Let's not get carried away.

Let's not get carried away.

It SEEMS like Omicron is giving people a mild case of Covid that does not often lead to hospitalization and that's a good thing – like the way we now live with Influenza, which used to kill millions (still kills 10s of thousands) so markets are a bit relieved this morning though the World is still ending and stuff – but we can worry about that some other time…

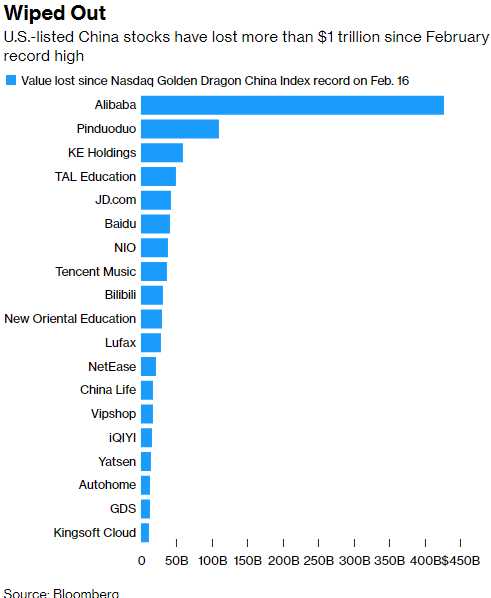

China's Central Bank reduced bank reserve requirements by 0.5%, pusing $188Bn into the system. This is because they are "not worried" about Evergrande, which has another round of note payments due this week. Another Chinese developer, Sunshine 100, defaulted on $170M in bonds over the weekend. Chinese stocks listed in the US have lost $1Tn since February. We should have stuck with all those Chinese Ultra-Short (FXP) longs we had at the time (we cashed in early).

China's Central Bank reduced bank reserve requirements by 0.5%, pusing $188Bn into the system. This is because they are "not worried" about Evergrande, which has another round of note payments due this week. Another Chinese developer, Sunshine 100, defaulted on $170M in bonds over the weekend. Chinese stocks listed in the US have lost $1Tn since February. We should have stuck with all those Chinese Ultra-Short (FXP) longs we had at the time (we cashed in early).

Bitcoin bounced big this weekend, coming back to $48,600 from $42,000 on Saturday but still down 9% from Friday. Here's a converstation you can have when you use Bitcoin – Friend: "So how much money do you have for retirement?" You: "I have no F'ing idea." See – FUN!!! There's something truly thrilling about leaving the house with $100 worth of BitCoin to go on a date and not being actually sure you can afford dinner and a movie by the time you get there….

Of course, with inflation, I don't see how people can afford dinner and movies at all. I had a simple dinner with my mom at a normal restaurant last night and it was still $80 ($67 + tip). Still, people seem to be going out so they must be finding money somewhere. I feel bad for my kids though – I was wondering why their bank accounts are constantly melting down in college but EVERYTHING is so expensive. And employers are wondering why no one wants to work for $20 an hour – what are you going to do with that – taking home $100 a day?

