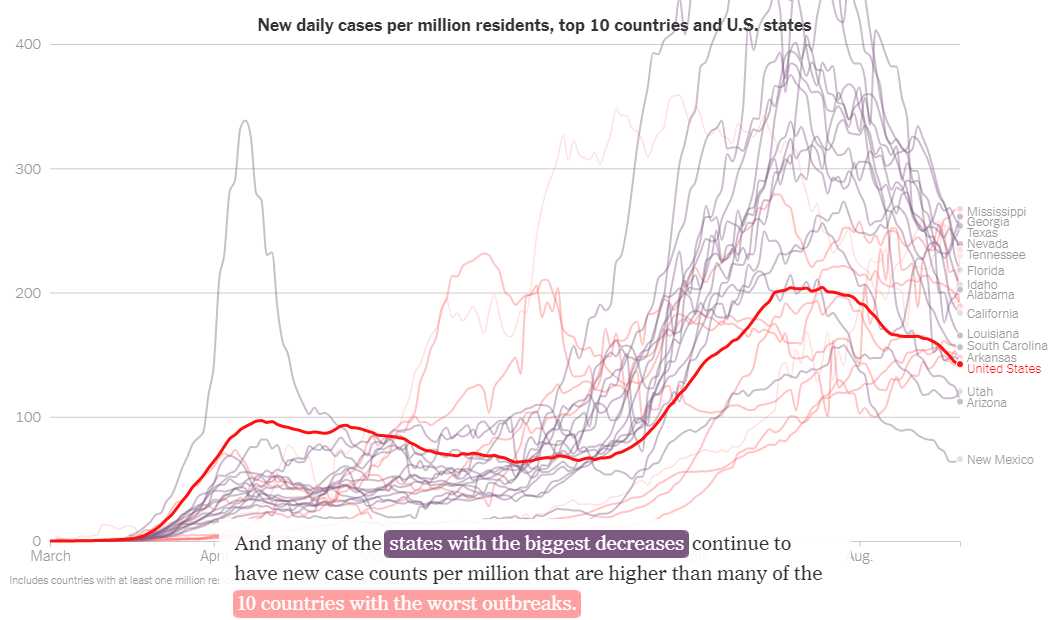

President Trump was right – as soon as we stopped the CDC from counting cases, less cases have been reported and the official number of US virus cases has dropped off considerably. That's SCIENCE! As you can see from this New York Times chart, however, there's a very suspicious amount of states that are way over the US Average, which indicates the US average is simply not reporting all the cases. SCIENCE!

Also, as pointed out, even our best states are having more cases than the 10 WORST countries in the world (besides ours, of course). Meanwhile, we have a new miracle cure – exactly the kind of cure rich people think up – we take the plasma from people who have recovered from covid and inject it into people who've been exposed. It's called "convalescent plasma" and it's based on the same sciency-sounding principle that has old, rich people getting transfusions from young, healthy people to "keep their blood fresh".

Trump has had the FDA grant this "treatment" and emergency-use authorization which is like the FDA saying "This could be total BS but we don't have any better ideas, so what the Hell?" Trump also had the FDA grant the same authorization to hydroxychloroquine back in April and it was revoked in June once a few studies were done that showed the "treatment" to do far more harm than good.

NONETHELESS, Global markets are rallying this morning on news of a "cure" with the Dow back above the 28,000 line but we're still shy of the February high of 29,500. The S&P 500 is over 3,400, where it topped out before and the Nasdaq was 9,750 before the crash but now blown past it at 11,680 – 20% over the pre-crash highs and 50% over the lows of March.

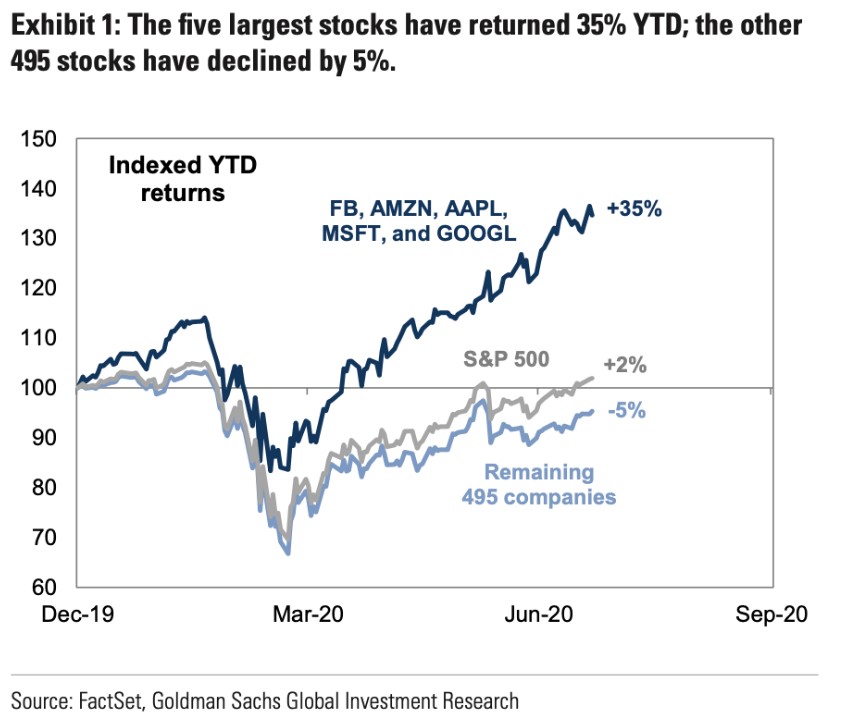

Of course, the reason the Nasdaq 100 is doing so well is that it is the most concentracted index on FAAMG: Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Google (GOOGL) – our Trillionaire Corporate Citizens. Those stocks are up 35% for the year, adding $3Tn in market cap in 8 months so, if you're wondering where all that stimuluss money went, look no further than into the stock valuations of our 5 Tech Titans.

