What is a fish flop?

That's where you have a fish that is still alive on the deck of your boat and it's gasping and flopping – but soon to be dead. That is not the same as a flip-flop – in which the markets reverse direction. This is not that, this is much more like only bouncing around because death is creeping quickly towards them and they are trying to escape. Get the picture?

Amazon (AMZN) had strong earnings yesterday and the Nasdaq is up 116.25 pre-market but, on the whole, it's really nothing and that's why we have our Bounce Chart – so we are reminded of the true scale of the destruction. We should probably have one for Global Warming so people will stop thinking the problem is solved every time we get a snow storm. For our indexes, we have:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

This was our stronger bounce chart and we are just one bad turn on the unreliable Dow away from falling back into our weaker chart, which would indicate we are likely on a path to revisit our recent market lows (and more likely to surpass them) in Februrary – which is what we expected would happen after this stronger-than-expected bounce series of the past week.

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong). We were below our predicted 33,120 mid-point at yesterday's lows.

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong) is where we are this morning (again).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,706. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

Nothing should be red on this chart if we are recovering. These are the bounces off PROJECTED lows – we haven't even hit those lows yet, so failing the bounce lines of those lows is NO BUENO! We thought the rally was BS because the Dollar dropped 2% in the past week and all the S&P did was move up 6.66% – which is not impressive at all when your currency is collapsing.

Nothing should be red on this chart if we are recovering. These are the bounces off PROJECTED lows – we haven't even hit those lows yet, so failing the bounce lines of those lows is NO BUENO! We thought the rally was BS because the Dollar dropped 2% in the past week and all the S&P did was move up 6.66% – which is not impressive at all when your currency is collapsing.

Of course, now we're back near the year's low and the Dollar is harder to manipulate lower because, doing that means you have to find a currency you can strengthen and neither Canada, Great Briain, Japan or Europe are up to the task and the Chinese can't run away from their currency fast enough as that massive real estate disaster is just moments away from hitting the fan (pushed back until New Year's is over by the Party Committee).

