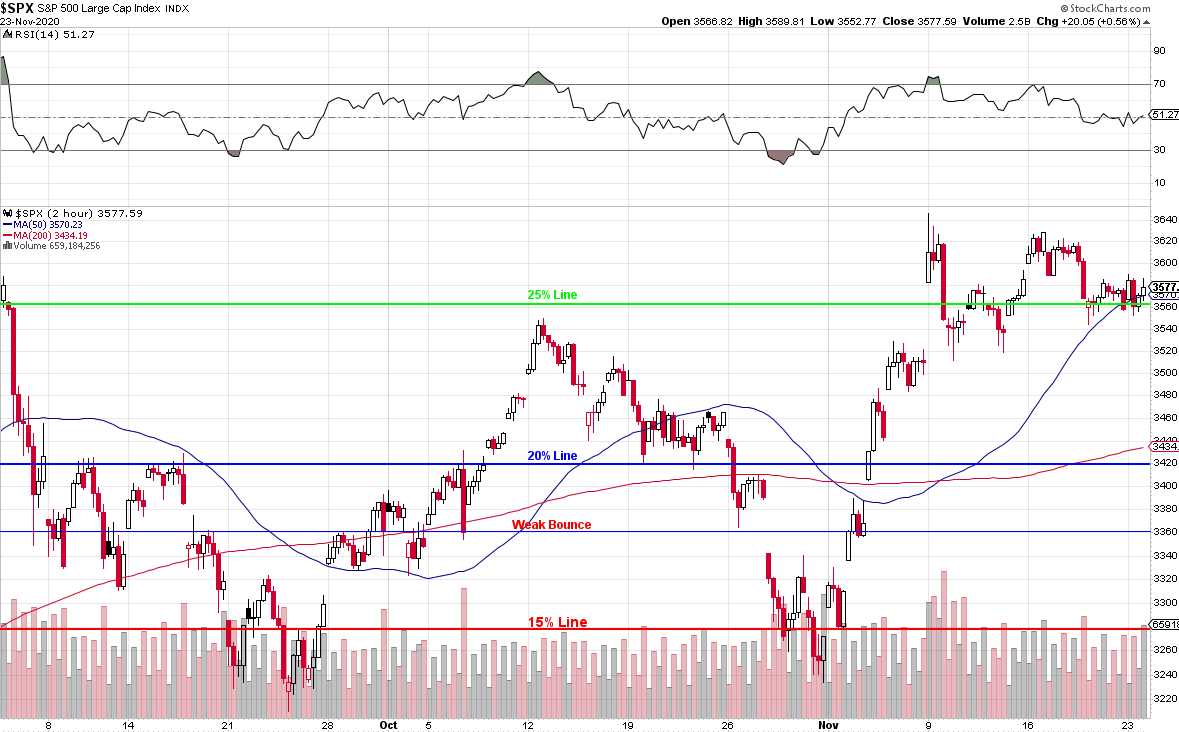

This is a strong-looking chart:

The S&P 500 is clearly consolidating ABOVE the 3,600 line at this point and, if we hold it into the end of the year, that will bode very well for next year. Nonetheless, we're still shorting the S&P (/ES) Futures if they dip back below the 3,600 line (now 3,602) with tight stops above simply because it's a very positive risk/reward play as we can stop out at, for example, 3,602.50 with a $125 loss but, just yesterday, /ES was down at 3,550, which would have been a $2,500 gain. When you can win $2,500 and risk $125, you only have to be right once in a while to do very well.

Yes there is going to be a vaccine, I would say by May, things should be getting back to normal but they aren't normal now and they won't be normal for Christmas so I really don't see how Q4 GDP will be any good and Q1 not so great either. So it's another sub-par year for the first half, at least and, even if there is not a coup, Biden will not be likely to run up $6Tn in debt – as Trump did this year. Biden is also very likely to raise taxes on the wealthy (over $400,000 in income) and wealthy Corporations – doesn't that impact their bottom-line earnings?

Biden is likely to move us towards a stronger Dollar and that too, is not great for stocks and Biden wants stronger wages – not good for the bottom line. That's why Chipotle (CMG) is one of my favorite shorts – higher wages hit them hard, as will reality if it ever rears its ugly head and notices that CMG is trading at over 150 TIMES their annual earnings.

$1,300 per share is a $36Bn valuation for a company whose best year was a profit of $475M – and that was back in 2015! Since then, $22M (when they poisoned their customers), $176M, $176M and $350M last year. Even if they get back to $500M ($164M in the first 3 quarters of 2020) – they'd still be at an insane 72x earnings for a restaurant that is near its saturation point. Labor is 1/3 of their expenses and expenses on $5.5Bn in 2019 revenue that left them with a profit of $350M must be around $5.15Bn and 1/3 of $5.15Bn is $1.71Bn or 500% of their profits.