Of course, the reason the Nasdaq 100 is doing so well is that it is the most concentracted index on FAAMG: Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Google (GOOGL) – our Trillionaire Corporate Citizens. Those stocks are up 35% for the year, adding $3Tn in market cap in 8 months so, if you're wondering where all that stimuluss money went, look no further than into the stock valuations of our 5 Tech Titans.

In the S&P, the Tech Titans have gained 35% while the rest of the index has gained 2% – and that was only through the end of July! In the Nasdaq, those companies ARE the Nasdaq 100 – the other 95 don't matter as far as index weighting. Even the Dow (30 stocks) is deeply affected by the moves of AAPL and MSFT, which have added 2,125 points out of the 350-point loss since Januar 1st.

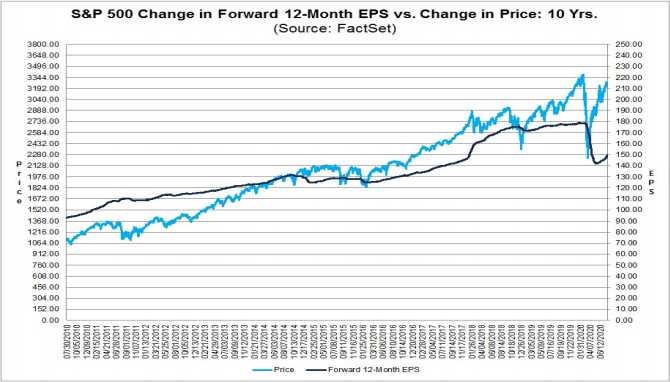

That's right, the Dow Jones started this year at 28,500 and now it's at 28,150 so DOWN 350 points for the year DESPITE MSFT gaining $50 and AAPL gaining $200. Each $1 move in a Dow component adds 8.5 points to the index so 2,125 added by two companies and 2,275 lost by the other 30 in 2020 – yet we think this is some kind of fabulous bull market? Q2 Earnings for the S&P 500 were down 35%:

Earnings Scorecard: For Q2 2020 (with 63% of the companies in the S&P 500 reporting actual results), 84% of S&P 500 companies have reported a positive EPS surprise and 69% have reported a positive revenue surprise. If 84% is the final percentage, it will mark the highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008.

Earnings Growth: For Q2 2020, the blended earnings decline for the S&P 500 is -35.7%. If -35.7% is the actual decline for the quarter, it will mark the largest year-over-year decline in earnings reported by the index since Q4 2008 (-69.1%).

Earnings Revisions: On June 30, the estimated earnings decline for Q2 2020 was -44.1%. Nine sectors have smaller earnings declines or higher earnings growth rates today (compared to June 30) due to upward revisions to EPS estimates and positive EPS surprises.

Earnings Guidance: For Q3 2020, 7 S&P 500 companies have issued negative EPS guidance and 25 S&P 500 companies have issued positive EPS guidance.

Valuation: The forward 12-month P/E ratio for the S&P 500 is 22.0. This P/E ratio is above the 5-year average (17.0) and above the 10-year average (15.3).

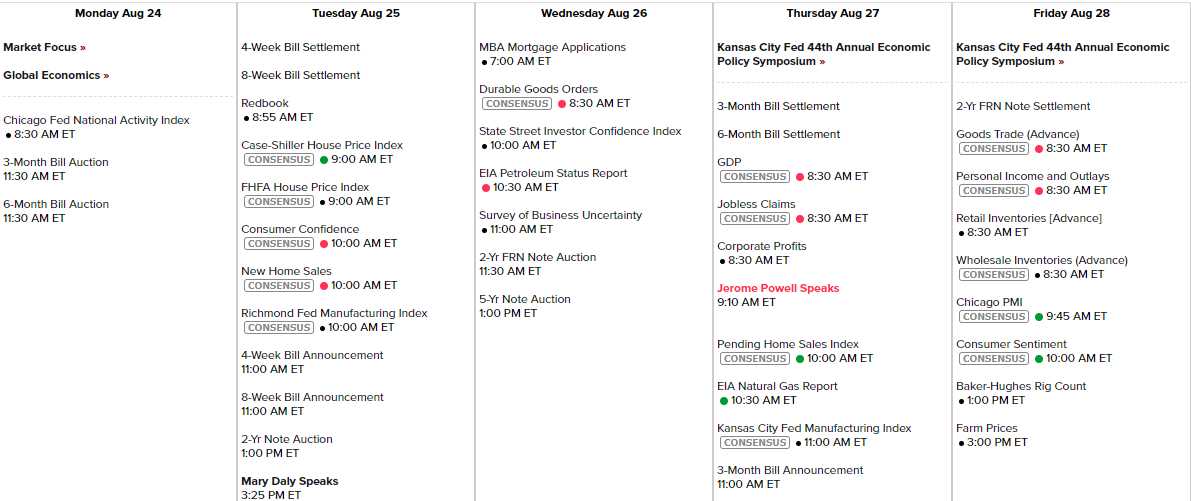

The Fed is, of course, injecting their own plasma into the market but will it be enough to save the patient or just another one of Trump's fake "cures"? There's a fake conference for the Fed "in Jackson Hole" even though Powell will be speaking from his living room in his pajamas on Thursday and not from Wyoming. Notice Powell is speaking right after what is bound to be a disastrous GDP Report – hopefully he will be able to make us feel better.