It's an important week for the Nasdaq.

It's an important week for the Nasdaq.

All the big tech names have reported so there's not a lot to boost the market other than, of course, the Stimulus Bill but that's already baked into the cake so now it's time to see how high the Nasdaq can fly without a net. Notice after the April earnings reports, the Nadaq gave up half it's gains into May. A pullback like that would take us back to 14,000, which is not a terrible sell-off (6.66%) but you never know what's going to change investor sentiment.

According to the 5% Rule™, the last consolidation zone was at 12,500 so we're up 2,500 and that means we expect 500-point pullbacks to 14,750 (weak) and 14,500 (strong) before we can get over 15,500 – we'll see how that plays out. On the other hand, there's no particular reason to expect bad news in the tech sector – so it's all about sentiment in the weeks ahead. We have the Consumer Sentiment Report on Friday and yesterday the NFIB Small Business Optimism Index dropped 2.8 points to 99.7 – completely reversing June's gains.

6 of the 10 Index components declined, three improved, and one was unchanged. The NFIB Uncertainty Index decreased 7 points to 76. Sales expectations over the next three months decreased 11 points to a net negative 4% of owners. Owners expecting better business conditions over the next six months decreased 8 points to a net NEGATIVE 20%. Earnings trends over the past three months decreased 8 points to a net NEGATIVE 13%. 49% of owners reported job openings that could not be filled, an increase of 3 points from June and a 48-year record high.

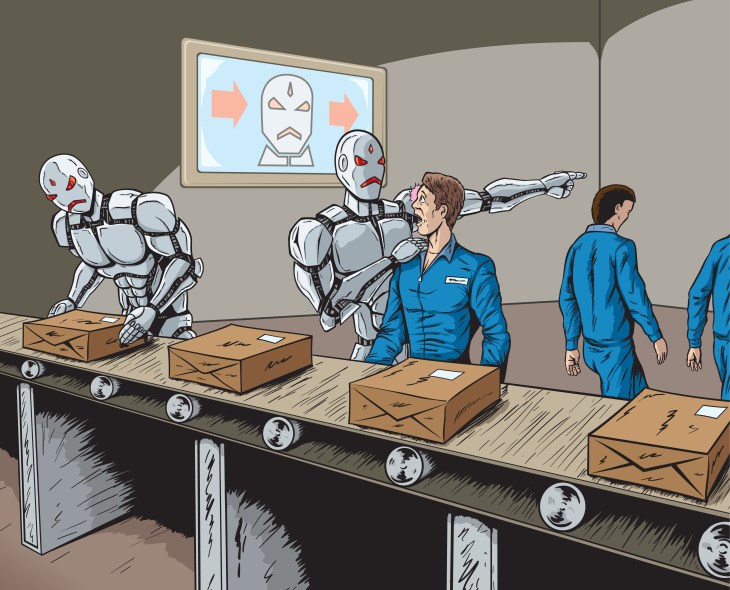

So we have a labor shortage and rapidly deteriorating forward expectations and a very negative earnings trend. That is NOT GOOD. 49% of all businesses consider themselves understaffed – we saw that in last weeks stutter in the productivity report – how can you grow the economy when you don't have enough workers? While we are waiting for the robots to take our jobs, this is a serious problem.

So we have a labor shortage and rapidly deteriorating forward expectations and a very negative earnings trend. That is NOT GOOD. 49% of all businesses consider themselves understaffed – we saw that in last weeks stutter in the productivity report – how can you grow the economy when you don't have enough workers? While we are waiting for the robots to take our jobs, this is a serious problem.

55% reported capital outlays in the last six months, up 2 points from June but historically not strong. Capital Spending is critical to the growth of the economy and increased output and income. 26% plan capital outlays in the next few months, up 1 point from June. Capital Investment (equipment, technology etc.) is the key to improvements in worker productivity, and consequently, worker compensation, but owners have a very dim view of prospects for business conditions and sales growth needed to support the demand for new equipment and expanded capacity.

This is REALITY, not the FANTASY the stock market is selling us.

A net 5% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 4 points from June. The net percent of owners expecting higher real sales volumes declined 11 points to a net negative 4%. It appears that owners are losing confidence in the strength of the economy. The net percent of owners reporting inventory increases declined 7 points to a net negative 6%. This is due primarily to the very strong levels of sales and the inability of owners to replenish inventories through their supply chains – NOT because of robust sales – that does not bode well for future sales either as it's hard to buy things when the shelves are empty.

Seasonally adjusted, a net 38% reported raising compensation, down 1 point from June’s record high of 39%. A net 27% plan to raise compensation in the next three months, up 1 point from June and a 48-year record high reading. 9% cited labor costs as their top business problem (up 1 point) and 26% said that labor quality was their top business problem.

The frequency of reports of positive profit trends declined 8 points to a net NEGATIVE 13%. Among owners reporting lower profits, 32% blamed weaker sales, 31% cited a rise in the cost of materials, 10% cited labor costs, 7% cited lower prices, 6% cited the usual seasonal change, and 3% cited higher taxes or regulatory costs..

We just got our CPI Report this morning and Core CPI was only up 0.3% vs 0.4% expected so calming down a bit is good news. The top-line index was up 0.5% as expected, down from 0.9% in June, when fuel prices jumped higher. Over the past 12 months, prices are up 5.5% overall but the Core CPI, which the Fed supposedly wants at 2%, is now at a 4.3% annual pace – way too hot. In addition to the rise in Shelter and New Vehicles increase, indexes for Recreation, Medical, Auto, and Personal Care also climbed higher.

In fact, the only thing that was really lower in the report was Fuel Oil, which fell from 2.9% to 0.6% (still going up – just slower) for the month and Transportation Services dropped hard from 1.5 to -1.1 as airlines dropped fares with less people traveling than expected. None of these are real positives for bulls to hang their hats on but we'll rally off the headline number, nonetheless.

And, of course:

Image Credits: Danomyte