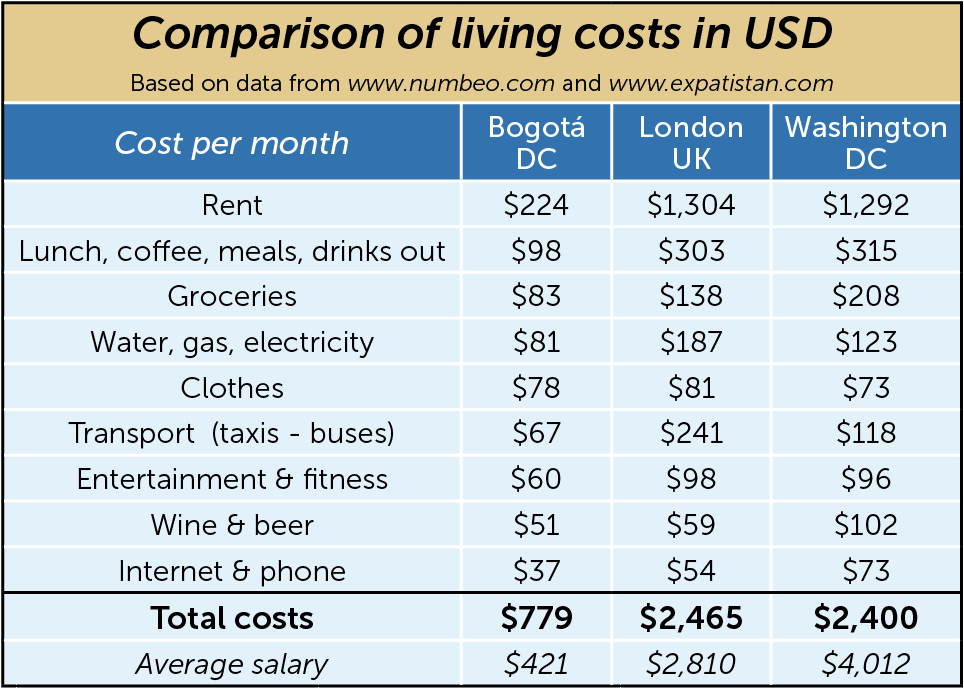

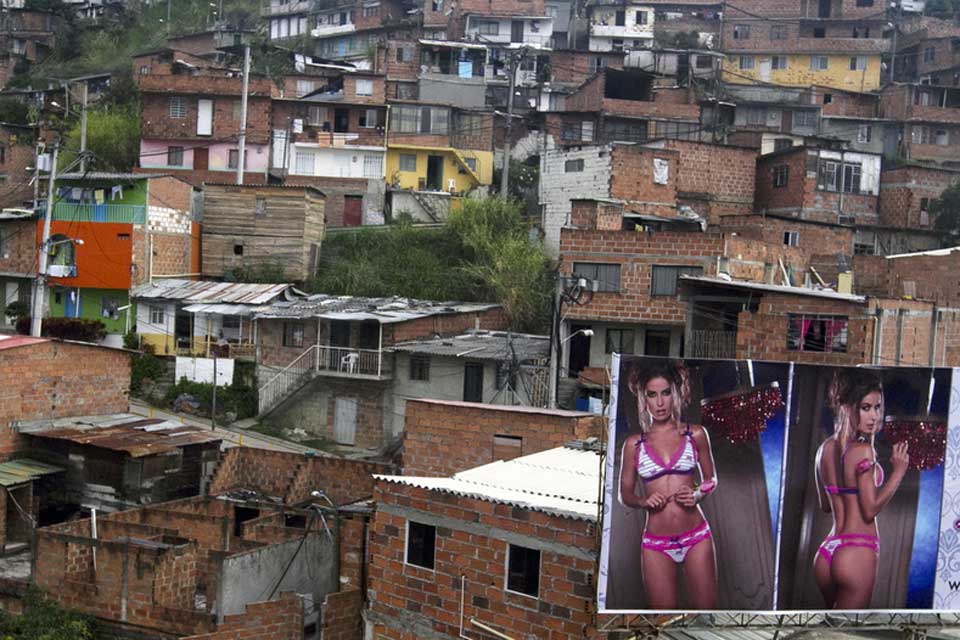

Yes, moving to Columbia is always an option but, sadly, my kids go to college in the US and I don't know the planet where clothes for young women are $73/month, but I'd like to send them there – at least for a vaction… And, while Colombia may have serious cost of living advantages over the US, not even my college kids would be willing to crash in this bario (and notice the advertisement for expensive lingerie as people drive by):

There's a lot of international data out this week and inflation is very much in the spotlight:

- China and Taiwan will both report export figures on Tuesday

- China’s producer-price index due Thursday is in focus as it reflects the impact of commodity-driven costs. PPI is rising at the fastest pace in 26 years. CPI is due the same day

- The Reserve Bank of India’s policy decision Wednesday will the first among major Asian central banks following the emergence of omicron. Traders will be watching for any signs of a more dovish tilt, particularly as India was the epicenter of the delta strain

- November inflation data from the Philippines will give a sense on whether the slide in oil prices and tightened travel restrictions have weighed on price growth

- Russia releases November CPI data on Wednesday. The previous month’s 8.1% rate was at the highest since January 2016

- Polish central bankers will decide on the scale of tightening on Wednesday after raising the benchmark rate by a bigger-than-expected 75 basis points last month

- Brazil’s central bank will have to choose whether to raise its policy rate on Wednesday as inflation remains elevated after an increases of 575 basis points since March

- Peru’s central bank is also set to determine whether to extend monetary tightening for a fifth month on Thursday

- Hungary will deliberate on its one-week deposit rate on Thursday, which had already been raised in the last three weeks.

Inflation, China and Virus: What to Watch in Stocks in 2022.

U.S. Winds of Inflation Are Blowing Winter Gale: Eco Week Ahead

COVID Outbreak On US Cruise Ship Despite Fully Vaxxed Passengers

Watch: Paris Police Check Proof Of Vaccination While Diners Eat

And, of course, we're still watching our bounce lines. Even with this morning's bounce, the S&P's Strong Bounce Box turned from green to black (too close to call), both of the Nasdaq levels turned red and the Russell's Strong Bounce Box turned red as well. That's a lot of ground lost from Friday morning to this morning – nothing to be bullish about:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

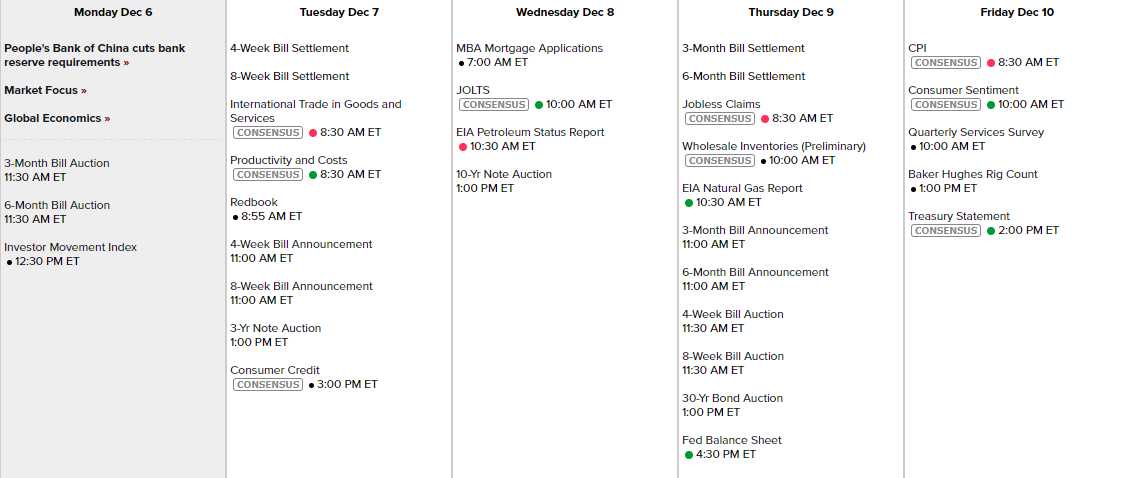

It's a slow week for data and no Fed speak either as the Fed has their final meeting of the year next Wednesday. Productivity tomorrow, Mortgage Applications Wednesday (something we wouldn't mention if anything else were happening), nothing at all worth mentioning Thursday and CPI and Consumer Credit give us SOMETHING on Friday, at least.

Earnings are still trickling in and look at AVGO, COST and ORCL on Thursday – that will keep things a little bit interesting.

On the whole though, it looks like a good week to take a vacation – probably a good month for it.