In fourteen hundred and ninety two,

In fourteen hundred and ninety two,

Columbus sailed the ocean blue – and got totally lost, missed India by 6,000 miles but called the Native American Islanders Indians anyway, slaughtered them and stole their gold and, lacking any real wealth to go back to Spain with, instituted a slave trade that lasted 250 years and ruined the lives of tens millions of people. Yay!

That was essentially my daughter's 7th grade (2012) report on Columbus and, though I was called in to the Principal's office at the time for giving my children heretical opinions, it's no longer shocking for people to hear the truth about the colonization of America. We want Russians to question Marx and Lennin and we want the Chinese to question Mao so why shouldn't our own children question Columbus and Jefferson? Either you want to raise critical thinkers or you don't, right?

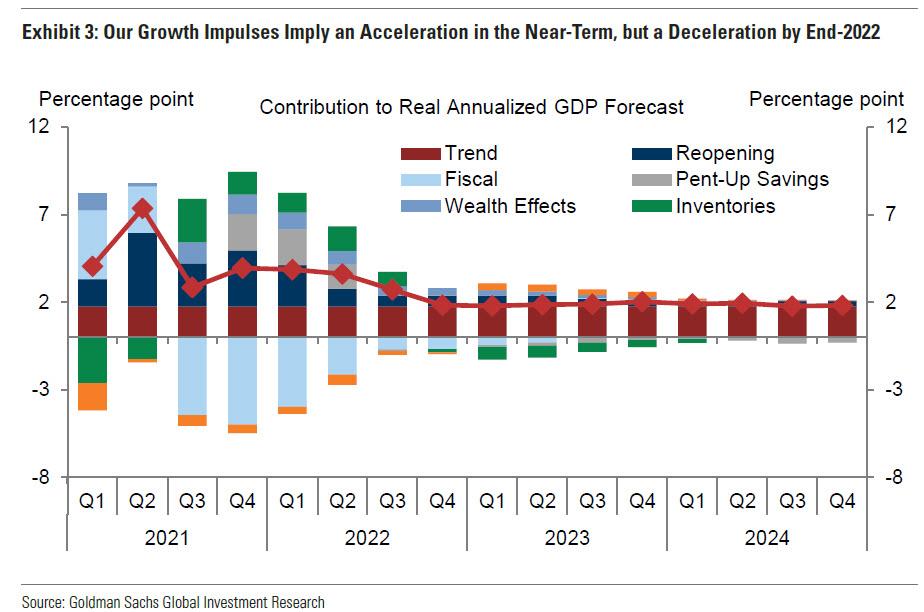

There aren't many critical thinkers playing the markets these days. On Wednesday we get our second to last FOMC decision for the year but Friday's poor jobs report has given them cover to hold off on raising rates or even tapering yet again. Oil is back at $81.50 on Goldman Sach's call of a strong rebound in demand but, just this weekend, GS has dropped their Q3 GDP Forecast to 3.25% and Q4 is now down to 4.5% and next year is down around 3% – HALF of what it was!

The Atlanta Fed agrees with Goldman and their forecast has come all the way down to 1.25% for Q3 – and they are the ones who get the reports while the Leading Economorons they consult for the "consensus" forecast are still raising their expections – now up to 6.5% for Q3. Q3 ended on September 30th – how can there be this much dispute as to what actually happened?

The Atlanta Fed agrees with Goldman and their forecast has come all the way down to 1.25% for Q3 – and they are the ones who get the reports while the Leading Economorons they consult for the "consensus" forecast are still raising their expections – now up to 6.5% for Q3. Q3 ended on September 30th – how can there be this much dispute as to what actually happened?

Those rising expectations come from the same people you are subscribing to in market newsletters and following in newspapers and magazines and listening to on the radio and on TV so of course you are forgiven for thinking that we are better off economically than we actually are – just as it was excusable when you grew up that you thought Columbus discovered America and was a great man – you didn't have all the facts…

My daughters learned at an early age that it's uncomfortable to go against the prevailing opinion – even if the prevailing opinion is clearly wrong. There are consequences to being a free thinker and, more often than not, they tend to involve nails and crosses for those who are not willing to go along with the current doctrines. Rather than fight the tide, we simply cashed out at the end of August and we've spent September pretty much on the sidelines but now we've gained our first disciple – and it's Goldman Sachs!