That is how we analyze a company. Think about what can go right AND what can go wrong and do the math! With CMG, a 10% increase in labor cost will hit them for $171M or 1/2 of their profits. Since they already have 2,700 restaurants (MCD and SBUX have 35,000 each), they can expand but not rapidly so even optimistically assuming 20% growth in new stors without straining cash flow (no way) – getting to a reasonble valuation above $20Bn is simply out of reach for this decade.

| CMG Long Put | 2022 21-JAN 1,300.00 PUT [CMG @ $1,281.00 $0.00] | 6 | 10/28/2020 | (423) | $136,800 | $228.00 | $-31.90 | $210.70 | $196.10 | $0.00 | $-19,140 | -14.0% | $117,660 | ||

| CMG Short Put | 2022 21-JAN 1,100.00 PUT [CMG @ $1,281.00 $0.00] | -3 | 10/28/2020 | (423) | $-39,525 | $131.75 | $-25.05 | $106.70 | $0.00 | $7,515 | 19.0% | $-32,010 | |||

| CMG Short Call | 2021 15-JAN 1,300.00 CALL [CMG @ $1,281.00 $0.00] | -5 | 10/28/2020 | (52) | $-41,550 | $83.10 | $-30.30 | $52.80 | $0.00 | $15,150 | 36.5% | $-26,400 |

When will people be smart enough to agree with me and sell this turkey off? I have no idea but we did sell the Jan $1,300 calls for $83.10 ($41,550) in our Short-Term Portfolio last month as we thought $1,300 was just too ridiculous and we sold 3 $1,100 puts for $131.75 ($39,525) – just in case it wasn't. That means we've collected $51,075 against 5 longs and 3 shorts so we have roughly $100 of room to spare on the upside (to $1,400) and $150 to the downside (since there are only 3 short puts), so that's as low as $850.

So the bet we made is that CMG will be above $850 ($23.4Bn valuation) next year but below $1,300 in the short-term. If we're right, we will make $51,075 plus whatever we make on the short $1,300 puts, which then double-cover the short 1,100 puts we sold. It seems like a risky play but I don't see it that way because I have strong conviction that CMG is simply not worth $1,300 and can't sustain it.

Our net $55,725 spread is now net $59,250 – not much of a move but that just means it's still good for a new trade. We like it in the STP as I see no reason CMG would hold up if the market falls so it makes a nice hedge with a potential to pay back over $120,000 if CMG is below $1,100 – plus whatever we make selling calls along the way. That's a nice hedge!

The best thing about this hedge is that, even if the market does well, investors might still wake up and realize CMG is NOT a stock they should be investing in. They might even poison some more customers! What I DON'T think is going to happen is that everything goes perfectly and they grow revenues and earnings 50% in a year and begin to justify this outrageous valuation. That I do not see happening. We've never had a short play for a Trade of the Year – this one is in the running….

- Stocks Gain on Start of Formal Biden Power Shift: Markets Wrap.

- World Economy Risks Buckling Into 2021 Despite Vaccine Nearing.

- Central Banks To Add Liquidity Worth 0.66% Of Global GDP On Average Every Month In 2021.

- China Debt Defaults Set to Top 100 Billion Yuan for a Third Year.

- These AAA-Rated Bonds Are Tumbling as China Default Fears Spread.

- SEC Pressures China Firms’ Listings, Warning of Accounting Risks.

- "Just Let Me Go" – Shanghai Airport Plunged Into Chaos After Workers Sealed In For COVID Testing.

- JPMorgan Sees Possible $300 Billion Rebalancing Flow From Stocks.

- BlackRock to Buy Equity-Index Provider Aperio for $1 Billion.

- Propaganda, Election Fraud, & The Death Of Journalism.

- Micron stock surges to highest prices since the dot-com boom as analysts see cloud demand improving.

- 3.1% of COVID cases traced to restaurants, bars: LA county data.

- Doctors say CDC should warn people the side effects from Covid vaccine won’t be ‘a walk in the park’

- Elon Musk Overtakes Bill Gates to Grab World’s Second-Richest Ranking.

- In Reversal, General Motors Backs Biden, Withdraws Support For Trump Emissions Rollbacks.

- Trump officially authorizes presidential transition, but there’s a catch.

- 7 Things That Used To Be "Crazy Conspiracy Theories" Until 2020 Happened.