Dow 32,000!

Dow 32,000!

I guess it's time to read that book by Glassman and Hassett from 1999 – as that was their prediction at the time for where we'd be in 5 years. Sure it's 22 years later but, hey, better late than never, right? At the time, with the Dow at 12,000, they said:

The single most important fact about stocks at the dawn of the twenty-first century: They are cheap….If you are worried about missing the market's big move upward, you will discover that it is not too late. Stocks are now in the midst of a one-time-only rise to much higher ground–to the neighborhood of 36,000 on the Dow Jones industrial average.

The Dow was pushed down by the bursting of the dot-com bubble as the NASDAQ peaked in 2000 and bottomed out in 2002, and by the September 11 attacks in 2001. The Dow fell below 8,000 in 2002, remained below 12,000 until 2006, and below 30,000 until later 2020 and now, here we are at 32,000 (for a moment), this morning.

At the time, the book was largely discredited as misstating the risk characteristics of equity securities as equivalent to U.S. Treasury fixed income securities, it is commonly believed discredited for predicting a grossly inflated stock market.

The point is, everyone sounds like a genius when telling you to follow a trend – for as long as the trend holds out. When the trend reverses, however, it's more like "who could have seen that coming?" Well, rational people for one thing. Water boils at 212 degrees and you can put water on the stimulus of a 500 degree burner and it will heat up very quickly and the trend from 180 to 200 may suggest the water will be at 280 degrees in 10 minutes but it never will be, will it? That's because, at a certain point, Physics takes over and limitations are reached.

No matter how much stimulus you apply, you will never get the water over 212 degrees because it simply can't be water at 213 degrees. The economy and the market may not be as rigidly constrained as hydrogen bonding but they too have their physical limits – as does, believe it or not, the stock market. Even with the Fed printing $4Tn a year, there is only so much money in the World and, in December of 2019, the US Equity Market was $37.7Tn. After a full year of stimulus arguably about $7Tn in total, the US Equity Market Cap is now $55.3Tn – up $17.6Tn.

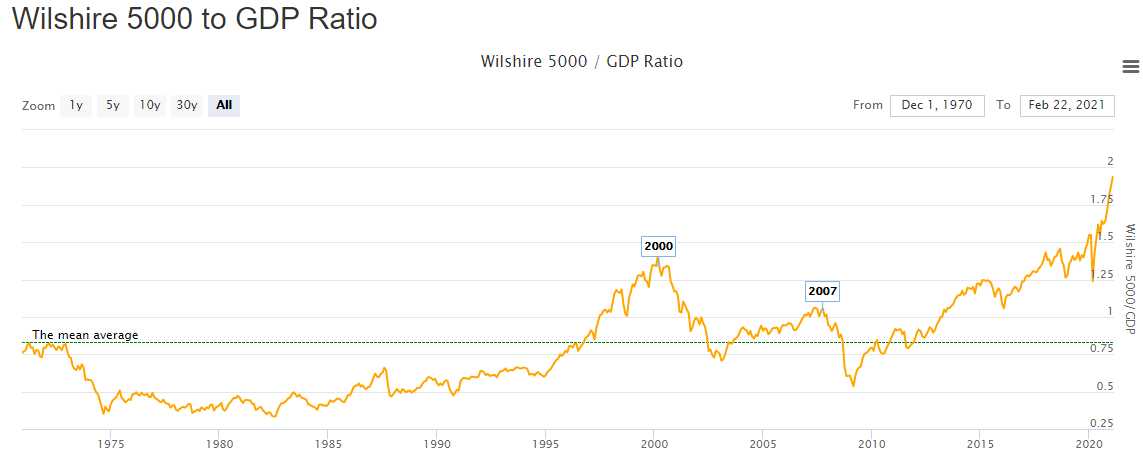

How did the market grow $17.6Tn when only $7Tn in new money was created? Did the GDP grow $10Tn? No, it shrank. That $10Tn – 20% of the entire market cap – is empty speculation backed up by ZERO Dollars of actual cash. You can see it in this chart that compares the Wilshire 5000 to GDP and you can see how high we are sitting compared to previous bubbles:

That's pretty high, right? You don't really have to do the math to see that a bubble like this is going to burst – the question is only when. It's OK to participate in the rally (we are) but always keep one hand firmly on the exit door at all times because this is a very dangerous low-volume rally – which again is about physics – as there's only so many buyers so, when people do decide to sell, the whole market could look like GameStop (GME) – which is up again this morning.

It's a really fun ride and even more fun when you catch it right but not fun at all if you get on the wrong side so DON'T play with money that you cannot afford to lose. Out in the real World, money is very hard to make these days.

Be careful out there!