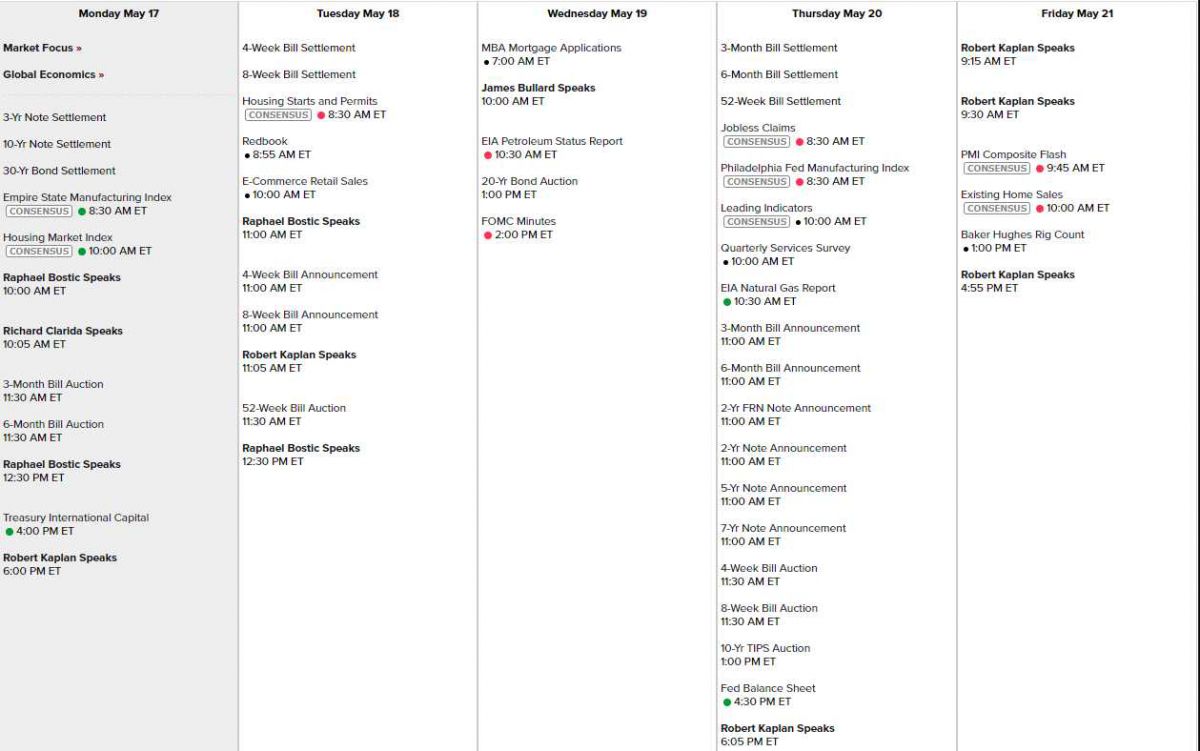

There are 12 Fed speeches this week.

There are 12 Fed speeches this week.

6 of them are by Robert Kaplan, who is the President of the Federal Reserve Bank of Dallas and was a Vice-Chairman at Goldman Sachs (GS) with a 23-year carrer there before being sent off to the Fed. Kaplan is the Fed's Inflation Hawk and that means, most likely, he's here to cool off the markets so make sure you have your hedges up to date (see Friday's PSW Report) as it's not only time for retail earnings (which could be rough) but also options expire on Friday – so strap yourselves in...

"What you don't know is, depending on how long that goes on, whether that starts to get embedded in inflation expectations, and you worry that inflation expectations start to get to be more elevated, and then you are getting them elevated to a level that is not consistent with anchoring them at 2%. That's the part I'm concerned about – this is a risk for me." – Kaplan

On Friday, Kaplan said contacts in industries affected by the global semiconductor shortage, for instance, have told him it could now take as long as two years to resolve the issue. Clogged chip supply chains led to a record jump in used car and truck prices last month. And it's not just chips, Kaplan said on Friday: it's unclear how long bottlenecks could last in many industries. There are signs inflation expectations are beginning to rise. Consumers’ estimates of inflation for the next five years shot up to 3.1% – the highest in more than a decade, a University of Michigan survey showed on Friday.

On Friday, Kaplan said contacts in industries affected by the global semiconductor shortage, for instance, have told him it could now take as long as two years to resolve the issue. Clogged chip supply chains led to a record jump in used car and truck prices last month. And it's not just chips, Kaplan said on Friday: it's unclear how long bottlenecks could last in many industries. There are signs inflation expectations are beginning to rise. Consumers’ estimates of inflation for the next five years shot up to 3.1% – the highest in more than a decade, a University of Michigan survey showed on Friday.