What's behind the latest downgrade? Well, in addition to the continued lack of consumers' service spending, Goldman is now pointing to the sharp drop in fiscal support as the tailwind from trillions in Biden stimuli ends. As Briggs explains, he sees two main challenges to medium-term growth.

First, fiscal support is set to step down significantly through the end of the year. Although we maintain a positive outlook for household income because a recovering labor market and firm wage growth—particularly among low-wage workers—should keep income above its pre-pandemic trend through end-2022, the decline in transfer income will likely cause a pullback in spending for some households.

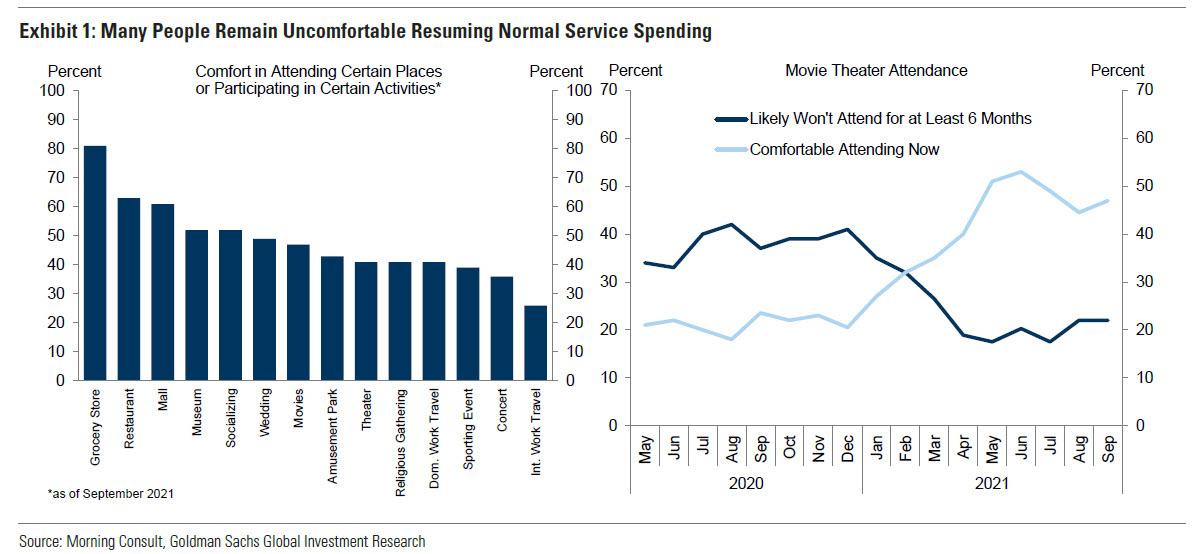

Second, consumers’ service spending will need to recover quickly to offset a decline in goods spending as the latter normalizes from its current elevated level. This will likely prove challenging while COVID cases remain elevated, since many people still feel at least somewhat uncomfortable engaging in many activities that were routine prior to the pandemic (left chart, Exhibit 1). Furthermore, for activities like going to a movie theater, many individuals don’t anticipate resuming normal spending patterns for at least another 6 months, suggesting a full normalization in economic activity may take some time (right chart, Exhibit 1).

I went to the movies for the first time in almost two years yesterday and it was downright sad. We saw the new James Bond movie, which is #1 at the box office this week but the theater was 75% empty and #1 at the box office was a very sad $59M for the weekend. I wasn't worried about Covid as there was no one else within 6 feet of us and no one in the lobby and hardly any concession workers (who were wearing masks) – it was just sad….

As noted on the chart, the restaurant we ate at afterwards (CAKE) was better-attended but still had seen better days. Broadway is back in New York and, so far, playing to packed houses after being closed for 18 months but tourism is still down 70% from pre-pandemic leves so what will happen when NYC's local theater fans have all cycled through their favorite shows? Buses full of tourists are usually Broadway's main audience.

Baseball is wrapping up a summer where parks had 30% less attendance than they did in 2019. Tampa Bay, Oakland and Miami had less than 10,000 people per game on average and Pittsburgh, Baltimore and Toronto were all between 10,000 and 11,000 on average with half the teams averaging less than 20,000 people per game. Sad….

