I thought it was Saturday!

I thought it was Saturday!

Don't ask how, that's the most senile thing I've ever done and I'll be 59 in March – in case you are keeping track. I had a nice, relaxing morning, woke up at 6 and did some reading and then caught up on some late-night talk shows (I just watch the monologs) and, in my defense, Seth Meyer's said he'd be back in the studio on Monday and I didn't realize he doesn't do Friday shows so I think that's where I got the impression it was Saturday.

Anyway, I got some washing done and then I went out for breakfast and, on the TV, the stock tickers were going by and we were down about as much as yesterday so I thought it was just showing yesterday's finish but then I saw the Nas below 15,500 and I realized something was wrong and I raced back home. First time I've ever done that.

So, it's 10:10 now and the indexes are down a bit more this morning but nothing tragic. Looking at our bounce chart, which we've had since Dec 21st, the only change since Wednesday's rally is the Weak Bounce line on the Russell, which has turned black (too close to call) – also, we have a new bottom for the Nasdaq, better reflecting our expectations:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,000 has bounce lines of 15,300 (weak) and 15,600 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

As you can see,, we tested 15,300 this morning but already bouncing back to the strong bounce line but failing this at the end of a bad two weeks would not be a good sign.

It's a holiday weekend and Oil (/CL) is jacked up at $83 and I'm still playing it painfully short. Brent is trading over $85 ($85.50) so it's not a good sign but I think the whole thing is way overdone as Retail Sales were off 1.9% in December, down from +0.2% expected by leading Economorons. Ex-Auto they were down 2.3% so a total disaster of a report. Industrial Production was also down 0.1% in December – a 125% miss from the +0.4% expected by our leading prognosticators.

It's a holiday weekend and Oil (/CL) is jacked up at $83 and I'm still playing it painfully short. Brent is trading over $85 ($85.50) so it's not a good sign but I think the whole thing is way overdone as Retail Sales were off 1.9% in December, down from +0.2% expected by leading Economorons. Ex-Auto they were down 2.3% so a total disaster of a report. Industrial Production was also down 0.1% in December – a 125% miss from the +0.4% expected by our leading prognosticators.

Consumer Sentiment is also dropping – down to 68.8 in January from 70.6 in December. And, keep in mind, by the way, that Retail Sales are not adjusted for the 7% inflation we've had this year so, on the whole, people bought about 10% less stuff at higher prices – this is getting into recessionary territory, folks.

Bank earnings were scattered this morning with JP Morgan (JPM) showing 14% less profit than last year and Citigroup down 26% from last year at 0.20 below expectations. Neither one is being hit very hard as rising rates are good for the outlook – as it gives the banks the chance to put the squeeze on borrowers.

Black Rock (BLK) has been getting no respect since May, despite now having $10,000,000,000,000 under management. They made $1.64Bn in Q4 or $10.63 per $846 share, which is $132Bn in market cap. So 20x earnings is reasonable for BLK though we haven't played them since they were $200 and won't be playing them again unless they go on a better sale than this because, the problem with having $10Tn to invest in a toppy market, is that you end up investing in things that you shouldn't.

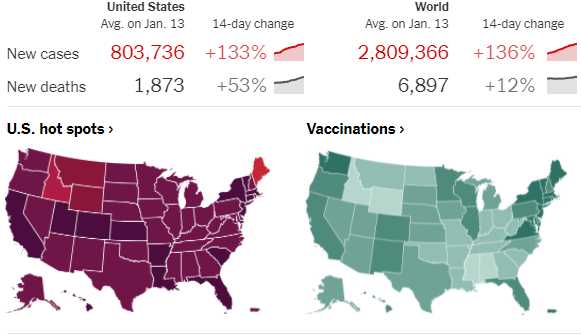

Beware the stories you are hearing about Covid numbers turning down. We just had a surge based on Thanksgiving and Christmas and New Year's gatherings so, of course we hit very high infection rates and of course they will head a bit lower unless we are all heading out to MLK gatherings this weekend? You can't react to small data samples – long-term trends are what we need to watch – like 24 (out of 50) states now have hospitals at or near capacity. The country as a whole and 26 states have reported more coronavirus cases in the past week than in any other seven-day period.

Beware the stories you are hearing about Covid numbers turning down. We just had a surge based on Thanksgiving and Christmas and New Year's gatherings so, of course we hit very high infection rates and of course they will head a bit lower unless we are all heading out to MLK gatherings this weekend? You can't react to small data samples – long-term trends are what we need to watch – like 24 (out of 50) states now have hospitals at or near capacity. The country as a whole and 26 states have reported more coronavirus cases in the past week than in any other seven-day period.

Since Thanksgiving, the White House has sent more than 350 military doctors, nurses, medics and other personnel to 24 states to help hospitals with staffing challenges, President Biden said this week, and plans to send an additional 1,000 service members to six hard-hit states. That is in addition to the more than 14,000 National Guard members deployed in 49 states to help staff hospitals and other medical facilities, he and other officials said. Do you think Biden is doing this because the crisis is over?

Biden is distributing 500M N95 masks (the kind that actually work) and that won't even begin until March so that would be a huge, futile waste of money if this was all going away this weekend, wouldn't it? Pay attention to what the politicians are doing – not what they are saying…

After spending $11Tn on SOMETHING over the past two years, it turns out it was not medical supplies as nurses across the US are joining protests against working conditions at their hospitals, where the ones that haven't come down with Covid are working double shifts to cover the ones who did.

After spending $11Tn on SOMETHING over the past two years, it turns out it was not medical supplies as nurses across the US are joining protests against working conditions at their hospitals, where the ones that haven't come down with Covid are working double shifts to cover the ones who did.

“We don’t have food service people … we don’t have supply chain people to deliver our most critical supplies, we don’t have people to repair our equipment,” a nurse said. “But every job that doesn’t get done by somebody else ends up falling to the bedside nurse. We’re overwhelmed.”

Next week is officially the start of earnings season so we'll see how things shake out. Monday is a holiday in the US and it will be mostly Housing Data along with the NY (Tues) and Philly (Thurs) Fed Indexs and Leading Economic Indicators on Friday. After that, on Jan 27th, Q4 GDP makes its debut.

Have a great weekend (starting tomorow),

– Phil