The 2,200 line.

The 2,200 line.

After shooting up to it last Winter on a stimulus-fueled 50% run, the Russell kind of lost interest in going anywhere this year and, once again, it's looking to prove itself on one side or the other of the 2,200 line. Perhaps that's because despite the Russell having a forward (dreamland) p/e ratio of 30 at 2,200 – it has a trailing (reality) p/e ratio of 642 times earnings.

That's right, even after ingesting $3Tn (15% of our GDP) of stimulus in the past 12 months, even with ultra-low interest rates from the Fed and all those SBA loans and even with all that free money given to their customers – things are still not going so great for the small-caps. By comparison, the Nasdaq is trading at 35 times trailing earnings (still ridiculous) and the S&P is at 29 times trailing earnings with forward estimates at 30 and 22 respectively – though I can't see the S&P possibly improving that much in 12 months.

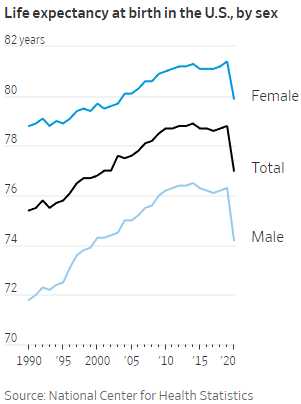

Dividends are down 20% on the S&P 500 this year – not good for people who invest to get dividend income during inflationary times. Another sneaky way we all got taxed this year is on our Life Expectancy, which is down 1.8 years for 2020 – so we've been "taxed" 2% of our lives thanks to Trump's amazing handling of the Covid crisis, the environment, etc. Not that it will matter much in 100 years, when everyone's life expectancy will be closer to zero, the way this planet is progressing.

Dividends are down 20% on the S&P 500 this year – not good for people who invest to get dividend income during inflationary times. Another sneaky way we all got taxed this year is on our Life Expectancy, which is down 1.8 years for 2020 – so we've been "taxed" 2% of our lives thanks to Trump's amazing handling of the Covid crisis, the environment, etc. Not that it will matter much in 100 years, when everyone's life expectancy will be closer to zero, the way this planet is progressing.

The drop was 0.3 years more than that of provisional estimates released in July 2021 and remains the biggest life-expectancy decline since at least World War II. Covid-19 was the nation’s third leading cause of death last year, behind heart disease and cancer, and was the underlying cause in about 351,000 deaths, the new figures show. Increases in mortality from unintentional injuries—which include drug overdoses – as well heart disease, homicide and diabetes also decreased life expectancy.

So happy holidays – enjoy Grandma while you still can!

China Evergrande will put coal in the stockings of investors, who loaned the developer over $300Bn as the Chinese Government has taken over and will begin "negotiating" with creditors on behalf of the company. Since the choice in China are settle or "disappear" – I imagine a lot of settlements will be reached. Last week, S&P Global Ratings downgraded China Evergrande Group to one of its lowest possible ratings, meaning the world’s three largest credit-rating companies all now judge the giant developer to be in default.

While this may be good news for the company (relatively, they are still dead), it's bad news for anyone who invested in anyone who invested in China Evergrande as now the official write-downs will begin and people won't be able to hide the damage on their books and $300Bn is a LOT of damage. For example, JPM, the World's biggest bank (10% of Global Market Share), makes "only" $35Bn a year so if they lent Evergrande just $9Bn (3% of their total loans) and get back even $5Bn, they would still be writing off 15% of their profits. Some lenders will be hit harder than others but these are devastating numbers – and Evergrande is one of many struggling property developers in China.

One way to play this is to go long on the 2x Ultra-Short Financials (SKF) into Q1 earnings, when this is most likely to hit the fan. The index is up 10% since late October and we can play it simply not to go below $8 into April with the following spread:

- Sell 20 SKF April $8 puts for 0.50 ($1,000)

- Buy 20 SKF April $6 calls for $2.70 ($5,400)

- Sell 20 SKF April $8 calls for $1.35 ($2,700)

That's net $1,700 on the $4,000 spread that's 110% in the money to start. All SKF has to do is hold $8 and you make $2,300 (135%) in 113 days. The worst case is SKF goes lower and you end up owning 2,000 shares at net $8.85, about the current price but you can prevent that by using that bottom trendline at $8.50 as a stop, which should keep the losses well under $1,000 on the risk side.

A more aggressive spread would be to just buy 20 of the SKF April $8 calls for $1.35 ($2,700) and sell 10 of the SKF July $10 puts for $2.35 ($2,350). Here we're spending just net $350 on the spread but it's a much more directional bet which would still pay back $4,000 at $10 but has no upside limitation. It makes a good hedge if you hold a lot of banking stocks (we don't) and using the same $8.50 stop should keep the damage to a minimum on the risk side.

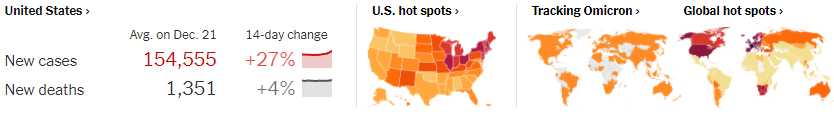

Don't forget that we're still getting 154,555 new cases of Covid every day in the US (3 football stadiums full of people) and 1,351 people a day are still dying – 1% of the people infected – despite all the "advances" they've made in treatment. The Winder Olympics are still on in China in 6 weeks – we'll see if they go through with that. The World Financial Conferecne in Davos has been cancelled – that's what our Corporate Masters really think about the virus risk – despite all their assurances to the contrary.

Biden is sending 1,000 military doctors to hot spots in the US along with ambulences and medical teams to transport patients but that's because we're overhwelmed and patients have to be transported to more distant hospitals as many hospitals are over their capacity to treat new patients. Most cities aren't equipped to deal with shipping patients out of town en mass. Biden is also sending out 500M home testing kits but they won't come until January and the reason for that is also not good – since there are more people needing tests than there are professionals who are available to administer them – so DIY is the new watch-word.

Be careful out there.