Fed meeting Wednesday.

Fed meeting Wednesday.

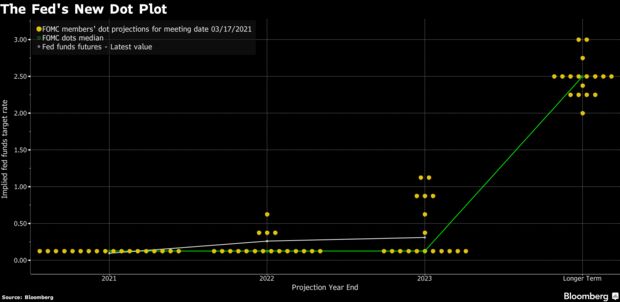

Until then, nothing is likely to happen and, after that, anything can happen. There are currently rumors that the Fed may begin to gear their language to being to anticipate a rate hike sooner than later – due to recent data that has pointed to rampant inflation. Sooner, of course, would be next year anyway, as the March "Dot Plots" didn't indicate any movement by the Fed through 2023 but the March Fed Data pedicted consumer prices rising 2.4% for the year and, after a 5% Q2, they'd have to flall by more than 1% in Q3 and Q4 for that to be right and, if that happened – we'd be in a recession.

Fed officials’ individual March projections, charted in their dot-plot, showed all 18 policy makers expected to leave interest rates unchanged through this year. Four expected to start lifting rates next year, and seven projected that rates would be higher by the end of 2023. The new dot-plot coming Wednesday should show more individuals expect to raise rates in 2022 or 2023. A June survey of 127 market participants by MacroPolicy Perspectives LLC showed 68% of respondents expecting at least one rate increase in 2023.

So, EITHER the Fed has to admit that inflation is running away and they need to tighten to control it OR the Fed needs to predict a Recession in the 2nd half of the year – what's it going to be? Not only has Inflation soared since then, as the economy has rebounded much faster than expected, but businesses have struggled to hire workers and shortages of key materials have wreaked havoc on supply chains.

Signs of surging inflation have emerged faster than the Fed anticipated as recently as its April policy meeting. Fed officials haven’t publicly commented on the May inflation report because it was released Thursday during their self-imposed blackout period, when they refrain from speaking publicly on monetary policy ahead of their meeting. Before the blackout period began on June 5, officials repeatedly said they expected this year’s inflation surge to prove "transitory."

Signs of surging inflation have emerged faster than the Fed anticipated as recently as its April policy meeting. Fed officials haven’t publicly commented on the May inflation report because it was released Thursday during their self-imposed blackout period, when they refrain from speaking publicly on monetary policy ahead of their meeting. Before the blackout period began on June 5, officials repeatedly said they expected this year’s inflation surge to prove "transitory."

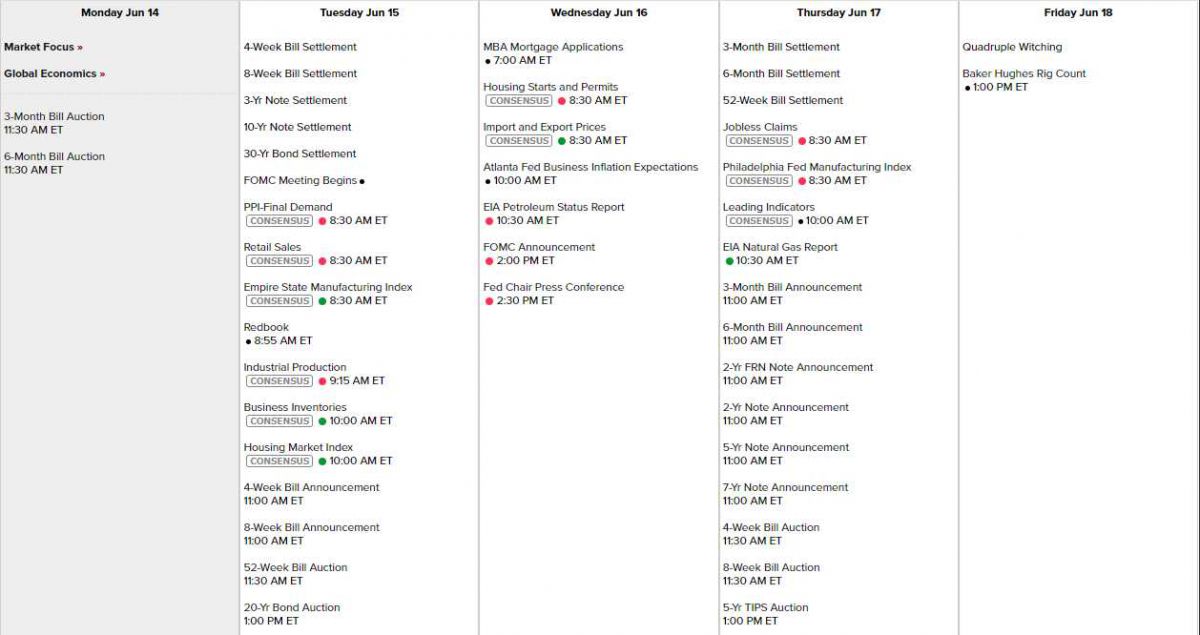

We have some useful data around the Fed with a lot of Bond Auctions going off this week along with PPI, Empire State Manufacturing, Industrial Production, Business Inventories and Housing – all by 10am. Wednesday, besides the Fed, we have Housing Starts, Mortgage Applications and the Atlanta Fed's Inflation Expectations ahead of whatever BS the Fed tries to spin at 2pm – that will be fun!

Thursday it's the Philly Fed and Leading Economic Indicators, which have not been good lately and Friday is the end of the Quarter for options – so that could be crazy all on it's own.

Earnings are harldy even worth mentioning but there are still some good ones like ORCL, HRB, LEN, KR and ADBE this week but mostly it's all about the Fed. Oil hit $71.75 this morning and we shorted $71.50 over the weekend so NOT GOOD but if we DD here and hopefully get 1/2 back out at $70 – then all we've done is raised our basis on another silly Monday rally. Oil is up today because the G7 did not mandate a mostly electric fleet by 2030 over the weekend. How that affects the price of gas today – I do not know.

The communique reiterated the promise for rich countries to release $100 billion annually in support for developing world efforts to cope with climate change transitions. It said the G-7 members will all increase their contributions but did not disclose by how much. The G7 also disappointed on the vaccine front, failing to pledge the hoped-for 1Bn doses desperately needed around the World.

“Recognizing that ending the pandemic in 2022 will require vaccinating at least 60% of the global population, we will intensify our action to save lives,” the leaders said in their final communique from the G-7 summit in the coastal Cornwall region of the U.K.

That's right, they pledge to get around to it NEXT YEAR!

No wonder Jeff Bezos is leaving the planet…