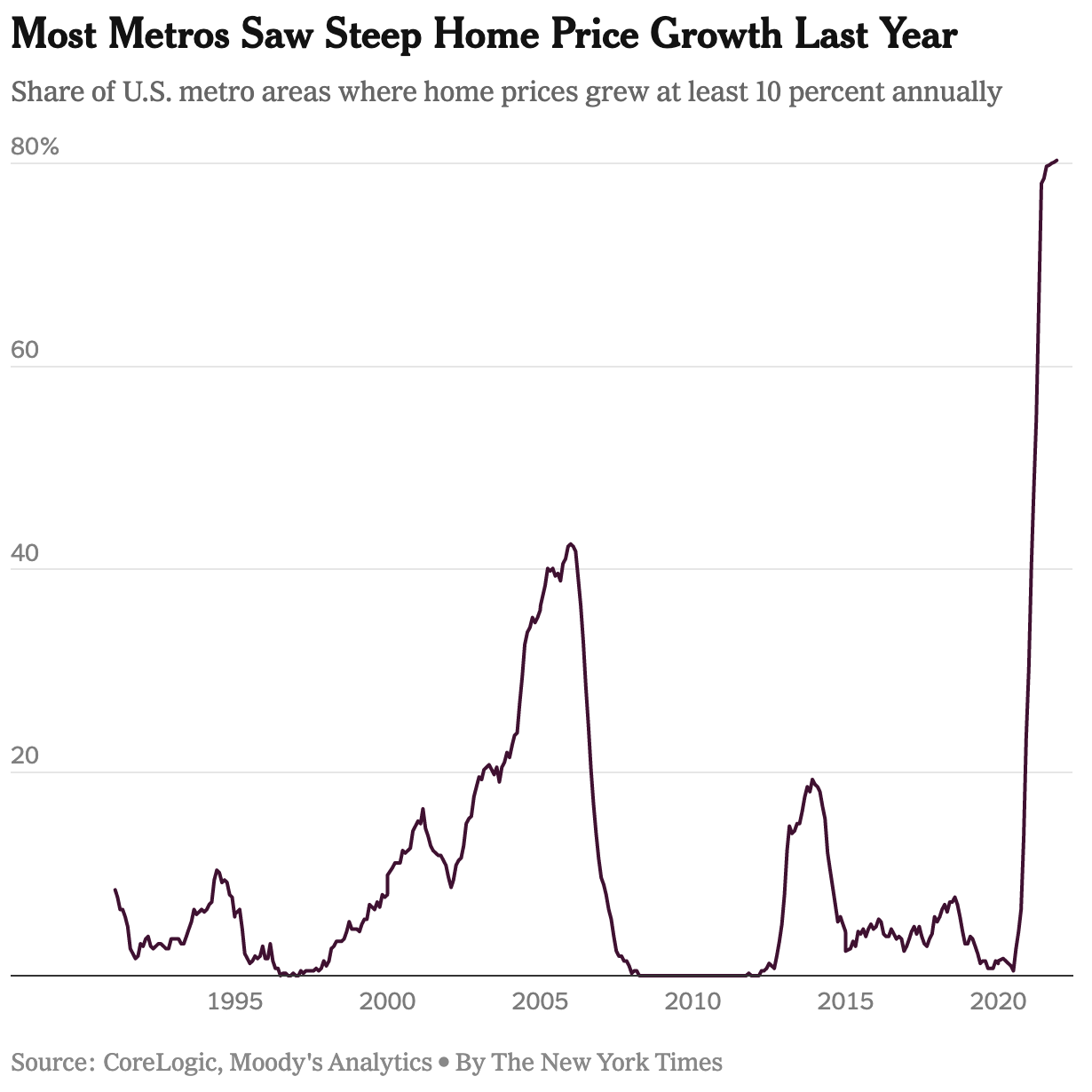

China is heading for one massive hangover and Japan is simply depressed while Europe is fighting off massive inflation and looking forward to their own housing collapse as rates rise – and so are we but no one seems ready to face up that reality even though, once again, MATH!!!

China is heading for one massive hangover and Japan is simply depressed while Europe is fighting off massive inflation and looking forward to their own housing collapse as rates rise – and so are we but no one seems ready to face up that reality even though, once again, MATH!!!

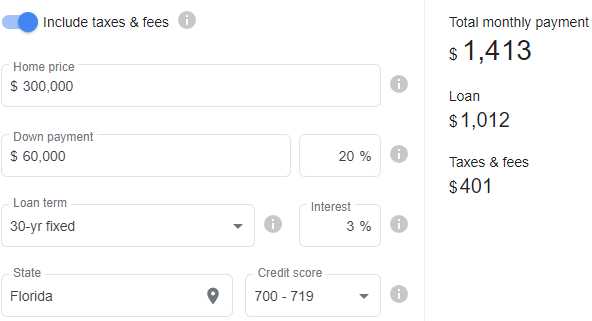

The average home in America is now $329,000 – up over 50% from $240,000 in our last crisis. Instead of letting home prices correct, our Government bailed out banks and gave out low-rate loans so most people have 3% loans or less at this point and here's the math. So it's $1,413/month to pay for that $300,000 home. Problem number one is taxes are going up. If inflation is 7% and your town, like most, have to balance their budgets – then taxes go up 7%.

That means, without outside assistance, home prices will need to drop 13% to match the ability of consumers to pay. In fact, Canada's Bank Regulator is warning of up to 20% drops in housing prices in some of their overpriced markets. Those markets often border on the US where the lack of a wall has allowed 300,000 people to Emigrate to the Great White North and driven up housing prices as well.

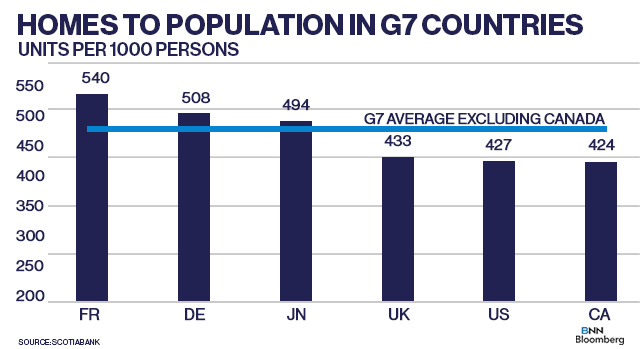

As you can see, the US, UK and Canada are all suffering from an acute housing shortage and that's the kind of thing that takes year to rectify. To add 60 homes per 100,000 people in the US, we need to build 200,000 more homes per year than the 700,000 per year we have averaged for the past decade.

KBH was our top Home-Builder pick and, in our Long-Term Portfolio, we sold 10 2023 $35 puts for $4.90 ($4,900) on July 8th and, though the stock has goine nowhere since, the premium on the short puts has decayed and they are now $3.60 – up 26%. If the market were stronger, I would love to add a bullish spread but KBH was down to $12 in March of 2020 – we'll be happy if they just stay over $35 but, if they do collapse, we will jump right in on the home builders as homes HAVE to be built.

We will be adjusting our Short-Term Portfolio a bit more bearish into the weekend during our Live Member Chat – we'll see how low the Nasdaq can go today. Even if we do hit 14,100 next week – there should be a bounce off of that line back to 14,400 – which is where we are now – so not a crisis but, just in case – better safe than sorry! Non-Farm Payrolls came in stronger than expected with 467,000 jobs added in January but hourly earnings were up a shocking 0.7%, almost double what was expected as employees are forced to pay more and more for their labor and that is exactly what the Fed is trying to prevent.

Also, unemployment did not budge – still 4%. None of this takes the Fed's foot off the brakes on the economy.

Have a great weekend,

– Phil