Just when we thought we were out….

Just when we thought we were out….

China has had 483 cases of the Delta Virus in the past 2 weeks – more than they had in the first 5 months of the year. 15 of 31 Chinese provinces are reporting Delta cases. According to Chen Xi, a professor of Public Health at Yale:

“Once it reaches so many provinces, it’s very hard to mitigate. I think this would be surprising and shocking to the rest of the world. Such a powerful government has been breached by Delta. This will be a very important lesson — we cannot let our guard down.”

For now, China has stuck to its strict playbook. Across the country, the government has instructed people not to travel unless necessary. In the cities of Zhangjiajie and Zhuzhou, 5.4 million people have been barred from leaving their homes. Roughly 13 million residents in the city of Zhengzhou, the site of deadly floods in July, had to stand in line for virus testing starting last weekend.

US investors are also following the same playbook as last year – ignorning the Delta Varient the same way we ignored Covid-19 (original recipe) back in March of last year. After all, how could something all the way over in China affect the US markets, right?

Of course, now we know that, should the market begin to falter – the Government will jump right in and hand us Trillions and Trillions of Dollars and it won't have any sort of negative repercussions at all – not even inflation! It is so great to live in this magical land where there are no consequences for our actions, right?

Of course, now we know that, should the market begin to falter – the Government will jump right in and hand us Trillions and Trillions of Dollars and it won't have any sort of negative repercussions at all – not even inflation! It is so great to live in this magical land where there are no consequences for our actions, right?

35% of all the money in the World was printed in 2020. If there's 35% more money and the same amount of goods, Econ 101 tells us that the price of goods will tend to INFLATE to match the greater money supply. So far, in 2021, inflation is running at a 10% pace but the Fed says the inflation is "transitory" and all those stores and restaurants can't wait to mark those prices back down, right?

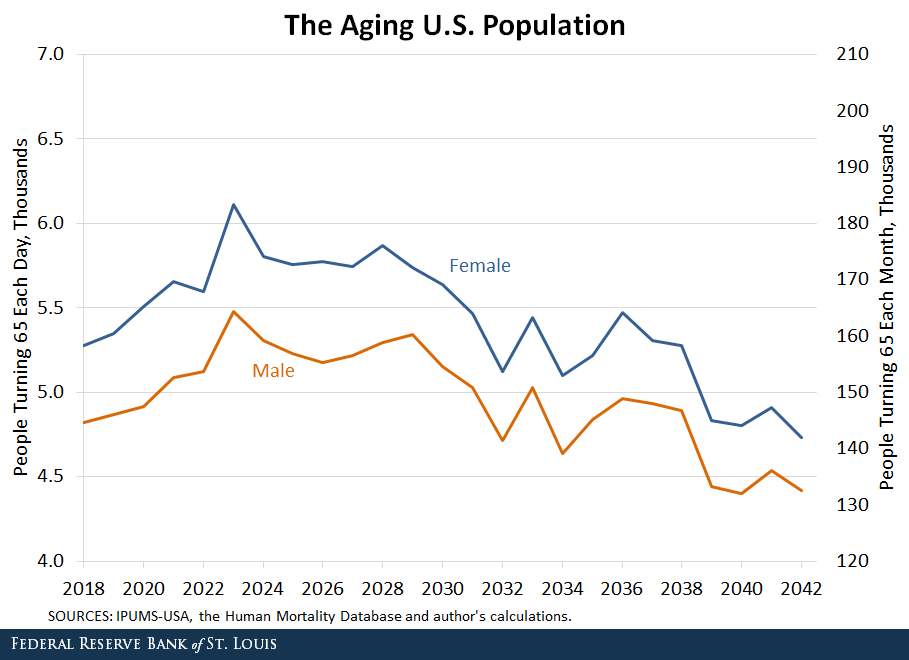

Maybe that was a lesson in Econ 404 – I never made it that far as it was so boring but a very surprising twist if that's the way it turned out at the end. Whether inflation is transitory or not matters a lot as we are now entering the peak of the Baby Boomers retiring. 2023 is going to be our biggest year with over 7.5M Americans (2.5% of the population) turning 65 in a single year. We remain near that pace until 2029, when things start to drop off but the damage will be done with over 75M people (1/4 of the population) hitting retirement age in the next 10 years.

What is your plan to support these people? If you don't have a plan to support them, what is your plan to deal with the deaths from starvation, disease and poor living conditions? How will you deal with the protests and the riots and the social upheaval? Where will you find the workers to replace them? How will we support Social Security and Medicare with 1/4 of the contributors going from paying into the sytem to being paid by the system?

Everything is fine until it isn't. Miami will be underwater in 2050 but people are still buying beachfront condos and, at the current pace, our Social Security system will run out of money in 2035, but that was calculated using 2% annual inflation rates. At 10%, we won't last this decade. So inflation better be "transitory" or we're totally screwed.

We also still need $2.6Tn just to FIX the Infrastructure that already exists in the US. That does not include improving our grid, our Internet and it doesn't even include clean energy projects as that's under the $10Tn we need to get to Carbon Neutral by 2035 – in order to save the planet.

That's quite a shopping list we have and Congress is currently finalizing a 6-month debate over $500Bn in Infrastructure Spending (was $3.5Tn when they started) and we still haven't passed a budget for 2021. We're already running a $1Tn deficit going forward but this year it will be over $3Tn due to the prior stimulus (the thing we'll need more of to prop up the market if Delta spreads).

And we NEED more stimulus as, now that we are past most of the large-cap earnings, the small-caps are starting to look shakey. Last night, we had misses from BNFT, CDLX, DCPH, ET, HTA, H, KAR, NBIX, OSUR, PRIM, PUMP, TSLX, SKLZ, VRSK and WTI and we had guide-downs from ATVI, AKAM, BNFT, CDLX, FMC, JAZZ, MCRY, NPTN, OSUR, PRO, SPWR, VREX and WK. That's 25 out of 100 reports with negatives in them! 10% is usually considered alarming….

ISM and Construction Spending missed on Monday, Mortgage Applications were down 1.7% this morning and ADP missed by a mile (300,000 vs 700,000 expected by leading Economorons) and we're waiting for IHS Service PMI and ISM Service Reports but Friday we get Non-Farm Payroll and, if that's as much below 900,000 as ADP was – BIG TROUBLE!

ISM and Construction Spending missed on Monday, Mortgage Applications were down 1.7% this morning and ADP missed by a mile (300,000 vs 700,000 expected by leading Economorons) and we're waiting for IHS Service PMI and ISM Service Reports but Friday we get Non-Farm Payroll and, if that's as much below 900,000 as ADP was – BIG TROUBLE!

Outside of Consumer Spending, Contruction Spending is the backbone of this economy and, as you can see from this chart – it's not very pretty. Even with TRILLIONS of Dollars in stimulus, we're still not even as strong as the weakest pre-pandemic months and we haven't even begun kicking 10M families (10%) out of their homes as the eviction moratorium expires. Who will move in to fill up those spaces? 10M recently evicted families with bad credit and no money for deposits? Immigrants? Oops, we don't have those anymore and we're not making any new Americans either with negaive birth rates in 2020.

Less people, less homes, less money… Hey, maybe this inflation is going to be transitory – no one can afford it long-term!