We see these things, they are happening every week, right in front of us yet we still buy into the narrative that the economy is back on track? As noted by Zero Hedge:

While it remains to be seen just how positive the impact from reopenings will be – especially if the winter brings a new round of Fauci-driven restrictions to coincide with the coming flu season – one area where we disagree profoundly with Goldman is the bank's generous modeling of an upside boost to growth from "pent-up savings" which the bank expects to offset a substantial portion of the fiscal hit. As we will show in a subsequent post, the excess savings – in as much as they still exist – mostly benefit the top 1%, with the bulk of the population benefiting from only 30% of the total accumulated amount.

As such the contribution to consumption from excess savings will end up being far smaller than most Wall Street strategists predict (since the propensity of the top 1% to spend their savings which are instead invested in the market, is far less than the broader population). The result: expect even more aggressive cuts to GDP growth in coming quarters – from both Goldman and its peers – even as inflation continues to rise, cementing a painful period of non-transitory stagflation for the US as the mid-term elections approach.

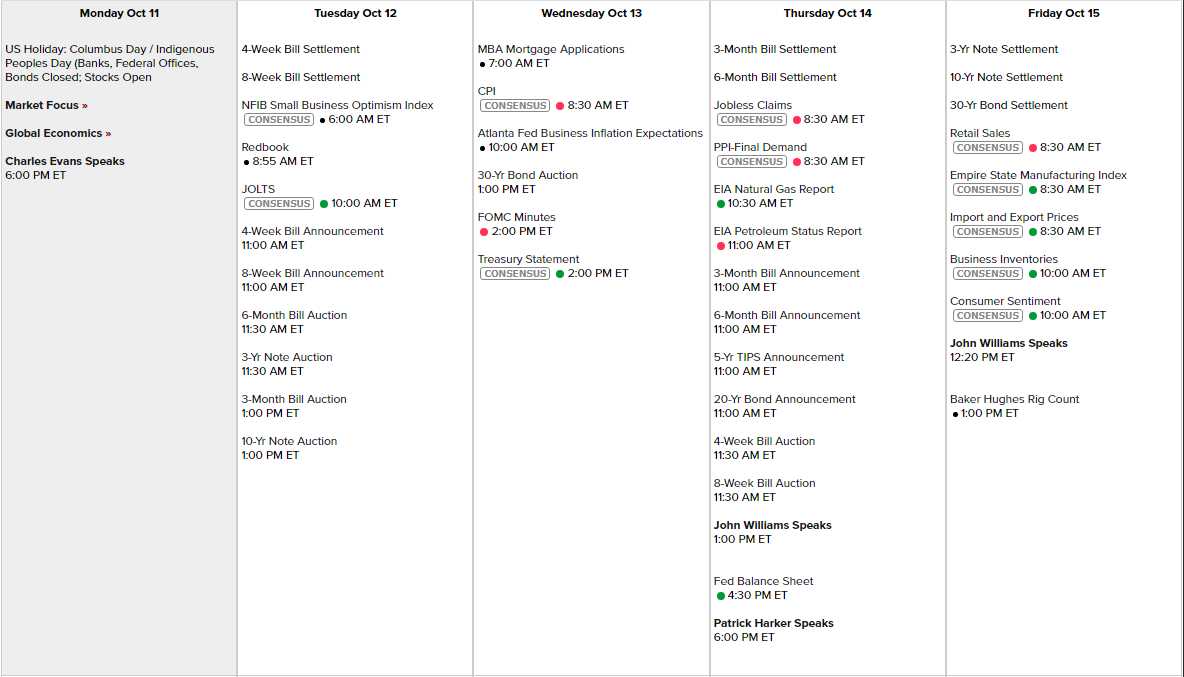

Yikes! Well, that's why we moved to the sidelines and, so far, we haven't missed much. Just a lot of gyrations that have left us about 5% below the August highs we cashed out at. The idea was to wait for earnings reports to be safe and those begin coming in this week and ratchet up very quickly:

But today is a holiday so let's celebrate that time Columbus discovered Haiti (and he never went North from there). It's kind of a holiday and it's going to be a pretty slow week but things will pick up nicely next week – so enjoy the rest while you can.