Happy holiday!

Happy holiday!

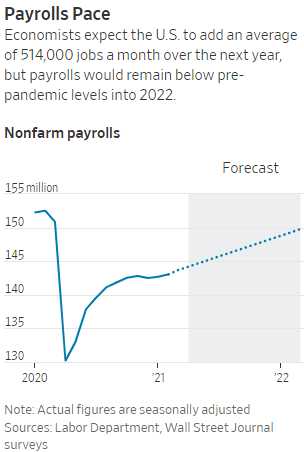

The markets are closed this morning but, for some reason, they are still releasing the Non-Farm Payroll Report, which is usually a market-mover. It's 8:30 now and the numbers are bigger than expected with 916,000 new jobs added in Biden's second full month as President and that's well over expectations and, more importantly, Unemployment is down to 6%. The Futures are open and the Dow is blasting higher and the other indexes are likely to follow

“There’s a seismic shift going on in the U.S. economy,” said Beth Ann Bovino, a Ph.D. economist at S&P Global. The confluence of additional federal stimulus, growing consumer confidence and the feeling that the pandemic is close to abating – despite rising infections in recent weeks – is propelling economic growth and hiring, she said.

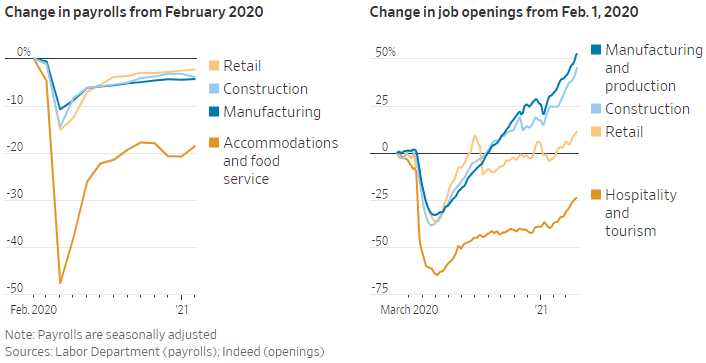

Stronger growth should return jobs to industries with the deepest losses during the pandemic, such as restaurants, stores and hotels, and support additional job growth at warehouses, delivery services and manufacturing. Job growth could also pick up in hard-hit cities in the Northeast and California, and in tourist hotbeds such as Las Vegas and Orlando.

There are still about two million fewer food-service jobs this year in the U.S. than before the pandemic-related shutdowns that began in March 2020. The industry accounts for one in five total jobs lost in the past year, suffering the most pandemic-related losses. Those jobs can come back quickly once we are vaccinated and more people with jobs means more people who can afford to eat out – so the cycle tends to feed itself.

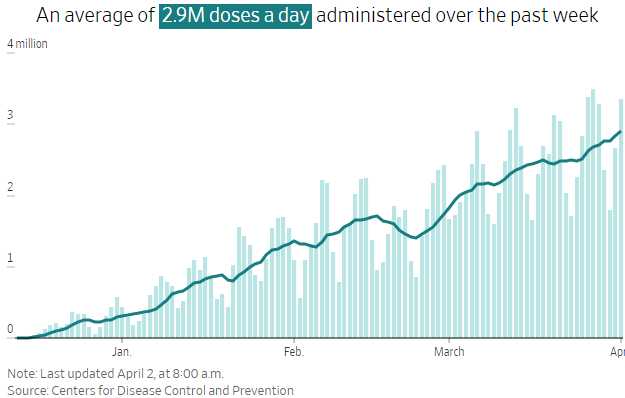

Another major factor in favor of a better Q2 is our very successful vaccination roll-out in the US with an average of 2.9M doses PER DAY being given out. That is 87M more in April and 90M more in May – only if we don't speed up. Biden is miles ahead of his vaccine rollout schedule after 72 days on the job. 30% of the poulation has gotten at least on dose and I'm getting mine tomorrow! My appointment is at 11:36 am, so they have started to get very exact and efficient about it and that's helping to speed up the process. My mother got hers in early March and she waited 4 hours in a car line both times.