Also signaling caution is AT&T's (T) spinning off Warner Media to merge with Discovery (DISCB) for $43Bn in cash. T bought Warner Media for $81Bn just 3 years ago and has been criticized for holding $169Bn in total debt – the most of any non-financial company. T will maintain 71% ownership in the combined company, so a good deal for them overall but it seems very likely they are reducing debt ahead of a cycle which will raise their borrowing costs and T pays out $15Bn in annual dividends – they can't risk missing one of those payments.

Expect more of the same as companies who have a lot of ourstanding debt to refinance begin to worry about what the rates will be when the time comes. We have a 20-year Bond Auction on Wednesday and we'll see how that goes as well as a 10-year TIPS Auction on Thursday. The last 10-year auction went very poorly and lack of demand for bonds at auction is another sign the Fed is getting behind the curve on inflation and will need to raise rates in the near future. As we've noted before – companies are running record levels of debt as they are comming off a 10-year low-interest borrowing binge. What happens next?

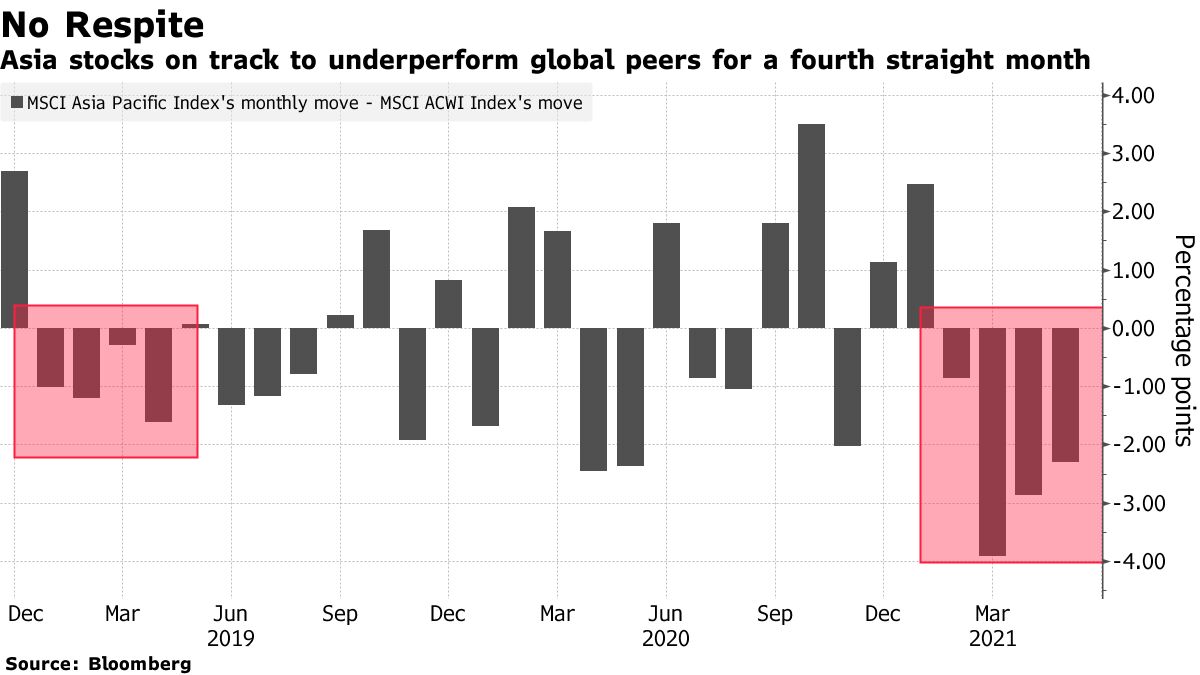

Asia is a little ahead of us in suffering for inflation and the MSCI Asia Pacific Index fell 3.2% last week and is now down 2.7% for the month and this is the 4th consecutive month of declines as Covid is resurging and Earnings have been disappointing along with concerns about Inflation and Governments backing off on the stimulus in response. Singapore, for example, is going back on lock-down and their index fell 3.2% on Friday when that was announced. India is, of course, a complete disaster, with 300,000 new daily cases of Covid.

The market is unwinding. Last week, the S&P ETF (SPY) fell from 422.50 on Monday to 405.41 on Wednesday on 383.5M volume (127.8M/day) and then bounced back Thursday and Friday to 416.58 on 188.5M volume (94.3/day). 33% more down volume than up and dip buyers in tech stocks appear to be mainly day traders and other individuals, rather than hedge funds and other professional investors. Retail traders bought a daily average of $300M in tech stocks and related ETFs, according to data from Vanda Research. Meanwhile, JPMorgan's (JPM) hedge-fund clients boosted bearish wagers against growth stocks while adding money to value sectors like banks. Semiconductor stocks in particular saw cooling interest amid production constraints, with net exposure falling to the lowest level since at least the start of 2020, according to JPMorgan’s prime broker data.

Earnings will be coming in hot and heavy this week and lots and lots of retail reports are on deck but, overall, I'm expecting a down week unless Kaplan is changing his tune: