$2,209,446!

$2,209,446!

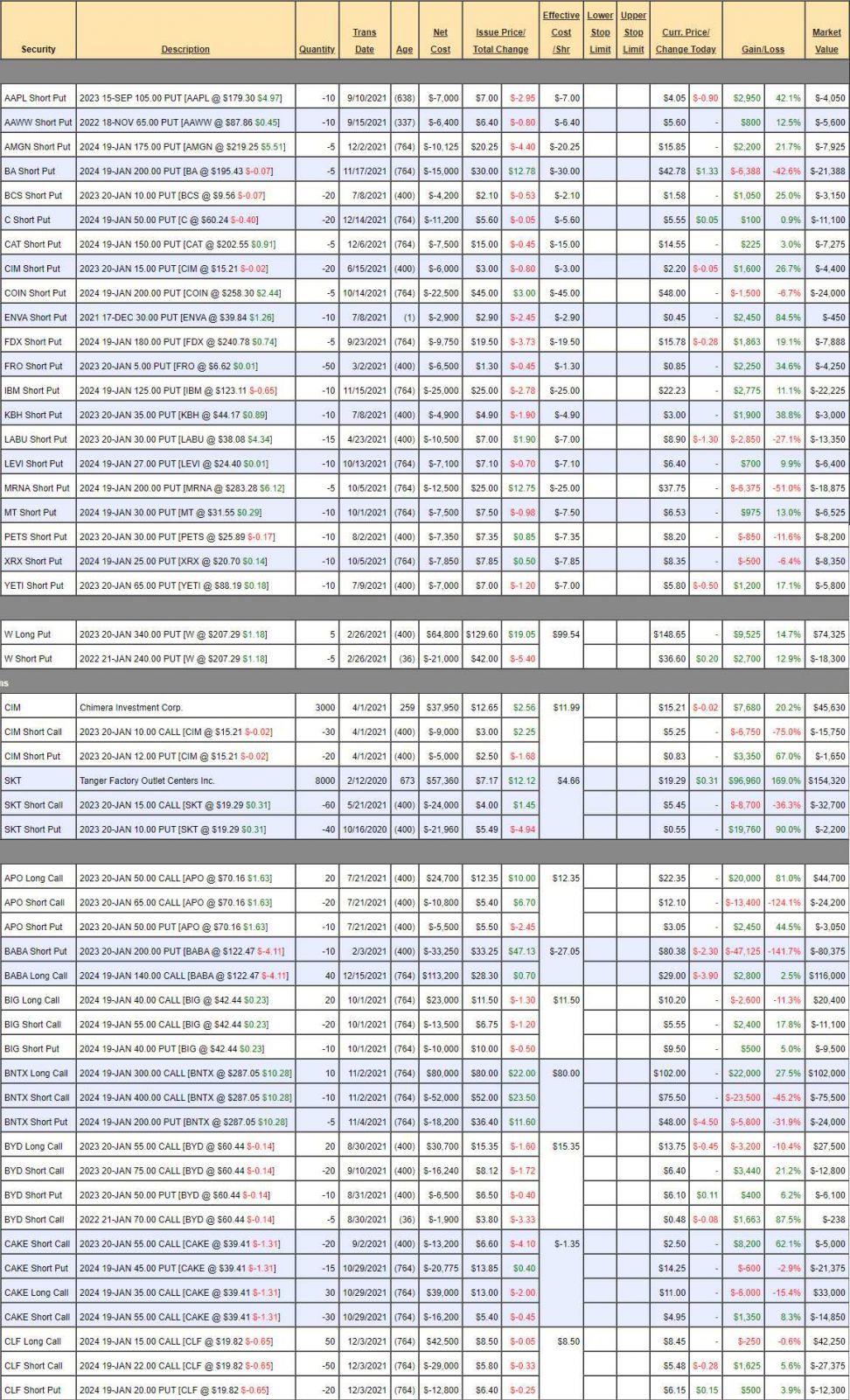

Actually that's DOWN $64,619 in our paired Long and Short-Term Portfolios since our last review on November 18th but it's up $1,609,446 (268%) from our $600,000 start back on October 1st, 2019 so, on the whole – we're in pretty good shape and playing defensively to protect our gains in what I still consider to be a dangerous market. The past few weeks have been an excellent example of WHY we hedge. Having our hedges in place not only allowed us to ride out the dip with our longs but it gave us cover to add new positions when stocks went on sale – as well as improving the positions we had. In fact, if the pre-market rally holds up this morning – we should have enough gains in the LTP to recover our deficit.

It's been our busiest month in a long time as the Thanksgiving dip was our first real chance to bargain shop since September and we took full advantage of it, adding 4 short puts and 15 bullish positions (up from 25 total) to our LTP in November and December. After sitting with CASH!!! on the side for so long – it felt good to be back in the game. Patience is the hardest thing I have to teach our Members – the lessons take a very long time to take hold. IBM, for example, was our Trade of the Year in 2018 as they were under $120 at Thanksgiving but they hit $150 and we got out and then they went below $120 again when the virus hit and we bought them again but got out at $140 and then we waited again and, this Thanksgiving, $115 made them our Trade of the Year again, for 2022:

Obviously we love IBM, but not so much that we don't know when they are overpriced and, just like our children – we sell them when the price is right. Well no, that's the problem people have with stocks – they think they are children but they are not – and you DO need to sell them when you make a nice profit. Stocks don't love you and you shouldn't love them – remember that…

As usual, there are plenty of trades that are still good for new ones – and I'll be pointing them out below:

Short Puts – These are essentially a watch list for stocks we'd like to take full positions in if they get cheaper. If we sold a short put only, it probably means we thought a stock may have bottomed – but not sure enough that we wanted to spend money on a bull call spread just yet. Short puts generate cash for the portfolio and, in a Portfolio Margin account – they don't use a lot of margin – unless the market goes the wrong way on you, of course. As a rule of thumb, we try to sell about $5,000 a month in short puts and we have 7 expiring next month.

We have collected $198,000 in premiums for promising to buy stocks we think are already cheap if they go on an even bigger discount. The only thing you know for sure in the trading world is that all premiums expire worthless. The options you sell may be in or out of the money (that was your bet), but the premiums will be gone on their expiration dates and that is our house advantage – we'd be fools not to take advantage of it!

- AAPL – Not a problem but I can't believe you can still sell the Sept 2023 $105 puts for $4.05 – they are just giving you free money if you want to take it.

- BA – Went a bit lowe than we through but that's why we only sold 5. Our net entry would be $170, so that's where we might become concerned but the short 2024 $200 puts are now $43 and the $160 puts are $23 so, if we have to, we can roll our 5 short $200s to 10 short $160s and then we'd be in 1,000 shares of BA at net $145. Since that sounds like something we'd really like to have for the long-term – we have no fear at $195, do we?

- C, CAT, COIN, FDX, IBM, LABU, MRNA, MT, XRX, YETI – all good for new trades.

- W – I think we should be thrilled with the gains on the Jan $340 puts and we'll take this off the table – it's the leftover part of a spread and I think this is a good bottom – or at least a place where W will bounce – so let's cash them out. Even though we don't actually like W, we may as well set up for the roll and sell 5 2023 $170 puts for $32 and we will stop out of the short Jan $240 puts if W fails to hold $200. Ideally, we bounce back to the top of the channel into January expirations and make money on both puts.

- CIM – Great dividend stock, paying 0.33/qtr. So the net of this spread is $28,230 and we collect $1,000 (3.5%) per quarter while waiting to be called away at $30,000 for another 7% profit (and we already made $4,500 (15%)). Of course, when the time comes, we'll just roll the calls along to higher strikes with longer dates and keep going.

- SKT – They restarted their dividends, so we're thrilled with that. Still, it's not enough of a dividend (0.183/q) to keep us in $154,320 worth of stock so let's cash that out and cover our 60 2023 $15 calls with 180 2024 $20 calls at $3 ($54,000) and we'll buy back the short puts for $2,200 and sell 20 of the 2024 $20 puts for $5.50 ($11,000), so we're taking $109,120 off the table and we still have 180 2024 $20 calls and 60 short 2023 $15 calls which we plan on rolling to 120 2024 $25 calls, which are now $2 – eventually. For now, they make very nice downside protection.

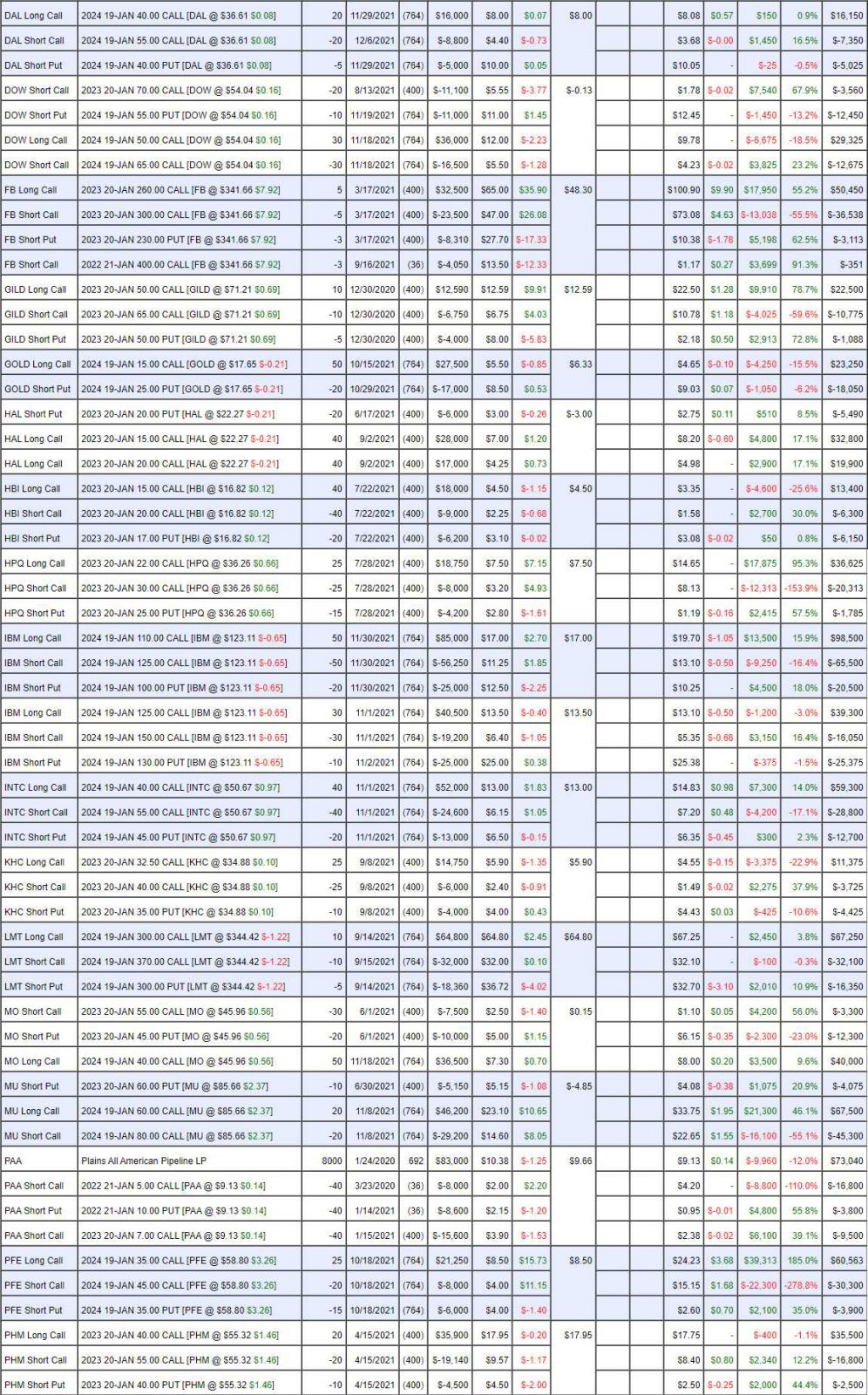

- APO – Over target already.

- BABA – We got way more aggressive on these.

- BIG – Still good for a new trade.

- BNTX – Still good for a new trade. I think people are really missing out on these guys. This is a $100,000 spread you can buy for net $2,500 so there's $97,500 (3,900%) upside potentail at $400, which I think is a conservative target and the worst-case is you are forced to buy 500 shares at net $205, which was the November low.

- BYD – Still good for a new trade and I'm very glad we played it as an income-producer or we'd have less profit.

- CAKE – We're pretty aggressive with this one and Omicron has derailed their progress but I still like it as a long-term play. Let's buy back the short 2023 $55 calls as they only have $5,000 left to give us over 12 months and we'll either sell lower calls and roll down if things get worse or we'll sell them again for a better price on a bounce.

- CLF – Still has that new trade smell. This spread is almost $25,000 in the money yet you can buy it for net $2,575. This is why the rich are getting so much richer – they are just giving money away for people who can afford to play the market.

- DAL – Another new trade that's still good as a new one. Also slowed by Omicron.

- DOW – Speaking of giving money away. Stupidly low price so let's buy back the short 2023 $70 calls – even though they are miles out of the money. It frees a slot for us to sell something else on the bounce.

- FB – I don't even like this company so the options premiums must have been great. I guess at the time, it was a bargain and now we're using it to produce income while we wait to collect our full $20,000 (now just $10,448 despite being $41.66 over our target). So we have this net $10,448 spread and, in September, we sold $4,050 of short calls that will go worthless so we have 3 or 4 more sales like that ahead of us for a nice little return. There's more than one way to make money using options spreads.

- GILD – Over our target.

- GOLD – We're aggressively long here. The Fed has decided to fight inflation so they might drop further but we'll just buy more – $27,500 on the long calls is not a big investment for us – we're happy to add more if the markdowns continue.

- HAL – In the money already.

- HBI – Still good for a new trade. Even in the pandemic, people wear underwear. Probably even more T-shirts than usual, too. Net $950 on the $20,000 spread that's $8,000 in the money – another giveaway.

- HPQ – Blasted over our target already. Was so stupidly cheap in the summer.

- IBM #1 – This one is our Trade of the Year position. We were well-timed so already a big profit.

- IBM #2 – This was our original position at $120. As noted above, we know what IBM is worth ($150) so, at $120, we buy it. Not a complicated trading strategy. The reason it became our Trade of the Year was that, at $115, the options had inflated premiums that made the more conservative spread (#1) a complete no-brainer. All IBM has to do is hit $125 in two years to turn a $3,750 cash outlay into $75,000.

Do you know how you find trades like these? PATIENCE!!! We KNOW we like IBM, we ALWAYS like IBM but, if we wait PATIENTLY – it eventually goes on sale and, if we play the market strategically with cash on the side – we can take full advantage when other people are panicking out of their positions.

- INTC – This was our 2021 Trade of the Year and it did so well we cashed it out early but then it went on sale again so, SURPRISE, we bought it again. See, this is not a complicated trading strategy to follow, is it? In this case, it's still good for a new trade at net $17,800 on the $60,000 spread that's $40,000 in the money already.

- KHC – Notice all the blue chips in the LTP. Notice the lack of momentum stocks. You don't need them to make money using options because you can leverage the slow, steady gains of blue chips to make fantastic returns. This is still good for a new trade at net $3,225 on the $18,750 spread.

- LMT – This is our Stock of the Century as we're betting on LMT being a leader in Fusion as well as Aerospace, which is picking up. This is a $70,000 spread that's $44,000 in the money yet it only costs net $18,800 to enter still. We can only lead you to water – we can't make you drink…

- MO – Speaking of blue chips. This one is on track and we got aggressively long last month because it went on sale. See – SIMPLE. It's simple because we are Fundamental investors and we don't get all confused because the PRICE of a stock goes lower – since we KNOW that has nothing to do with its value.

- MU – Already in the money.

- PAA – Paying a nice 0.18/q dividend. The 40 short Jan $5 calls at $4.20 ($16,800) can be rolled to 40 short 2024 $10 calls at $1.10 for net $3.10 ($12,400) and that gives us $20,000 of additional upside potential and allows us to keep collecting those dividends.

- PFE – We're doing really well because of those 5 extra longs. PFE is just going crazy with Omicron (more shots). Since we are so deep in the money, let's roll the 20 short 2024 $45 calls at $15 ($30,000) to 40 short 2023 $55 calls at $8.50 ($34,000) and we'll cash in the 25 2024 $35 calls at $24.23 ($60,563) and buy 40 2024 $50 calls for $13 ($52,000). So we're taking $12,563 off the table and we're left with a $20,000 spread but a year advantage to roll the short calls so more like $60,000 potential (the 2024 $60 calls are $8.30 and the $70 calls are $5.70) – up from $25,000 if we just left it alone (and we took half that $25,000 off the table).

- PHM – At our target already.

- QSR – We went aggressively long on them.

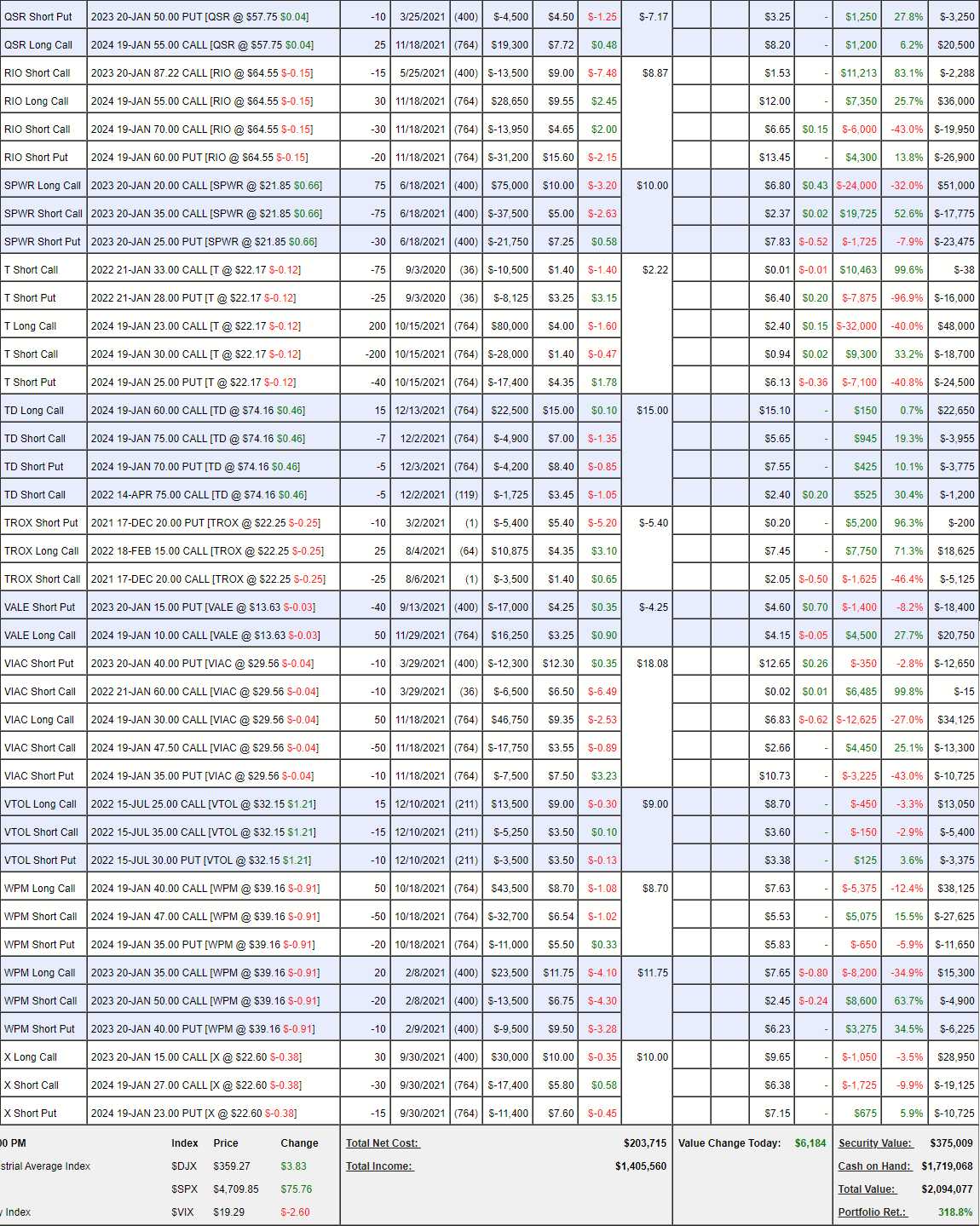

- RIO – Ridiculously cheap. We caught the panic and things have calmed down so we're doing well simply because the premiums dropped (and we sold a lot of premium). Hopefully this will be a nice boring climb to $45,000 from the current net $13,138 credit so the upside potential here is $58,138 at $70 – aren't options fun? Just in case – let's buy back the 15 short 2023 $87.22 calls for $2,288 – no sense in having something there that could ruin our fun.

- SPWR – Year one has not been good for our Stock of the Decade. Well, really it's year two I guess, since 2020 was the first year, right? In that case, we're doing great since we started at $5 at the end of 2019 so $21.71 is "on track" – but what a wild ride it has been. We have to take advantage of this dip and buy back the short 2023 $35 calls for $2.37 ($17,775) as they can only make us 0.20/month. That means skipping a month or two to see how things go into earnings can't cost us more than 0.40 – that's worth it. 2023 $20 calls are $6.80 and the 2024 $20 calls are $8.50 so let's buy another year to gain for $1.70 and we may as well bump it up to 100 longs while we're at it. That's $12,750 for the roll and $17,775 to buy back the short calls and $21,250 for the 25 new calls is $51,775 spent. The 2024 $35 calls are $4.50 – so we can recover $45,000 of it by selling those. We won't now, but that's why I have confidence to lay out the $51,775 – we KNOW we can get it back. If we follow through with that, we will have taken the net $15,750 we spent on the $112,500 spread and turned it into net $22,525 on a $150,000 spread with 12 more months to hit our target. If we are lucky, SPWR pops and we sell $40 calls for the same price and we'll have a $200,000 spread.

Also not complicated. When did we buy this spread? In June, when we say it found a base. When are we adding to it? In December, when it's triple-testing the lows for the year (in August we were less confident, so we PATIENTLY waited).

- T – Oh no, it's going up? This is just dumb at $22.50 and it makes me really lose respect for traders to see them selling T at a $165Bn valuation. Hard to imagine how they are able to tie their own shoes… We already made ourselves a big position and the Jan $33 calls will expire worthless and it's too early to sell more. We'll roll the Jan puts next month, no hurry there. The 2024 $30s aren't down enough to buy back and, if we're going to spend money, I'd rather invest in a better long position. The 2024 $23 calls are $2.40 and the $20 calls are $4.50 – I don't want to spend $2.10 to roll down $3 but I would spend $1.50 so look for that opportunity to roll down to the $20s ($30,000 for $60,000 better position).

- TD – I'm sor happy they have long-term options now. Still good for a new trade. In fact, we're still trying to fill this one as it's thinly traded.

- TROX – The 25 short Dec $20s at $2.05 can be rolled to 25 short Feb $22s for about even so that's a no-brainer.

- VALE – We got aggressively long on these and it's working so far but we do need to cover at some point. Not yet though.

- VIAC – As unloved as T and just as silly. The short Jan $60s will go worthless, of course and the 2024 $25 calls are $9.15 so let's do that roll for $2.50 or less and pick up $25,000 in positiion for $12,500.

- VTOL – I love these guys. Good for a new trade.

- WPM – Great for a new trade, could have been trade of the year if they were this low on Thanksgiving. The 2024 $35s are $11, so not cheap enough to roll, so we'll leave it alone.

- WPM #2 – Oh good, we have two of them. Now I feel better.

- X – I'm pretty sure Build Back Better uses steel – if it ever passes. If not, we still use steel and X is cheap down here so great for a new play at a net $900 credit on the $36,000 spread. Worst case is owning 1,500 shares of X at less than $23/share – can't see any reason not to make this trade with that potential catalyst so close to being realized.

IN PROGRESS