Another major factor in favor of a better Q2 is our very successful vaccination roll-out in the US with an average of 2.9M doses PER DAY being given out. That is 87M more in April and 90M more in May – only if we don't speed up. Biden is miles ahead of his vaccine rollout schedule after 72 days on the job. 30% of the poulation has gotten at least on dose and I'm getting mine tomorrow! My appointment is at 11:36 am, so they have started to get very exact and efficient about it and that's helping to speed up the process. My mother got hers in early March and she waited 4 hours in a car line both times.

153.6M doses have been administered so far and 200.5M have been distributed (Democrats love data) which means we can still pick up the pace on dosing without running low on vaccines. 75% of the population should have at least one dose by July 1st at the current pace but it won't take much of an improvement to get us there by the end of May and that should be pretty much game over for Covid – hopefully. We still had 77,717 cases yesterday and 955 people died so nothing to celebrate yet, but there's light at the end of the tunnel.

Meanwhile, will someone tell the Republicans to shut the F up about Corporate Taxes? Of all the things Biden could have done to pay for the stimulus, putting Corporate Taxes back to 28% (from 21%) is the smallest possible burden for our country. We had a great stock market under Obama and did much worse under Trump (though that was really Covid's fault, not the tax breaks) and 28% still is not the 35% we had before Trump.

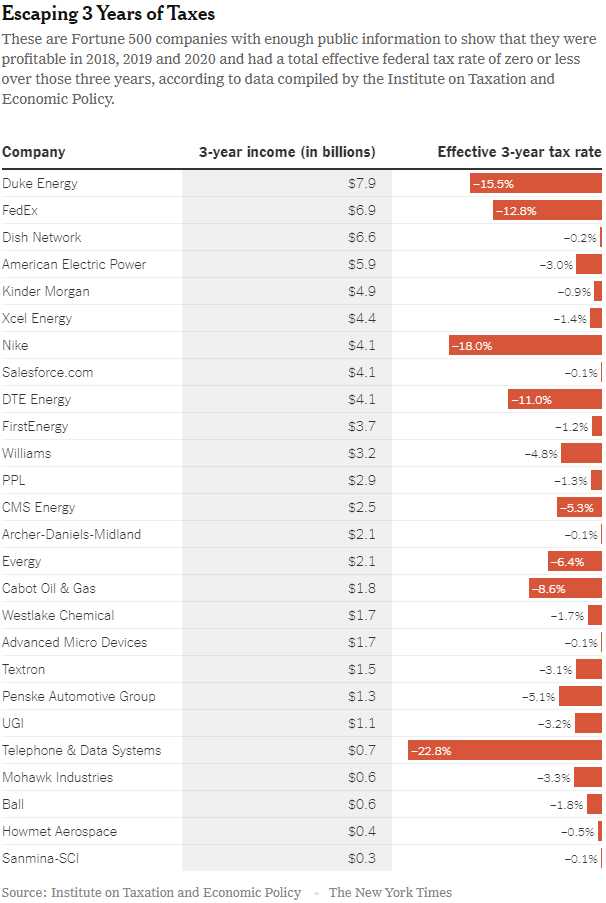

Meanwhile, here is the reality of our tax code – with so many loopholes that these companies paid NO taxes at all under Trump – some even collected money from the Government, despite making vast sums of money:

Remember, these are just companies that paid NO taxes, there are 1,000 companies that paid very little tax on their earnings – the average collection rate on Corporate Income is just 12% and Corporations, on the whole, contribute just 10% of the tax base – the rest is paid by individuals, which is funny since labor costs average 20% of Corporate Revenues, yet we give 1/3 of it back to the Government while the Corporations themselves pay about 2% of their revenues as taxes. Does that seem fair?

Tax avoidance strategies include a mix of old standards and new innovations. Companies, for example, saved billions by allowing top executives to buy discounted stock options in the future and then deducting their value as a loss – that's brilliant! The Biden Administration announced this week that it planned to establish a kind of minimum tax that would limit the number of zero-payers along with the rate increase. The White House estimated that the revisions would raise $2 trillion over 15 years, which will be used to fund the President’s ambitious infrastructure plan.

Referring to the proposed revisions, Matt Gardner, a senior fellow at the taxation institute, said, “If I were going to make a list of the things I would want the corporate tax reform to do, this outline tackles all these issues.”

Where do you stand on this issue? It's a good weekend to contemplate: "What would Jesus do?"

Have a happy holiday!